- 1. Near Protocol: A Quick Overview

- 2. Near Protocol: How Does It Work?

- 3. Near Price Prediction: Price History

- 4. NEAR Price Prediction: Technical Analysis

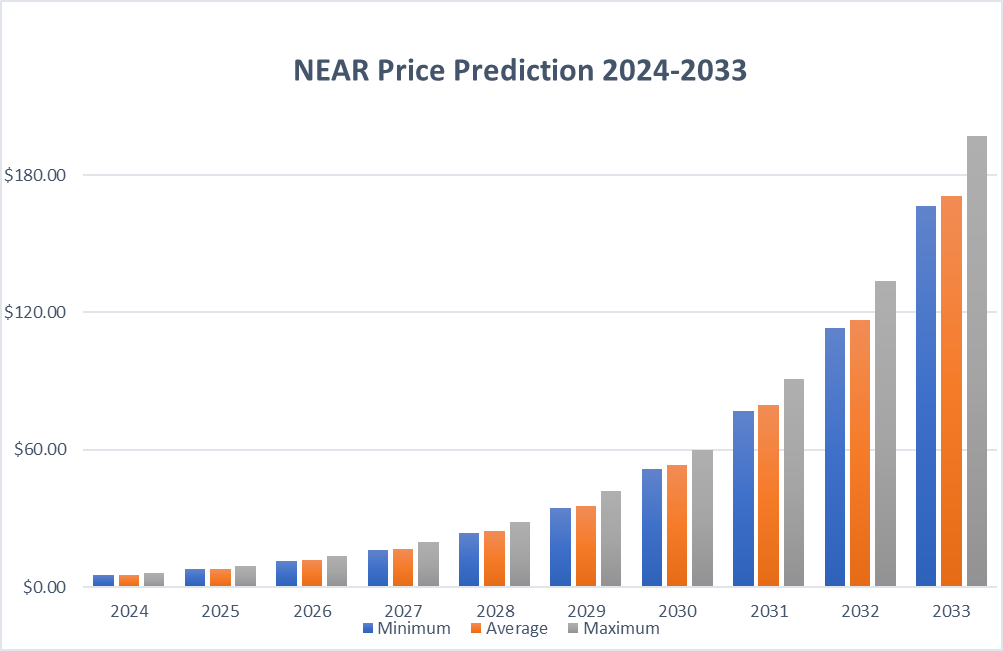

- 5. NEAR Protocol Price Prediction By Blockchain Reporter

- 5.0.1. NEAR Protocol Price Prediction 2024

- 5.0.2. NEAR Protocol Price Prediction 2025

- 5.0.3. NEAR Price Forecast for 2026

- 5.0.4. NEAR Protocol (NEAR) Price Prediction 2027

- 5.0.5. NEAR Protocol Price Prediction 2028

- 5.0.6. NEAR Protocol Price Prediction 2029

- 5.0.7. NEAR Protocol (NEAR) Price Prediction 2030

- 5.0.8. NEAR Protocol Price Forecast 2031

- 5.0.9. NEAR Protocol (NEAR) Price Prediction 2032

- 5.0.10. NEAR Protocol Price Prediction 2033

- 6. NEAR Price Forecast: By Experts

- 7. Is NEAR a Good Investment? When To Buy?

- 8. Advantages and Disadvantages of Near Protocol

- 9. Conclusion

Near Protocol operates as a layer 1 blockchain network, offering developers a platform to construct decentralized applications (dapps). It competes directly with Ethereum, the leading layer 1 blockchain, positioning itself as a challenger in the field.

Critical benchmarks for layer 1 networks include transaction costs, speed, and scalability as transaction volumes increase. Near Protocol focuses on enhancing these aspects to address challenges faced by Ethereum, particularly concerning costs and transaction speeds in recent years.

In 2023, the Near Protocol blockchain experienced a significant surge in its user base, growing tenfold, primarily due to the launch of NEAT inscriptions in November. These inscriptions, functioning as the blockchain’s version of non-fungible tokens (NFTs), played a crucial role in drawing new users to the network.

