- 1. THORChain: A Quick Introduction

- 2. How Does THORChain Work?

- 3. RUNE Price History

- 4. THORChain Price Prediction: Technical Analysis

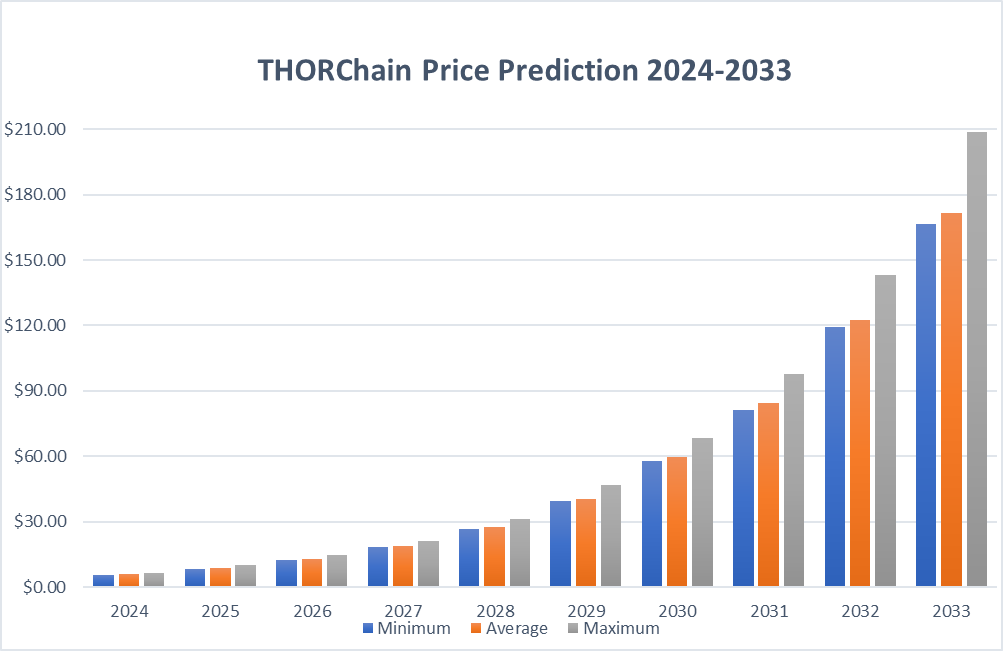

- 5. THORChain Price Prediction By Blockchain Reporter

- 5.0.1. THORChain Price Prediction 2024

- 5.0.2. THORChain Price Prediction 2025

- 5.0.3. RUNE Price Forecast for 2026

- 5.0.4. THORChain (RUNE) Price Prediction 2027

- 5.0.5. THORChain Price Prediction 2028

- 5.0.6. THORChain Price Prediction 2029

- 5.0.7. THORChain (RUNE) Price Prediction 2030

- 5.0.8. THORChain Price Forecast 2031

- 5.0.9. THORChain (RUNE) Price Prediction 2032

- 5.0.10. THORChain Price Prediction 2033

- 6. THORChain Price Forecast: By Experts

- 7. Is THORChain a Good Investment? When To Buy?

- 8. Conclusion

The growth of decentralized finance (DeFi) and its associated products and services is driving an increased demand for cross-chain liquidity and efficient asset exchange. THORChain, a leading DeFi project, provides immutable and multi-chain trading of various cryptocurrencies without the need for wrapping. As decentralized experiences seek seamless interoperability, third-generation blockchain platforms are emerging as essential. THORChain supports a cross-chain ecosystem that allows users to trade cryptocurrencies across different networks through a single protocol. Initially launched on the Cosmos network, THORChain moved to its mainnet in April 2021 to further accommodate the growing need for interoperable multi-currency exchanges. THORChain offers a decentralized exchange (DEX) solution using the Cosmos software development kit (SDK). Its AMM-based protocol supplies the necessary technology for exchanging cryptocurrencies across previously non-interoperable blockchains. The network is powered by the RUNE token, which acts as a pairing token in the platform’s liquidity pools. This setup requires users to deposit RUNE alongside another asset to facilitate trading, enhancing its utility and value within the network. Additionally, RUNE is utilized for payment of transaction fees, governance participation, and securing the THORChain network. In this article, we’ll explore THORChain price prediction with an in-depth technical analysis of RUNE price and its future market sentiment.

