- 1. Cosmos: A Quick Overview

- 2. Cosmos: How Does It Work?

- 3. ATOM Price Prediction: Price History

- 4. Cosmos Price Prediction: Technical Analysis

- 5. Cosmos Price Prediction By Blockchain Reporter

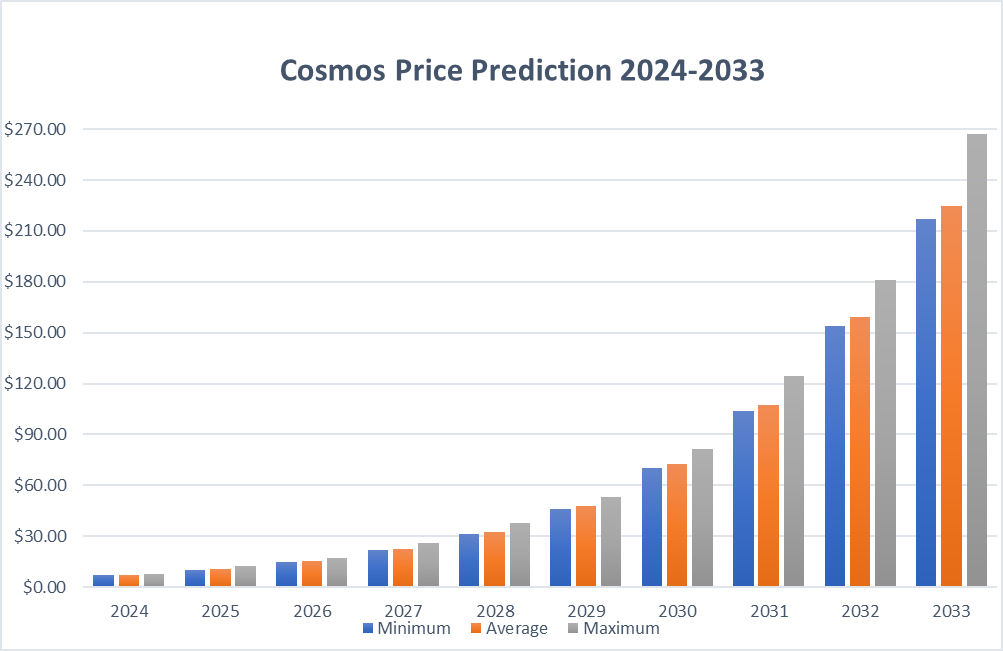

- 5.0.1. Cosmos Price Prediction 2024

- 5.0.2. Cosmos Price Prediction 2025

- 5.0.3. ATOM Price Forecast for 2026

- 5.0.4. Cosmos (ATOM) Price Prediction 2027

- 5.0.5. Cosmos Price Prediction 2028

- 5.0.6. Cosmos Price Prediction 2029

- 5.0.7. Cosmos (ATOM) Price Prediction 2030

- 5.0.8. Cosmos Price Forecast 2031

- 5.0.9. Cosmos (ATOM) Price Prediction 2032

- 5.0.10. Cosmos Price Prediction 2033

- 6. ATOM Price Forecast: By Experts

- 7. Is ATOM a Good Investment? When to Buy?

- 8. Conclusion

The Cosmos blockchain was created to enable different blockchains to communicate with each other without needing a central server. Its foundational document, the Cosmos white paper, was released in 2016. The founders envisioned it as the “Internet of blockchains,” aiming to provide a platform where various open-source blockchains could easily exchange transactions.

From the beginning of blockchain technology, allowing different blockchains to work together has been a tough problem for developers.

Interoperability is the ability for different systems to exchange information. It’s similar to how emails can be sent between Gmail and Hotmail accounts, or how an Android phone can share data with Apple’s iOS.

Initially, specific blockchains are developed independently, but for them to be truly effective, they must be able to communicate with one another. If they can’t, it limits their usefulness and can hinder the broader adoption of technology.

Cosmos stands out as the first completely open platform that supports such interoperability. It connects various systems including the Binance Chain, Terra, and Crypto.org, managing over $151 billion in digital assets.

In this article, we’ll explore Cosmos price prediction with in-depth technical analysis of the current market sentiment and its future price potential.

