- 1. Litecoin: A Quick Introduction

- 2. Litecoin: How Does It Work?

- 3. Litecoin Price Prediction: Price History

- 4. Litecoin Price Prediction: Technical Analysis

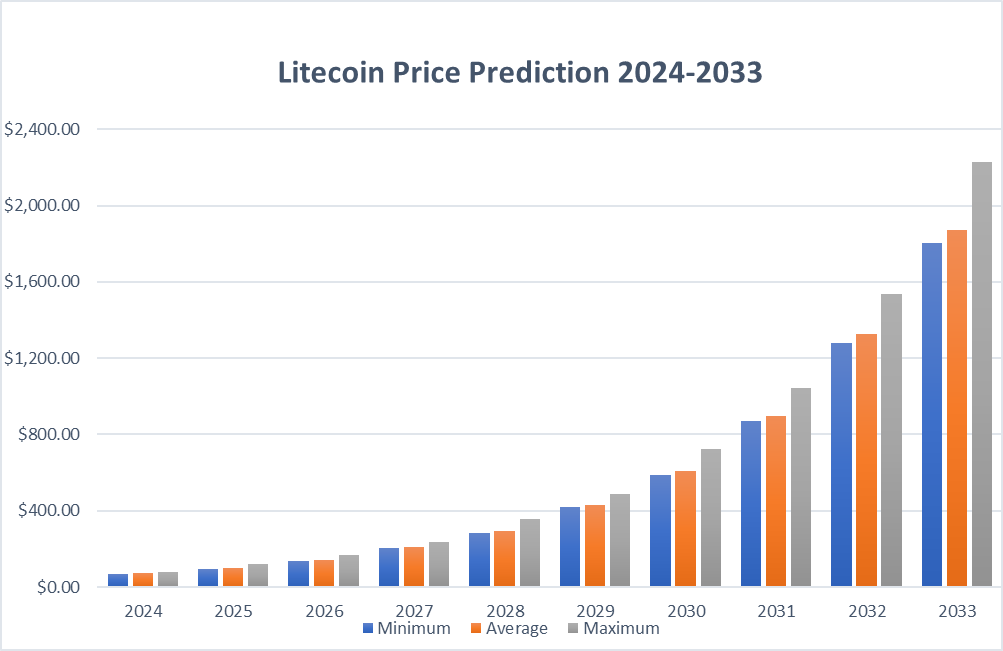

- 5. Litecoin Price Prediction By Blockchain Reporter

- 5.1. Litecoin Price Prediction 2024

- 5.2. Litecoin Price Prediction 2025

- 5.3. Litecoin Price Prediction 2026

- 5.4. Litecoin Price Prediction 2027

- 5.5. Litecoin Price Prediction 2028

- 5.6. Litecoin Price Prediction 2029

- 5.7. Litecoin Price Prediction 2030

- 5.8. Litecoin Price Prediction 2031

- 5.9. Litecoin Price Prediction 2032

- 5.10. Litecoin Price Prediction 2033

- 6. Litecoin Price Prediction: By Experts

- 7. Is Litecoin a Good Investment?

- 8. Conclusion

A few years following the inception of Bitcoin, certain founding developers recognized insurmountable problems within the cryptocurrency. They concluded that a completely new coin was necessary—a version that was quicker and had greater scalability. This led to the creation of Litecoin, the pioneering altcoin, which aimed to enhance the features of its predecessors. Although Litecoin (LTC) may not feature as prominently in the headlines as Bitcoin (BTC), it remains a highly favored cryptocurrency. Launched in 2011 by a former Google engineer, Litecoin stands as one of the oldest and most recognized cryptocurrencies in the market. Originating as a derivative of Bitcoin, Litecoin was dubbed the “silver to Bitcoin’s gold,” aimed at addressing some of Bitcoin’s shortcomings, such as slow transaction times. It boasts quicker block generation and a higher maximum supply than Bitcoin, making it more practical for frequent transactions, while Bitcoin has become more of a “store of value.” Throughout the years, Litecoin has consistently been among the top traded cryptocurrencies. It enjoys robust support from a dedicated community and widespread merchant acceptance. Nevertheless, as the digital currency landscape expands, Litecoin encounters growing competition from newer, more technologically sophisticated cryptocurrencies. In this article, we’ll explore Litecoin price prediction with an in-depth analysis of the current market sentiment and future LTC price forecast.