THORChain: A Quick Introduction

THORChain marks a pivotal shift in the blockchain sector by tackling a fundamental issue: liquidity. Liquidity is essentially the ability to quickly convert cryptocurrencies into cash or other digital assets. The lack of liquidity can complicate trading, often leading to poor exchange rates and potential financial losses due to slippage. This issue is exacerbated as liquidity is dispersed across various blockchains like Ethereum, Solana, Terra, and Polygon, each operating in near isolation, which hinders efficient asset movement and trading.

THORChain acts as a bridge linking these separate ‘islands’ of blockchains, with its main objective being to consolidate the fragmented liquidity across these networks.

The platform provides a decentralized venue for native cross-chain liquidity that is accessible to everyone—from individual traders to both centralized and decentralized exchanges, and other cryptocurrency projects.

THORChain facilitates cross-chain swaps and allows for yield generation using native assets, operating without the need for wrapped assets or custodians.

How Does THORChain Work?

THORChain runs a network that lets different blockchain products and services work together. For example, THORSwap, the first multichain decentralized exchange (DEX) that uses THORChain as its interface, allows users to swap different cryptocurrencies across chains. Users simply pick the two assets they want to trade, and THORSwap calculates the transaction fees based on the current network activity.

Swaps on THORChain are powered by what’s called a continuous liquidity pool (CLP), with RUNE acting as a go-between for every trade. Here’s how it works: if you want to swap USDT for ETH on THORChain, you first trade USDT for RUNE in one liquidity pool, and then swap that RUNE for ETH in another pool.

This process involves trading one asset for RUNE and then moving it to a different pool to get the desired asset, all without the user having to handle RUNE directly.

THORChain’s CLP model adjusts to changes in liquidity demand, ensuring smooth transactions.

There are four main roles within the THORChain ecosystem:

- Liquidity Providers (LPs): These participants supply assets to the pools and earn block rewards and fees from swaps, calculated based on their share and the pool’s activity.

- Swappers: These are users who trade various cryptocurrencies on THORChain.

- Traders: Traders look for price discrepancies between assets on THORChain and other exchanges. They buy or sell these assets to bring their prices in line with the broader market, thus balancing the liquidity pools.

- Node Operators: They bond RUNE to support the network and take part in the proof-of-stake consensus. These operators are anonymous and are periodically rotated to maintain network security, a process known as “churning.”

THORChain’s Infrastructure Explained

A Layer 1 DEX: Built using the Cosmos SDK, THORChain operates as a standalone Layer 1 cross-chain decentralized exchange (DEX). It enables the exchange of native assets across different blockchain networks.

Automated Market Makers and Liquidity Providers: THORChain employs Automated Market Makers (AMMs) to manage liquidity and determine asset prices through algorithms. Liquidity Providers (LPs) add to these pools and earn rewards from transaction fees and sometimes block rewards.

THORChain’s Native Token – RUNE

RUNE fulfills multiple roles, including acting as a settlement asset in liquidity pools, enhancing network security, facilitating governance, and functioning as a reward mechanism. Additionally, RUNE rewards incentivize Node operators to maintain network security and manage transactions efficiently.

Overall, THORChain addresses the issue of liquidity fragmentation in the blockchain sphere. Its mechanism for enabling smooth cross-chain transactions and providing a decentralized platform for liquidity management represents a significant progression in blockchain technology.

With ongoing integration of new chains and enhancements to its functionalities, THORChain is poised to become a pivotal player in decentralized finance (DeFi).

RUNE Price History

Let’s delve into the price history of THORChain. While it’s important to remember that past performance is not necessarily indicative of future results, understanding the historical achievements of the coin can offer valuable context when considering or analyzing a THORChain price prediction.

RUNE first appeared on the open market in the summer of 2019, initially priced at about $0.015. Over the next 18 months, its value increased, ending 2020 at $1.17. The cryptocurrency then experienced a prosperous start to 2021, reaching an all-time high of $21.26 on May 19 of that year. However, by the end of 2021, the price had declined to $6.80.

