- 1. Akash Network: A Quick Introduction

- 2. Akash Network: How Does It Work?

- 3. Akash Network: Historical Price Sentiment

- 4. AKT Coin Price: Technical Analysis

- 5. Akash Network Price Prediction By Blockchain Reporter

- 5.1. Akash Network Price Prediction 2024

- 5.2. Akash Network Price Prediction 2025

- 5.3. AKT Price Forecast for 2026

- 5.4. Akash Network (AKT) Price Prediction 2027

- 5.5. Akash Network Price Prediction 2028

- 5.6. Akash Network Price Prediction 2029

- 5.7. Akash Network (AKT) Price Prediction 2030

- 5.8. Akash Network Price Forecast 2031

- 5.9. Akash Network (AKT) Price Prediction 2032

- 5.10. Akash Network Price Prediction 2033

- 6. Akash Network Price Prediction: By Experts

- 7. Is Akash Network a Good Investment? When to Buy?

- 8. Conclusion

Akash is an open-source cloud computing platform that’s decentralized and built with the Cosmos SDK on the Cosmos blockchain. It lets you run any cloud-native application, enhancing both performance and scale for decentralized apps and organizations using its network. Akash supports many current cloud applications, opening up opportunities for businesses in the decentralized cloud market. The platform taps into unused cloud resources to offer more efficient and cost-effective services than traditional, centralized cloud providers. Akash stands out for its commitment to open-source technology, claiming to be much cheaper than mainstream cloud services. AKT is the native token of the Akash network. It plays a key role in governing and securing the network, facilitates value storage and transfer among users, and encourages active participation in the network. A series of developments propelled Akash Network to become one of the top performers in the sector. Its parent company, Overclock Labs, acquired the Cloudmos protocol and made its code publicly available. The launch of a hackathon and the integration of the USD Coin (USDC) stablecoin further fueled its growth. Additionally, plans to upgrade its mainnet were announced. Consequently, AKT’s value surged by over 1,200% last year. In this article, we will explore Akash Network price prediction with an in-depth analysis of the AKT coin price and its future market sentiment.

Akash Network: A Quick Introduction

The Akash Network is a decentralized cloud computing marketplace designed for developers of decentralized applications (dApps), particularly in decentralized finance (DeFi) and other demanding areas like machine learning. It operates within the Cosmos Hub, which connects it to a broad network of distinct blockchain platforms, allowing it to support various development needs. As a decentralized platform, Akash Network aims to make cloud computing power more accessible and affordable, reducing costs and offering more flexibility to users. It works alongside major cloud service providers to introduce a more fair and efficient approach to cloud computing.

To appreciate Akash Network’s innovative approach, it’s useful to compare it with traditional cloud computing models. Traditional cloud computing involves on-demand services provided over the internet, typically controlled by major tech companies that make up about 70% of the market as of 2021. These providers enable developers to deploy applications quickly without managing physical servers, although options for service and providers can be limited. Studies indicate that developers often pay for more hosting space than they use, leading to unnecessarily high costs.

In contrast, Akash Network offers a decentralized alternative that uses about 85% of its computing resources from underutilized data centers. It allows cloud providers to sell their excess capacity on its marketplace, sparking competition that can lower prices for developers and end-users. Akash promotes a flexible model where developers pay only for the resources they use when they need them, avoiding the limitations of fixed server capacity typical with traditional providers.

Akash Network: How Does It Work?

Akash is a decentralized cloud computing marketplace that redistributes unused computing power to those who need it. Its ‘Supercloud’ connects customers with providers using a clear, distributed leasing service while keeping the benefits of decentralized computing through the Akash blockchain.

This system allows users to switch between providers easily and benefits from the performance boosts of global operations. Providers make money from their spare capacity.

In this setup, computer resources are divided into containerized applications known as ‘Containers,’ which are then rented out to ‘Tenants’—the users buying cloud services on the network. ‘Providers’ bid on these service requests, and the one offering the lowest price for the needed resources wins the contract.

This arrangement incentivizes all involved parties financially. Providers gain by selling off their unused resources, and Tenants save money. All transactions take place on the Akash blockchain.