Litecoin: A Quick Introduction

Litecoin was created by Charlie Lee, a former Google engineer, and is one of the earliest cryptocurrencies after Bitcoin, commonly referred to as “altcoins.” Jay Blaskey, a digital currency specialist at BitIRA in the US, explains that Litecoin was created in 2011 by modifying Bitcoin’s original code. This process, known as forking, involved copying Bitcoin’s code and making specific changes to improve it, resulting in a new cryptocurrency called Litecoin.

These modifications were aimed at overcoming some of Bitcoin’s drawbacks. For example, Litecoin was designed to enable faster, secure, and cheaper payments. A significant alteration was the adoption of a simpler hashing algorithm called Scrypt, which helped Litecoin process transactions quicker than Bitcoin. While Bitcoin processes about five transactions per second and takes about 10 minutes to create a new block, Litecoin can handle 56 transactions per second with new blocks being created every 2.5 minutes. This faster processing made Litecoin more suitable for everyday transactions, like buying coffee, which could be impractical with Bitcoin’s slower speeds and occasional delays.

Since Litecoin’s creation, however, the cryptocurrency landscape has evolved significantly. The development of the Lightning Network, for instance, has improved Bitcoin’s transaction speed to nearly instant, addressing many of the scalability issues and lessening the need for alternatives like Litecoin. Moreover, many new cryptocurrencies now offer even faster transaction speeds, intensifying market competition and challenging Litecoin’s role as a preferred option for quick and affordable transactions.

Litecoin: How Does It Work?

Litecoin has a lot in common with Bitcoin, the biggest cryptocurrency by market cap, but they are not identical.

Like Bitcoin, Litecoin operates on an open-source blockchain framework and uses a proof-of-work system. This means users contribute computing power to process transactions and in return, they can earn Litecoin. However, the specific algorithms that the two cryptocurrencies use to verify transactions differ significantly. Bitcoin uses the Secure Hash Algorithm (SHA), whereas Litecoin employs a different method known as Scrypt.

Additionally, Litecoin stands out from *BTC* in two key areas: its total supply and how quickly it processes blocks. Litecoin processes blocks four times faster than Bitcoin and has quadrupled the total number of coins to 84 million.

Mining Litecoin

Litecoin uses a mining process to verify transactions, secure its network, and create new coins, much like Bitcoin. This involves solving complex cryptographic puzzles to validate transactions and record them on the blockchain. Miners who successfully solve these puzzles are rewarded with newly minted LTC and transaction fees, in a system known as proof-of-work (PoW).

As more miners join the network, they help spread the control of the ledger across more users, enhancing the system’s decentralization and reducing the risk of any single point of failure. Additionally, the increased computational power contributed by more miners bolsters the network’s security, making it more resistant to attacks.

Initially, it was feasible to mine Litecoin with ordinary home computers. However, as the network expanded, the required computational power increased, raising the difficulty of mining. This challenge has been further intensified by the introduction of ASIC miners, which are custom-built machines specifically designed to mine using the Scrypt algorithm.

Litecoin Price Prediction: Price History

Since its launch in 2011 by former Google engineer Charlie Lee, Litecoin has seen various periods of growth and declines. Operating as a global, peer-to-peer payment system on an open-source platform, Litecoin was designed with a cap of 84 million tokens, of which over 73.1 million are currently in circulation. The cryptocurrency has experienced notable highs, particularly in 2017 and 2021, when it reached significant price levels.

In 2017, Litecoin’s price surged to approximately $366. It reached its all-time high in 2021, peaking at around $413. Following this peak, the price generally trended downward until it hit a low of $39 in June of the previous year, which then triggered a rise, forming what’s known as an ‘ascending channel’ marked in yellow on the charts.

An ascending channel is a chart pattern that indicates a trend of upward movement, defined by rising trend lines that frame the price action. Despite this, the cryptocurrency market remains highly volatile, and any trend can quickly reverse.

Over the past four months, Litecoin has faced resistance between $89 and $94. This resistance aligns with the two-year trendline, creating a significant barrier to further price increases.

The price eventually broke out of this upward channel, leading to a drop toward the $72 zone. Nevertheless, the bulls have managed to keep the price above the 20-day Exponential Moving Average (EMA), a key indicator used by traders to gauge short-term price trends.

