- 1. Terra Luna (LUNA 2.0): A Quick Introduction

- 2. LUNA 2.0: Infrastructure

- 3. LUNA Price Prediction: Price History

- 4. LUNA Price Prediction: Technical Analysis

- 5. Terra Luna Price Prediction By Blockchain Reporter

- 5.1. Terra Price Prediction 2023

- 5.2. Terra Price Prediction 2024

- 5.3. LUNA Price Forecast for 2025

- 5.4. Terra (LUNA) Price Prediction 2026

- 5.5. Terra Price Prediction 2027

- 5.6. Terra Price Prediction 2028

- 5.7. Terra (LUNA) Price Prediction 2029

- 5.8. Terra Price Forecast 2030

- 5.9. Terra (LUNA) Price Prediction 2031

- 5.10. Terra Price Prediction 2032

- 6. Terra Luna Price Target: By Experts

- 7. Should You Invest In Terra Luna?

- 8. Conclusion

- 8.0.1. What is Terra (LUNA) and its background?

- 8.0.2. What happened to Terra's founder, Do Kwon?

- 8.0.3. What is the current status of Terra (LUNA 2.0)?

- 8.0.4. What are the key features of LUNA 2.0's infrastructure?

- 8.0.5. What are the recent legal developments involving Terra and the SEC?

- 8.0.6. How has LUNA's price performed historically?

- 8.0.7. What are the predictions for LUNA's price in the future?

- 8.0.8. Should investors consider investing in Terra Luna (LUNA 2.0)?

- 8.0.9. What factors could influence LUNA's future success?

- 8.0.10. How can one manage token delegation in LUNA 2.0?

The aspiration that the new Terra LUNA would regain the billion-dollar market cap and reclaim its position among the top 10 cryptocurrencies, as its predecessor had achieved, was dashed following a hacking incident in August 2023. This setback occurred shortly after LUNA reached its lowest value ever on August 17. The Terra (LUNA) cryptocurrency emerged in mid-2022 as a reformation following the original Terra’s collapse in May of the previous year. Initially, Terra was designed to support the TerraUSD (UST) stablecoin. However, the destabilization of UST in May 2022 sent shockwaves through the crypto market, from which it has yet to fully recover. After the collapse, the original Terra blockchain was renamed Terra Classic (LUNC), while the new iteration adopted the LUNA moniker. By August 23, access to the blockchain’s official website was disrupted.

These developments followed the arrest of Terra’s founder, Do Kwon, in March of the same year. Kwon, now facing legal challenges, has been indicted on eight counts by U.S. authorities and detained in Montenegro for allegedly falsifying official documents. Amid all these, we’ll explore Luna price prediction with in-depth technical analysis and its future market performance to guide with a profitable investment option.

Terra Luna (LUNA 2.0): A Quick Introduction

Established in 2018 by Daniel Shin and Do Kwon, Terra’s primary objective was to accelerate the adoption of blockchain and cryptocurrencies, emphasizing user-friendliness and price stability. Do Kwon, serving as the CEO of Terraform Labs, the organization responsible for Terra, has a diverse background in the tech industry. Before his role at Terraform Labs, he founded Anyfi, a decentralized wireless mesh networking startup. Kwon also has experience as a software engineer at prominent companies like Apple (AAPL) and Microsoft (MSFT).

Following Terra’s downfall, numerous investors have initiated legal actions against Kwon and various Terra-related entities, accusing them of providing misleading information to investors. On June 12, Kwon refuted allegations that he had withdrawn $2.7 billion in the months preceding Terra’s collapse.

Terra 2.0 represents the latest iteration of the Terra (LUNA) blockchain, conceptualized by Do Kwon as part of a revival strategy. This strategy involves creating a fork of the original Terra blockchain and implementing an airdrop aimed at compensating cryptocurrency investors affected by the recent market downturn. The primary objective of Terra 2.0 is to rebuild confidence in the stablecoin by launching a renewed version within the Terra ecosystem.

Under the policies of Terra 2.0, certain conditions are set for issuing additional LUNA tokens to investors. Specifically, this applies to those who held more than 10,000 LUNA tokens prior to the significant devaluation of the stablecoin. This measure is intended to prevent immediate sell-offs of Terra 2.0. A significant portion, about 300%, of these investors’ LUNA holdings will be made available immediately, while the remaining 70% will be distributed over a two-year period.

LUNA 2.0: Infrastructure

The Terra 2.0 cryptocurrency blockchain operates using a standard proof-of-stake (PoS) consensus mechanism. At any given time, there are 130 validators participating in the network consensus, with their voting power being proportional to the amount of LUNA 2.0 staked on each node. Rewards are generated through gas fees and an annual fixed inflation rate of 7% for LUNA 2.0.

