- 1. Lido DAO: A Quick Introduction

- 2. LDO: How Does It Work?

- 3. Lido Dao Historical Price Sentiment

- 4. LDO Price Forecast: Technical Analysis

- 5. Lido Dao Price Prediction By Blockchain Reporter

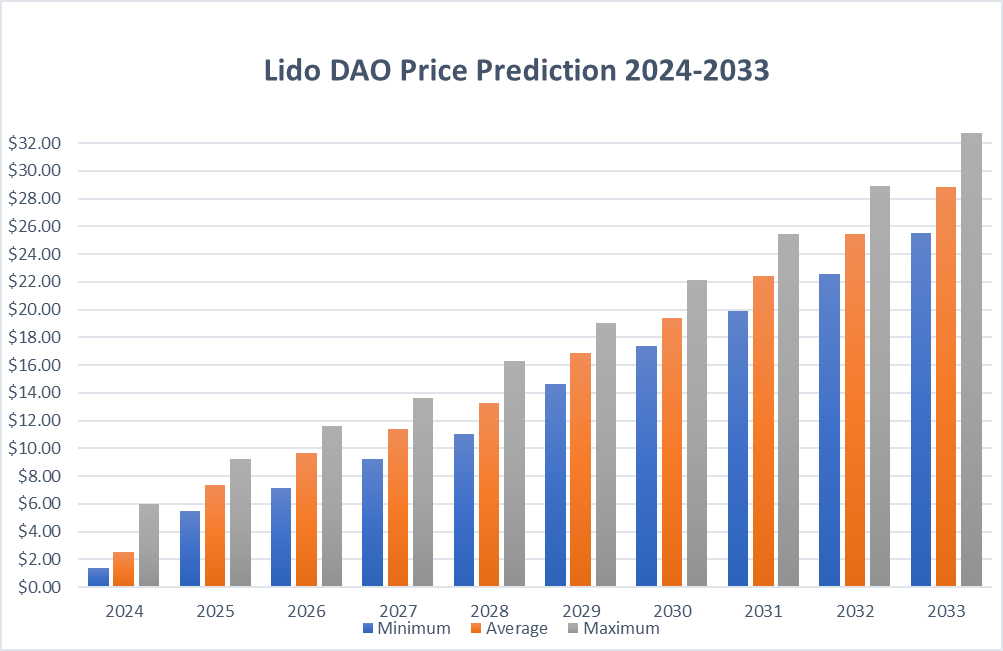

- 5.0.1. LDO Price Prediction 2024

- 5.0.2. LDO Price Prediction 2025

- 5.0.3. Lido DAO Price Prediction 2026

- 5.0.4. Lido Price Prediction 2027

- 5.0.5. Lido DAO Price Prediction 2028

- 5.0.6. LDO Crypto Price Prediction 2029

- 5.0.7. Lido DAO Price Prediction 2030

- 5.0.8. Lido DAO Price Prediction 2031

- 5.0.9. Lido Price Prediction 2032

- 5.0.10. Lido DAO Price Prediction 2033

- 6. Lido Dao Price Forecast: By Experts

- 7. Is LDO a Good Investment? When To Buy?

- 8. Conclusion

Lack of liquidity poses a significant challenge for staking on proof-of-stake (PoS) blockchains. Once tokens are locked, users are unable to withdraw funds, which restricts their ability to gain additional yields from other decentralized finance (DeFi) protocols until the lock-up period concludes. Moreover, high entry barriers, including the substantial costs of operating a node and a complex validator configuration, discourage many retail users from engaging in PoS staking. As a solution, Lido offers a liquid staking option that increases the liquidity of staked tokens and makes staking more accessible for its users. Lido DAO is a liquid staking protocol operating on the Ethereum blockchain. It offers non-custodial staking, allowing users to stake their locked Ethereum in other protocols. While staking on Ethereum’s beacon chain typically locks the assets, Lido DAO enables the liquefaction of these assets. This process provides users with the opportunity to earn higher returns. Additionally, Lido DAO has boosted retail participation due to its distinctive features. In this article, we’ll explore Lido DAO price prediction with an in-depth analysis of the current market sentiment of LDO price. This will help us to gauge the future LDO price forecasts and upcoming trends.