In August, the price of LTC dropped toward $50; however, it is now holding above the $70 support channel.

Litecoin Price Prediction: Technical Analysis

The price of Liteocin has fallen below its 20-day exponential moving average (EMA), with the current trading price around the $71 support level, marking a decrease of over 1.8% in the last 24 hours. Sellers are pushing for a further decline below the immediate Fibonacci channel.

If sellers keep the price under the 20-day EMA, the LTC/USDT pair might drop to the 50-day simple moving average (SMA) at $65. The area between the 50-day SMA and $58 is crucial for buyers to defend; failing to do so could see the price plummet to $52.

On the flip side, a rise above the 20-day EMA would indicate that buyers are regaining momentum. This could lead the pair to potentially test the $75 resistance level. A successful break above this could propel the price to $80.

Litecoin Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 68.79 | 72.09 | 77.58 |

| 2025 | 95.93 | 98.81 | 123.43 |

| 2026 | 138.62 | 143.56 | 167.53 |

| 2027 | 203.45 | 210.63 | 234.13 |

| 2028 | 281 | 291.54 | 356.1 |

| 2029 | 420.3 | 431.96 | 490.44 |

| 2030 | 587.95 | 609.54 | 722.45 |

| 2031 | 869.82 | 894.2 | 1,041 |

| 2032 | 1,280 | 1,325 | 1,537 |

| 2033 | 1,803 | 1,870 | 2,230 |

Litecoin Price Prediction 2024

A significant event on the horizon for Litecoin is its upcoming halving, which occurs roughly every four years or after every 840,000 blocks are mined. Since its inception, the reward for mining Litecoin has decreased from 50 LTC per block to the current 12.5 LTC. The next halving will further reduce the mining reward to 6.25 LTC per block.

What does this reduction in mining reward mean practically? As rewards decrease, fewer Litecoins are released into circulation, creating a scarcity of supply. If demand for Litecoin remains stable or increases, this scarcity could potentially drive up the coin’s price.

However, the reaction of Litecoin’s price to previous halvings has not been as positive as one might expect. Despite the reduced supply following the halvings in 2015 and 2019, Litecoin’s price did not experience significant rallies and even continued to trend downward after the 2019 event.

In 2024, the price of Litecoin is expected to fluctuate between a minimum of $68.79 and a maximum of $77.58, with an average price of $72.09 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $68.79 | $68.90 | $69.10 |

| February | $69.00 | $69.20 | $70.30 |

| March | $69.20 | $69.50 | $71.50 |

| April | $69.40 | $69.80 | $72.70 |

| May | $69.60 | $70.10 | $73.90 |

| June | $69.80 | $70.40 | $75.10 |

| July | $70.00 | $70.70 | $75.90 |

| August | $70.20 | $71.00 | $76.70 |

| September | $70.40 | $71.30 | $77.10 |

| October | $70.60 | $71.60 | $77.40 |

| November | $70.80 | $71.90 | $77.50 |

| December | $71.00 | $72.09 | $77.58 |

Litecoin Price Prediction 2025

According to predictions, Litecoin’s price in 2025 is likely to vary from a low of $95.93 to a high of $123.43, averaging around $98.81 over the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $68.49 | $75.69 | $77.86 |

| February | $74.32 | $77.21 | $81.64 |

| March | $75.92 | $79.52 | $84.73 |

| April | $79.03 | $81.91 | $88.71 |

| May | $80.67 | $83.55 | $92.80 |

| June | $82.34 | $85.22 | $96.98 |

| July | $85.02 | $88.63 | $101.24 |

| August | $87.52 | $90.40 | $105.67 |

| September | $88.60 | $92.21 | $110.19 |

| October | $91.37 | $94.98 | $114.80 |

| November | $93.27 | $96.87 | $119.55 |

| December | $95.93 | $98.81 | $123.43 |

Litecoin Price Prediction 2026

For 2026, Litecoin’s value is forecasted to range between a minimum of $138.62 and a maximum of $167.53, with the average trading price settling at $143.56.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $93.87 | $103.75 | $106.72 |