Approximately a year prior, Near Protocol, a blockchain designed to compete with Ethereum, announced a collaboration with Alibaba Cloud, the data storage and computing division of the Chinese tech behemoth, Alibaba. This partnership aimed to integrate Near Protocol’s technology with Alibaba Cloud’s services, potentially exposing it to nearly one billion Alibaba customers. Despite an initial drop in interest, the blockchain witnessed a recovery in October and November.

This resurgence was partly fueled by the introduction of the KAIKAINOW platform, which offers users curated content directly on their mobile phones without the need to unlock them. In this article, we will explore Near protocol price prediction with an in-depth technical analysis of the current market sentiment of Near price and its future price potential.

Near Protocol: A Quick Overview

Near Protocol is a blockchain designed to operate faster than many others, which could save users both time and money for various transactions. Established in 2017 by cryptocurrency entrepreneurs, it strives to achieve top-speed operations.

The protocol operates on a system known as Doomslug, enabling it to confirm blocks with just one validation round—significantly less than several of its competitors.

One distinctive feature of Near Protocol is its user-friendly approach to wallet addresses. Instead of the typical complex string of numbers and letters, it offers “human-readable” names. This feature aims to make the blockchain more accessible and easier to use for those less familiar with the technology.

Additionally, Near Protocol facilitates the development of decentralized applications (DApps).

Near Protocol offers faster and more cost-effective transaction processing than *ETH* and aims to outpace other major competitors. Once fully operational, Near Protocol is projected to handle up to approximately 100,000 transactions per second (TPS). In comparison, Solana, Ethereum’s prominent competitor, processes under 3,000 TPS as per its blockchain explorer, while Ethereum manages double-digit TPS and Bitcoin processes fewer than 10 TPS.

Beyond the realm of cryptocurrency, it’s insightful to compare this to Visa’s capabilities. The global payment leader claims to process around 7,000-8,000 TPS, based on its handling of 232.5 billion transactions in a year.

Near Protocol: How Does It Work?

The NEAR protocol is a blockchain that uses a Proof of Stake (PoS) system and tries to stand out with its approach called “Nightshade” for sharding. Sharding breaks the blockchain into smaller pieces so that each node only holds a fraction of the total data, which helps the system handle more transactions at a lower cost.

Nightshade

Nightshade, NEAR’s method for sharding, maintains a single continuous chain while dividing the workload into smaller sections called ‘chunks’. Nodes process these chunks and then integrate them back into the main chain. A key benefit of Nightshade is that it potentially reduces security risks by only giving nodes small sections of the chain to manage.

Rainbow Bridge

NEAR also features something called the Rainbow Bridge, which makes it easy to move Ethereum tokens back and forth between Ethereum and NEAR. Users lock their tokens into an Ethereum smart contract to transfer them, and then NEAR creates new tokens that mirror the original ones. These tokens can be moved back to Ethereum by reversing the process, with the original tokens securely held in the smart contract.

Aurora

Aurora is a Layer-2 solution on NEAR that lets developers run their Ethereum-based apps (dapps) on NEAR’s network. By using Ethereum’s coding setup (EVM) and a bridge between the chains, Aurora makes it possible for developers to link their Ethereum contracts and assets with NEAR, combining low fees and high processing speed of NEAR with the robust ecosystem of Ethereum.

According to the technical documentation or whitepaper of Near Protocol, the platform is created to support individuals in building, developing, and expanding applications.

The documentation states: “NEAR is developed from scratch to offer user-friendly experiences, expand its capacity to millions of devices, and give developers innovative and sustainable business models for their applications. By doing this, NEAR aims to establish a community-operated cloud robust enough to broaden the scope of Open Finance and drive the advancement of the Open Web.”

NEAR Tokenomics

The NEAR token is used primarily to pay for transaction fees and to serve as collateral for data storage on the blockchain. Those who participate in the blockchain ecosystem, such as transaction validators, are compensated with NEAR tokens. Validators receive rewards every epoch, which annually totals 4.5% of the entire NEAR supply.