Lido DAO: A Quick Introduction

Lido DAO is a pioneering decentralized autonomous organization that provides a liquid staking solution on the Ethereum 2.0 blockchain, as well as on other Proof of Stake (PoS) platforms such as Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM).

By enabling the initial locking of assets, Lido DAO facilitates the liquefaction of these holdings, allowing them to be utilized in other protocols—a process known as ‘liquid staking.’ This approach allows users to obtain a tokenized version of their staked tokens on a 1:1 basis when they deposit their cryptocurrency into the network. These can then be employed in various on-chain DeFi activities to generate additional yields.

Lido was co-founded by Kasper Rasmussen and Jordan Fish, who is also known by his pseudonym, CryptoCobain. Founded in December 2020 shortly after the release of ETH 2.0, Lido DAO is governed by several prominent members, including P2P Capital, KR1, and Semantic Ventures. Since its inception, Lido DAO has developed a strong reputation for its liquid staking services and currently manages over $13 billion in staked assets. Although it primarily focuses on Ethereum, Lido DAO is expanding its services to other blockchain networks, including Terra and Solana, both of which introduced staking options in 2021, along with several other layer 1 PoS blockchains.

Distinguished by its decentralized structure and competitive annual percentage rates (APR), Lido DAO offers APRs of 4.8% for Ethereum, 8.1% for Terra, and 6.6% for Solana, setting it apart from other liquid staking protocols.

LDO: How Does It Work?

Liquid staking services like Lido encourage new participants to engage in securing PoS networks by allowing them to stake any amount of proof-of-stake assets in exchange for block rewards. Lido offers a creative solution to the challenges of traditional PoS staking by reducing entry barriers and the costs linked to locking assets in a single protocol.

When users deposit their assets with Lido, those tokens are staked on the blockchain through a staking pool smart contract. This contract performs several functions, including:

- Managing user withdrawals and deposits,

- Delegating pooled funds to node operators,

- Setting staking reward fees,

- Minting and burning tokens,

- Maintaining a comprehensive list of node operators, validation keys, and records of reward distribution.

With Ethereum’s shift to a PoS model, individuals wishing to become staking validators must deposit a minimum of 32 ETH—a significant barrier for many. Lido mitigates this by enabling users to stake smaller fractions of Ether to earn block rewards. Users receive stETH, an ERC-20 compatible token, minted upon deposit into Lido’s smart contract and burned when withdrawing their ETH.

The ETH staked via Lido is allocated to the network’s validators (node operators) and sent to the Ethereum Beacon Chain on the mainnet for validation, where it is securely locked in a smart contract inaccessible to validators.

Each user’s deposited ETH is grouped into sets of 32 ETH and assigned to different node operators within the Lido network, who use public validation keys to manage transactions involving the staked assets.

This distribution across multiple validators enhances security by reducing risks linked to single points of failure and individual validator staking.

Lido Dao Historical Price Sentiment

The governance token debuted on CoinMarketCap at $1.84 on January 5, 2021, and initially struggled to exceed this launch price in the subsequent months.

Its first notable rally began in late April 2021, triggered by a community vote on whether to extend the protocol to Solana. Following the approval of this proposal, LDO reached a peak of $5.61 on May 8, 2021. The token surpassed this level again in August during a breakout prompted by announcements of plans for further decentralization, including a shift to a non-custodial model and the launch of a referral program on August 3. LDO climbed to $7.24 on August 20, 2021.