Cosmos: A Quick Overview

The relationship between cryptocurrency and blockchain technology is deeply interconnected. Most cryptocurrencies are built on blockchain technology, but transferring assets across different blockchains can be challenging. Cosmos addresses this issue.

Cosmos operates as a central network, connecting numerous smaller blockchains that can interact and transact with each other. This setup allows users to develop their own blockchains and applications on the Cosmos platform.

Developed in 2016 by computer programmers Jae Kwon, Zarko Milosevic, and Ethan Buchman, Cosmos is supported by its native cryptocurrency, ATOM. It successfully raised $17.3 million through an initial coin offering (ICO) and was launched to the public in 2019.

Cosmos Hub

Exploring the Cosmos ecosystem reveals the central role of the Cosmos Hub.

Acting as the main connector within the network, the Cosmos Hub links each new zone, or decentralized blockchain application. As the first blockchain to launch within the Cosmos network, it tracks the status of each zone and facilitates their interaction, ensuring smooth communication. Each zone operates independently, managing tasks like validating transactions, issuing new tokens, and implementing blockchain updates.

The Cosmos ecosystem includes many chains, each tailored to specific functions. For example, Osmosis functions mainly as a decentralized exchange, and it faces new competition as dYdX plans to launch its Cosmos-based chain.

The Cosmos Hub also enhances interoperability with other proof-of-work blockchains such as Bitcoin and Ethereum through the use of bridges, even extending to those that do not fully comply with the Cosmos protocol.

ATOM, the native cryptocurrency of the Cosmos Hub, plays a crucial role. Network participants can stake ATOM to earn rewards and potentially become validators, who help operate the blockchain and participate in governance. The amount of ATOM staked influences a validator’s voting power. Users have the flexibility to delegate their tokens to validators of their choice and can switch validators based on governance preferences.

Additionally, other blockchains can leverage the Cosmos Hub’s security features through a mechanism called Replicated Security, enabling them to operate without their own validators.

Cosmos: How Does It Work?

The Cosmos network is a growing ecosystem of interconnected apps and services.

It employs hubs, the Tendermint consensus algorithm, and the Inter-Blockchain Communication (IBC) protocol to facilitate secure communication between blockchains.

Some platforms enable cross-chain interaction using smart contracts, where tokens are locked on one blockchain and an equivalent amount of the asset is minted as wrapped tokens on another blockchain. For instance, instead of directly transferring *BTC* to Ethereum, the Bitcoin is locked on a service-providing blockchain, and an equivalent amount of wrapped Bitcoin (wBTC) is issued on *ETH*.

Cosmos, however, uses a different approach. It provides open-source tools that allow developers to create decentralized and independent blockchain applications known as zones, which operate like Cosmos’s own version of smart contracts.

To support developers, the Cosmos team has developed a software development kit (SDK) that simplifies and reduces the cost of building these zones, offering advantages over other platforms like Ethereum.

The SDK minimizes complexity by integrating common blockchain functionalities such as staking, governance, and token management, using straightforward and familiar programming languages like Go. This approach gives developers extensive freedom and flexibility to customize their zones with additional features and plugins as needed.

Cosmos SDK and Use Cases

The Cosmos SDK facilitates the development of blockchain applications, and deploying these applications within the Cosmos ecosystem involves three key steps:

- Creating a Custom Blockchain: Developers have the flexibility to tailor existing models or create new ones to establish their own blockchain.

- Launching a Custom Blockchain: The Cosmos SDK supports a variety of use cases for deploying a custom blockchain. This adaptability makes it suitable for sectors such as gaming, healthcare, prediction markets, cross-border payments, and real estate.

- Connecting to the Cosmos Network: Once an application-specific blockchain is operational, it can connect to the Cosmos Network via the Inter-Blockchain Communication (IBC) protocol. This connection not only helps in growing the user base but also boosts liquidity by linking to over 100 other IBC-enabled chains.

ATOM Price Prediction: Price History

Now, let’s review the historical prices of Cosmos (ATOM). While historical performance is not a reliable indicator of future results, understanding ATOM’s past price movements provides useful context for interpreting its potential future prices.

Cosmos entered the public market in March 2019 at approximately $7.40. Initially, this price represented a peak as it subsequently declined, fluctuating between $3 and $5 over the next two years. The lowest point occurred on March 13, 2020, when ATOM dropped to $1.13 amidst global market disruptions caused by the COVID-19 pandemic.

