- 1. SafeMoon: A Quick Introduction

- 2. SafeMoon: How Does It Work?

- 3. SFM Historical Price Sentiment

- 4. SFM Price Prediction: Technical Analysis

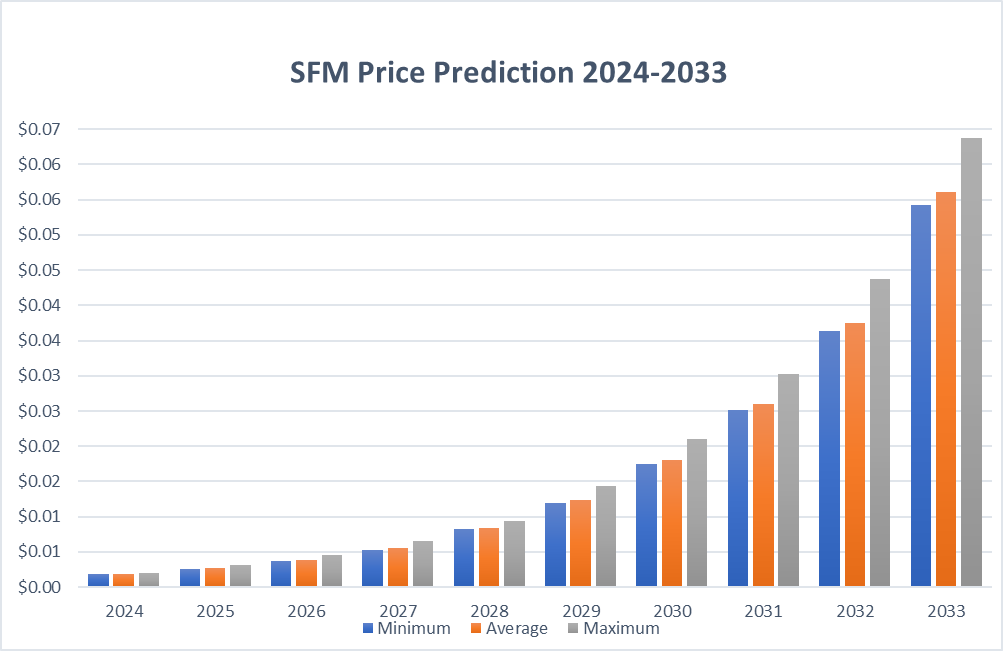

- 5. SafeMoon Price Prediction By Blockchain Reporter

- 5.1. SafeMoon Price Prediction 2024

- 5.2. SafeMoon Price Prediction 2025

- 5.3. SafeMoon Price Prediction 2026

- 5.4. SafeMoon Price Prediction 2027

- 5.5. SafeMoon Price Prediction 2028

- 5.6. SafeMoon Price Prediction 2029

- 5.7. SafeMoon Price Prediction 2030

- 5.8. SafeMoon Price Prediction 2031

- 5.9. SafeMoon Price Prediction 2032

- 5.10. SafeMoon Price Prediction 2033

- 6. SafeMoon Price Prediction: By Experts

- 7. Is SafeMoon a Good Investment? When to Buy?

- 8. Conclusion

SafeMoon is a fairly new cryptocurrency that is very unstable and well-known for its high transaction fees of 10% and a lot of attention on social media. Like popular cryptocurrencies such as Bitcoin and Ethereum, SafeMoon uses the same underlying technology and was launched in March 2021 using the Binance Smart Chain. Its creators designed it to promote holding the cryptocurrency for a long time. During transactions, half of the 10% fee is distributed to long-term holders and the other half goes into a pool to help keep SafeMoon’s price stable, unlike other cryptocurrencies like Dogecoin or Shiba Inu Coin, which might seem like jokes or less serious ventures. However, SafeMoon seems to be tapping into the popularity of meme-driven coins like *DOGE*.

Since the transaction fee rewards earlier investors, some people, including an investor, have criticized SafeMoon as a potential Ponzi scheme—a claim its CEO strongly rejects.

The founders aimed to make SafeMoon a long-term investment, setting the high transaction fee to prevent frequent trading and encourage keeping the coin. Despite this, SafeMoon is considered one of the more speculative investments in the cryptocurrency market. It’s similar to *SHIB* in that it doesn’t have any intrinsic utility and only gains value as new investors buy in, leading some to label it a “shitcoin.”