The Akash blockchain uses a Delegated Proof-of-Stake (DPoS) consensus mechanism for security, relying on validators and delegators. Validators add new blocks to the blockchain through a voting process, using tokens staked by delegators who choose their validators based on public data available on the platform.

The protocol also uses a Tendermint algorithm to enhance speed and scalability. Being transparent and open to anyone, Akash stands out as the first open-source, decentralized cloud platform.

Blockchain Structure

Akash Network is built on a Proof-of-Stake (PoS) blockchain designed for interoperability, using the Cosmos software development kit (SDK) and incorporating the Tendermint algorithm for Byzantine fault tolerance. It’s a part of the Cosmos Hub, positioning it within a larger multi-blockchain ecosystem to enhance cross-chain interactions.

Like other Cosmos-based PoS blockchains, Akash Network uses its native utility token, AKT, to secure the network through staking and acts as the reserve currency within its multi-blockchain environment. AKT is central to powering Akash’s decentralized cloud platform, known as DeCloud, and facilitates the transfer and storage of value on the network.

With the launch of Akash Network’s mainnet 1.0 in September 2020, there was an initial pre-mined supply of 100 million AKT tokens, with a total cap set at 388,539,008 AKT. This initial batch was allocated among investors, the Akash Network foundation, and its team. Additionally, the project conducted a public sale of 1.8 million AKT. Around 75% of AKT’s maximum supply is earmarked for distribution as network rewards, which will decrease gradually over time.

Akash Network: Historical Price Sentiment

Let’s explore the ups and downs of Akash Network’s price history. While past performance isn’t an indicator of future results, understanding its price trends can provide useful insights for future price predictions.

2020-2021: Akash Network (AKT) launched in October 2020 at about $0.40 and saw a steady increase, breaking the $1 mark by January 2021. It reached its peak at $8.08 on April 6, driven by strong market interest, but fell below $3 in July before rebounding to over $5 by September. The year ended at $1.79.

2022: This year was tough for AKT, reflecting wider market downturns. It fell below $1 early in the year. After the Terra (LUNA) collapse in May and troubles at FTX (FTT) in November, AKT dropped to a record low of $0.16. Despite a slight recovery, it ended the year at $0.18, nearly 90% down from the beginning of the year.

2023: The year started more positively as the market began to recover. AKT rose above $0.50 in February and surged past $6 by late May. However, regulatory actions by the SEC against Binance and Coinbase in June caused a drop to $0.463. It later stabilized around $6, supported by mainnet upgrades and other positive news.

2024: The momentum extended into early 2024, with AKT reaching a high of $6.83 in April. However, it adjusted to about $1.81 in August before showing signs of recovery. In recent weeks, the price of AKT coin recovered slightly as it surged toward $2.2.

AKT Coin Price: Technical Analysis

AKT coin dipped below the critical support level of $2.5, but the decline didn’t hold, suggesting limited selling activity at lower prices. Currently, buyers are actively defending the $2.1 support line, creating a solid rebound momentum. As of writing, AKT coin trades at $2.36, declining over 1.1% in the last 24 hours.

The price has rebounded to the previous breakdown level of $2.1, where a fierce confrontation between buyers and sellers is anticipated. Should the price surge past $2.5 and the 20-day EMA, it would indicate a market dismissal of the prior decline. Under such circumstances, the AKT/USDT pair could ascend to the 50-day SMA ($2.9).

On the flip side, if the price retreats from $2.1 or the 20-day EMA and dips below $2, it would herald a new bearish trend. This scenario could see the pair plummet to $1.6.