Developers who create smart contracts also earn a share of the fees generated by their contracts. The rest of each transaction fee is burned, which helps reduce the overall supply of NEAR tokens and increases their scarcity. Additionally, the NEAR protocol has set up a treasury that receives 0.5% of the total NEAR supply each year, intended to fund further ecosystem development.

The NEAR protocol also supports ‘wrapped’ tokens from other blockchain systems and non-fungible tokens (NFTs). It has established a connection with Ethereum through a bridge that enables users to transfer ERC-20 tokens from Ethereum to NEAR.

Near Price Prediction: Price History

| Time period | Near Protocol Price |

| Last week (June 14 2024) | $6 |

| Last month (May 21 2024) | $8.33 |

| Three months ago (March 21 2024) | $6.96 |

| One year ago (June 21 2024) | $1.35 |

| Launch price (October 14 2020) | $1.69 |

| All-time high (January 16 2022) | $20.42 |

| All-time low (November 4 2020) | $0.53 |

NEAR Price Prediction: Technical Analysis

Near’s rebound toward $5 indicates that bulls are actively defending the support zone between $4.5 and $4.8. However, buyers failed to hold the price around the $5 mark, resulting in a minor correction. This has plunged the Near price toward the EMA20 trend line, strengthening the dominance of sellers. As of writing, Near price trades at $4.9, surging over 4.6% in the last 24 hours.

A sharp decline from the 20-day EMA would suggest that sentiment remains bearish and traders are taking advantage of rallies to sell. If bears manage to drive the NEAR/USDT pair below the support zone, the pair could fall to the psychological level of $4.

Conversely, a sign of bullish momentum would be a break and close above the 20-day EMA. This could set the stage for a rise towards the 50-day simple moving average (SMA) at $5.6, indicating that the price may oscillate within the range of $6 to $6.4 for some time.

NEAR Protocol Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 5.3 | 5.48 | 6.01 |

| 2025 | 7.9 | 8.12 | 9.07 |

| 2026 | 11.39 | 11.8 | 13.69 |

| 2027 | 16.34 | 16.81 | 19.74 |

| 2028 | 23.83 | 24.67 | 28.53 |

| 2029 | 34.52 | 35.5 | 41.82 |

| 2030 | 51.69 | 53.11 | 59.86 |

| 2031 | 76.78 | 79.44 | 90.89 |

| 2032 | 113.38 | 116.56 | 133.77 |

| 2033 | 166.35 | 171.01 | 196.93 |

NEAR Protocol Price Prediction 2024

In 2024, the minimum expected price of NEAR Protocol is $5.30. The price could climb to a maximum of $6.01, with an average throughout the year around $5.48.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 4.77 | 4.93 | 5.71 |

| February | 4.82 | 4.98 | 5.74 |

| March | 4.87 | 5.03 | 5.76 |

| April | 4.91 | 5.08 | 5.79 |

| May | 4.96 | 5.13 | 5.82 |

| June | 5.01 | 5.18 | 5.85 |

| July | 5.06 | 5.23 | 5.87 |

| August | 5.11 | 5.28 | 5.9 |

| September | 5.16 | 5.33 | 5.93 |

| October | 5.2 | 5.38 | 5.96 |

| November | 5.25 | 5.43 | 5.98 |

| December | 5.3 | 5.48 | 6.01 |

NEAR Protocol Price Prediction 2025

Based on detailed technical analysis of past price trends, NEAR Protocol’s price in 2025 is projected to reach a minimum of $7.90. It could peak at $9.07, with an average price of $8.12 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 7.11 | 7.31 | 8.62 |

| February | 7.18 | 7.38 | 8.66 |

| March | 7.25 | 7.46 | 8.7 |

| April | 7.33 | 7.53 | 8.74 |

| May | 7.4 | 7.6 | 8.78 |

| June | 7.47 | 7.68 | 8.82 |

| July | 7.54 | 7.75 | 8.86 |

| August | 7.61 | 7.82 | 8.91 |

| September | 7.68 | 7.9 | 8.95 |

| October | 7.76 | 7.97 | 8.99 |

| November | 7.83 | 8.05 | 9.03 |

| December | 7.9 | 8.12 | 9.07 |

NEAR Price Forecast for 2026

For 2026, the NEAR Protocol price is predicted to hit a minimum of $11.39. It could reach a high of $13.69, with an average price settling around $11.80.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 10.25 | 10.62 | 13.01 |