In this article, we’ll explore SafeMoon price prediction with an in-depth analysis of the current market sentiment and future SFM price forecasts.

SafeMoon: A Quick Introduction

SafeMoon is an alternative cryptocurrency (altcoin) that started on the Binance Smart Chain. It was launched in a “fair launch” on March 8, 2021, meaning the developers burned all their tokens and joined the coin offering just like any other buyer. Since its inception, SafeMoon has attracted nearly 2.5 million users and has burned over 40% of its total token supply.

SafeMoon aims to tackle the problem of impermanent loss and encourages users to hold onto their tokens rather than trading them to spike the price. It does this by imposing a fee on transactions where SafeMoon tokens are sold.

A common criticism of *BTC* and similar cryptocurrencies is that they have veered away from their original goal. Initially introduced as alternatives to centralized fiat currencies governed by central banks, Bitcoin and many others have transformed into mere commodities. Now, they are primarily seen as investments or assets to be traded, much like stocks.

Safemoon has a few distinct features that have attracted both applause and criticism. One notable aspect is Safemoon’s smart contract, which imposes a 10% fee on any holder who decides to sell their tokens. Half of this fee is permanently removed or “burned,” while the other half is redistributed to the remaining token holders, potentially increasing the value of their holdings over time.

Critics have also pointed out concerns with how Safemoon’s tokens are distributed. A significant portion of Safemoon’s liquidity is controlled by its founding team members. Although these funds are locked up, the concentration of so much ownership within the founding team is often viewed as problematic in the cryptocurrency community because it can lead to significant price volatility when these large holders decide to sell.

Additionally, there has been disappointment regarding the progress of developments promised by the founding team, such as a dedicated wallet application for Safemoon’s ecosystem, which has not yet met expectations.

SafeMoon: How Does It Work?

The way SafeMoon V2 works is designed to gradually decrease the number of tokens in circulation, which is intended to make them more valuable over time and encourage people to keep their tokens for longer. Every time someone buys or sells SafeMoon V2 tokens, a 10% fee is charged. This fee is key to reducing the total number of tokens over time.

Out of this 10% fee, 4% is given back to the token holders as a reward for keeping their tokens. This not only rewards them but also motivates them to hold on to their tokens for longer, potentially earning more over time.

Another 3% of the fee goes into a pool to help keep the price of the token stable. This pool helps ensure there’s always enough cash flow to support people buying and selling the token.

Additionally, 2% of the tokens involved in each transaction are permanently removed, or “burned,” which means they are taken out of circulation forever, helping to make the remaining tokens rarer and more valuable.

Finally, 1% of the transaction fee is set aside for a fund dedicated to developing new products and services for SafeMoon V2, ensuring the project can continue to grow and develop.

History and Core Features

SafeMoon is a type of cryptocurrency that builds on existing *ETH* technology to operate within the crypto ecosystem. It was created by a team of six developers and launched on the Binance Smart Chain (BSC) blockchain on March 8, 2021. The name “SafeMoon” comes from the phrase “Safely To The Moon,” suggesting that the goal of the coin is to increase in value steadily and securely. Since its launch, SafeMoon has attracted over 2.9 million users, as reported by BscScan.

Core features of SafeMoon include:

- Reflection: According to its white paper, SafeMoon charges a transaction fee of about 5%, which is then redistributed to all SafeMoon holders. This encourages people to hold onto their tokens to receive dividends.

- LP Acquisition: Another key aspect mentioned in the white paper is that SafeMoon charges an additional transaction fee of about 5% for liquidity. This fee is used to supply liquidity pools on platforms like PancakeSwap. Half of this 5% fee is converted into Binance Coin (BNB) to ensure there is always enough of both SafeMoon and Binance Coin available for trading.

- Token Burn: SafeMoon also has a feature called “token burn” where a portion of the tokens are permanently destroyed. This reduces the overall supply of SafeMoon, making it a deflationary asset, which can help increase the value per token as the total available supply decreases.

