As we reach the mid-point of September, the cryptocurrency market is at a crossroads. Bitcoin and Ethereum’s frustrating range-bound behavior has traders scratching their heads while their address activities are surging. Meanwhile, the big whales are conspicuously absent, biding their time on the sidelines. With crucial on-chain data, we’ll dive into the sentiment of the current crypto market, the impact of the latest Consumer Price Index (CPI) report, and what we can expect in the coming weeks.

Bitcoin’s Continuous Rejection Frustrates Traders

The month kicked off on a shaky note. Following a Grayscale victory over the SEC that momentarily sent Bitcoin to around $28K on August 29th, the market took a nosedive. Just when traders thought they were in for a bullish September, Bitcoin price plummeted back down to $25K on the very first day of the month. This set the tone for what has been a series of short-lived rallies and isolated altcoin pumps, leaving the market largely unchanged at the end of the day.

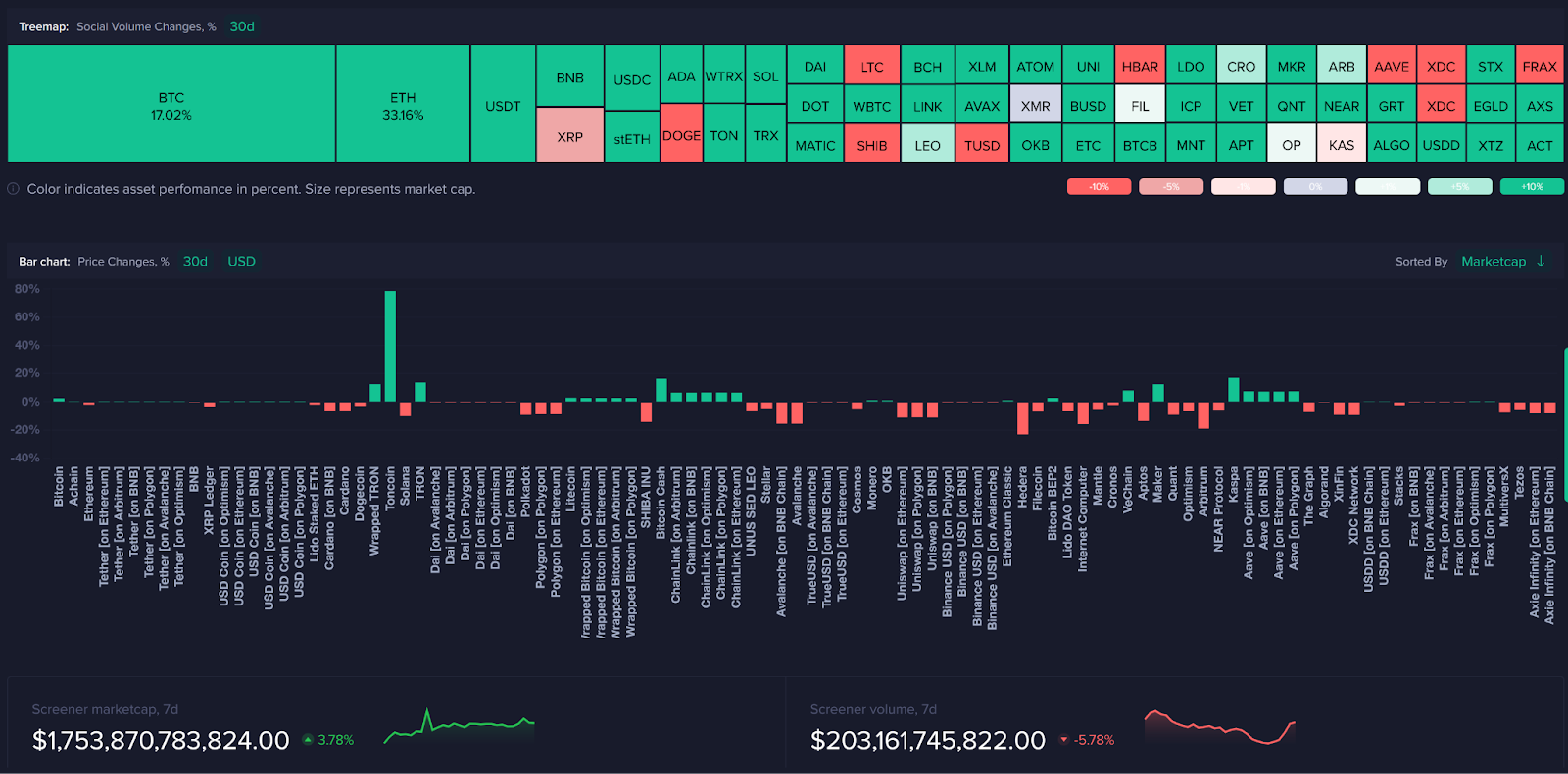

Since last Tuesday’s downturn, the crypto market has seen a modest rebound, though not enough to turn heads. Bitcoin Cash has been riding a wave of buying activity following expectations of being a key asset in upcoming ETF offerings. Meanwhile, Toncoin has stolen the spotlight, surging over 100%—more than doubling its value—since the start of August.

However, the recent CPI release is creating an opportunity for sellers to open short positions. In August, inflation picked up pace for the second consecutive month, fueled by a surge in gasoline prices. Additionally, a key indicator of household expenditures exceeded expectations, signaling that the Federal Reserve’s efforts to curb rising consumer prices may still have a long way to go.

As consumer prices have climbed 3.7% year-over-year, an increase from July’s 3.2%, coupled with the Federal Reserve’s bearish outlook for the upcoming FOMC meeting, there’s a strong likelihood of short-term downward volatility affecting Bitcoin and Ethereum price.