November 2021 marked LDO’s most significant rally as Lido saw an increase in total value locked (TVL) within the protocol, with the governance token hitting an all-time high of $18.62 on November 16, 2021. Despite falling below its initial launch price at the start of 2022, LDO rebounded in March when Lido integrated with the Polygon blockchain. On March 2, its TVL surged from $13.95 billion to a high of $20.83 billion by April 5, 2022, according to DeFi Llama, with LDO reaching $4.90 on the same day.

The token resumed a downward trend in late May due to exposure to the Terra blockchain collapse, with Lido’s TVL dropping below $10 billion. Recovery efforts began shortly thereafter, with Lido announcing on July 18, 2022, plans to expand across Ethereum layer-2 networks to reduce gas fees and broaden its DeFi ecosystem, reaching $3.09 on August 14.

Momentum resumed with the integration of the Ethereum Merge on September 15, 2022, which promised higher APR/staking yields for active stakers, as detailed in a Lido DAO blog post. In early October, Lido realized its layer-2 expansion plans, launching its DeFi services on the Optimism and Arbitrum networks to enhance accessibility and lower gas fees.

In 2023, the LDO price started with a blast as it broke above $2. In February, the price further climbed and touched the $3 milestone. However, LDO price was on a slow decline since then as it dropped toward the low of $1.5. By the end of 2023, Lido again made a robust surge and ended the year at $2.5.

In 2024’s March, LDO price reached $3.6 as the entire crypto market went on a bull run. However, it later declined toward the $1.5 mark in the following months.

LDO Price Forecast: Technical Analysis

LDO price has been on a bearish trend for over the past few hours, resulting in the retest of the immediate support line. LDO price is currently holding momentum below the $1.5 mark as bearish dominance continues to increase. As of writing, LDO price trades at $1.4, declining over 10% in the last 24 hours.

As selling intensifies, the bears aim to push the price below the 50-day SMA. A break below this level could lead to a decline towards the psychological support at $0.87, and potentially further down to $0.6.

At the $0.87 support, buyers are likely to mount a strong defense. Should the price rebound sharply from this level, the LDO/USDT pair might enter a period of sideways trading. A new directional trend could emerge either with a break above $1.7 or a fall below $0.87.

Lido Dao Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 1.4 | 2.5 | 6 |

| 2025 | 5.498 | 7.389 | 9.239 |

| 2026 | 7.149 | 9.635 | 11.631 |

| 2027 | 9.263 | 11.414 | 13.595 |

| 2028 | 11.01 | 13.27 | 16.273 |

| 2029 | 14.628 | 16.853 | 19.026 |

| 2030 | 17.364 | 19.423 | 22.112 |

| 2031 | 19.93 | 22.402 | 25.481 |

| 2032 | 22.578 | 25.443 | 28.936 |

| 2033 | 25.527 | 28.852 | 32.754 |

LDO Price Prediction 2024

Messari, a blockchain analysis firm, recently unveiled its latest quarterly report on Lido DAO. The report highlights both the benefits and drawbacks of the platform.

According to the report, from January to March 2024, Lido DAO experienced significant growth in several areas:

- The average market capitalization reached $2.64 billion, an increase from $2.12 billion on a yearly basis and from $2.35 billion on a quarterly basis.

- The total value locked (TVL) in the platform surged to $35.3 billion, a significant rise from $11.2 billion year-on-year and from $21 billion quarter-on-quarter.

- Lido DAO recorded net deposits of 3.15 million ETH, up from 2.16 million year-on-year and from 1.76 million ETH quarter-on-quarter.

- Net protocol revenue was $28.7 million, which was higher than the $13.4 million recorded year-on-year and the $20.9 million from the previous quarter.