A significant recovery began in early 2021, aligned with a broader cryptocurrency market boom, propelling ATOM to a high of $32.14 on May 12. However, the market then entered a slow period over the summer. By autumn, Cosmos had reached a new peak of $44.70 on September 20. Despite a subsequent decline, ATOM ended the year at $32.47.

The year 2022 started promisingly for ATOM, hitting $44.45 on January 17, fueled by a partnership with the now-defunct Terra blockchain. The collapse of Terra in May plunged the market into chaos, and by mid-June, ATOM had fallen to $5.59. Nevertheless, a recovery was sparked by news that the dYdX exchange would begin operations on Cosmos, leading to a rise above $16 by September 18. However, following the bankruptcy of the FTX exchange, ATOM ended the year at $9.34, reflecting an annual loss exceeding 70%.

The beginning of 2023 marked a relatively positive period for Cosmos. On February 3, 2023, ATOM capitalized on a strong market to reach $15.36, but it subsequently began to decline. The situation worsened after the SEC classified ATOM as an unregistered security, leading to a significant price drop below $10 by early June, hitting a low of $7.50 on June 10 following Crypto.com’s suspension of its American institutional operations.

However, Cosmos saw a rebound, trading above $10 again by July 3. Despite a subsequent drop, on July 13, news that a judge ruled Ripple’s XRP was not a security on exchanges briefly boosted ATOM’s price to $10.27. Yet, the price fell once more, settling at about $9.20 by July 24, 2023.

The year concluded with ATOM at $10.99, but 2024 began on a downward trend, pushing the price below $9 by early February. A brief recovery occurred, with the price reaching $14.48 on March 7, but another downturn followed, and by June 7, 2024, ATOM was priced around $8.65.

In recent weeks, the price of ATOM declined heavily and touched the low of $6.

Cosmos Price Prediction: Technical Analysis

ATOM price attempted to surpass the 20-day simple moving average, but resistance from sellers prevented this at $6.2. This indicates a continued negative market sentiment with traders selling during price rallies. As of writing, ATOM price trades at $6.2, surging over 2.5% in the last 24 hours.

The responsibility now falls on the bulls to defend the price range between $5.6 and $5. A sharp rebound from this support zone would indicate strong purchasing activity at lower prices. To alleviate selling pressure, the bulls must breach the 200-day EMA. Subsequently, the ATOM/USDT pair could potentially reach the $8 mark.

However, this positive scenario could be negated if the price drops further and breaks below $5, suggesting the beginning of a downward trend. Under this condition, the pair might fall to $4.2, where bulls will likely attempt to halt further declines.

Cosmos Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 7.05 | 7.35 | 7.86 |

| 2025 | 10.18 | 10.47 | 12.2 |

| 2026 | 14.94 | 15.36 | 17.33 |

| 2027 | 22.14 | 22.75 | 25.72 |

| 2028 | 31.52 | 32.43 | 37.77 |

| 2029 | 46.27 | 47.57 | 53.3 |

| 2030 | 70.17 | 72.54 | 81.31 |

| 2031 | 103.85 | 107.48 | 124.31 |

| 2032 | 153.87 | 159.24 | 181.17 |

| 2033 | 216.77 | 224.73 | 267.06 |

Cosmos Price Prediction 2024

During the contentious legal actions against Binance and Coinbase in June 2023, the SEC classified Cosmos as a security. The full effects of this designation remain unclear, but it is expected to potentially restrict liquidity inflows into the Cosmos ecosystem in 2024. Despite this, Cosmos, with its impressive capability of handling 10,000 transactions per second (TPS) and its recent integration with Wormhole, may become a preferred choice over Ethereum for many users in the upcoming bull market.

Supporting this potential shift is Injective Protocol, which has been one of the top-performing cryptocurrencies over the past year. Developed using the Cosmos SDK, Injective Protocol is a blockchain ecosystem tailored for the creation of DeFi applications. Its design, optimized for DeFi, simplifies the development process for high-quality protocols. Additionally, its integration within the Cosmos ecosystem facilitates seamless cross-chain data and liquidity transfers. With a remarkable 503% increase over the past year, Injective could play a crucial role in driving momentum for Cosmos in the next bull market.