Whales Ditch Bitcoin And Ethereum

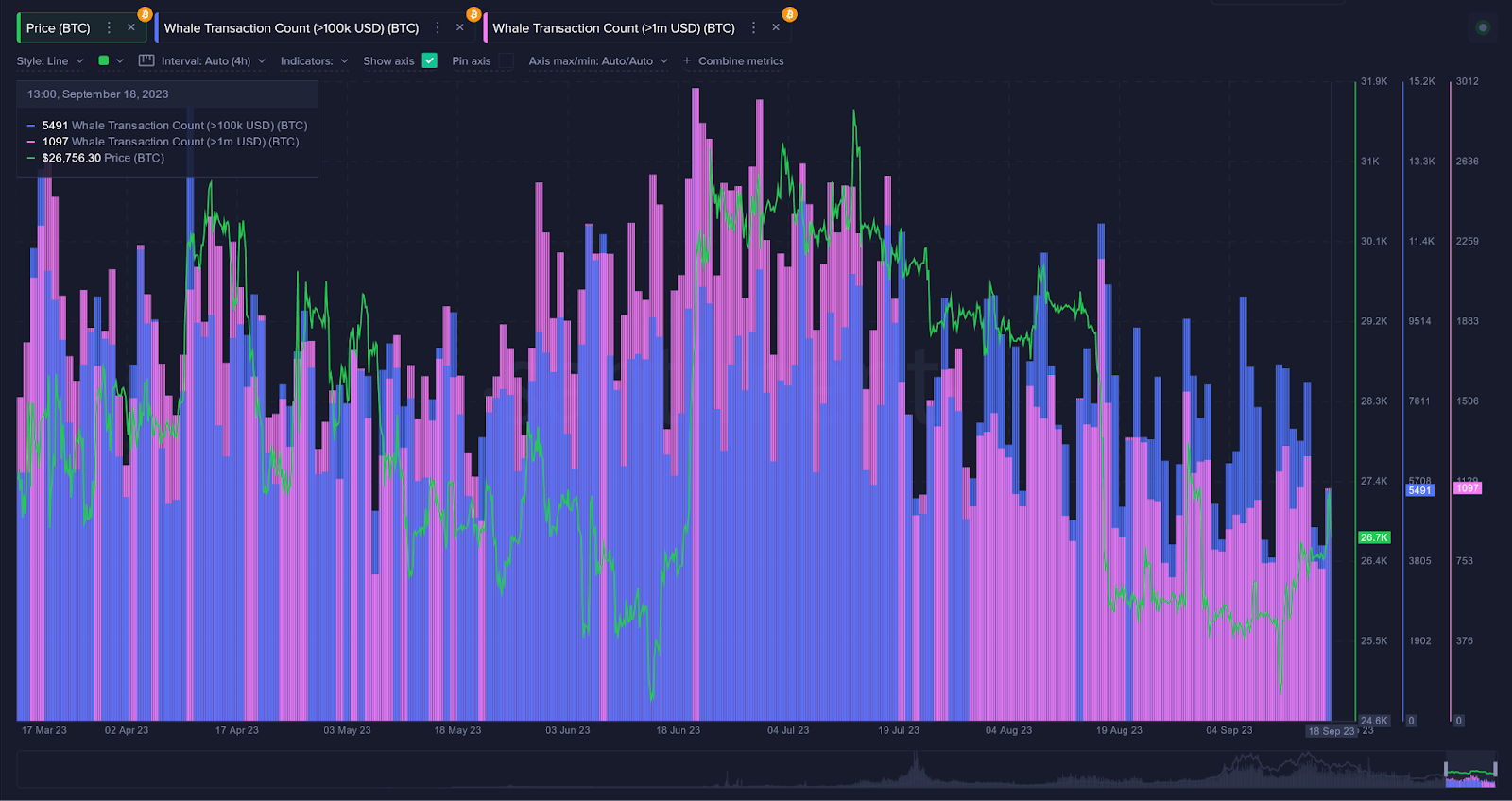

Whales have been known to either fuel rallies or trigger sell-offs. However, recent data suggests that whales are increasingly distancing themselves from Bitcoin and Ethereum. Data suggests a steep decline in transactions over $100K and $1 million in Bitcoin and Ethereum, hinting at a bearish sentiment among whale traders recently.

As both Bitcoin and Ethereum have been stuck in a trading range, they have been unable to break through key resistance levels. This range-bound behavior is particularly frustrating for traders and investors who thrive on volatility and price swings. The lack of whale movement has led to diminished trading volumes and a general sense of market apathy.

Nonetheless, there’s bullish news for both Bitcoin and Ethereum, as recent data shows a notable increase in social volume for both cryptocurrencies over the past thirty days. Specifically, Bitcoin’s social volume has seen a 17% uptick, while