- 1. Ethereum And Its Use Cases

- 2. Ethereum ETFs: Hype And Current Status

- 3. Ethereum Price Prediction: Price History

- 4. Ethereum Price Prediction: Technical Analysis

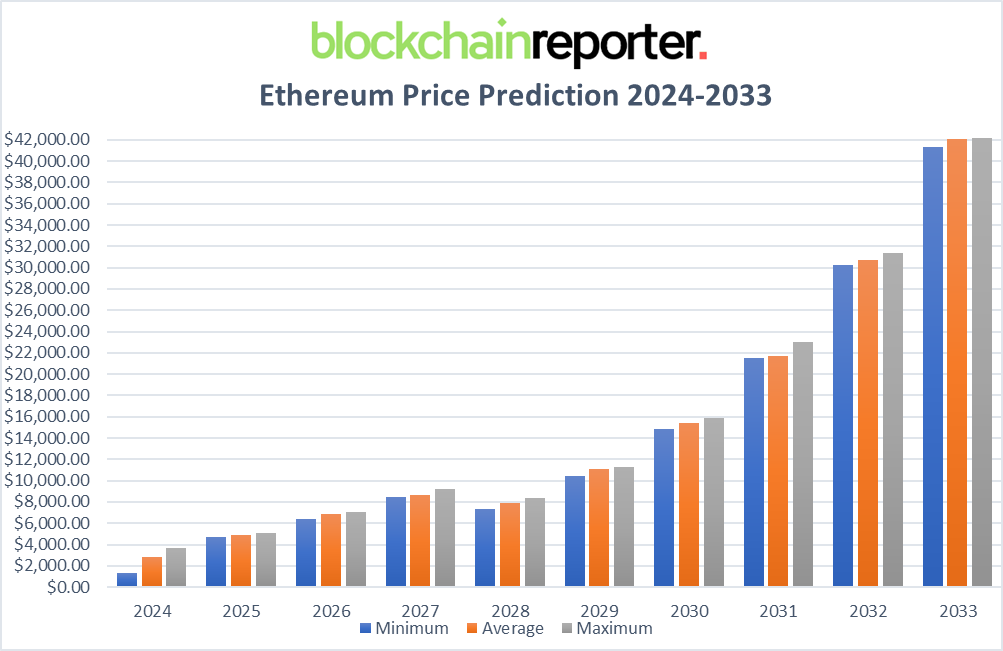

- 5. Ethereum Price Prediction By Blockchain Reporter

- 5.0.1. Ethereum Price Prediction 2024

- 5.0.2. Ethereum Price Prediction 2025

- 5.0.3. ETH Price Forecast for 2026

- 5.0.4. Ethereum (ETH) Price Prediction 2027

- 5.0.5. Ethereum Price Prediction 2028

- 5.0.6. Ethereum Price Prediction 2029

- 5.0.7. Ethereum (ETH) Price Prediction 2030

- 5.0.8. Ethereum Price Forecast 2031

- 5.0.9. Ethereum (ETH) Price Prediction 2032

- 5.0.10. Ethereum Price Prediction 2033

- 6. Ethereum Price Forecast: By Experts

- 7. Is Ethereum A Good Investment? When To Buy?

- 8. Conclusion

Ethereum (ETH), ranking as the second-largest cryptocurrency globally, is widely recognized for its extensive and interesting features as a blockchain platform. It serves its role as just a cryptocurrency, earning high esteem among crypto enthusiasts for its significant worth and the distinct investment opportunities it offers. Recently, Ethereum has gained spotlight following spot Bitcoin ETF approval by the SEC. In 2023, while the US crypto market was focused on Bitcoin ETFs, Blackrock’s proposal for an Ethereum-based ETF shifted the spotlight to Ethereum, the world’s second-largest cryptocurrency. This shift, alongside a positive market trend and a crypto rally in late October, helped Ethereum’s value surpass $2,000, a significant milestone it hadn’t reached in months. Ethereum’s rise was further triggered after the SEC approved Bitcoin ETFs on January 10, leading to a peak in Ethereum’s value in nearly two years by January 12. Looking ahead, Ethereum is set for notable upgrades with the upcoming Deneb and Cancun updates. The Dencun upgrade is particularly significant, introducing proto-danksharding to improve network scalability, reduce gas fees for users, and enhance interoperability with other blockchains, paving the way for more efficient cross-chain interactions. Amid all these, our Ethereum price prediction aims to explore the future trend of ETH price with in-depth technical analysis to offer profitable investment opportunities. Looking for crypto with more potential than Ethereum? Explore our guide to the best crypto to buy now.