The projected lowest price for Cosmos in 2024 is $7.05. Our analysis suggests that the ATOM price may peak at $7.86, with an average price of $7.35 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $6.75 | $7.05 | $7.56 |

| February | $6.78 | $7.08 | $7.59 |

| March | $6.80 | $7.10 | $7.61 |

| April | $6.83 | $7.13 | $7.64 |

| May | $6.86 | $7.16 | $7.67 |

| June | $6.89 | $7.19 | $7.70 |

| July | $6.91 | $7.21 | $7.72 |

| August | $6.94 | $7.24 | $7.75 |

| September | $6.97 | $7.27 | $7.78 |

| October | $7.00 | $7.30 | $7.81 |

| November | $7.02 | $7.32 | $7.83 |

| December | $7.05 | $7.35 | $7.86 |

Cosmos Price Prediction 2025

Cosmos utilizes the Inter-Blockchain Communication (IBC) protocol to facilitate data transfer between connected blockchains. The primary alternative to Cosmos’ IBC is the use of cross-chain bridges, which have become notorious as central points of failure in the crypto industry, with billions of dollars lost to exploits in recent years. A notable example is the $600 million hack of Axie Infinity’s Ronin bridge in 2022.

Given these risks, Cosmos offers a more secure and interconnected option for developers who wish to maintain complete autonomy over their blockchains. This has enabled Cosmos to become a pioneering platform in the industry, contributing to its achievement of a multi-billion-dollar market cap. Significant blockchains such as Binance Beacon Chain, Crypto.com’s Cronos, and THORChain have all been developed using the Cosmos SDK.

However, Cosmos faces criticism for its unlimited coin supply, designed to encourage network security through high staking rewards for validators and delegators. This approach can adversely affect the price of ATOM due to the potential for inflation.

Despite a proposal to burn ATOM coins to address this issue, a similar proposal was rejected last year, indicating that the Cosmos community may prioritize staking rewards over creating scarcity through tokenomics.

In 2025, the minimum expected price of Cosmos is $10.18. It could potentially reach a high of $12.20, with an average trading price of $10.47 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $9.88 | $10.17 | $11.90 |

| February | $9.91 | $10.20 | $11.93 |

| March | $9.93 | $10.22 | $11.95 |

| April | $9.96 | $10.25 | $11.98 |

| May | $9.99 | $10.28 | $12.01 |

| June | $10.02 | $10.31 | $12.04 |

| July | $10.04 | $10.33 | $12.06 |

| August | $10.07 | $10.36 | $12.09 |

| September | $10.10 | $10.39 | $12.12 |

| October | $10.13 | $10.42 | $12.15 |

| November | $10.15 | $10.44 | $12.17 |

| December | $10.18 | $10.47 | $12.20 |

ATOM Price Forecast for 2026

Based on historical price data, the minimum price of Cosmos in 2026 is forecasted to be $14.94. The price could climb to a maximum of $17.33, with an average of $15.36 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $14.64 | $15.06 | $17.03 |

| February | $14.67 | $15.09 | $17.06 |

| March | $14.69 | $15.11 | $17.08 |

| April | $14.72 | $15.14 | $17.11 |

| May | $14.75 | $15.17 | $17.14 |

| June | $14.78 | $15.20 | $17.17 |

| July | $14.80 | $15.22 | $17.19 |

| August | $14.83 | $15.25 | $17.22 |

| September | $14.86 | $15.28 | $17.25 |

| October | $14.89 | $15.31 | $17.28 |

| November | $14.91 | $15.33 | $17.30 |

| December | $14.94 | $15.36 | $17.33 |

Cosmos (ATOM) Price Prediction 2027

For 2027, Cosmos is expected to have a minimum price of $22.14. The price may rise to a maximum of $25.72, with the average for the year around $22.75.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $21.84 | $22.45 | $25.42 |

| February | $21.87 | $22.48 | $25.45 |

| March | $21.89 | $22.50 | $25.47 |

| April | $21.92 | $22.53 | $25.50 |

| May | $21.95 | $22.56 | $25.53 |

| June | $21.98 | $22.59 | $25.56 |

| July | $22.00 | $22.61 | $25.58 |

| August | $22.03 | $22.64 | $25.61 |

| September | $22.06 | $22.67 | $25.64 |

| October | $22.09 | $22.70 | $25.67 |

| November | $22.11 | $22.72 | $25.69 |

| December | $22.14 | $22.75 | $25.72 |

Cosmos Price Prediction 2028

According to projections, the price of Cosmos in 2028 could drop to a minimum of $31.52 and may rise to a maximum of $37.77, averaging $32.43 over the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $31.22 | $32.13 | $37.47 |