LUNA 2.0 token holders contribute to the consensus process by delegating their tokens to a validator of their choice. Validators often stake their own tokens as well, acting as delegates. In this system, the validation node retains a portion of the rewards as a commission before distributing the remaining rewards to the delegators.

The rewards earned by delegators of Terra 2.0 tokens vary depending on the voting power of their chosen validators. Validators with greater voting power tend to earn more rewards, but these rewards are then distributed among a larger group of delegators.

Token delegation can be managed through the Terra Station interface. However, this process carries inherent risks. Validators may face penalties for misconduct, which can lead to a reduction (slashing) of the staked LUNA 2.0 tokens. This slashing can occur even in cases where validators unintentionally go offline for a short period.

SEC Vs Do Kwon

On November 2, 2023, the U.S. Securities and Exchange Commission (SEC) made a significant move in the ongoing legal proceedings against Terra, filing a motion for summary judgment. The SEC asserts that it possesses irrefutable evidence of the alleged violations committed by Do Kwon, the former CEO of Terraform Labs, and the company itself.

In its legal submission, the SEC accuses Terraform Labs and Kwon of engineering a deceptive scheme that resulted in a staggering $45 billion loss in market value, causing severe financial damage to investors in the United States.

The defense attorney’s motion contends that despite a comprehensive two-year investigation, which included extensive discovery, the SEC has failed to show any wrongdoing by Kwon and the other defendants. According to the defense, the evidence brought forward by the SEC remains unchanged and insufficient, even after a detailed examination.

However, the SEC’s legal team disputes this view, maintaining that Kwon and Terraform Labs engaged in deceptive practices regarding the usage and stability of these crypto asset securities.

The SEC maintains its stance that Terraform Labs and Kwon were involved in selling unregistered securities and conducting unregistered, fraudulent transactions on the blockchain as part of a scheme to defraud. The prosecutors further argue that the defendants converted a substantial amount of their cryptocurrency holdings into fiat currency, effectively “cashing out” at the expense of others.

LUNA Price Prediction: Price History

The new LUNA tokens, also known as LUNA2 by some cryptocurrency exchanges, were distributed to qualifying wallet addresses via an airdrop on May 28, 2022.

On its debut day, May 28, the new LUNA coin opened at a price of $18.98 but experienced a sharp decline, closing the day at $4.94. The price temporarily rebounded to $11.97 on May 30, 2022, but then fell again, hitting a low of $1.96 on June 8. The situation worsened following the suspension of withdrawals on the Celsius (CEL) crypto lending platform, which signaled a bear market, and by June 18, LUNA dropped to a low of $1.66.

Although there was a slight recovery, with LUNA trading above $2 in early July and at the beginning of April, the coin faced continuous downward pressure. On August 29, 2022, it hit an all-time low of $1.53. However, some recovery was seen, and by September 10, the price climbed to $7.06, only to fall again. By November 5, it was trading at $2.70, slightly up from a low of $2.26 three days earlier. But the collapse of the FTX (FTT) exchange led to another downturn, with LUNA dropping to $1.44 on November 22, 2022.

The markets reacted tepidly when Kwon accused FTX founder Sam Bankman-Fried of contributing to UST’s downfall, and on December 16, LUNA declined to $1.17. It managed a modest recovery, ending the year at around $1.26.

In 2023, there seemed to be a turn for the better. A bull run in late January propelled LUNA to a high of $2.52 on January 21, but this was followed by a gradual decline. The fall was exacerbated by the collapse of Silvergate Bank and Kwon’s arrest, with the coin trading around $1.25 on March 28. It briefly surged to $1.50 on April 12 but fell back to $1.42 by April 14, 2023.

After reaching a low of $0.4 in November, LUNA’s price has recently recovered as the market recovery pushed LUNA’s price above immediate resistance levels.

LUNA Price Prediction: Technical Analysis

Recently, the LUNA coin price experienced intense bullish sentiment, which has triggered buyers near the immediate resistance levels. The price has been on a steady upward trajectory over the last few weeks due to the market’s ‘Uptober’ trend revival. After surging above the $0.55-mark, LUNA’s price sparked an intense buying momentum and surged exponentially. The price has been facing intense buying pressure recently, and it managed to break above multiple resistance levels following Bitcoin’s surge above $36K. A thorough technical analysis of the LUNA token price reveals mixed indicators, which may soon send the price either to new lows or highs.