In 2024, LDO price might record an average price of $2.5, with a minimum price of $1.4 and a maximum price of $6.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.70 | $1.25 | $3.00 |

| February | $0.76 | $1.36 | $3.27 |

| March | $0.83 | $1.48 | $3.55 |

| April | $0.89 | $1.59 | $3.82 |

| May | $0.95 | $1.70 | $4.09 |

| June | $1.02 | $1.82 | $4.36 |

| July | $1.08 | $1.93 | $4.64 |

| August | $1.15 | $2.05 | $4.91 |

| September | $1.21 | $2.16 | $5.18 |

| October | $1.27 | $2.27 | $5.45 |

| November | $1.34 | $2.39 | $5.73 |

| December | $1.40 | $2.50 | $6.00 |

LDO Price Prediction 2025

Lido distinguishes itself in the marketplace by enabling users to enjoy staking benefits without managing the staking infrastructure directly. Its planned integrations and updates are expected to open a wide array of opportunities for stakers, potentially driving the price up to $9.239 by the end of 2025.

However, regulatory challenges could limit LDO to a low of $5.498. It is projected that by the end of 2025, the coin could average a price of $7.389 based on typical buying and selling activities.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $2.749 | $3.694 | $4.620 |

| February | $2.999 | $4.030 | $5.039 |

| March | $3.249 | $4.366 | $5.459 |

| April | $3.499 | $4.702 | $5.879 |

| May | $3.749 | $5.038 | $6.299 |

| June | $3.999 | $5.374 | $6.719 |

| July | $4.248 | $5.710 | $7.139 |

| August | $4.498 | $6.046 | $7.559 |

| September | $4.748 | $6.381 | $7.979 |

| October | $4.998 | $6.717 | $8.399 |

| November | $5.248 | $7.053 | $8.819 |

| December | $5.498 | $7.389 | $9.239 |

Lido DAO Price Prediction 2026

Our analysts estimate that in 2026, the price of LDO could fluctuate between $7.149 and $11.631, with an average price likely hovering around $9.635.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $3.574 | $4.818 | $5.816 |

| February | $3.899 | $5.255 | $6.344 |

| March | $4.224 | $5.693 | $6.873 |

| April | $4.549 | $6.131 | $7.402 |

| May | $4.874 | $6.569 | $7.930 |

| June | $5.199 | $7.007 | $8.459 |

| July | $5.524 | $7.445 | $8.988 |

| August | $5.849 | $7.883 | $9.516 |

| September | $6.174 | $8.321 | $10.045 |

| October | $6.499 | $8.759 | $10.574 |

| November | $6.824 | $9.197 | $11.102 |

| December | $7.149 | $9.635 | $11.631 |

Lido Price Prediction 2027

For 2027, the price range for Lido DAO is predicted to be between $9.263 and $13.595, with an average price likely settling at $11.414.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $4.632 | $5.707 | $6.798 |

| February | $5.053 | $6.226 | $7.415 |

| March | $5.474 | $6.745 | $8.033 |

| April | $5.895 | $7.263 | $8.651 |

| May | $6.316 | $7.782 | $9.269 |

| June | $6.737 | $8.301 | $9.887 |

| July | $7.158 | $8.820 | $10.505 |

| August | $7.579 | $9.339 | $11.123 |

| September | $8.000 | $9.858 | $11.741 |

| October | $8.421 | $10.376 | $12.359 |

| November | $8.842 | $10.895 | $12.977 |

| December | $9.263 | $11.414 | $13.595 |

Lido DAO Price Prediction 2028

Looking ahead to 2028, LDO is forecasted to range between $11.010 and $16.273, with the average price anticipated to be around $13.270.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $5.505 | $6.635 | $8.136 |

| February | $6.005 | $7.238 | $8.876 |

| March | $6.506 | $7.841 | $9.616 |

| April | $7.006 | $8.445 | $10.356 |

| May | $7.507 | $9.048 | $11.095 |

| June | $8.007 | $9.651 | $11.835 |

| July | $8.508 | $10.254 | $12.575 |

| August | $9.008 | $10.857 | $13.314 |

| September | $9.509 | $11.460 | $14.054 |

| October | $10.009 | $12.064 | $14.794 |

| November | $10.510 | $12.667 | $15.533 |

| December | $11.010 | $13.270 | $16.273 |

LDO Crypto Price Prediction 2029

In 2029, the price of Lido DAO is expected to vary from $14.628 to $19.026, with an average value of $16.853.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $7.314 | $8.426 | $9.513 |