Ethereum And Its Use Cases

Ethereum, launched in 2015, revolutionized blockchain technology by enabling the creation of decentralized applications (DApps) beyond just supporting cryptocurrencies. It introduced its native coin, Ether (commonly referred to as Ethereum or ETH), which is used for transactions on the blockchain. *ETH* can be traded, staked for blockchain contributions, and was initially part of a Proof-of-Work (PoW) system, where complex computations added blocks to the blockchain. However, this system was environmentally costly, using more energy annually than Kazakhstan, and led to slow, congested transactions.

To address these issues, *ETH* transitioned to a Proof-of-Stake (PoS) mechanism in 2020, allowing holders to add blocks based on their ETH holdings. This shift, known as The Merge, was completed on September 15, 2022, making the network more efficient and environmentally friendly.

Ethereum ETFs: Hype And Current Status

Currently, with 11 spot Bitcoin ETFs operational, the crypto community is speculating about the potential approval and timing of a spot Ethereum ETF. However, the situation is complex. The SEC has not clarified if ether qualifies as a security, a determination that could impede an ETF’s approval.

Furthermore, the SEC’s approval of a spot Bitcoin ETF was contentious, narrowly passing with a one-vote margin, including SEC Chair Gary Gensler’s vote. Gensler emphasized that this approval does not equate to an endorsement of Bitcoin by the SEC and should not be interpreted as openness to approving crypto asset securities in general.

These factors, among others, have led to mixed opinions about the likelihood of a spot Ethereum ETF being approved soon. While banks generally view such approval as improbable, crypto experts maintain a cautiously optimistic outlook.

Proponents expecting a spot Ethereum ETF approval this year draw parallels to the recent approval process of spot Bitcoin ETFs.

Matt Kunke, a research analyst at the crypto market making firm GSR, predicts a 75% chance of a spot Ethereum ETF approval in May. His optimism is based on Grayscale’s Court of Appeals victory and the subsequent green light for Ethereum Futures ETF. He believes these developments indicate that a spot Ethereum ETF approval is imminent.

Kunke also noted that if the SEC rejects the current spot Ethereum ETF applications in May, an appeal is likely to follow. In such a scenario, he suggests that the SEC might choose the easier route of approval, while still maintaining a cautious approach towards other cryptocurrencies.

The SEC has recently postponed Grayscale Investments’ request to transform its Ethereum trust product (ETHE) into an exchange-traded fund (ETF). This decision came just a day after the SEC similarly deferred BlackRock’s application for a comparable ETF proposal.

Market sentiment has shown a degree of optimism regarding the potential approval of spot Ethereum ETF by May 23, the deadline set by the SEC for the Ark 21Shares application. However, according to JPMorgan (JPM), the likelihood of the SEC granting approval for the ETF by this date is estimated to be no higher than 50%.

Ethereum Price Prediction: Price History

*ETH* price history has seen significant fluctuations. Launching at around $2.77 in 2015, it surpassed $10 in 2016 but faced setbacks due to a hack. In 2017, it crossed $100 and briefly went over $1,000 in early 2018 during a crypto bubble, then stabilized around $300 for the next three years.

In early 2021, Ethereum’s price surged, nearly reaching $4,000 in May. Despite a summer dip, it rebounded, partly driven by the NFT craze. *ETH* hit a record high of $4,891.70 in November as *BTC* also soared.

2022 was challenging for crypto, with Ethereum nearly falling below $1,000 despite the successful completion of The Merge.

In 2023, Ethereum saw a period of recovery, surpassing the $2,000 mark in April for the first time in almost a year. However, it experienced a downturn in early June, dropping to $1,624.14 by June 15. The market then rebounded, and following a decision that Ripple’s XRP was not a security on exchanges, Ethereum peaked at $2,026.20 on July 14.

By December 9, Ethereum’s value climbed to $2,401.76, the highest since May 2022. On December 13, it was trading around $2,180. The price peaked again at $2,445.02 on December 28, before closing the year at $2,281.47. However, Ethereum started this year on a bearish note as spot Bitcoin ETF approval triggered a ‘sell the news’ event in the market, plunging ETH price toward the $2,100 level.