| February | 10.35 | 10.73 | 13.07 |

| March | 10.46 | 10.83 | 13.13 |

| April | 10.56 | 10.94 | 13.19 |

| May | 10.67 | 11.05 | 13.25 |

| June | 10.77 | 11.16 | 13.32 |

| July | 10.87 | 11.26 | 13.38 |

| August | 10.98 | 11.37 | 13.44 |

| September | 11.08 | 11.48 | 13.5 |

| October | 11.18 | 11.59 | 13.57 |

| November | 11.29 | 11.69 | 13.63 |

| December | 11.39 | 11.8 | 13.69 |

NEAR Protocol (NEAR) Price Prediction 2027

The projected minimum price of NEAR Protocol in 2027 is $16.34, potentially rising to a maximum of $19.74. The average trading price is expected to be $16.81.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 14.71 | 15.13 | 18.75 |

| February | 14.85 | 15.28 | 18.84 |

| March | 15 | 15.43 | 18.93 |

| April | 15.15 | 15.59 | 19.02 |

| May | 15.3 | 15.74 | 19.11 |

| June | 15.45 | 15.89 | 19.2 |

| July | 15.6 | 16.05 | 19.29 |

| August | 15.75 | 16.2 | 19.38 |

| September | 15.89 | 16.35 | 19.47 |

| October | 16.04 | 16.5 | 19.56 |

| November | 16.19 | 16.66 | 19.65 |

| December | 16.34 | 16.81 | 19.74 |

NEAR Protocol Price Prediction 2028

In 2028, the minimum forecast price for NEAR Protocol is $23.83, with the potential to reach a maximum of $28.53. The average price throughout the year is predicted to be $24.67.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 21.45 | 22.2 | 27.1 |

| February | 21.66 | 22.43 | 27.23 |

| March | 21.88 | 22.65 | 27.36 |

| April | 22.1 | 22.88 | 27.49 |

| May | 22.31 | 23.1 | 27.62 |

| June | 22.53 | 23.32 | 27.75 |

| July | 22.75 | 23.55 | 27.88 |

| August | 22.96 | 23.77 | 28.01 |

| September | 23.18 | 24 | 28.14 |

| October | 23.4 | 24.22 | 28.27 |

| November | 23.61 | 24.45 | 28.4 |

| December | 23.83 | 24.67 | 28.53 |

NEAR Protocol Price Prediction 2029

By 2029, the price of NEAR Protocol is anticipated to reach a minimum of $34.52. The maximum price could hit $41.82, with an average around $35.50.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 31.07 | 31.95 | 39.73 |

| February | 31.38 | 32.27 | 39.92 |

| March | 31.7 | 32.6 | 40.11 |

| April | 32.01 | 32.92 | 40.3 |

| May | 32.32 | 33.24 | 40.49 |

| June | 32.64 | 33.56 | 40.68 |

| July | 32.95 | 33.89 | 40.87 |

| August | 33.26 | 34.21 | 41.06 |

| September | 33.58 | 34.53 | 41.25 |

| October | 33.89 | 34.85 | 41.44 |

| November | 34.21 | 35.18 | 41.63 |

| December | 34.52 | 35.5 | 41.82 |

NEAR Protocol (NEAR) Price Prediction 2030

The price of NEAR Protocol in 2030 is forecast to have a minimum level of $51.69. It could rise to a maximum of $59.86, with the average price around $53.11.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 46.52 | 47.8 | 56.87 |