SFM Historical Price Sentiment

Let’s take a look at the price history of SafeMoon V2. While it’s important to remember that past performance is not necessarily indicative of future results, understanding the coin’s history can give us useful insight when trying to predict or understand its future price movements.

Since launching in March 2021, SafeMoon V2 quickly experienced an incredible rise, with its price increasing by over 2,000% in just a few weeks. This sharp increase was driven by a mix of strong social media interest, celebrity endorsements, and the potential for high returns.

By May 2021, the cryptocurrency had hit its highest value, reaching a market cap of $5.75 billion, according to CoinMarketCap.

Not long after reaching its peak, SafeMoon V2 saw a significant drop in value. This decline came during a broader downturn in the cryptocurrency market, but specific issues with the token greatly exacerbated its loss in value. Critics raised concerns about the sustainability of SafeMoon’s economic model, questioning its long-term viability and predicting that it could contribute to the currency’s downfall.

These worries proved to be well-founded in mid-May 2023, when SafeMoon V2’s market capitalization dramatically fell to just $3.57 million—a near-total decrease of 99.9% from its previous high.

Over the last few months, the price of SFM failed to show any significant volatility as it declined gradually. In March 2024, the price of SFM surged to $0.00016; however, it failed to hold that momentum. In the following months, the price declined further and is currently consolidating below the $0.00003 mark.

SFM Price Prediction: Technical Analysis

SFM price has dipped below its 20-day exponential moving average (EMA), currently hovering around the $0.0000264 support mark—a drop of more than 1.8% in the past day. This movement indicates that sellers are aiming for a further descent within the current Fibonacci channel.

If the price remains below the 20-day EMA, there’s potential for SafeMoon, trading as SFM/USDT, to fall toward the 50-day simple moving average (SMA) at $0.000025. The region from $0.000025 down to $0.000023 is critical for buyers to maintain; otherwise, the price could plunge to $0.00002.

Conversely, if SFM price moves above the 20-day EMA, it would suggest a shift in momentum favoring buyers, potentially leading to a test of the $0.00003 resistance level. Surpassing this barrier could drive the price up to $0.000036.

SafeMoon Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.0018 | 0.0019 | 0.002 |

| 2025 | 0.0026 | 0.0027 | 0.0032 |

| 2026 | 0.0037 | 0.0038 | 0.0046 |

| 2027 | 0.0053 | 0.0055 | 0.0065 |

| 2028 | 0.0082 | 0.0084 | 0.0094 |

| 2029 | 0.012 | 0.0123 | 0.0144 |

| 2030 | 0.0175 | 0.0181 | 0.021 |

| 2031 | 0.0251 | 0.026 | 0.0303 |

| 2032 | 0.0364 | 0.0375 | 0.0438 |

| 2033 | 0.0542 | 0.0561 | 0.0637 |

SafeMoon Price Prediction 2024

SafeMoon has faced a series of challenges, including being sued by investors and being publicly criticized by YouTuber Coffeezilla last year. Additionally, the project’s liquidity pool was hacked, resulting in a loss of $8.9 million. Although the hacker eventually returned the funds, this incident has further harmed SafeMoon’s reputation.

Currently, SafeMoon has over 700,000 holders and a market capitalization of $15 million. Despite having a dedicated community, many of these holders have experienced substantial financial losses and are likely to sell their tokens if the price begins to rise.

Moreover, SafeMoon may find it difficult to attract new investors given its damaged reputation, especially when competing against other meme coins that are viewed more favorably by investors.

Based on detailed technical analysis of past price data of SFM, in 2024 the price of SafeMoon is predicted to potentially reach a low of $0.0018, a high of $0.0020, with an average price around $0.0019.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0015 | $0.0017 | $0.0019 |

| February | $0.001527 | $0.001718 | $0.001909 |

| March | $0.001555 | $0.001736 | $0.001918 |

| April | $0.001582 | $0.001755 | $0.001927 |

| May | $0.001609 | $0.001773 | $0.001936 |

| June | $0.001636 | $0.001791 | $0.001945 |

| July | $0.001664 | $0.001809 | $0.001955 |

| August | $0.001691 | $0.001827 | $0.001964 |

| September | $0.001718 | $0.001845 | $0.001973 |

| October | $0.001745 | $0.001864 | $0.001982 |

| November | $0.001773 | $0.001882 | $0.001991 |

| December | $0.001800 | $0.001900 | $0.002000 |

SafeMoon Price Prediction 2025

The SafeMoon “Focus Map” indicates that the team is pursuing a variety of initiatives, from developing a new blockchain to establishing a centralized exchange in the EU.