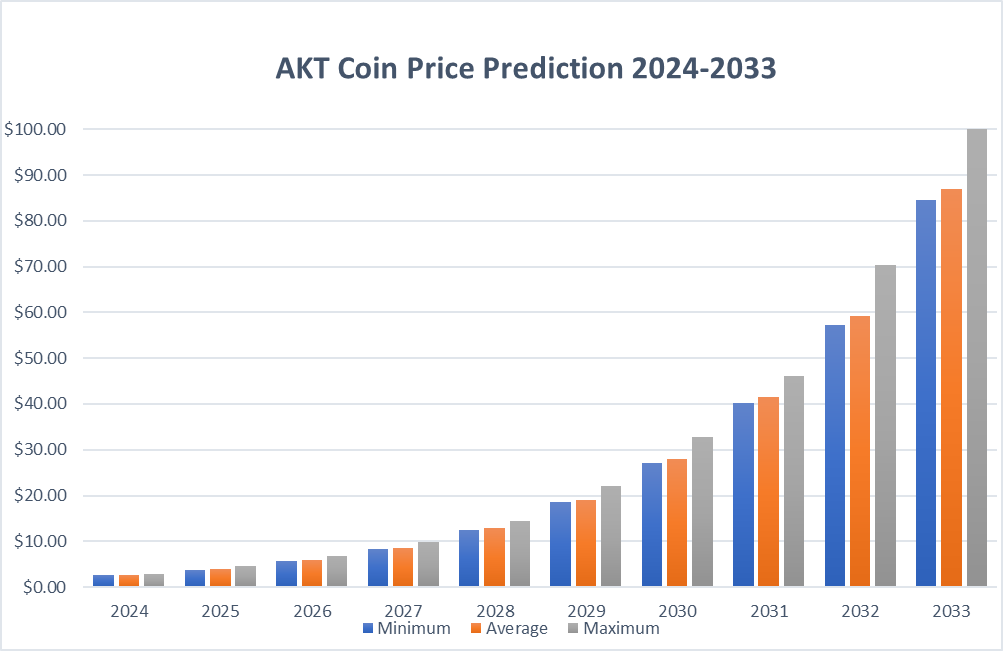

Akash Network Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 2.61 | 2.71 | 2.93 |

| 2025 | 3.82 | 3.93 | 4.51 |

| 2026 | 5.67 | 5.82 | 6.73 |

| 2027 | 8.31 | 8.55 | 9.88 |

| 2028 | 12.48 | 12.91 | 14.52 |

| 2029 | 18.61 | 19.12 | 22.14 |

| 2030 | 27.1 | 28.06 | 32.87 |

| 2031 | 40.16 | 41.56 | 46.07 |

| 2032 | 57.15 | 59.23 | 70.29 |

| 2033 | 84.54 | 86.9 | 100.88 |

Akash Network Price Prediction 2024

Akash Network launched its mainnet 2.0 in March 2021. Before this, the network operated in testnet phases to test its capabilities before going live. During the final testnet, hundreds of developers deployed thousands of applications using the decentralized cloud, paving the way for the 2.0 public mainnet release.

Akash Network also offers a small supercomputer called the Supermini, designed to make it easy for users to generate passive income by becoming cloud providers on the Akash Network. The Supermini is simple to set up and connect to the decentralized cloud, allowing users to rent out its capacity and earn AKT tokens from home, without the need to build a data center. The Supermini is another step in Akash Network’s mission to decentralize cloud computing.

Based on our in-depth technical analysis of AKT’s past price data, we anticipate that in 2024, Akash Network’s price could reach a minimum of $2.61. The maximum price may go up to $2.93, with an average trading price around $2.71.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $2.41 | $2.51 | $2.73 |

| February | $2.43 | $2.53 | $2.75 |

| March | $2.45 | $2.55 | $2.77 |

| April | $2.46 | $2.56 | $2.78 |

| May | $2.48 | $2.58 | $2.80 |

| June | $2.50 | $2.60 | $2.82 |

| July | $2.52 | $2.62 | $2.84 |

| August | $2.54 | $2.64 | $2.86 |

| September | $2.56 | $2.66 | $2.88 |

| October | $2.57 | $2.67 | $2.89 |

| November | $2.59 | $2.69 | $2.91 |

| December | $2.61 | $2.71 | $2.93 |

Akash Network Price Prediction 2025

Akash Network stands out from its centralized competitors with key features like its censorship-resistant and permissionless design. Unlike centralized, permissioned cloud computing providers, Akash Network’s decentralized infrastructure is built to reduce the risk of control or influence by a single entity. Its permissionless nature also allows developers to use its services with fewer limitations.