| February | $7.979 | $9.193 | $10.378 |

| March | $8.644 | $9.959 | $11.243 |

| April | $9.309 | $10.725 | $12.107 |

| May | $9.974 | $11.491 | $12.972 |

| June | $10.639 | $12.257 | $13.837 |

| July | $11.303 | $13.023 | $14.702 |

| August | $11.968 | $13.789 | $15.567 |

| September | $12.633 | $14.555 | $16.432 |

| October | $13.298 | $15.321 | $17.296 |

| November | $13.963 | $16.087 | $18.161 |

| December | $14.628 | $16.853 | $19.026 |

Lido DAO Price Prediction 2030

For the year 2030, our analysts predict that LDO will range between $17.364 and $22.112, with the average price projected to be approximately $19.423.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $8.682 | $9.712 | $11.056 |

| February | $9.471 | $10.594 | $12.061 |

| March | $10.261 | $11.477 | $13.066 |

| April | $11.050 | $12.360 | $14.071 |

| May | $11.839 | $13.243 | $15.076 |

| June | $12.628 | $14.126 | $16.081 |

| July | $13.418 | $15.009 | $17.087 |

| August | $14.207 | $15.892 | $18.092 |

| September | $14.996 | $16.774 | $19.097 |

| October | $15.785 | $17.657 | $20.102 |

| November | $16.575 | $18.540 | $21.107 |

| December | $17.364 | $19.423 | $22.112 |

Lido DAO Price Prediction 2031

Our analysis suggests that in 2031, Lido DAO’s price could range between $19.930 and $25.481, with an average price expected to settle at approximately $22.402.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $9.965 | $11.201 | $12.740 |

| February | $10.871 | $12.219 | $13.899 |

| March | $11.777 | $13.238 | $15.057 |

| April | $12.683 | $14.256 | $16.215 |

| May | $13.589 | $15.274 | $17.373 |

| June | $14.495 | $16.292 | $18.532 |

| July | $15.400 | $17.311 | $19.690 |

| August | $16.306 | $18.329 | $20.848 |

| September | $17.212 | $19.347 | $22.006 |

| October | $18.118 | $20.365 | $23.165 |

| November | $19.024 | $21.384 | $24.323 |

| December | $19.930 | $22.402 | $25.481 |

Lido Price Prediction 2032

For 2032, the forecasted price range for Lido DAO is anticipated to be between $22.578 and $28.936, with the average price likely to be around $25.443.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $11.289 | $12.722 | $14.468 |

| February | $12.315 | $13.878 | $15.783 |

| March | $13.342 | $15.035 | $17.099 |

| April | $14.368 | $16.191 | $18.414 |

| May | $15.394 | $17.348 | $19.729 |

| June | $16.420 | $18.504 | $21.044 |

| July | $17.447 | $19.660 | $22.360 |

| August | $18.473 | $20.817 | $23.675 |

| September | $19.499 | $21.974 | $24.990 |

| October | $20.525 | $23.130 | $26.305 |

| November | $21.552 | $24.287 | $27.621 |

| December | $22.578 | $25.443 | $28.936 |

Lido DAO Price Prediction 2033

Looking forward to 2033, LDO is predicted to vary between $25.527 and $32.754, with the average price estimated to be about $28.852.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $12.764 | $14.426 | $16.377 |