The year 2022 was challenging for the cryptocurrency market as a whole, and RUNE was no exception, suffering from multiple market crashes. By the end of 2022, THORChain had declined more than 80%, closing the year at $1.26.

2023 proved to be a mixed year for THORChain. The coin started on a positive note, reaching a high of $1.96 on February 8, but subsequently experienced a decline. Its value dropped to $0.7836 on June 15, following the SEC’s legal actions against the Binance and Coinbase exchanges.

However, the coin managed to recover. It gained momentum in August, and despite news of Elon Musk’s SpaceX selling off millions in Bitcoin, RUNE traded around $1.70 by October 10. The price continued to climb, reaching $7.27 on December 2, before ending the year at $5.16. Despite some volatility, THORChain managed to achieve a nearly 60% gain throughout 2023.

The beginning of 2024 has been somewhat challenging. RUNE price declined toward the low of $4 on 25 January. However, the price recovered in March and broke above the $10 milestone.

Since then, the price went on a heavy decline and dropped significantly in the following weeks. As of writing, the RUNE price is consolidating below $5.

THORChain Price Prediction: Technical Analysis

RUNE has remained within a substantial trading range of $4.5 to $4.9 for several days, demonstrating a pattern of buying during price dips and selling during rallies. As of writing, RUNE price trades at $4.6, surging over 0.7% in the last 24 hours.

The bulls managed to drive the price above the 50-day Simple Moving Average (SMA) of $4.9, but they are struggling to push the rally towards $6.3. Sellers are likely to attempt to drive the price back below the 50-day SMA. If successful, the RUNE/USDT pair could fall to the 200-day EMA.

The key resistance level to monitor in the short term is $5. If the bulls break through this level, it could indicate that the uptrend is resuming. Following this breakthrough, the pair might aim for a rally to $5.6, where strong resistance from the bears is anticipated.

THORChain Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 5.63 | 5.83 | 6.35 |

| 2025 | 8.51 | 8.8 | 10.02 |

| 2026 | 12.22 | 12.66 | 14.9 |

| 2027 | 18.31 | 18.94 | 21.15 |

| 2028 | 26.57 | 27.52 | 31.09 |

| 2029 | 39.27 | 40.37 | 46.98 |

| 2030 | 57.8 | 59.81 | 68.37 |

| 2031 | 81.42 | 84.41 | 97.83 |

| 2032 | 119.25 | 122.62 | 143.26 |

| 2033 | 166.48 | 171.39 | 208.54 |

THORChain Price Prediction 2024

THORChain’s 2024 outlook is shaped by several key factors. The integration of the BNB Smart Chain has expanded its utility, allowing swaps with BNB and BEP-20 assets, which could attract more users. Support for BNB Chain enhances its existing infrastructure, boosting market position.

Wallet and exchange integrations, including potential central exchange involvement, are set to increase accessibility and usability. Additionally, THORChain plans to raise the synthetic asset limit from 30% to 50% and activate Protocol Owned Liquidity (POL) to enhance pool stability and reduce fluctuations.

In 2024, the expected minimum price of THORChain (RUNE) is $5.63. It could climb to a high of $6.35, with an average price of $5.83 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $5.13 | $5.33 | $5.85 |

| February | $5.18 | $5.38 | $5.90 |

| March | $5.22 | $5.42 | $5.94 |

| April | $5.27 | $5.47 | $5.99 |

| May | $5.31 | $5.51 | $6.03 |

| June | $5.36 | $5.56 | $6.08 |

| July | $5.40 | $5.60 | $6.12 |

| August | $5.45 | $5.65 | $6.17 |

| September | $5.49 | $5.69 | $6.21 |

| October | $5.54 | $5.74 | $6.26 |

| November | $5.58 | $5.78 | $6.30 |

| December | $5.63 | $5.83 | $6.35 |

THORChain Price Prediction 2025

Looking ahead to 2025, THORChain is set to experience notable growth driven by several planned upgrades and integrations. The platform’s ecosystem could significantly expand with additional blockchain integrations beyond BNB, pending successful node votes. Another major development is the introduction of overcollateralized lending, which will feature no liquidations, expirations, or interest, and is currently undergoing testing.