Ethereum’s has skyrocketed by 33% within a month. This growing chatter within the community points to a bullish sentiment, potentially laying the groundwork for an imminent price surge.

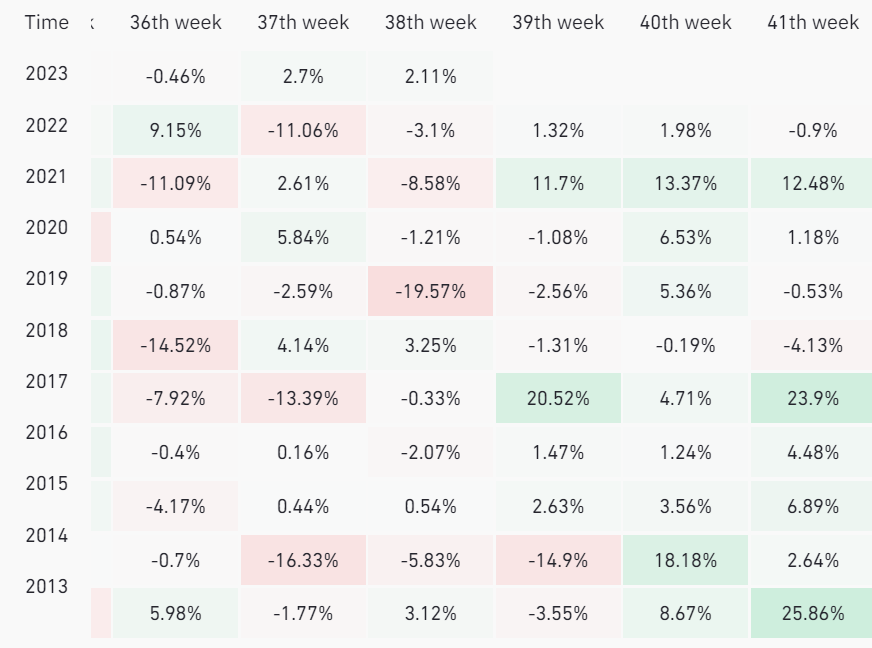

Traditionally, the crypto market kicks off September on a downbeat note, often experiencing a 1-2% decline in the first week. However, data from Coinglass suggests that the weeks following this initial dip tend to be bullish, with Bitcoin usually rebounding by month’s end and lifting the market upward.

Given the current market conditions, which include Bitcoin facing selling pressure around the $27,500 mark and Ethereum experiencing slight downward volatility, this period could present a prime accumulation opportunity. This is especially relevant as we approach the SEC’s upcoming decision on ETF approvals set for October 17th. Should the SEC take a favorable stance on the ETF applications, we could witness Bitcoin prices soaring to between $30K and $35K in a matter of hours.