Ethereum Price Prediction: Technical Analysis

Ether gained momentum after it surpassed the $2,400 resistance level, showcasing strong buying interest from investors. Over the last few hours, ETH price faced strong buying pressure near the $2,700 level and knocked the $2,830 level; however, it faced resistance from the bears. As of writing, ETH price trades at $2,802, surging over 1.9% from yesterday’s rate.

Investors are currently attempting to hold the price beyond the $2,800 resistance, indicating a continuation of the upward trend. Should the buyers maintain the upward trend above immediate Fib channels, the ETH/USDT pair might surge to the key $3,000 mark. At this level, short-term traders could begin to take profits and trigger a correction.

The pressure is increasing on the bears. To plunge the bullish momentum, they must lower and keep the price under the EMA20 trend line. If successful, the pair could retreat to the $2,600 level and might prepare for a retest of the $2,400 level. However, this support zone will likely attract buyers to accumulate more ETH.

Ethereum Price Prediction By Blockchain Reporter

| Years | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 1,336.16 | 2,802.23 | 3,694.71 |

| 2025 | 4,724.31 | 4,851.80 | 5,044.96 |

| 2026 | 6,432.54 | 6,864.13 | 7,024.51 |

| 2027 | 8,436.93 | 8,610.28 | 9,225.42 |

| 2028 | 7,356.01 | 7,853.56 | 8,372.82 |

| 2029 | 10,476.50 | 11,116.55 | 11,267.95 |

| 2030 | 14,884.16 | 15,434.11 | 15,892.40 |

| 2031 | 21,468.24 | 21,708.27 | 23,002.47 |

| 2032 | 30,257.37 | 30,703.18 | 31,393.21 |

| 2033 | 41,282.84 | 42,125.08 | 42,202.84 |

Ethereum Price Prediction 2024

In 2024, the price of 1 Ethereum is expected to attain a minimum level of $1,336.16. The ETH price may peak at $3,694.71, with an average price of $2,802.23 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1,800.74 | $2,100.57 | $2,300.55 |

| February | $2,154.55 | $2,194.58 | $2,387.59 |

| March | $2,345.87 | $2,360.54 | $2,578.59 |

| April | $2,555.55 | $2,578.57 | $2,758.33 |

| May | $2,320.25 | $2,578.64 | $2,698.58 |

| June | $1,958.58 | $2,674.48 | $2,874.58 |

| July | $2,415.44 | $2,455.58 | $2,977.47 |

| August | $1,587.65 | $2,200.58 | $2,578.48 |

| September | $1,336.16 | $1,958.58 | $2,587.47 |

| October | $2,488.87 | $2,745.69 | $2,987.54 |

| November | $2,647.97 | $2,801.25 | $3,245.54 |

| December | $3,154.52 | $2,802.23 | $3,694.71 |

Ethereum Price Prediction 2025

As per the forecast data analysis, the price of ETH is expected to cross the level of $4,851.80. By the end of the year, Ethereum is expected to reach a minimum fee of $4,724.31. In addition, the ETH price can achieve a maximum level of $5,044.96.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $4,765.95 | $5,043.17 | $5,146.55 |

| February | $4,671.52 | $5,157.36 | $5,263.67 |

| March | $4,725.68 | $5,156.15 | $5,447.80 |

| April | $4,771.75 | $5,028.54 | $5,344.05 |

| May | $4,665.68 | $5,060.07 | $5,200.03 |

| June | $4,664.26 | $4,847.20 | $4,905.94 |

| July | $4,741.66 | $4,974.17 | $5,111.49 |

| August | $4,734.52 | $4,800.46 | $5,213.57 |

| September | $4,709.67 | $5,304.62 | $5,418.67 |

| October | $4,764.70 | $4,916.14 | $4,965.32 |

| November | $4,721.91 | $5,283.81 | $5,481.06 |

| December | $4,724.31 | $4,851.80 | $5,044.96 |

ETH Price Forecast for 2026

As per the forecast data analysis, the price of ETH is expected to surpass the level of $6,864.13. By the end of the year, Ethereum is expected to reach a minimum fee of $6,432.54. In addition, the ETH price can secure a maximum level of $7,024.51.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $6,472.88 | $6,979.96 | $7,058.92 |