According to Coinmarketcap, the LUNA price is currently trading at $0,639, reflecting a decrease of 5.7% in the last 24 hours. Our technical evaluation of LUNA price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at $0.9; however, bulls are trying to prevent the price from dropping below the support level of $0.65. Examining the daily price chart, LUNA coin price has found support near the $0.6521 level, from which the price gained bullish momentum and was attempting to break above multiple Fib channels. As LUNA price continues to trade below the EMA200, sellers are gaining confidence to open further short positions and send the price to test its upcoming support. The Balance of Power (BoP) indicator is currently trading in a positive region zone at 0.35 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of a LUNA coin, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a surge as the LUNA price failed to hold sellers’ demand near $0.55. The trend line is currently hovering above the midline as it trades at level 55, hinting that further upward correction is on the horizon. It is anticipated that the LUNA price will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $1. If bears fail to plunge below the current 0.038 Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its swing by trading at 60, it trades slightly above the RSI line, potentially holding promises about the coin’s upward movement on the price chart. If LUNA’s price makes a bullish reversal, it can pave the way to resistance at $0.9. A breakout above will drive the coin’s price toward the upper limit of the Bollinger band at $1.3.

Conversely, if LUNA fails to hold above the critical support region of $0.65, a sudden collapse may occur, resulting in further price declines and causing the coin’s price to trade near the Bollinger Band’s lower limit of $0.51. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $0.44.

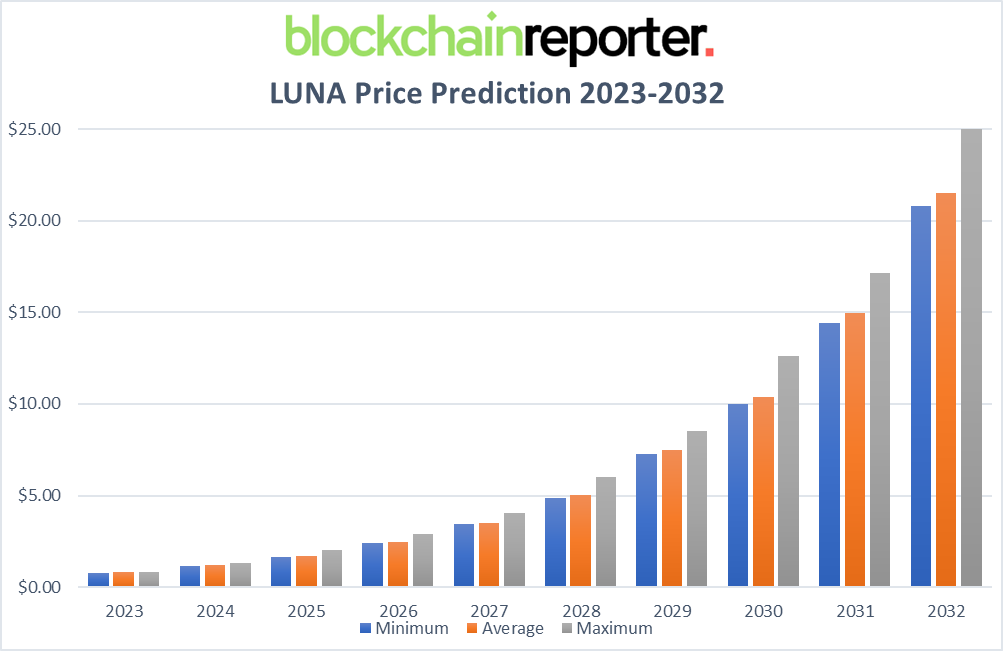

Terra Luna Price Prediction By Blockchain Reporter

Terra Price Prediction 2023

According to our deep technical analysis of past price data of LUNA, In 2023, the price of Terra is predicted to reach a minimum level of $0.77. The LUNA price can reach a maximum level of $0.84 with an average trading price of $0.80.

Terra Price Prediction 2024

According to our deep technical analysis of past price data of LUNA, In 2024, the price of Terra is forecasted to be at around a minimum value of $1.16. The Terra price value can reach a maximum of $1.32, with an average trading value of $1.19.

LUNA Price Forecast for 2025

The price of Terra is predicted to reach a minimum level of $1.64 in 2025. The Terra price can reach a maximum level of $2.03, with an average price of $1.70 throughout 2025.

Terra (LUNA) Price Prediction 2026

Terra’s price is forecasted to reach the lowest possible level of $2.39 in 2026. As per our findings, the LUNA price could reach the maximum possible level of $2.89 with an average forecast price of $2.47.

Terra Price Prediction 2027

The price of Terra is predicted to reach a minimum value of $3.43 in 2027. The Terra price could reach a maximum value of $4.06, with an average trading price of $3.52 throughout 2027.

Terra Price Prediction 2028

As per the forecast price and technical analysis, In 2028, the price of Terra is predicted to reach a minimum level of $4.88. The LUNA price can reach a maximum level of $6.00 with an average trading price of $5.02.

