TRON’s native cryptocurrency, $TRX, has experienced a notable reduction in its circulating supply over the past year, falling from 88.97 billion to 86.56 billion tokens, a decrease of 2.41 billion $TRX valued at approximately $381.2 million. This marks a deflation rate of -2.93% year-over-year as TRON continues its path toward a more deflationary asset structure.

According to Lookonchain, the decline in $TRX’s supply can be attributed to ongoing token burns and network-based deflationary mechanisms implemented to reduce circulating supply and bolster long-term value. As of October 10, 2024, the latest data shows a daily reduction of over 5.7 million $TRX, signaling consistent efforts to curb supply growth.

Market Response and Price Action

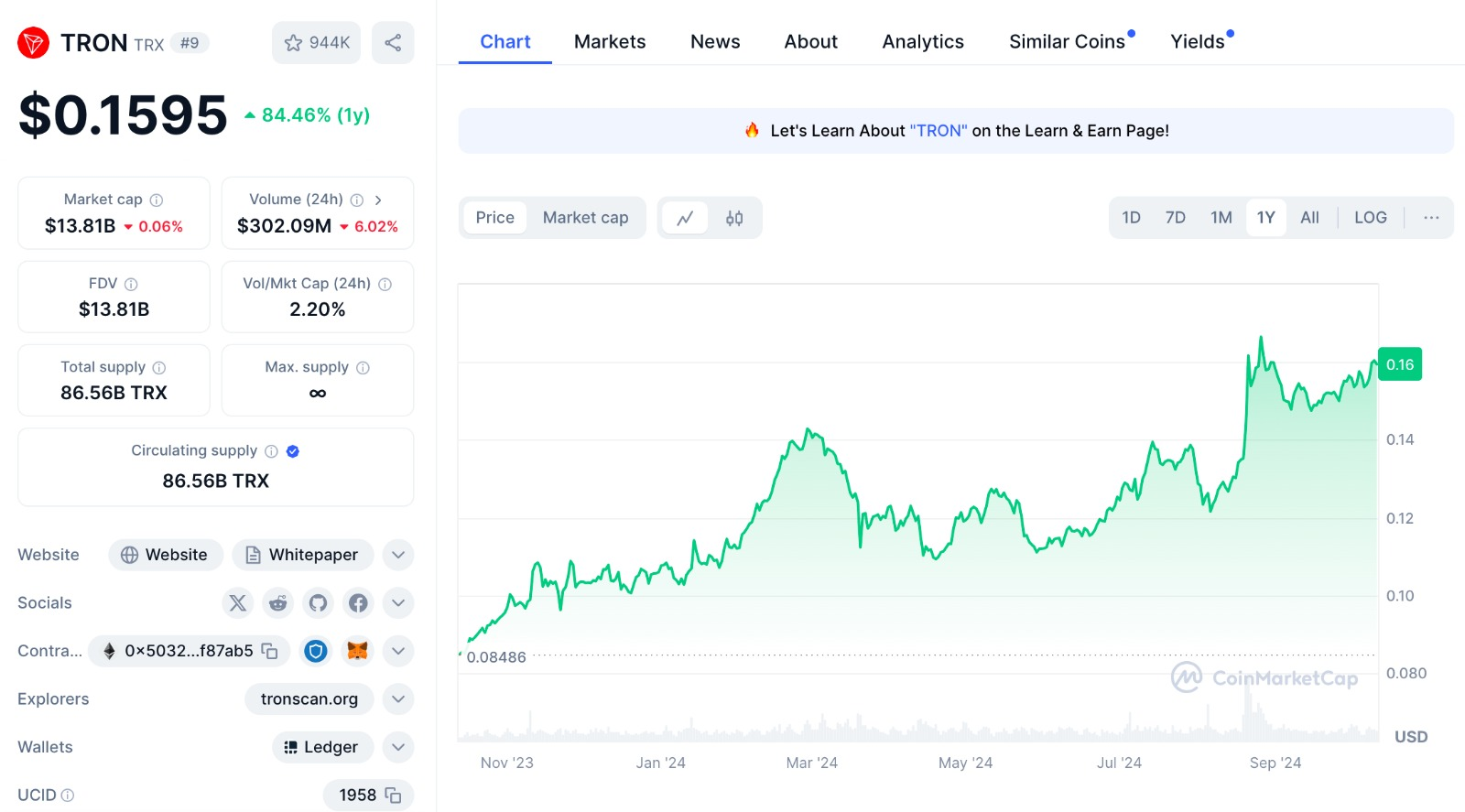

Amid the deflationary trend, $TRX has seen a substantial price increase. It traded at $0.1595 on October 10, 2024, reflecting an 84.46% rise over the past year. The positive price trajectory aligns with the decreasing supply, which typically enhances scarcity and potentially drives demand in the market. TRON’s market capitalization currently stands at $13.81 billion, despite a slight dip in 24-hour trading volume to $302.09 million.

The ongoing supply reduction will likely have significant implications for TRON’s ecosystem. By reducing the number of $TRX tokens in circulation, the network aims to create a deflationary environment that can support price stability and long-term investor confidence. For stakeholders, the sustained deflation could be a positive indicator of future growth potential as the token’s scarcity increases.