| February | $6,501.49 | $6,686.16 | $6,997.69 |

| March | $6,468.03 | $7,288.75 | $7,657.01 |

| April | $6,454.81 | $7,171.57 | $7,562.06 |

| May | $6,502.52 | $7,280.14 | $8,017.62 |

| June | $6,456.38 | $7,376.67 | $8,021.05 |

| July | $6,440.68 | $7,203.22 | $7,508.73 |

| August | $6,407.11 | $6,465.61 | $6,734.86 |

| September | $6,494.84 | $7,142.82 | $7,425.25 |

| October | $6,409.78 | $6,718.60 | $6,766.55 |

| November | $6,452.43 | $6,641.76 | $6,880.61 |

| December | $6,432.54 | $6,864.13 | $7,024.51 |

Ethereum (ETH) Price Prediction 2027

As per the forecast data analysis, the price of ETH is expected to exceed the level of $8,610.28. By the end of the year, Ethereum is expected to reach a minimum price of $8,436.93. In addition, the ETH price is capable of getting a maximum level of $9,225.42.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $8,412.41 | $8,727.90 | $9,191.09 |

| February | $8,411.23 | $8,706.60 | $9,939.71 |

| March | $8,393.01 | $9,886.35 | $10,107.76 |

| April | $8,394.15 | $8,972.19 | $9,127.08 |

| May | $8,408.88 | $8,814 | $9,609.50 |

| June | $8,389.26 | $9,315.76 | $9,604.32 |

| July | $8,435.54 | $9,611.26 | $9,851.96 |

| August | $8,423.27 | $8,670.04 | $9,629.64 |

| September | $8,446.50 | $8,598.70 | $9,011.23 |

| October | $8,461.05 | $8,550.07 | $9,487.44 |

| November | $8,427.12 | $8,766.87 | $9,852.14 |

| December | $8,436.93 | $8,610.28 | $9,225.42 |

Ethereum Price Prediction 2028

Based on the analysis of forecast data, it is anticipated that the price of Ethereum (ETH) will exceed $7,853.56. Ethereum is projected to reach a minimum price of $7,356.01 by the end of the year. Furthermore, the ETH price has the potential to achieve a maximum level of $8,372.82.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $7,296.49 | $8,023.49 | $8,599.40 |

| February | $7,382.96 | $8,241.38 | $8,379.09 |

| March | $7,365.72 | $7,781.33 | $7,897.62 |

| April | $7,316.16 | $8,441.23 | $8,649.63 |

| May | $7,338.97 | $7,784.69 | $8,569.46 |

| June | $7,290.52 | $7,855.19 | $8,318.27 |

| July | $7,288.53 | $7,719.22 | $8,038.11 |

| August | $7,291.02 | $7,670.56 | $7,952.73 |

| September | $7,343.97 | $7,563.47 | $8,236.57 |

| October | $7,369.22 | $7,502.63 | $8,368.68 |

| November | $7,366.48 | $7,449.04 | $7,717.71 |

| December | $7,356.01 | $7,853.56 | $8,372.82 |

Ethereum Price Prediction 2029

As per the forecast data analysis, the price of ETH is expected to surpass the level of $11,116.55. By the end of the year, Ethereum is expected to reach a minimum price of $10,476.50. In addition, the ETH price is capable of getting a maximum level of $11,267.95.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $10,400.38 | $10,682.96 | $11,223.85 |

| February | $10,410.02 | $10,489.28 | $10,651.49 |

| March | $10,420.88 | $11,080.25 | $11,457.78 |

| April | $10,455.73 | $10,695.82 | $11,737.39 |

| May | $10,452.44 | $11,226.28 | $12,007.48 |

| June | $10,369.95 | $11,216.72 | $11,886.05 |

| July | $10,419.54 | $11,058.40 | $11,218.04 |

| August | $10,404.56 | $10,536.24 | $10,930.74 |

| September | $10,391 | $10,638.40 | $10,986.58 |

| October | $10,470.77 | $10,717.77 | $11,148.06 |

| November | $10,475.62 | $10,828.72 | $11,262.29 |

| December | $10,476.50 | $11,116.55 | $11,267.95 |

Ethereum (ETH) Price Prediction 2030

As per the forecast data analysis, the price of ETH is expected to cross the level of $15,434.11. By the end of the year, Ethereum is expected to reach a minimum value of $14,884.16. In addition, the ETH price is capable of getting a maximum level of $15,892.40.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $14,850.43 | $15,522.27 | $15,952.37 |