The project has already rolled out some notable features, including a multi-chain wallet (SafeMoon Wallet) and a decentralized exchange (SafeMoon Swap). However, despite these developments, the price of SafeMoon continues to drop to new lows.

While upcoming enhancements could potentially boost SafeMoon’s price, the project faces significant challenges related to security and leadership, which need to be addressed before it can approach its all-time high again.

Looking forward to 2025, SafeMoon’s price is expected to vary between a minimum of $0.0026 and a maximum of $0.0032, averaging about $0.0027 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0018 | $0.0020 | $0.0020 |

| February | $0.0019 | $0.0020 | $0.0021 |

| March | $0.0020 | $0.0021 | $0.0022 |

| April | $0.0021 | $0.0022 | $0.0023 |

| May | $0.0022 | $0.0023 | $0.0024 |

| June | $0.0023 | $0.0023 | $0.0025 |

| July | $0.0023 | $0.0024 | $0.0026 |

| August | $0.0024 | $0.0025 | $0.0027 |

| September | $0.0024 | $0.0025 | $0.0028 |

| October | $0.0025 | $0.0026 | $0.0030 |

| November | $0.0025 | $0.0026 | $0.0031 |

| December | $0.0026 | $0.0027 | $0.0032 |

SafeMoon Price Prediction 2026

The predictions for 2026 forecast that SafeMoon’s price may bottom out around $0.0037 and could climb to as high as $0.0046, with an average price likely hovering around $0.0038.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0026 | $0.0029 | $0.0030 |

| February | $0.0028 | $0.0029 | $0.0031 |

| March | $0.0029 | $0.0030 | $0.0033 |

| April | $0.0029 | $0.0031 | $0.0034 |

| May | $0.0030 | $0.0031 | $0.0035 |

| June | $0.0031 | $0.0032 | $0.0037 |

| July | $0.0031 | $0.0033 | $0.0038 |

| August | $0.0032 | $0.0033 | $0.0039 |

| September | $0.0034 | $0.0035 | $0.0041 |

| October | $0.0035 | $0.0036 | $0.0042 |

| November | $0.0036 | $0.0037 | $0.0044 |

| December | $0.0037 | $0.0038 | $0.0046 |

SafeMoon Price Prediction 2027

For 2027, SafeMoon is anticipated to reach a minimum price of $0.0053, possibly reaching up to $0.0065, with the average staying near $0.0055.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0036 | $0.0040 | $0.0041 |

| February | $0.0040 | $0.0041 | $0.0043 |

| March | $0.0042 | $0.0043 | $0.0045 |

| April | $0.0042 | $0.0044 | $0.0047 |

| May | $0.0044 | $0.0046 | $0.0049 |

| June | $0.0046 | $0.0048 | $0.0052 |

| July | $0.0047 | $0.0049 | $0.0054 |

| August | $0.0048 | $0.0049 | $0.0056 |

| September | $0.0049 | $0.0051 | $0.0058 |

| October | $0.0050 | $0.0052 | $0.0060 |

| November | $0.0053 | $0.0054 | $0.0063 |

| December | $0.0053 | $0.0055 | $0.0065 |

SafeMoon Price Prediction 2028

The projection for 2028 estimates that SafeMoon will have a minimum price of $0.0082 and could peak at $0.0094, with the average trading price expected to be around $0.0084.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0053 | $0.0058 | $0.0060 |