Much like a decentralized blockchain, Akash Network’s decentralized cloud marketplace gains its security from its widely distributed structure. This architecture makes Akash more resilient to hackers, attacks, and outages that often affect large, centralized data centers.

In 2025, the price of one Akash Network token is expected to reach at least $3.82. The maximum price could be around $4.51, with the average price throughout the year likely to be $3.93.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $3.62 | $3.73 | $4.31 |

| February | $3.64 | $3.75 | $4.33 |

| March | $3.66 | $3.77 | $4.35 |

| April | $3.67 | $3.78 | $4.36 |

| May | $3.69 | $3.80 | $4.38 |

| June | $3.71 | $3.82 | $4.40 |

| July | $3.73 | $3.84 | $4.42 |

| August | $3.75 | $3.86 | $4.44 |

| September | $3.77 | $3.88 | $4.46 |

| October | $3.78 | $3.89 | $4.47 |

| November | $3.80 | $3.91 | $4.49 |

| December | $3.82 | $3.93 | $4.51 |

AKT Price Forecast for 2026

For 2026, Akash Network’s price is predicted to have a minimum of $5.67. The price might reach a high of $6.73, with an average price of $5.82 during the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $5.47 | $5.62 | $6.53 |

| February | $5.49 | $5.64 | $6.55 |

| March | $5.51 | $5.66 | $6.57 |

| April | $5.52 | $5.67 | $6.58 |

| May | $5.54 | $5.69 | $6.60 |

| June | $5.56 | $5.71 | $6.62 |

| July | $5.58 | $5.73 | $6.64 |

| August | $5.60 | $5.75 | $6.66 |

| September | $5.62 | $5.77 | $6.68 |

| October | $5.63 | $5.78 | $6.69 |

| November | $5.65 | $5.80 | $6.71 |

| December | $5.67 | $5.82 | $6.73 |

Akash Network (AKT) Price Prediction 2027

In 2027, Akash Network’s price is expected to reach a minimum of $8.31. Our analysis suggests the price could climb to a maximum of $9.88, with an average forecast of $8.55.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $8.11 | $8.35 | $9.68 |

| February | $8.13 | $8.37 | $9.70 |

| March | $8.15 | $8.39 | $9.72 |

| April | $8.16 | $8.40 | $9.73 |

| May | $8.18 | $8.42 | $9.75 |

| June | $8.20 | $8.44 | $9.77 |

| July | $8.22 | $8.46 | $9.79 |

| August | $8.24 | $8.48 | $9.81 |

| September | $8.26 | $8.50 | $9.83 |

| October | $8.27 | $8.51 | $9.84 |

| November | $8.29 | $8.53 | $9.86 |

| December | $8.31 | $8.55 | $9.88 |

Akash Network Price Prediction 2028

For 2028, the price of Akash Network is projected to reach a minimum of $12.48. The maximum price could go up to $14.52, with an average price of $12.91.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $12.28 | $12.71 | $14.32 |

| February | $12.30 | $12.73 | $14.34 |

| March | $12.32 | $12.75 | $14.36 |

| April | $12.33 | $12.76 | $14.37 |

| May | $12.35 | $12.78 | $14.39 |

| June | $12.37 | $12.80 | $14.41 |

| July | $12.39 | $12.82 | $14.43 |

| August | $12.41 | $12.84 | $14.45 |

| September | $12.43 | $12.86 | $14.47 |

| October | $12.44 | $12.87 | $14.48 |

| November | $12.46 | $12.89 | $14.50 |

| December | $12.48 | $12.91 | $14.52 |

Akash Network Price Prediction 2029

Our detailed technical analysis indicates that in 2029, the price of Akash Network could reach a minimum of $18.61. The maximum price might be around $22.14, with an average trading value of $19.12.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $18.41 | $18.92 | $21.94 |