| February | $14,778.57 | $15,707.81 | $15,987.42 |

| March | $14,779.60 | $15,164.92 | $15,904.70 |

| April | $14,880.01 | $15,668.95 | $15,752.55 |

| May | $14,887.77 | $15,369.37 | $15,584.79 |

| June | $14,787.72 | $15,483.05 | $15,977.34 |

| July | $14,810.88 | $16,183.64 | $16,491.21 |

| August | $14,832.08 | $16,208.49 | $16,303.65 |

| September | $14,840.30 | $15,043.02 | $15,619.98 |

| October | $14,839.22 | $15,377.92 | $15,553.52 |

| November | $14,786.93 | $15,311.32 | $15,535.99 |

| December | $14,884.16 | $15,434.11 | $15,892.40 |

Ethereum Price Forecast 2031

According to the predictive data analysis, the price of Ethereum (ETH) is anticipated to surpass $21,708.27. By the conclusion of the year, it’s expected that Ethereum will achieve a minimum price of $21,468.24. Additionally, there’s a potential for the ETH price to attain a peak of $23,002.47.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $21,459.90 | $22,482.93 | $22,703 |

| February | $21,399.33 | $21,839.94 | $22,012.58 |

| March | $21,421.31 | $21,868.28 | $22,224.86 |

| April | $21,498.33 | $22,477.31 | $22,867.53 |

| May | $21,418.57 | $21,879 | $21,972.77 |

| June | $21,443.35 | $22,306.70 | $22,570.05 |

| July | $21,397.93 | $21,466.84 | $21,876.70 |

| August | $21,447.54 | $21,533.27 | $21,915.75 |

| September | $21,424.24 | $22,708.37 | $22,997.21 |

| October | $21,476.04 | $21,781.55 | $22,356.91 |

| November | $21,435.79 | $22,240.56 | $22,307.84 |

| December | $21,468.24 | $21,708.27 | $23,002.47 |

Ethereum (ETH) Price Prediction 2032

Based on the analysis of predictive data, the price of Ethereum (ETH) is projected to exceed $30,703.18. It is forecasted that by the end of this year, Ethereum will attain a minimum value of $30,257.37. Moreover, the ETH price has the potential to reach a maximum of $31,393.21.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $30,232.32 | $30,425.69 | $30,672.49 |

| February | $30,236.53 | $30,326.16 | $30,689.62 |

| March | $30,292.87 | $30,587.89 | $30,669.67 |

| April | $30,318.41 | $31,065.97 | $31,116.51 |

| May | $30,268.21 | $31,030.68 | $31,113.34 |

| June | $30,256.93 | $30,361.57 | $30,963.69 |

| July | $30,293.32 | $31,183.60 | $31,346.77 |

| August | $30,237.93 | $30,347.25 | $30,934.78 |

| September | $30,293.26 | $31,111.48 | $31,753.36 |

| October | $30,303.48 | $30,657.80 | $31,443.37 |

| November | $30,256.95 | $30,558.42 | $31,017.82 |

| December | $30,257.37 | $30,703.18 | $31,393.21 |

Ethereum Price Prediction 2033

According to the analysis of forecast data, it is anticipated that the price of Ethereum (ETH) will surpass $42,125.08. By the year’s end, it is projected that Ethereum will achieve a minimum value of $41,282.84. Furthermore, there is potential for the ETH price to attain a maximum of $42,202.84.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $41,245.82 | $42,007.91 | $42,497.92 |

| February | $41,246.33 | $42,161.73 | $42,302.38 |

| March | $41,297.03 | $41,378.26 | $41,765.65 |

| April | $41,267.28 | $41,400.21 | $41,485.31 |

| May | $41,319.28 | $41,392.19 | $41,490.75 |

| June | $41,300.92 | $42,302.38 | $42,936.63 |

| July | $41,344.06 | $42,514.19 | $42,719.22 |

| August | $41,244.98 | $42,425.09 | $42,899.07 |

| September | $41,311.39 | $41,376.66 | $42,313.83 |

| October | $41,319.64 | $42,527.33 | $42,649.53 |

| November | $41,307.98 | $42,248.30 | $42,560.79 |

| December | $41,282.84 | $42,125.08 | $42,202.84 |

Ethereum Price Forecast: By Experts

According to the Ethereum price prediction by Coincodex, it is forecasted that Ethereum’s value will increase by 7.61%, reaching $2,394.45 by January 31, 2024. The technical indicators used by Coincodex suggest a current Bearish sentiment, with the Fear & Greed Index indicating a Neutral stance at 49. In the past 30 days, Ethereum has experienced 40% green days, showing a 5.25% price volatility.