Terra (LUNA) Price Prediction 2029

As per the forecast and technical analysis, in 2029, the price of Terra is expected to reach a minimum price value of $7.26. The LUNA price can reach a maximum price value of $8.52 with an average value of $7.51.

Terra Price Forecast 2030

The price of 1 Terra is expected to reach a minimum level of $10.02 in 2030. The LUNA price can reach a maximum level of $12.60 with an average price of $10.40. Top of Form

Terra (LUNA) Price Prediction 2031

Terra’s price is predicted to reach the lowest possible level of $14.44 in 2031. As per our findings, the LUNA price could reach a maximum level of $17.15 with an average forecast price of $14.96.

Terra Price Prediction 2032

The price of Terra is predicted to reach a minimum price of $20.78 in 2032. The Terra price could reach a maximum target of $25.00, with an average trading price of $21.53 throughout 2032.

Terra Luna Price Target: By Experts

Coincodex’s current Terra price prediction indicates a potential decline of 7.25%, bringing its value to $0.694195 by November 19, 2023. Neutral market sentiment is suggested by technical indicators, while the Fear & Greed Index displays 69, indicating Greed. Terra has experienced 60% green days (18 out of 30) with a 21.14% volatility rate in the past month. Their forecast suggests it is an opportune moment to purchase Terra.

Analyzing historical trends and BTC halving cycles, Terra’s lowest projected price for 2024 is around $0.651278. Additionally, Terra’s value is expected to peak at approximately $1.719010 in the following year.

Should You Invest In Terra Luna?

Before its ecosystem collapsed, LUNA was a rising star in the DeFi sector. By December 2021, Terra had surpassed BNB Smart Chain, positioning itself as the second-largest DeFi protocol with over $20 billion invested across its applications.

However, the downfall of the algorithmic stablecoin UST and its counterpart LUNA during the Terra ecosystem crash led to a significant price drop. This event eroded investor confidence in smart contracts and algorithm-based cryptocurrencies.

As for investing in LUNA 2.0, the decision rests with each investor. Individual goals and the balance between risk and return vary among investors, especially in projects like this. Therefore, thorough personal research is advised before investing in any digital assets.

Conclusion

Predicting the future of LUNA 2.0 with absolute certainty is challenging, especially after the collapse of its UST stablecoin. While LUNA previously hosted numerous popular DeFi projects, their current number is comparatively low. Terra’s achievement in surpassing the Binance Smart Chain (now BNB Chain) to become the second most used DeFi platform is significant.

Nevertheless, future outcomes cannot be reliably forecasted based solely on past events. The success of Terra LUNA 2.0 hinges on the performance of its new blockchain and the ability to rebuild investor confidence. Ethereum’s upcoming transition to Proof of Stake (PoS) might change the competitive landscape, considering Ethereum’s extensive recognition in the sector.

What is Terra (LUNA) and its background?

Terra (LUNA) emerged in mid-2022 following the collapse of the original Terra blockchain, which was designed to support TerraUSD (UST). The new version, LUNA 2.0, aims to rebuild confidence in the Terra ecosystem.

What happened to Terra’s founder, Do Kwon?

Do Kwon, Terra’s founder, faces legal challenges including an indictment on eight counts by U.S. authorities and detention in Montenegro for allegedly falsifying official documents.

What is the current status of Terra (LUNA 2.0)?

Terra 2.0, launched as a revival strategy, operates on a proof-of-stake consensus mechanism. It aims to compensate investors affected by the market downturn and stabilize the Terra ecosystem.

What are the key features of LUNA 2.0’s infrastructure?

LUNA 2.0 uses a standard proof-of-stake mechanism with 130 validators. Token holders can delegate their tokens to validators, influencing the consensus process and earning rewards.

What are the recent legal developments involving Terra and the SEC?

The U.S. Securities and Exchange Commission (SEC) filed a motion for summary judgment against Terraform Labs and Do Kwon, accusing them of deceptive practices and significant financial damage to investors.

How has LUNA’s price performed historically?

LUNA has experienced significant volatility since its launch, with fluctuations influenced by various market events and the broader crypto market trends.

What are the predictions for LUNA’s price in the future?

Various sources provide differing predictions for LUNA’s future price, ranging from cautious optimism to significant growth over the next decade.

Should investors consider investing in Terra Luna (LUNA 2.0)?

Investing in LUNA 2.0 depends on individual risk tolerance and investment goals. It’s crucial to conduct thorough research before investing in digital assets.

What factors could influence LUNA’s future success?

LUNA’s success hinges on the performance of its new blockchain, investor confidence rebuilding, and external factors such as Ethereum’s transition to Proof of Stake.

How can one manage token delegation in LUNA 2.0?

Token delegation can be managed through the Terra Station interface, but it carries risks, including potential penalties for validator misconduct.