| February | $100.89 | $105.83 | $110.87 |

| March | $105.05 | $109.00 | $116.16 |

| April | $107.23 | $111.18 | $121.61 |

| May | $109.58 | $114.52 | $127.17 |

| June | $115.15 | $119.10 | $132.89 |

| July | $118.92 | $123.86 | $137.66 |

| August | $121.40 | $126.34 | $143.85 |

| September | $123.93 | $128.87 | $150.17 |

| October | $127.79 | $132.73 | $155.32 |

| November | $134.09 | $138.04 | $160.63 |

| December | $138.62 | $143.56 | $167.53 |

Litecoin Price Prediction 2027

The predictions for 2027 suggest that Litecoin’s price could be as low as $203.45 and as high as $234.13, with an average throughout the year around $210.63.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $137.82 | $150.74 | $155.05 |

| February | $146.58 | $153.76 | $161.08 |

| March | $149.65 | $156.83 | $167.23 |

| April | $155.79 | $161.54 | $173.50 |

| May | $160.82 | $168.00 | $179.96 |

| June | $168.98 | $174.72 | $186.68 |

| July | $175.97 | $181.71 | $193.67 |

| August | $179.98 | $187.16 | $200.94 |

| September | $187.03 | $192.77 | $208.43 |

| October | $189.45 | $196.63 | $216.14 |

| November | $196.79 | $202.53 | $224.00 |

| December | $203.45 | $210.63 | $234.13 |

Litecoin Price Prediction 2028

Forecasting for 2028 indicates that Litecoin could reach a minimum price of $281.00 and a maximum price of $356.10, with the average price expected to be about $291.54.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $202.20 | $221.16 | $227.48 |

| February | $221.58 | $230.01 | $238.54 |

| March | $226.18 | $234.61 | $250.04 |

| April | $228.77 | $239.30 | $259.42 |

| May | $238.05 | $246.48 | $271.39 |

| June | $245.45 | $253.87 | $283.71 |

| July | $248.42 | $258.95 | $293.87 |

| August | $253.60 | $264.13 | $306.81 |

| September | $258.88 | $269.41 | $317.38 |

| October | $266.96 | $277.49 | $330.85 |

| November | $274.62 | $283.04 | $341.95 |

| December | $281.00 | $291.54 | $356.10 |

Litecoin Price Prediction 2029

In 2029, Litecoin is anticipated to reach a minimum value of $420.30 and a maximum value of $490.44, with the average price likely around $431.96.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $279.87 | $306.11 | $314.86 |

| February | $303.63 | $315.30 | $327.10 |

| March | $310.18 | $324.75 | $342.87 |

| April | $319.92 | $334.50 | $359.10 |

| May | $329.95 | $344.53 | $372.48 |

| June | $340.29 | $354.87 | $389.71 |

| July | $354.49 | $369.06 | $407.45 |

| August | $372.16 | $383.82 | $422.22 |

| September | $383.68 | $395.34 | $437.57 |

| October | $395.54 | $407.20 | $453.38 |

| November | $400.77 | $415.34 | $469.67 |

| December | $420.30 | $431.96 | $490.44 |

Litecoin Price Prediction 2030

Litecoin’s price is expected to have a floor price of $587.95 in 2030, potentially reaching up to $722.45, with an average price of $609.54.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $410.36 | $453.56 | $466.51 |

| February | $445.35 | $462.63 | $484.66 |

| March | $454.60 | $471.88 | $507.79 |

| April | $468.76 | $486.04 | $526.66 |

| May | $483.88 | $505.48 | $550.96 |

| June | $508.42 | $525.70 | $571.18 |

| July | $514.61 | $536.21 | $592.21 |

| August | $536.06 | $557.66 | $619.02 |

| September | $551.53 | $568.81 | $646.90 |

| October | $562.91 | $580.19 | $669.66 |

| November | $570.19 | $591.79 | $692.86 |

| December | $587.95 | $609.54 | $722.45 |

Litecoin Price Prediction 2031

In 2031, it is predicted that Litecoin will reach a minimum of $869.82 and a maximum of $1,041, averaging at $894.20.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $579.07 | $640.02 | $658.31 |