| February | $0.0056 | $0.0059 | $0.0062 |

| March | $0.0059 | $0.0061 | $0.0065 |

| April | $0.0062 | $0.0064 | $0.0068 |

| May | $0.0063 | $0.0066 | $0.0071 |

| June | $0.0066 | $0.0068 | $0.0074 |

| July | $0.0068 | $0.0071 | $0.0078 |

| August | $0.0070 | $0.0073 | $0.0081 |

| September | $0.0073 | $0.0075 | $0.0084 |

| October | $0.0075 | $0.0078 | $0.0088 |

| November | $0.0078 | $0.0081 | $0.0091 |

| December | $0.0082 | $0.0084 | $0.0094 |

SafeMoon Price Prediction 2029

In 2029, SafeMoon might reach as low as $0.0120 and could go up to $0.0144, with an average price of approximately $0.0123.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0080 | $0.0088 | $0.0091 |

| February | $0.0088 | $0.0092 | $0.0095 |

| March | $0.0091 | $0.0095 | $0.0099 |

| April | $0.0094 | $0.0097 | $0.0104 |

| May | $0.0096 | $0.0100 | $0.0109 |

| June | $0.0100 | $0.0104 | $0.0114 |

| July | $0.0102 | $0.0106 | $0.0118 |

| August | $0.0107 | $0.0111 | $0.0123 |

| September | $0.0110 | $0.0114 | $0.0127 |

| October | $0.0114 | $0.0119 | $0.0132 |

| November | $0.0118 | $0.0121 | $0.0138 |

| December | $0.0120 | $0.0123 | $0.0144 |

SafeMoon Price Prediction 2030

The price of SafeMoon in 2030 is predicted to fluctuate between a minimum of $0.0175 and a maximum of $0.0210, with the average price likely around $0.0181.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0118 | $0.0130 | $0.0133 |

| February | $0.0130 | $0.0135 | $0.0138 |

| March | $0.0134 | $0.0139 | $0.0145 |

| April | $0.0135 | $0.0142 | $0.0152 |

| May | $0.0141 | $0.0147 | $0.0158 |

| June | $0.0145 | $0.0152 | $0.0164 |

| July | $0.0151 | $0.0156 | $0.0170 |

| August | $0.0156 | $0.0161 | $0.0178 |

| September | $0.0159 | $0.0164 | $0.0186 |

| October | $0.0166 | $0.0171 | $0.0192 |

| November | $0.0171 | $0.0177 | $0.0201 |

| December | $0.0175 | $0.0181 | $0.0210 |

SafeMoon Price Prediction 2031

By 2031, SafeMoon’s price could dip to as low as $0.0251 and rise to a maximum of $0.0303, with an average price around $0.0260.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0172 | $0.0190 | $0.0195 |

| February | $0.0187 | $0.0196 | $0.0203 |

| March | $0.0191 | $0.0200 | $0.0211 |

| April | $0.0197 | $0.0206 | $0.0219 |

| May | $0.0203 | $0.0210 | $0.0227 |

| June | $0.0207 | $0.0216 | $0.0238 |

| July | $0.0215 | $0.0223 | $0.0246 |

| August | $0.0224 | $0.0231 | $0.0257 |

| September | $0.0227 | $0.0236 | $0.0269 |

| October | $0.0232 | $0.0241 | $0.0281 |

| November | $0.0241 | $0.0250 | $0.0290 |

| December | $0.0251 | $0.0260 | $0.0303 |

SafeMoon Price Prediction 2032

In 2032, it is expected that SafeMoon will reach a minimum price of $0.0364 and could achieve a maximum price of $0.0438, with the average price possibly being $0.0375.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0250 | $0.0273 | $0.0281 |

| February | $0.0271 | $0.0282 | $0.0295 |

| March | $0.0274 | $0.0287 | $0.0306 |

| April | $0.0288 | $0.0299 | $0.0321 |

| May | $0.0292 | $0.0305 | $0.0336 |

| June | $0.0298 | $0.0311 | $0.0351 |

| July | $0.0307 | $0.0320 | $0.0363 |

| August | $0.0323 | $0.0333 | $0.0379 |

| September | $0.0329 | $0.0340 | $0.0393 |

| October | $0.0337 | $0.0350 | $0.0410 |

| November | $0.0353 | $0.0364 | $0.0424 |

| December | $0.0364 | $0.0375 | $0.0438 |

SafeMoon Price Prediction 2033

According to forecasts, in 2033, the price of SafeMoon could fall to $0.0542 at its lowest and rise to a high of $0.0637, with an average price of about $0.0561.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.0360 | $0.0394 | $0.0405 |

