Bitcoin’s price continues to hold its upward trajectory, hovering around the $52,000 mark, triggered by investors’ bullish hopes sparked by positive ETF-related on-chain data. However, the growing appetite for *BTC* purchases signals caution, suggesting an impending downturn might be on the horizon, a sentiment echoed by several on-chain indicators pointing towards an overheated market atmosphere. Furthermore, stablecoin holders with portfolio sizes between $10,000 and $100,000 are increasingly seen as unexpected predictors of Bitcoin’s upcoming price fluctuations.

Market Goes In A Profit-Taking Mood

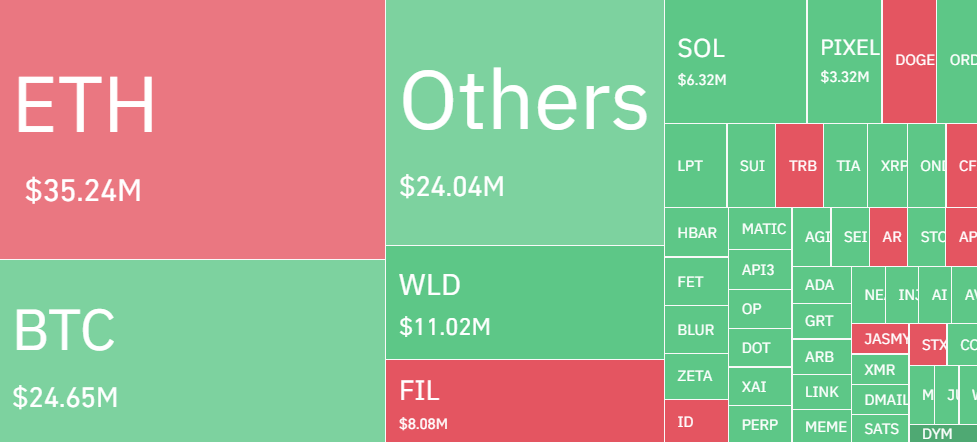

Over the last 24 hours, the crypto market witnessed a surge in liquidations, with the total amount surpassing $152 million worth of positions. Notably, BTC price saw a liquidation of nearly $25 million, out of which, long-position holders liquidated around $20 million, suggesting a profit-booking sentiment among holders near the market top of $52K.

Small to mid-tier stablecoin holders, wielding portfolios ranging from $10,000 to $100,000, have influenced Bitcoin’s price swings. Over the past two weeks, these traders have collectively increased their holdings in *USDT* by $44.3 million, while simultaneously reducing their stakes in *USDC* by $20.6 million. This move in stablecoin could be influencing Bitcoin’s buy and sell points.

The recent trend shows these traders engaging in a strategic exchange between stablecoins and Bitcoin, suggesting an approach to capitalizing on market volatility. An increase in stablecoin holdings implies that these traders are taking profits from Bitcoin’s rallies, moving their gains into stablecoins as a hedge against potential market downturns. This action often brings market tops, where traders anticipate a short-term decline in Bitcoin prices.

Conversely, a decrease in stablecoin holdings among this group points to a growing confidence in Bitcoin’s short-term appreciation. By converting stablecoins into Bitcoin, traders are effectively buying the dip, positioning themselves to benefit from anticipated price increases. This behavior reflects a bullish sentiment on Bitcoin, suggesting that these traders see potential for gains in the near term.

Traditionally, market watchers have focused on the actions of large-scale investors, or “whales,” to predict price movements. However, the collective behavior of smaller traders is proving to be an equally potent predictor of market trends

However, the current sentiment for Bitcoin remains bullish as CoinShares’ recent report highlights a record $2.45 billion inflow into crypto funds from major asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares last week, predominantly driven by new U.S. Bitcoin ETFs.

Year-to-date, digital asset investments have reached $5.2 billion, pushing the assets under management to a peak of $67 billion, the highest since the 2021 bull market peak, according to James Butterfill, Head of Research at CoinShares.

Bitcoin Needs A Retest To Stabilize Sentiment

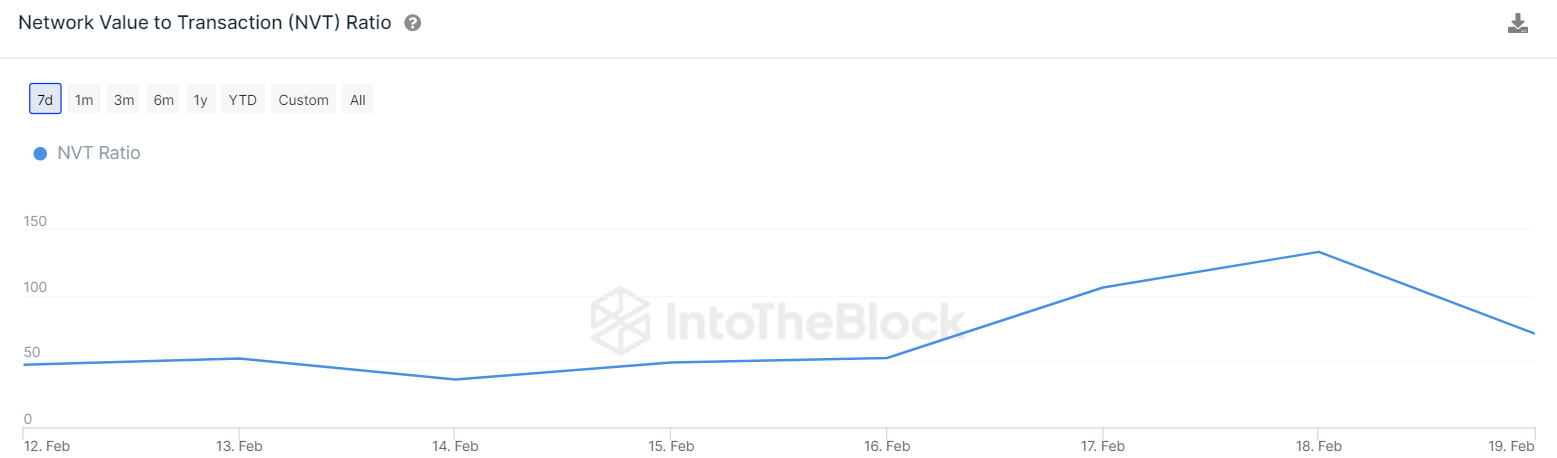

Several on-chain indicators are currently pointing towards an overheated sentiment around the BTC price, hinting at the possibility of a price adjustment. A key metric among these, the NVT ratio (Network Value to Transactions), has seen a significant rise, now at 71.09. This suggests that despite the increase in Bitcoin’s network value alongside its price, the transaction volume hasn’t risen much, signaling a potential overvaluation of the asset.

Additionally, the Netflow metric has seen a notable uptick, shifting into positive territory. This signifies that Bitcoin inflows are surpassing outflows, resulting in a growth of exchange reserves. This trend could signal an upcoming price correction for BTC. Nonetheless, these corrections could potentially trigger buying momentum near the dip.

For a downward trend to be firmly established, sellers must drive the price beneath the 20-day exponential moving average, currently at $51,909, which could initiate a slide towards the $50K mark. Conversely, for buyers to aim for a rise to $55,000, overcoming the resistance at $52,800 is essential.

Meanwhile, to reverse the current upward trend, bears need to force the price below the moving averages, setting the stage for a potential decline to the breakout level of $48,400. Although bulls are expected to defend this level, if overcome, the price might fall to $47,000, with a further drop to $44,900 being a possibility.