| February | $622.35 | $652.82 | $683.91 |

| March | $635.40 | $665.88 | $716.55 |

| April | $668.13 | $692.51 | $743.19 |

| May | $695.83 | $720.21 | $777.81 |

| June | $718.55 | $749.02 | $813.82 |

| July | $741.02 | $771.49 | $843.78 |

| August | $770.26 | $794.64 | $874.64 |

| September | $802.04 | $826.42 | $914.37 |

| October | $818.57 | $842.95 | $955.70 |

| November | $835.43 | $859.81 | $997.84 |

| December | $869.82 | $894.20 | $1,041 |

Litecoin Price Prediction 2032

According to detailed technical analysis, in 2032, Litecoin is expected to range from a minimum of $1,280 to a maximum of $1,537, with an average price of $1,325.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $858.44 | $938.91 | $965.74 |

| February | $922.37 | $967.08 | $1,003 |

| March | $941.71 | $986.42 | $1,052 |

| April | $980.25 | $1,016 | $1,101 |

| May | $1,012 | $1,057 | $1,142 |

| June | $1,063 | $1,099 | $1,194 |

| July | $1,076 | $1,121 | $1,249 |

| August | $1,110 | $1,155 | $1,305 |

| September | $1,165 | $1,201 | $1,363 |

| October | $1,204 | $1,249 | $1,423 |

| November | $1,229 | $1,274 | $1,473 |

| December | $1,280 | $1,325 | $1,537 |

Litecoin Price Prediction 2033

For 2033, the forecast suggests that the price of Litecoin will start at a minimum of $1,803, potentially climbing to a maximum of $2,230, with the average trading value estimated at $1,870 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1,272 | $1,391 | $1,431 |

| February | $1,366 | $1,433 | $1,500 |

| March | $1,395 | $1,461 | $1,557 |

| April | $1,439 | $1,505 | $1,631 |

| May | $1,469 | $1,535 | $1,691 |

| June | $1,530 | $1,597 | $1,768 |

| July | $1,592 | $1,645 | $1,831 |

| August | $1,628 | $1,694 | $1,897 |

| September | $1,662 | $1,728 | $1,982 |

| October | $1,727 | $1,780 | $2,068 |

| November | $1,749 | $1,815 | $2,157 |

| December | $1,803 | $1,870 | $2,230 |

Litecoin Price Prediction: By Experts

According to the current Litecoin price prediction from Coincodex, the price of Litecoin is expected to rise by 31.01% and reach $93.54 by November 30, 2024. Coincodex’s technical indicators suggest a Neutral current sentiment, while the Fear & Greed Index indicates 69, pointing to Greed. Litecoin has seen 16 out of 30 (53%) green days with a price volatility of 4.38% over the past 30 days.

According to the forecast, now is considered a good time to buy Litecoin. For 2024, Litecoin (LTC) is expected to trade within a channel ranging from $69.02 to $153.58, with an average price of $100.64 for the year. This represents a potential return on investment of 118.23% compared to current prices. November’s forecast anticipates a continuation of the market trend, potentially increasing the price to $84.88.

The expected price range for the month is between $69.02 and $108.05, influenced by the previous month’s market performance. Investors could see a potential gain of 53.55% if they purchase LTC at current prices and sell at the forecasted rates.

According to market analysts and experts cited by Digital Coin Price, LTC is expected to begin 2026 with a price of $208.95 and could trade around $258.44 during the year. This represents a significant increase compared to the previous year and is viewed as a notable surge in Litecoin’s value.

By the start of 2030, technical analysis and price predictions from Digital Coin Price suggest that Litecoin’s price will reach $517.91, maintaining this level through to the end of the year, with a potential high of $477.36 during the same period. The period from 2024 to 2030 is anticipated to be a crucial time for significant growth in Litecoin’s value.

Is Litecoin a Good Investment?

Determining Litecoin’s future performance is challenging. While it has generally shown steady performance and even outpaced the market in 2022, Litecoin lacks the allure of more glamorous cryptocurrencies. Its performance has declined since the last halving, and the overall market conditions haven’t been favorable either.

Moreover, when the managing director of the blockchain foundation acknowledges that Litecoin’s recent performance has been underwhelming, it’s a significant indicator that merits attention. Litecoin has also underperformed in 2023 and 2024. Looking forward, it remains to be seen whether LTC can secure more real-world applications, which might enhance its visibility and attract a new wave of potential investors.