Additionally, THORChain plans to remove Impermanent Loss Protection (ILP) for new liquidity providers after block ‘9450000,although existing providers will still be protected. This change represents a significant shift in risk mitigation strategies. Lastly, the potential adoption of perpetual contracts could add a new dimension to THORChain’s financial offerings, further enhancing its appeal and functionality.

According to forecasts and technical analysis, THORChain’s price is anticipated to start at a minimum of $8.51 in 2025. The peak price is projected to hit $10.02, averaging $8.80 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $7.71 | $8.00 | $9.22 |

| February | $7.78 | $8.07 | $9.29 |

| March | $7.86 | $8.15 | $9.37 |

| April | $7.93 | $8.22 | $9.44 |

| May | $8.00 | $8.29 | $9.51 |

| June | $8.07 | $8.36 | $9.58 |

| July | $8.15 | $8.44 | $9.66 |

| August | $8.22 | $8.51 | $9.73 |

| September | $8.29 | $8.58 | $9.80 |

| October | $8.36 | $8.65 | $9.87 |

| November | $8.44 | $8.73 | $9.95 |

| December | $8.51 | $8.80 | $10.02 |

RUNE Price Forecast for 2026

Projections for 2026 indicate that the minimum price of THORChain could be $12.22. The peak price is expected to be $14.90, with an average value of $12.66.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $11.02 | $11.46 | $13.70 |

| February | $11.13 | $11.57 | $13.81 |

| March | $11.24 | $11.68 | $13.92 |

| April | $11.35 | $11.79 | $14.03 |

| May | $11.46 | $11.90 | $14.14 |

| June | $11.57 | $12.01 | $14.25 |

| July | $11.67 | $12.11 | $14.35 |

| August | $11.78 | $12.22 | $14.46 |

| September | $11.89 | $12.33 | $14.57 |

| October | $12.00 | $12.44 | $14.68 |

| November | $12.11 | $12.55 | $14.79 |

| December | $12.22 | $12.66 | $14.90 |

THORChain (RUNE) Price Prediction 2027

For 2027, THORChain’s price is forecasted to have a floor price of $18.31 and may rise to a maximum of $21.15. The year’s average price is predicted to be $18.94.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $16.81 | $17.44 | $19.65 |

| February | $16.95 | $17.58 | $19.79 |

| March | $17.08 | $17.71 | $19.92 |

| April | $17.22 | $17.85 | $20.06 |

| May | $17.36 | $17.99 | $20.20 |

| June | $17.49 | $18.12 | $20.33 |

| July | $17.63 | $18.26 | $20.47 |

| August | $17.76 | $18.39 | $20.60 |

| September | $17.90 | $18.53 | $20.74 |

| October | $18.04 | $18.67 | $20.88 |

| November | $18.17 | $18.80 | $21.01 |

| December | $18.31 | $18.94 | $21.15 |

THORChain Price Prediction 2028

Forecasts for 2028 suggest THORChain could have a minimum price of $26.57 and may rise to a maximum of $31.09, with the average settling at $27.52.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $24.57 | $25.52 | $29.09 |

| February | $24.75 | $25.70 | $29.27 |

| March | $24.93 | $25.88 | $29.45 |

| April | $25.12 | $26.07 | $29.64 |

| May | $25.30 | $26.25 | $29.82 |

| June | $25.48 | $26.43 | $30.00 |

| July | $25.66 | $26.61 | $30.18 |

| August | $25.84 | $26.79 | $30.36 |

| September | $26.02 | $26.97 | $30.54 |

| October | $26.21 | $27.16 | $30.73 |

| November | $26.39 | $27.34 | $30.91 |

| December | $26.57 | $27.52 | $31.09 |

THORChain Price Prediction 2029

According to projections, the minimum price of THORChain in 2029 could be $39.27, with a potential high of $46.98 and an average price of $40.37.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $36.77 | $37.87 | $44.48 |