| February | $18.43 | $18.94 | $21.96 |

| March | $18.45 | $18.96 | $21.98 |

| April | $18.46 | $18.97 | $21.99 |

| May | $18.48 | $18.99 | $22.01 |

| June | $18.50 | $19.01 | $22.03 |

| July | $18.52 | $19.03 | $22.05 |

| August | $18.54 | $19.05 | $22.07 |

| September | $18.56 | $19.07 | $22.09 |

| October | $18.57 | $19.08 | $22.10 |

| November | $18.59 | $19.10 | $22.12 |

| December | $18.61 | $19.12 | $22.14 |

Akash Network (AKT) Price Prediction 2030

According to the forecast and technical analysis, in 2030, Akash Network’s price is expected to have a minimum value of $27.10. The price could reach a maximum of $32.87, with an average value of $28.06.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $26.90 | $27.86 | $32.67 |

| February | $26.92 | $27.88 | $32.69 |

| March | $26.94 | $27.90 | $32.71 |

| April | $26.95 | $27.91 | $32.72 |

| May | $26.97 | $27.93 | $32.74 |

| June | $26.99 | $27.95 | $32.76 |

| July | $27.01 | $27.97 | $32.78 |

| August | $27.03 | $27.99 | $32.80 |

| September | $27.05 | $28.01 | $32.82 |

| October | $27.06 | $28.02 | $32.83 |

| November | $27.08 | $28.04 | $32.85 |

| December | $27.10 | $28.06 | $32.87 |

Akash Network Price Forecast 2031

In 2031, Akash Network’s price is predicted to have a minimum of $40.16. The maximum price might be around $46.07, with an average trading price of $41.56 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $39.96 | $41.36 | $45.87 |

| February | $39.98 | $41.38 | $45.89 |

| March | $39.99 | $41.40 | $45.91 |

| April | $40.01 | $41.41 | $45.92 |

| May | $40.03 | $41.43 | $45.94 |

| June | $40.05 | $41.45 | $45.96 |

| July | $40.07 | $41.47 | $45.98 |

| August | $40.09 | $41.49 | $46.00 |

| September | $40.11 | $41.51 | $46.02 |

| October | $40.12 | $41.52 | $46.03 |

| November | $40.14 | $41.54 | $46.05 |

| December | $40.16 | $41.56 | $46.07 |

Akash Network (AKT) Price Prediction 2032

Based on forecast price and technical analysis, by 2032, Akash Network’s price could reach a minimum of $57.15. The maximum price might go up to $70.29, with an average trading price around $59.23.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $56.95 | $59.03 | $70.09 |

| February | $56.97 | $59.05 | $70.11 |

| March | $56.99 | $59.07 | $70.13 |

| April | $57.00 | $59.08 | $70.14 |

| May | $57.02 | $59.10 | $70.16 |

| June | $57.04 | $59.12 | $70.18 |

| July | $57.06 | $59.14 | $70.20 |

| August | $57.08 | $59.16 | $70.22 |

| September | $57.10 | $59.18 | $70.24 |

| October | $57.11 | $59.19 | $70.25 |

| November | $57.13 | $59.21 | $70.27 |

| December | $57.15 | $59.23 | $70.29 |

Akash Network Price Prediction 2033

In 2033, the price of Akash Network is expected to reach a minimum of $84.54. The maximum price could be as high as $100.88, with an average trading price of $86.90 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $84.34 | $86.70 | $100.68 |

| February | $84.36 | $86.72 | $100.70 |

| March | $84.38 | $86.74 | $100.72 |

| April | $84.39 | $86.75 | $100.73 |

| May | $84.41 | $86.77 | $100.75 |

| June | $84.43 | $86.79 | $100.77 |

| July | $84.45 | $86.81 | $100.79 |

| August | $84.47 | $86.83 | $100.81 |

| September | $84.49 | $86.85 | $100.83 |

| October | $84.50 | $86.86 | $100.84 |

| November | $84.52 | $86.88 | $100.86 |

| December | $84.54 | $86.90 | $100.88 |

Akash Network Price Prediction: By Experts

According to Coincodex’s current Akash Network price prediction, the price of Akash Network is expected to rise by 228.23% and reach $7.68 by October 11, 2024. Their technical indicators suggest a Bearish sentiment, with the Fear & Greed Index showing a reading of 37 (Fear). Over the past 30 days, Akash Network had 13 out of 30 (43%) green days, with a price volatility of 7.03%. Based on their forecast, it is currently considered a bad time to buy Akash Network. Taking into account the historical price movements of Akash Network and BTC halving cycles, Coincodex estimates the yearly low Akash Network price prediction for 2025 at $2.34, while the price could reach as high as $11.06 next year.