Litecoin Vs Bitcoin

Yes, Litecoin originated from Bitcoin, yet they are not identical—think of them as siblings with a two-year age gap. They share similar foundational technology but have taken different paths. On the Litecoin blockchain, a new block is validated every 2.5 minutes, much quicker than Bitcoin’s 10-minute interval, facilitating faster transaction processing. Both blockchains cap block size at 1MB, though the adoption of SegWit protocols has allowed for more data to be included in each block.

Due to its faster block time, Litecoin also adjusts its halving events differently. While Bitcoin halves every 210,000 blocks, Litecoin does so every 840,000 blocks, aligning its long-term mining and supply strategy more closely with Bitcoin.

In terms of supply, Bitcoin’s maximum is set at 21 million coins, compared to Litecoin’s 84 million, which makes Litecoin more affordable and keeps it viable as a payment option.

Another distinction lies in their hashing algorithms. Litecoin uses Scrypt, designed to be less amenable to optimization by specialized mining hardware than Bitcoin’s SHA-256. This initially helped decentralize mining by making it feasible with ordinary home computers. However, the advantage diminished as ASICs developed for Scrypt became prevalent, increasing mining centralization over time.

Conclusion

In the United States, several prominent companies and organizations, including Newegg, SlingTV, and the American Red Cross, now accept Litecoin as a payment method. This acceptance underscores Litecoin’s, and more broadly cryptocurrency’s, viability as an alternative to traditional payment systems.

Internationally, Litecoin’s presence is expanding as well. For instance, in 2022, the Commonwealth Bank of Australia launched a pilot within its CommBank app that enabled customers to buy, sell, and hold Litecoin. Although the trial was temporarily halted due to market volatility and upcoming regulatory decisions, it highlighted Litecoin’s potential for widespread adoption.

Despite some regulatory uncertainties, Litecoin remains one of the most widely accepted cryptocurrencies. According to CoinMarketCap, over 2,000 merchants and stores globally now accept LTC, demonstrating its growing acceptance around the world.

Frequently Asked Questions

What is Litecoin, and why was it created?

Litecoin (LTC) was created in 2011 by Charlie Lee, a former Google engineer, to address Bitcoin’s scalability issues. It offers faster transaction times and higher maximum supply, making it more suitable for frequent transactions.

How does Litecoin differ from Bitcoin?

Litecoin processes transactions four times faster than Bitcoin, with new blocks every 2.5 minutes versus Bitcoin’s 10 minutes. It uses the Scrypt hashing algorithm, compared to Bitcoin’s SHA-256, and has a maximum supply of 84 million coins instead of Bitcoin’s 21 million.

What is the current market outlook for Litecoin?

Litecoin has recently stabilized around $70 and has support from a dedicated community. Analysts expect it to rise modestly, with a forecast of $68.79 to $77.58 for 2024 and potential higher growth following its next halving event.

How has Litecoin's price performed historically?

Litecoin reached all-time highs in 2017 ($366) and 2021 ($413). It experienced declines afterward, with recent trading between $89 and $94, and ongoing support around the $70 level.

How does the upcoming Litecoin halving impact its price?

The next Litecoin halving will reduce the mining reward to 6.25 LTC per block, potentially decreasing supply and increasing demand, which may drive the price up, though past halvings have shown mixed effects.

What is Litecoin’s long-term price prediction?

Predictions suggest moderate growth, with prices potentially reaching $123.43 by 2025, $167.53 by 2026, and as high as $2,230 by 2033, assuming steady adoption and market demand.

Is Litecoin a good investment?

While Litecoin has shown resilience, it faces competition from newer, faster cryptocurrencies. It remains a stable investment for those looking for a trusted, widely accepted cryptocurrency but may yield slower growth than emerging assets.

What are some key use cases for Litecoin?

Litecoin is widely accepted for payments, including by Newegg, SlingTV, and over 2,000 global merchants. Its quick transaction times make it appealing for everyday transactions compared to Bitcoin.

How does Litecoin’s proof-of-work system work?

Litecoin uses a mining process to verify transactions, securing its network via a decentralized proof-of-work system, where miners are rewarded in LTC for maintaining the blockchain.

Where can I use Litecoin?

Litecoin is accepted by thousands of merchants worldwide, and notable companies in the U.S. and internationally recognize it as a payment method, underscoring its role in mainstream adoption.