| February | 46.99 | 48.28 | 57.14 |

| March | 47.46 | 48.76 | 57.41 |

| April | 47.93 | 49.25 | 57.68 |

| May | 48.4 | 49.73 | 57.96 |

| June | 48.87 | 50.21 | 58.23 |

| July | 49.34 | 50.7 | 58.5 |

| August | 49.81 | 51.18 | 58.77 |

| September | 50.28 | 51.66 | 59.04 |

| October | 50.75 | 52.14 | 59.32 |

| November | 51.22 | 52.63 | 59.59 |

| December | 51.69 | 53.11 | 59.86 |

NEAR Protocol Price Forecast 2031

According to analysis, the NEAR Protocol price in 2031 is expected to be at least $76.78, possibly reaching up to $90.89. The average trading price should be about $79.44.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 69.1 | 71.5 | 86.35 |

| February | 69.8 | 72.22 | 86.76 |

| March | 70.5 | 72.94 | 87.17 |

| April | 71.2 | 73.66 | 87.58 |

| May | 71.89 | 74.38 | 87.99 |

| June | 72.59 | 75.11 | 88.41 |

| July | 73.29 | 75.83 | 88.82 |

| August | 73.99 | 76.55 | 89.24 |

| September | 74.69 | 77.27 | 89.65 |

| October | 75.38 | 77.99 | 90.06 |

| November | 76.08 | 78.72 | 90.48 |

| December | 76.78 | 79.44 | 90.89 |

NEAR Protocol (NEAR) Price Prediction 2032

Following a deep analysis of past data, the price of NEAR Protocol in 2032 is expected to start at a minimum of $113.38 and could reach up to $133.77, with an average around $116.56.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 102.04 | 104.9 | 127.08 |

| February | 103.07 | 105.96 | 127.69 |

| March | 104.1 | 107.02 | 128.3 |

| April | 105.13 | 108.08 | 128.91 |

| May | 106.16 | 109.14 | 129.51 |

| June | 107.2 | 110.2 | 130.12 |

| July | 108.23 | 111.26 | 130.73 |

| August | 109.26 | 112.32 | 131.34 |

| September | 110.29 | 113.38 | 131.95 |

| October | 111.32 | 114.44 | 132.55 |

| November | 112.35 | 115.5 | 133.16 |

| December | 113.38 | 116.56 | 133.77 |

NEAR Protocol Price Prediction 2033

In 2033, the NEAR Protocol is predicted to have a minimum price of $166.35 and could reach a maximum of $196.93, with an average price expected to be $171.01.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 149.72 | 153.91 | 187.08 |

| February | 151.23 | 155.46 | 187.98 |

| March | 152.74 | 157.02 | 188.87 |

| April | 154.25 | 158.57 | 189.77 |

| May | 155.76 | 160.13 | 190.66 |

| June | 157.28 | 161.68 | 191.56 |

| July | 158.79 | 163.24 | 192.45 |

| August | 160.3 | 164.79 | 193.35 |

| September | 161.81 | 166.35 | 194.24 |

| October | 163.33 | 167.9 | 195.14 |

| November | 164.84 | 169.46 | 196.03 |

| December | 166.35 | 171.01 | 196.93 |

NEAR Price Forecast: By Experts

According to the NEAR Protocol price prediction by Coincodex, the price of NEAR Protocol is expected to increase by 226.11% and reach $16.15 by August 10, 2024. Technical indicators suggest that the current market sentiment is bearish, and the Fear & Greed Index indicates a level of 29, classified as Fear. Over the past 30 days, NEAR Protocol has experienced 17/30 (57%) green days with a price volatility of 9.33%. The forecast advises that it is currently not an opportune time to purchase NEAR Protocol.

Historical data on NEAR Protocol’s price movements and BTC halving cycles suggest that the minimum price for NEAR Protocol in 2025 could be around $4.95, while the maximum price could reach up to $23.25 in the following year.

According to forecasts from Digital Coin Price, market analysts and experts anticipate that NEAR will begin 2026 with a price of $14.33 and trade around $17.76, marking a significant increase compared to the previous year. This represents a considerable jump in the price of NEAR Protocol. By 2032, the price of NEAR Protocol is projected to reach at least $67.09, with an average trading price for the year estimated at $70.09. The highest expected value of NEAR Protocol could reach $70.27. Specialists predict that the maximum trading price will hover around $70.09 throughout 2032.

Is NEAR a Good Investment? When To Buy?