| February | $0.0394 | $0.0409 | $0.0421 |

| March | $0.0407 | $0.0426 | $0.0437 |

| April | $0.0423 | $0.0438 | $0.0454 |

| May | $0.0441 | $0.0456 | $0.0476 |

| June | $0.0455 | $0.0474 | $0.0494 |

| July | $0.0478 | $0.0493 | $0.0513 |

| August | $0.0484 | $0.0503 | $0.0538 |

| September | $0.0494 | $0.0513 | $0.0563 |

| October | $0.0505 | $0.0523 | $0.0583 |

| November | $0.0529 | $0.0544 | $0.0610 |

| December | $0.0542 | $0.0561 | $0.0637 |

SafeMoon Price Prediction: By Experts

According to Coincodex’s current SafeMoon price prediction, SafeMoon’s price is expected to increase by 227.51% and reach $0.00008788 by December 6, 2024. Coincodex’s technical indicators suggest that the current market sentiment is bearish, while the Fear & Greed Index indicates a reading of 69, showing a sentiment of greed. Over the last 30 days, SafeMoon has seen 13 out of 30 green days, with a price volatility of 6.67%.

According to Coincodex’s forecast, it is currently not a good time to buy SafeMoon. However, forecasts for November predict a potential market trend reversal with the price possibly rising to $0.00005300. The anticipated price range is between $0.00002683 and $0.00009101, influenced by the market’s performance in the previous month. Investors who buy at current prices and sell at the forecasted price could see a potential gain of 235.11%.

According to market analysts and experts cited by Digital Coin Price, SFM is expected to start the year 2026 at $0.0000798 and could reach around $0.0000977. This represents a significant increase compared to the previous year and is seen as a notable jump for SafeMoon V2.

By 2032, SafeMoon V2’s price is estimated to reach at least $0.000372, with an average trading price throughout the year of $0.000383. The peak value for 2032 could potentially reach $0.000390. Experts project that the maximum trading price could average around $0.000383 for that year.

Is SafeMoon a Good Investment? When to Buy?

Over the past year, SafeMoon’s value has declined even as the broader market has rebounded from its bear market lows. This indicates that market movements have less impact on SafeMoon compared to other cryptocurrencies.

Investor sentiment is a major factor influencing SafeMoon’s price this year. The project has been embroiled in multiple controversies, from lawsuits by investors to a recent $8.9 million hack, which have eroded confidence in the project. This lack of trust is likely why SafeMoon’s 24-hour trading volume is significantly lower than its market cap.

However, development within SafeMoon’s ecosystem could positively affect its price. Enhancing the utility and value for its holders may draw more investors, potentially increasing its price.

Conversely, while SafeMoon’s 10% transaction fee on buys and sells has been effective in the past, it could now act as a deterrent for new investors considering entering the market.

According to our analysis, it is advised to invest in SFM price at $0.000015 for a profitable return in the long term.

Conclusion

SafeMoon has indeed made some early investors very wealthy shortly after its launch, which can be quite alluring. However, this rapid enrichment is characteristic of how Ponzi schemes start and gain traction. Stories of early adopters earning returns of 500% to 5,000% can entice more people to invest, perhaps allowing the scheme to persist for years. Yet, historically, all Ponzi schemes eventually collapse.

Currently, SafeMoon’s primary function is to generate profit, which continues only as long as new excitement maintains rising prices. The decision to take on such risk depends entirely on whether you’re prepared to possibly end up with worthless tokens.

On a more optimistic note, the SafeMoon team plans to add real utility to the platform, with potential expansions into online gaming which could attract millions of new users. However, it’s important to recognize that many established projects are already competing in the online gaming space.

The team’s ambitions are high, aiming to develop a comprehensive ecosystem that includes a decentralized exchange (DEX), an NFT marketplace, and a cold wallet, alongside several other initiatives under Operation Phoenix. However, given the current team composition, there are doubts about their ability to fully realize these plans. It also remains unclear how actively they are engaging with commercial entities to incorporate SFM into everyday transactions.

Additionally, vulnerabilities in the smart contract have been discovered, suggesting the possibility of a significant security breach, or “rug pull,” in the future.