According to Digital Coin Price, market analysts and experts predict that by 2026, AKT will start the year at $6.94 and trade around $8.31, marking a significant increase compared to the previous year. This represents a notable jump for Akash Network. By the beginning of 2030, their analysis forecasts that the price of Akash Network will reach $17.11, with AKT expected to maintain this value by the end of the year. Additionally, AKT could potentially reach up to $15.87 during that time. The period from 2024 to 2030 is anticipated to be significant for Akash Network’s growth.

Is Akash Network a Good Investment? When to Buy?

The Artificial Intelligence sector has underperformed in 2024, despite substantial hype, possibly due to Nvidia’s significant surge. However, AKT has emerged as the top performer within the category. The price predictions for Akash Network in 2024, 2025, and 2030 remain bullish.

AKT has encountered certain challenges that require refinement to ensure long-term sustainability and scalability. One issue is price volatility; initially, AKT was used for hosting services with prices set at lease initiation. However, fluctuating AKT values can create discrepancies between agreed prices and actual costs for providers and tenants. Additionally, Akash Network, still in its early stages, hasn’t yet incentivized providers to commit significant computing resources due to limited demand. The community fund is also insufficient to drive substantial growth and development of the network. To secure the network’s future, AKT must accrue value beyond being a simple incentive.

AKT 2.0 introduces new token features to address these challenges, including “Take and Make Fees” and “Stable Payment and Settlement.” Upcoming improvements include an Incentive Distribution Pool, which rewards network participants, provider subsidies to ensure competitive pricing, and a Public Goods Fund to incentivize development and expansion through AKT tokens.

Conclusion

By adopting the principles of the sharing economy and decentralized technologies, Akash has opened up new opportunities for accessing computing resources, making GPU usage more accessible and reducing costs for users. The platform’s strong ecosystem, supported by its native utility token AKT, encourages collaboration, innovation, and community-driven governance. With ongoing improvements like the AKT 2.0 initiative, Akash Network is set to influence the future of cloud computing and AI hosting.

Akash Network offers a compelling alternative to traditional cloud service providers, giving individuals and businesses unmatched flexibility, efficiency, and cost savings in accessing computing resources.

Frequently Asked Questions

What is Akash Network (AKT)?

Akash Network is a decentralized cloud computing platform built on the Cosmos blockchain, offering cloud services by tapping into underutilized data centers to provide cost-effective solutions. AKT is the native token used for governance, security, and transactions within the network.

What drives Akash Network’s price prediction?

Factors include Akash’s unique decentralized cloud model, partnerships, market demand for decentralized cloud computing, and mainnet upgrades. Additionally, technological advancements and increased adoption of the platform impact price growth.

What is the price prediction for Akash Network in 2024?

In 2024, AKT is predicted to have a minimum price of $2.61, an average price of $2.71, and a maximum price of $2.93.

Will Akash Network reach $10 in the future?

According to long-term predictions, Akash Network could reach $10 by 2027 as the platform continues to grow and adopt new features, with a minimum predicted price of $8.31 and a maximum of $9.88 that year.

What is Akash Network’s projected price for 2030?

By 2030, Akash Network is predicted to reach a minimum of $27.10, with a maximum price of $32.87, reflecting strong growth in the decentralized cloud sector.

What makes Akash Network a good investment?

Akash offers lower cloud computing costs, enhanced security, and scalability through its decentralized model. With the potential to disrupt the traditional cloud market and its ongoing developments, AKT is seen as a strong long-term investment.

How does AKT’s price history impact future predictions?

Akash Network experienced significant price growth in 2023 and 2024, recovering from past lows. Historical trends combined with future developments contribute to optimistic price predictions for the coming years.

What role does AKT 2.0 play in price growth?

AKT 2.0 introduces features to stabilize pricing, incentivize providers, and promote long-term sustainability, which could positively influence the token's value and drive future price growth.