It is difficult to determine if NEAR will gain traction. The announcement of its collaboration with Alibaba is promising, as it could increase system usage among customers who might otherwise ignore cryptocurrency. Any enhancement in the platform’s utility and visibility should positively affect its native token, and NEAR has historically responded well to such developments. Additionally, the KAKINOW screen lock platform has attracted new users to Near Protocol.

However, Near Protocol faces challenges, notably from the SEC’s allegation that it is an unregistered security. Also, being labeled as an “Ethereum Killer,” the performance of Ethereum could influence perceptions of Near Protocol’s potential to attract attention. As with all cryptocurrency investments, thorough research is essential before making a decision to invest in NEAR.

It is advised to invest in the Near token at a price of $3.8 for a profitable return in the long term.

Advantages and Disadvantages of Near Protocol

Blockchain analytics firm Messari recently published its latest quarterly report on Near Protocol, highlighting several key strengths and weaknesses of the blockchain.

According to the report, from January to March 2024, Near Protocol experienced significant growth:

- The number of active daily addresses reached 1.2 million, a substantial increase from 100,000 year-on-year and from 868,800 the previous quarter.

- The average market cap rose to $7.2 billion, up from $1.7 billion year-on-year and from $3.7 billion quarter-on-quarter.

- Revenue reached $1.9 million, an increase from $100,000 the previous year and from $1.1 million the previous quarter.

- Daily transactions totaled 2.4 million, up from 400,000 year-on-year and from 700,000 quarter-on-quarter.

Advantages of Near Protocol:

Messari noted that Near Protocol:

- Has become one of the most popular platforms on the blockchain.

- Is progressing well in its efforts to become more decentralized.

- Has benefited from NEAR inscriptions.

Disadvantages of Near Protocol:

The report also identified several challenges:

- Near Protocol faces ongoing accusations from the SEC of operating as an unregistered security.

- The platform could improve its user-friendliness.

- The number of active validators has plateaued.

Conclusion

Although Near Protocol introduces compelling innovations, it remains significantly behind Ethereum as a top competitor. Other blockchains like Solana, with its native token *SOL*, and Polkadot, whose token is *DOT*, have been in the space longer and have built more momentum. Near Protocol uses its NEAR token for staking, which is crucial for the validation of blocks on the network, with stakers receiving rewards in the same token.

Beyond its speed and scalability, Near Protocol engages in discussions about the environmental impact of cryptocurrencies by promoting its “carbon neutrality.” It achieves this through partnerships with carbon-offsetting firms to neutralize its energy consumption. Moreover, its proof-of-stake mechanisms generally produce fewer emissions compared to proof-of-work systems.

It is advised to do your own research and conduct investment analysis before investing in the volatile crypto market.

Frequently Asked Questions

What is Near Protocol?

Near Protocol is a layer 1 blockchain network that allows developers to build decentralized applications (dApps). It competes with Ethereum by focusing on improving transaction costs, speed, and scalability.

Why is Near Protocol significant?

Near Protocol addresses key issues like high transaction fees and slow speeds that have plagued Ethereum. It aims to offer faster and cheaper transactions, with the goal of handling up to 100,000 transactions per second (TPS).

What is the NEAR token used for?

The NEAR token is used for transaction fees, data storage collateral, and rewarding validators. It also plays a role in governance and is involved in 'wrapped' tokens and NFTs.

What is the price prediction for NEAR Protocol?

The NEAR token is expected to have significant price growth, with projections suggesting it could reach higher values in the coming years. For instance, by 2030, the price could potentially reach $59.86.

What are the advantages and disadvantages of Near Protocol?

Advantages include its popularity, progress towards decentralization, and benefits from NEAR inscriptions. Disadvantages include SEC accusations of it being an unregistered security, user-friendliness improvements needed, and a plateau in the number of active validators.

Is NEAR a good investment?

While Near Protocol has shown promising developments and partnerships, it's important to conduct thorough research and consider market conditions before investing. The platform's collaboration with Alibaba and the KAIKAINOW platform are positive signs, but regulatory challenges and competition remain concerns.