| February | $31.25 | $32.16 | $37.50 |

| March | $31.27 | $32.18 | $37.52 |

| April | $31.30 | $32.21 | $37.55 |

| May | $31.33 | $32.24 | $37.58 |

| June | $31.36 | $32.27 | $37.61 |

| July | $31.38 | $32.29 | $37.63 |

| August | $31.41 | $32.32 | $37.66 |

| September | $31.44 | $32.35 | $37.69 |

| October | $31.47 | $32.38 | $37.72 |

| November | $31.49 | $32.40 | $37.74 |

| December | $31.52 | $32.43 | $37.77 |

Cosmos Price Prediction 2029

The forecast for 2029 suggests that Cosmos could reach a minimum price of $46.27. The maximum price could be $53.30, with an average expected price of $47.57.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $45.97 | $47.27 | $53.00 |

| February | $46.00 | $47.30 | $53.03 |

| March | $46.02 | $47.32 | $53.05 |

| April | $46.05 | $47.35 | $53.08 |

| May | $46.08 | $47.38 | $53.11 |

| June | $46.11 | $47.41 | $53.14 |

| July | $46.13 | $47.43 | $53.16 |

| August | $46.16 | $47.46 | $53.19 |

| September | $46.19 | $47.49 | $53.22 |

| October | $46.22 | $47.52 | $53.25 |

| November | $46.24 | $47.54 | $53.27 |

| December | $46.27 | $47.57 | $53.30 |

Cosmos (ATOM) Price Prediction 2030

In 2030, Cosmos is predicted to reach a minimum price of $70.17 and could go up to $81.31, with the average trading price likely to be $72.54 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $69.87 | $72.24 | $81.01 |

| February | $69.90 | $72.27 | $81.04 |

| March | $69.92 | $72.29 | $81.06 |

| April | $69.95 | $72.32 | $81.09 |

| May | $69.98 | $72.35 | $81.12 |

| June | $70.01 | $72.38 | $81.15 |

| July | $70.03 | $72.40 | $81.17 |

| August | $70.06 | $72.43 | $81.20 |

| September | $70.09 | $72.46 | $81.23 |

| October | $70.12 | $72.49 | $81.26 |

| November | $70.14 | $72.51 | $81.28 |

| December | $70.17 | $72.54 | $81.31 |

Cosmos Price Forecast 2031

By 2031, the minimum price of Cosmos is expected to be $103.85, possibly reaching up to $124.31, with an average annual price of $107.48.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $103.55 | $107.18 | $124.01 |

| February | $103.58 | $107.21 | $124.04 |

| March | $103.60 | $107.23 | $124.06 |

| April | $103.63 | $107.26 | $124.09 |

| May | $103.66 | $107.29 | $124.12 |

| June | $103.69 | $107.32 | $124.15 |

| July | $103.71 | $107.34 | $124.17 |

| August | $103.74 | $107.37 | $124.20 |

| September | $103.77 | $107.40 | $124.23 |

| October | $103.80 | $107.43 | $124.26 |

| November | $103.82 | $107.45 | $124.28 |

| December | $103.85 | $107.48 | $124.31 |

Cosmos (ATOM) Price Prediction 2032

Based on past price data, the expected minimum price of Cosmos in 2032 is $153.87. The maximum price might reach $181.17, with the average trading value expected to be $159.24.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $153.57 | $158.94 | $180.87 |

| February | $153.60 | $158.97 | $180.90 |

| March | $153.62 | $158.99 | $180.92 |

| April | $153.65 | $159.02 | $180.95 |

| May | $153.68 | $159.05 | $180.98 |

| June | $153.71 | $159.08 | $181.01 |

| July | $153.73 | $159.10 | $181.03 |

| August | $153.76 | $159.13 | $181.06 |

| September | $153.79 | $159.16 | $181.09 |

| October | $153.82 | $159.19 | $181.12 |

| November | $153.84 | $159.21 | $181.14 |

| December | $153.87 | $159.24 | $181.17 |

Cosmos Price Prediction 2033

The price of Cosmos in 2033 is anticipated to be at least $216.77. It could reach a maximum of $267.06, with an average price of $224.73 during the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $216.47 | $224.43 | $266.76 |