| February | $13.924 | $15.737 | $17.866 |

| March | $15.084 | $17.049 | $19.355 |

| April | $16.244 | $18.360 | $20.843 |

| May | $17.405 | $19.672 | $22.332 |

| June | $18.565 | $20.983 | $23.821 |

| July | $19.725 | $22.295 | $25.310 |

| August | $20.886 | $23.606 | $26.799 |

| September | $22.046 | $24.918 | $28.288 |

| October | $23.206 | $26.229 | $29.776 |

| November | $24.367 | $27.541 | $31.265 |

| December | $25.527 | $28.852 | $32.754 |

Lido Dao Price Forecast: By Experts

According to the latest price prediction from Coincodex, the Lido DAO Token is expected to increase by 227.46% and reach $4.66 by September 2, 2024. The current market sentiment is bearish, and the Fear & Greed Index indicates a level of 37, which falls under “Fear.”

In the past 30 days, Lido DAO Token has experienced 14 out of 30 green days, with a price volatility of 7.90%. Coincodex suggests that it is currently not an optimal time to purchase Lido DAO Token. The forecast, taking into account historical price movements and BTC halving cycles, estimates the yearly low for Lido DAO Token in 2025 at $1.421836, with a potential high of $6.70 within the next year.

According to market forecasts by Digital Coin Price, LDO is expected to open the year 2026 at $4.14 and trade around $5.09, marking a significant increase compared to the previous year. Such a rise in the value of Lido DAO is considered a notable improvement. By the start of 2030, technical analyses and price predictions suggest that Lido DAO could reach a price of $10.26, maintaining this level through to the end of the year. Furthermore, LDO may achieve a peak of $9.47 during the same period. The span from 2024 to 2030 is anticipated to be a critical phase for the growth of Lido DAO.

Is LDO a Good Investment? When To Buy?

Lido conforms to the Ethereum network’s staking norms by aggregating ETH staked from various users. Distinct from other platforms, Lido does not mandate that nodes provide collateral matching the staking position to qualify as validators.

The Lido DAO appoints nodes with established histories of managing staked assets, necessitating only a single asset deposit into the protocol’s contract. While selected node operators are not permitted to access users’ funds, the DAO retains this ability. This approach is described by the Lido network as “capital efficiency.”

LDO has a wide user base and it has formed a robust dominance in the crypto market. As a result, LDO can be a good investment option in the future. According to our analysis, investing in LDO tokens at a price of $1.1 might turn out to be profitable in the long term.

Conclusion

Lido remains a leader in the DeFi sector as its total value of locked assets continues to rise, surpassing other formidable protocols like MakerDAO. This growth aligns with Ethereum’s transition to Proof of Stake (PoS) and the anticipated “Shanghai” upgrade.

As Ethereum moves to enable ETH withdrawals, Lido and other liquid staking protocols are poised to grow stronger. Initially, Lido managed collective assets of 600,000 ETH from various accounts, employing multisignature thresholds to lower the custody risk. Despite these security measures, there remains a significant risk of signatories being hacked or losing their keys, which could result in Lido’s funds being locked indefinitely.

Frequently Asked Questions

What is Lido DAO?

Lido DAO is a decentralized autonomous organization that provides a liquid staking solution on Ethereum 2.0 and other Proof of Stake (PoS) platforms like Solana, Polygon, Polkadot, and Kusama.

How does Lido DAO's liquid staking work?

Lido DAO allows users to stake their assets on the Ethereum blockchain and receive a tokenized version of their staked tokens on a 1:1 basis, which can be used in other DeFi activities to earn additional yields.

What are the future price predictions for LDO?

According to various analyses, LDO could range between $1.4 and $6 in 2024, with potential growth reaching up to $32.75 by 2033.

Is LDO a good investment?

LDO has a strong user base and dominance in the crypto market. It could be a profitable long-term investment, especially if bought at lower prices like $1.1.

How does Lido DAO compare to other DeFi protocols?

Lido DAO is one of the leaders in the DeFi sector, surpassing other protocols like MakerDAO in total value locked (TVL) and is poised for further growth with Ethereum's transition to Proof of Stake (PoS).