While investing in SafeMoon might yield substantial returns, there is also a real risk of significant losses. Therefore, caution is advised in navigating such volatile investments.

Frequently Asked Questions

What is SafeMoon?

SafeMoon is a cryptocurrency that launched in March 2021 on the Binance Smart Chain. It’s designed to encourage long-term holding through a 10% transaction fee—half of which rewards holders, while the other half goes into a liquidity pool to help stabilize prices.

How does SafeMoon’s transaction fee work?

Every time a SafeMoon transaction occurs, a 10% fee is applied. Half of this fee is redistributed to SafeMoon holders, incentivizing long-term holding. The remaining half contributes to the liquidity pool to help maintain price stability.

What is SafeMoon V2?

SafeMoon V2 is an upgraded version of the original SafeMoon token, aimed at improving its tokenomics and security features. This version also aims to reduce the total token supply, thereby increasing scarcity and potentially raising the token's value over time.

Why is SafeMoon often compared to a Ponzi scheme?

SafeMoon’s economic model, which relies on new investors to sustain its rewards system, has drawn criticism. Some critics argue that it operates similarly to a Ponzi scheme. However, the SafeMoon team disputes this claim and asserts their focus on developing utility and stability for the project.

Is SafeMoon a long-term investment?

SafeMoon was designed as a long-term investment with incentives for holders. However, it’s considered highly speculative, and prospective investors should carefully weigh the potential for gains against the risks of significant loss.

What are SafeMoon’s core features?

Reflection: Redistribution of a 5% transaction fee to all holders. Liquidity Pool Acquisition: 5% transaction fee goes to the liquidity pool. Token Burn: A percentage of each transaction is permanently removed from circulation to create a deflationary effect.

What makes SafeMoon different from other meme coins like Dogecoin or Shiba Inu?

Unlike meme coins that thrive primarily on social hype, SafeMoon aims to establish long-term value through its deflationary model, transaction fees, and liquidity pool system. This model aims to promote holding and discourage frequent trading.

What’s SafeMoon’s current price prediction?

Predictions vary widely, but conservative estimates suggest that SafeMoon’s price may reach between $0.0018 and $0.0020 by the end of 2024, depending on market conditions and further development within the SafeMoon ecosystem.

What are the risks of investing in SafeMoon?

Some risks include its speculative nature, regulatory uncertainty, and security concerns due to its smart contract vulnerabilities. SafeMoon has also faced criticism for lack of substantial use cases, reliance on new investors, and concentration of liquidity among founding team members.

How can I buy SafeMoon?

You can purchase SafeMoon on decentralized exchanges like PancakeSwap. You’ll need a Binance Coin (BNB) wallet to trade for SafeMoon since it operates on the Binance Smart Chain.

What future developments are planned for SafeMoon?

The SafeMoon team is planning a range of expansions, including a decentralized exchange (DEX), an NFT marketplace, a cold wallet, and potentially integrating with online gaming. These developments, if successful, could enhance the token’s utility and appeal.

What is Operation Phoenix?

Operation Phoenix is SafeMoon’s long-term initiative to expand its ecosystem, encompassing new features like a DEX, improved wallet services, and possibly partnerships with gaming platforms to integrate SafeMoon as a transaction medium.

Can I still participate in SafeMoon V2?

Yes, SafeMoon V2 is actively traded on the Binance Smart Chain. Current and new investors can participate by purchasing V2 tokens, and it’s essential to stay updated on SafeMoon’s official channels for details on any further updates.

How does SafeMoon’s liquidity pool function?

The liquidity pool is partially funded by transaction fees and aims to ensure stable trading by adding liquidity to exchanges like PancakeSwap. This pool helps balance market price fluctuations, providing some protection against volatility.

Is SafeMoon’s price influenced by overall crypto market trends?

While SafeMoon is part of the broader crypto ecosystem, its price movements can sometimes be isolated due to unique internal factors like its high transaction fee and reflection system. However, general market sentiment around crypto can still impact SafeMoon’s price direction.

Where can I learn more about SafeMoon?

For the latest updates, visit SafeMoon’s official website or follow their social media channels. It’s also helpful to read analyses from reputable crypto sites to better understand its current status and outlook.