Coincodex’s analysis currently advises against purchasing Ethereum. Their forecast, considering historical price trends of Ethereum and Bitcoin halving cycles, estimates the yearly low for Ethereum in 2025 to be around $2,161.48. However, they also predict that Ethereum’s price could soar up to $6,389.27 in the following year.

VanEck, a prominent global investment fund house, holds a bullish stance on Ethereum, viewing it as a “triple-point asset” that serves as a capital asset, a consumer asset, and a store of value. VanEck believes that, under favorable conditions, Ethereum’s market cap could surpass $2 trillion.

Ben Ritchie, the managing director of Digital Capital Management, forecasts that Ethereum could potentially end the year at around $2,500, provided positive developments continue.

Well-known cryptocurrency blogs such as Gov Capital and Traders Union also share a bullish outlook on Ethereum. Gov Capital predicts Ethereum’s value could reach $7,200 by 2025. Anton Kharitonov, an analyst at Traders Union, anticipates that Ethereum could be trading at about $6,196.08 by the end of 2025, with the potential to increase to $31,656.34 by 2030.

Is Ethereum A Good Investment? When To Buy?

Determining Ethereum’s future performance is challenging. The cryptocurrency has shown strong buying confidence, recovering well from the news of the SEC’s lawsuit against Binance and Coinbase. Additionally, Ethereum is progressing with new upgrades and there’s rising speculation about a potential spot Ethereum ETF, which has positively influenced its price.

However, the much-anticipated Merge, expected to significantly enhance Ethereum, did not have a substantial impact on its price. The inherent volatility of cryptocurrencies also means that Ethereum’s value could decrease at any moment. It’s noteworthy that Bitcoin’s value declined following the approval of its spot ETFs last week.

Conversely, the increasing amount of Ethereum being staked indicates that The Merge has been technically successful and well-received in the community. It is suggested to invest in ETH at a price of $1,800-$1,900 for a solid return in the long term.

Conclusion

Ethereum, renowned as a technologically advanced and established cryptocurrency, is poised to maintain its leading position in the altcoin market in the upcoming years, as indicated by the aforementioned Ethereum price prediction. Differing from Bitcoin, Ethereum functions as a utility token. While its price is significantly influenced by Bitcoin’s movements and broader macroeconomic factors, Ethereum’s value is also affected by a variety of crypto-specific elements.

Additionally, the trends in cryptocurrency and equity markets typically exhibit parallel movements. However, over the past year, these markets have shown a divergence. For instance, numerous tech stocks such as Apple (AAPL) have reached all-time highs, while the cryptocurrency sector continues to experience a bear market.

Recent improvements in macroeconomic conditions, like the slowdown in inflation and the Federal Reserve’s pause on interest rate hikes, have not led to a corresponding positive impact on cryptocurrency prices, including Ethereum. This raises questions about the factors influencing the crypto market’s reaction to these economic changes.

Frequently Asked Questions

What is Ethereum?

Ethereum is a blockchain platform that introduced Ether (ETH), a cryptocurrency used for transactions on its network. Launched in 2015, Ethereum is notable for enabling decentralized applications (DApps) and transitioning to a more energy-efficient Proof-of-Stake (PoS) system.

What are Ethereum ETFs and their current status?

Ethereum ETFs are proposed exchange-traded funds based on Ethereum. The current status is uncertain, as the SEC has not yet approved any Ethereum ETFs, and their potential impact on Ethereum's value and the broader crypto market is a subject of speculation.

What factors could influence Ethereum's price in the future?

Ethereum's price could be influenced by various factors including market trends, technological upgrades like Deneb and Cancun, regulatory decisions, the outcome of Ethereum ETFs, and overall investor sentiment in the cryptocurrency market.

Is Ethereum a good investment and when to buy?

Investing in Ethereum depends on individual risk tolerance and market analysis. The cryptocurrency is known for its volatility. Potential investors might consider buying during price dips, but should be aware of the market's unpredictability and do thorough research before investing.