| February | $36.99 | $38.10 | $44.71 |

| March | $37.22 | $38.32 | $44.93 |

| April | $37.45 | $38.55 | $45.16 |

| May | $37.68 | $38.78 | $45.39 |

| June | $37.91 | $39.01 | $45.62 |

| July | $38.13 | $39.23 | $45.84 |

| August | $38.36 | $39.46 | $46.07 |

| September | $38.59 | $39.69 | $46.30 |

| October | $38.82 | $39.92 | $46.53 |

| November | $39.04 | $40.14 | $46.75 |

| December | $39.27 | $40.37 | $46.98 |

THORChain (RUNE) Price Prediction 2030

The anticipated minimum price of THORChain in 2030 is $57.80, potentially reaching up to $68.37, with an average price of $59.81 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $54.80 | $56.81 | $65.37 |

| February | $55.07 | $57.08 | $65.64 |

| March | $55.35 | $57.36 | $65.92 |

| April | $55.62 | $57.63 | $66.19 |

| May | $55.89 | $57.90 | $66.46 |

| June | $56.16 | $58.17 | $66.73 |

| July | $56.44 | $58.45 | $67.01 |

| August | $56.71 | $58.72 | $67.28 |

| September | $56.98 | $58.99 | $67.55 |

| October | $57.25 | $59.26 | $67.82 |

| November | $57.53 | $59.54 | $68.10 |

| December | $57.80 | $59.81 | $68.37 |

THORChain Price Forecast 2031

In 2031, THORChain is forecasted to have a minimum price of $81.42, possibly reaching up to $97.83, with an average of $84.41.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $77.92 | $80.91 | $94.33 |

| February | $78.24 | $81.23 | $94.65 |

| March | $78.56 | $81.55 | $94.97 |

| April | $78.87 | $81.86 | $95.28 |

| May | $79.19 | $82.18 | $95.60 |

| June | $79.51 | $82.50 | $95.92 |

| July | $79.83 | $82.82 | $96.24 |

| August | $80.15 | $83.14 | $96.56 |

| September | $80.47 | $83.46 | $96.88 |

| October | $80.78 | $83.77 | $97.19 |

| November | $81.10 | $84.09 | $97.51 |

| December | $81.42 | $84.41 | $97.83 |

THORChain (RUNE) Price Prediction 2032

By 2032, THORChain is expected to maintain a minimum price of $119.25 and could reach a maximum of $143.26, with an average trading price of $122.62.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $115.25 | $118.62 | $139.26 |

| February | $115.61 | $118.98 | $139.62 |

| March | $115.98 | $119.35 | $139.99 |

| April | $116.34 | $119.71 | $140.35 |

| May | $116.70 | $120.07 | $140.71 |

| June | $117.07 | $120.44 | $141.08 |

| July | $117.43 | $120.80 | $141.44 |

| August | $117.80 | $121.17 | $141.81 |

| September | $118.16 | $121.53 | $142.17 |

| October | $118.52 | $121.89 | $142.53 |

| November | $118.89 | $122.26 | $142.90 |

| December | $119.25 | $122.62 | $143.26 |

THORChain Price Prediction 2033

In 2033, the price of THORChain is expected to start at a minimum of $166.48 and could rise to a maximum of $208.54, averaging $171.39 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $161.98 | $166.89 | $204.04 |

| February | $162.39 | $167.30 | $204.45 |

| March | $162.80 | $167.71 | $204.86 |

| April | $163.21 | $168.12 | $205.27 |

| May | $163.62 | $168.53 | $205.68 |

| June | $164.03 | $168.94 | $206.09 |

| July | $164.43 | $169.34 | $206.49 |

| August | $164.84 | $169.75 | $206.90 |

| September | $165.25 | $170.16 | $207.31 |

| October | $165.66 | $170.57 | $207.72 |

| November | $166.07 | $170.98 | $208.13 |

| December | $166.48 | $171.39 | $208.54 |

THORChain Price Forecast: By Experts

According to the current THORChain price prediction from Coincodex, THORChain’s price is expected to increase by 29.17% to reach $6.16 by August 22, 2024. Technical indicators suggest a Neutral current sentiment, while the Fear & Greed Index indicates a score of 71, classified as Greed.

Over the past 30 days, THORChain has experienced 60% green days with a price volatility of 10.17%. The forecast suggests it might be a favorable time to invest in THORChain. Historical data and BTC halving cycles inform a 2025 yearly low price prediction for THORChain at $4.61, with potential to escalate up to $15.61 the following year.

