Introduction

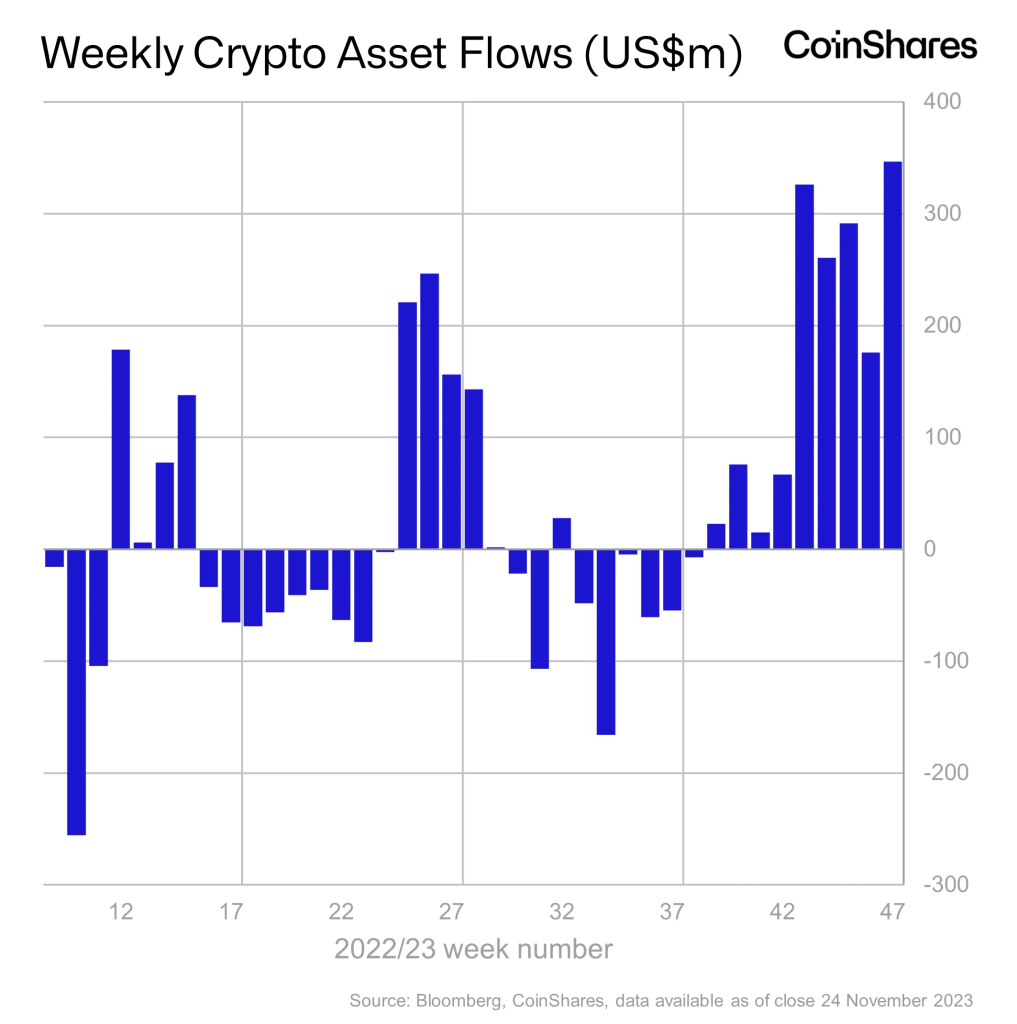

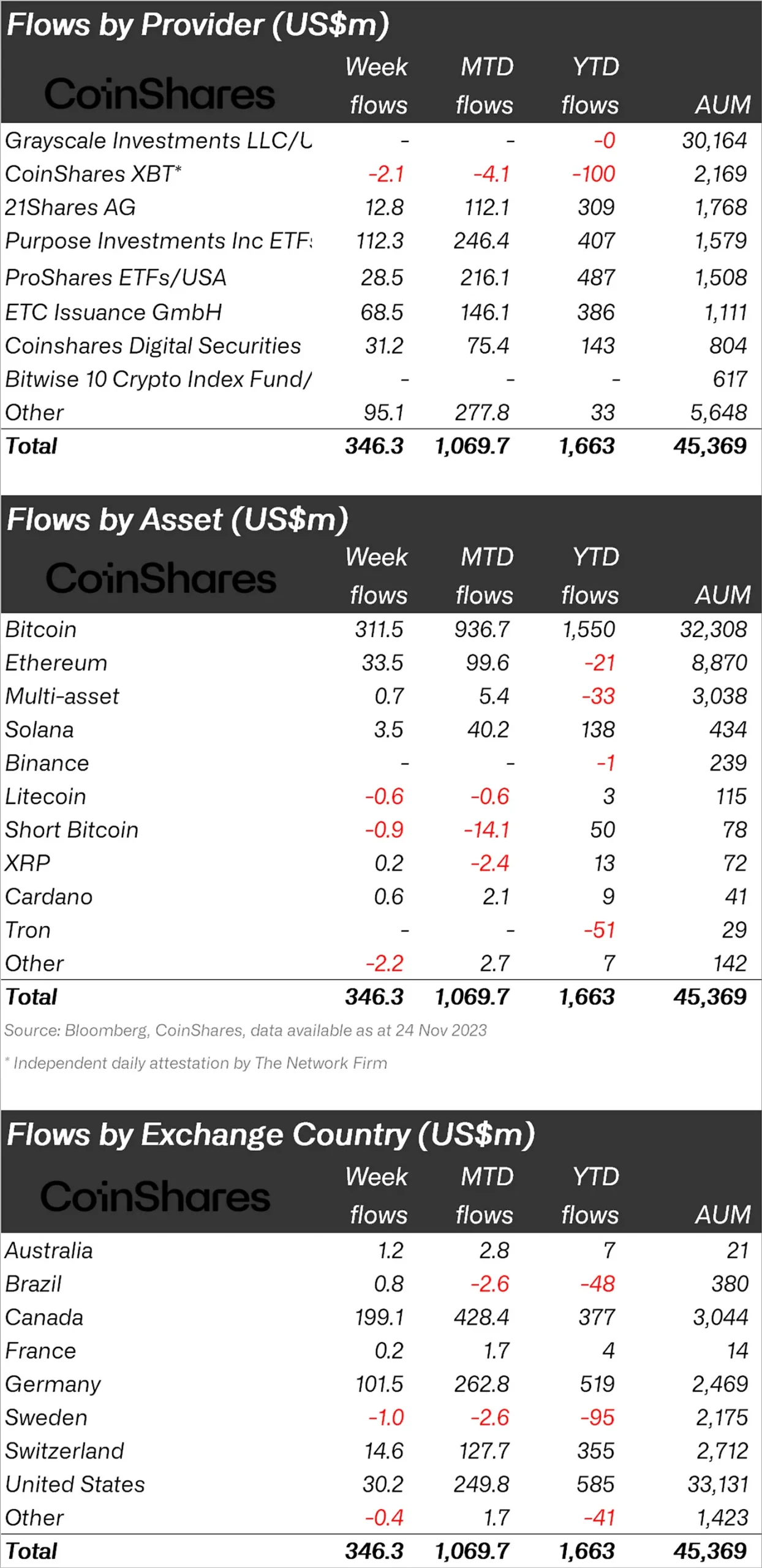

The digital asset sector is currently experiencing an unprecedented surge in capital inflow, reminiscent of the bullish trends observed in late 2021. This remarkable phase is marked by a cumulative inflow of $346 million into various digital asset investment products over the past week. This amount represents the pinnacle of a nine-week continuous influx, reflecting a robust and sustained interest in the digital asset market.

Bitcoin Dominates with Impressive Inflows

Bitcoin, the flagship cryptocurrency, has witnessed a remarkable investment influx, amounting to $312 million in the past week. This surge elevates the total year-to-date inflows into Bitcoin to an impressive $1.5 billion. Interestingly, the market is also observing a decline in short-selling activities, with short-sellers retracting their positions, further bolstering the cryptocurrency’s market strength.

Ethereum’s Inflow Milestone

Ethereum, another major player in the digital asset sphere, reported inflows of $34 million last week. This development marks a significant turnaround, totaling $103 million over four weeks, almost neutralizing the previous outflows experienced earlier this year. This shift indicates a changing sentiment among investors towards Ethereum.

The Rise in Total Assets Under Management

These inflows, driven by the anticipation of a new spot-based ETF in the United States, have escalated the total Assets under Management (AuM) to $45.3 billion. This figure is the highest recorded in the last one and a half years, underscoring the escalating investor confidence and market recovery.

Regional Investment Patterns

Geographically, Canada and Germany are leading the charge, contributing 87% of the total inflows. In contrast, the United States, presumably awaiting the ETF launch, recorded a relatively modest inflow of $30 million last week.

Other Cryptocurrencies Gaining Momentum

Beyond Bitcoin and Ethereum, other digital assets like Solana, Polkadot, and Chainlink are also gaining traction, with inflows of $3.5 million, $0.8 million, and $0.6 million, respectively. These figures suggest a diversifying interest and investment landscape within the digital asset market.

Conclusion

The digital asset investment sector is currently witnessing a significant influx of capital, showcasing a renewed investor interest and confidence. This trend, bolstered by the anticipation of new ETF launches and a shift in market sentiment, is shaping a promising outlook for the future of digital assets.