| February | $216.50 | $224.46 | $266.79 |

| March | $216.52 | $224.48 | $266.81 |

| April | $216.55 | $224.51 | $266.84 |

| May | $216.58 | $224.54 | $266.87 |

| June | $216.61 | $224.57 | $266.90 |

| July | $216.63 | $224.59 | $266.92 |

| August | $216.66 | $224.62 | $266.95 |

| September | $216.69 | $224.65 | $266.98 |

| October | $216.72 | $224.68 | $267.01 |

| November | $216.74 | $224.70 | $267.03 |

| December | $216.77 | $224.73 | $267.06 |

ATOM Price Forecast: By Experts

According to the current Cosmos price prediction from Coincodex, the price of Cosmos is expected to increase by 1.71% and reach $6.33 by August 12, 2024. Technical indicators suggest a bearish sentiment, while the Fear & Greed Index indicates extreme fear with a score of 25. Over the past 30 days, Cosmos has had 13 out of 30 green days, demonstrating a price volatility of 7.42%.

The forecast suggests that it is currently not an opportune time to purchase Cosmos. Historical price movements of Cosmos and BTC halving cycles inform a yearly low-price prediction for 2025 at $5.57. In contrast, the price of Cosmos could escalate to as high as $27.81 in the following year.

According to market analysts and experts cited by Digital Coin Price, ATOM is expected to start 2026 at $18.35 and trade around $22.65. This forecasted price represents a substantial increase compared to the previous year, marking an acceptable surge in Cosmos’ value.

By the beginning of 2030, technical analysis and price predictions suggest that the cost of Cosmos will rise to $44.80, with ATOM projected to maintain this price by year-end. Additionally, ATOM might reach as high as $41.98 during the year. The period from 2024 to 2030 is anticipated to be significantly impactful for the growth of Cosmos.

Is ATOM a Good Investment? When to Buy?

Cosmos has remained within the top 30 cryptocurrencies in recent years, attracting significant investment. However, its visibility has also drawn scrutiny from the SEC, which has accused it of operating as an unregistered security. The future of Cosmos now remains uncertain. In addition to addressing regulatory challenges, Cosmos must reaffirm its value to the broader cryptocurrency community. The recent downturn following its latest upgrade has likely not helped its standing with investors.

Much will also hinge on future market conditions. As with any investment, it is crucial to conduct thorough personal research.

Conclusion

The outlook for the Cosmos ecosystem is promising. With the development of Interchain Security, significant enhancements in security are anticipated, ensuring improved protection across all interconnected chains.

Enhanced fluidity in IBC connections will ease DeFi transactions and facilitate the transfer of interchain NFTs across various public and permissioned blockchains.

Cosmos has ambitious plans in the pipeline, supported by a dedicated team of developers. This foundation enables participants to look forward to a bright future.

Frequently Asked Questions

What is Cosmos (ATOM)?

Cosmos is a blockchain network designed to facilitate communication between different blockchains. Its native cryptocurrency is ATOM, which plays a critical role in the network’s operations.

What are some key features of Cosmos?

Interoperability: Allows various blockchains to communicate. Cosmos Hub: The central blockchain that connects different zones. Tendermint Consensus Algorithm: Ensures secure and fast transactions. Inter-Blockchain Communication (IBC) Protocol: Facilitates cross-chain communication.

What is the Cosmos SDK?

The Cosmos Software Development Kit (SDK) is a tool for developers to create custom blockchains within the Cosmos ecosystem. It simplifies the process by providing common blockchain functionalities.

What is the historical price performance of ATOM?

Initial Launch: $7.40 in March 2019 Lowest Point: $1.13 in March 2020 2021 Peak: $44.70 in September 2021 Recent Performance: $10.99 at the end of 2023, with fluctuations in 2024

What are the future price predictions for ATOM?

2025: $10.18 - $12.20 2026: $14.94 - $17.33 2030: $70.17 - $81.31 2033: $216.77 - $267.06

Is ATOM a good investment?

Investing in ATOM requires considering regulatory challenges and the network's ability to deliver on its technological promises. Conduct thorough research and stay updated on market conditions.