According to Digital Coin Price, by 2026, market analysts and experts anticipate that RUNE will open the year at $13.41 and hover around $16.26. This represents a significant increase compared to the previous year, marking a notable advance for THORChain.

The forecast for 2030, based on THORChain price predictions and technical analysis, suggests that the cost of THORChain will start at $33.31 and maintain this level by year’s end. Additionally, the price of RUNE could peak at $30.71. The period from 2024 to 2030 is projected to be a time of substantial growth for THORChain.

Is THORChain a Good Investment? When To Buy?

It is difficult to determine the future trajectory of RUNE. While there was a rally in late 2023, the year-on-year gains still fell short of market performance.

Conversely, the introduction of Streaming Swaps indicates that the platform continues to innovate, making it more appealing for users.

As with any crypto investment, it is crucial to conduct thorough research before deciding to invest in RUNE.

The global blockchain market is expected to surge to approximately $469.49 billion by 2030. This expansion, with a Compound Annual Growth Rate (CAGR) of nearly 60%, offers a promising outlook for blockchain initiatives such as THORChain.

Strategic Developments in THORChain:

- Memoless Transactions: THORChain is introducing a feature that allows for memo-free transactions, enhancing simplicity and user convenience. This functionality enables users to perform transactions by matching the last digits of the transaction amount with a reference number.

- Order Books Integration: THORChain is set to adopt a unique order book model that relies on synthetic assets, functioning alongside THORChain’s Automated Market Maker (AMM). This approach will facilitate more efficient and automated trading executions.

- Developer-Friendly UX: The Core Team is dedicated to make THORChain integration more straightforward for wallets and decentralized exchanges (DEXs), thereby increasing its attractiveness to developers.

Considering the above developments, an investment at around $4 might be a profitable investment in the long run.

Conclusion

RUNE’s trajectory since its launch, including an initial surge, a peak in May 2021, followed by a market downturn and a subsequent rebound, underscores its vulnerability to broader market trends and specific internal developments.

The integration with BNB Smart Chain and the potential inclusion of other blockchains such as Terra, along with features like overcollateralized lending and perpetual contracts, suggest a promising future for RUNE.

Analysts provide a range of forecasts on RUNE’s future price, reflecting the dynamic and often unpredictable nature of the cryptocurrency market.

While some forecasts are bullish, driven by technological advancements and overall market expansion, others adopt a cautiously optimistic stance, emphasizing the importance of a balanced and diversified investment strategy.

Given this context, investors are advised to diversify their holdings to mitigate risk, although identifying high-potential projects in a crowded market of over 10,000 active cryptocurrencies presents its own set of challenges.

Frequently Asked Questions

What is THORChain?

THORChain is a decentralized finance (DeFi) project that provides cross-chain liquidity and asset exchange without the need for wrapping. It supports trading across different networks through a single protocol, facilitating seamless interoperability.

How does THORChain work?

THORChain uses a continuous liquidity pool (CLP) model where RUNE acts as an intermediary for every trade. This process allows users to swap cryptocurrencies across chains without handling RUNE directly.

What are the price predictions for RUNE in the coming years?

2024: Minimum $5.63, Maximum $6.35 2025: Minimum $8.51, Maximum $10.02 2026: Minimum $12.22, Maximum $14.90 2027: Minimum $18.31, Maximum $21.15 2028: Minimum $26.57, Maximum $31.09 2029: Minimum $39.27, Maximum $46.98 2030: Minimum $57.80, Maximum $68.37 2031: Minimum $81.42, Maximum $97.83 2032: Minimum $119.25, Maximum $143.26 2033: Minimum $166.48, Maximum $208.54

How can investors get involved in THORChain?

Investors can participate by trading RUNE on supported exchanges, providing liquidity to THORChain pools, or staking RUNE for governance and rewards.

What roles exist within the THORChain ecosystem?

There are four main roles: Liquidity Providers (LPs) who supply assets, Swappers who trade cryptocurrencies, Traders who balance liquidity pools, and Node Operators who support network security and participate in the proof-of-stake consensus.