Blizz Finance, decentralized non-custodial liquidity protocol, announced integration of Chainlink Price Feeds for Avalanche mainnet

Blizz Finance is one of the greatest decentralized, non-custodial liquidity protocols available. The project is excited to announce integration of Chainlink Price Feeds as their go-to oracle solution on the Avalanche mainnet. Blizz Finance will benefit greatly from the inclusion of Chainlink’s industry-leading oracle network. To begin, to find out users’ borrowing rates and secondly, adjust their collateralization ratios on the Blizz protocol. Meanwhile, using global exact fair market prices.

Blizz Finance chose Chainlink Price Feeds for a number of reasons, one of which is that the project is the most time-tested market data solution in the whole blockchain sector. Which, given the sheer number of initiatives, is mind-boggling. Chainlink Price Feeds, in fact, have already helped secure $75 billion for major dApps throughout the multi-chain DeFi ecosystem.

Blizz Finance is one of the largest lending and borrowing markets on Avalanche with variable interest rates. The depositors constantly provide liquidity to the market to earn a passive income. Borrowers, on the other hand, might take out loans that are either overcollateralized or undercollateralized. Notably, the Blizz protocol’s objective is to have no governance and no VCs. Instead, the platform will have an income-generating token that will share 50% of platform revenue gained from borrowing straight to users that stake BLZZ. Keep in mind that the protocol will always be permissionless for everyone to use on the same basis.

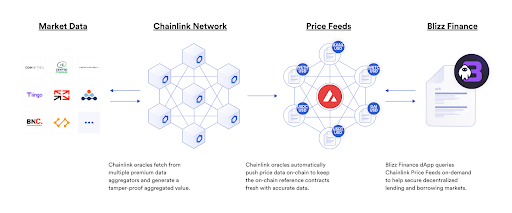

In order to help secure decentralized money markets, team needed access to fresh asset prices that are supplied directly on-chain in a highly reliable manner. Fair market asset prices should reflect a volume-weighted average from all trading environments. So, the project needed to make use of an oracle network to fetch aggregated price data off-chain and deliver it on-chain to be consumed by the application.

Choosing from many available oracle solutions, Blizz Protocol integrated Chainlink Price Feeds because they provide many attractive features such as:

- High-Quality Data — Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that’s aggregated from hundreds of exchanges, weighted by volume, and cleaned of outliers and wash trading. Chainlink’s data aggregation model generates more precise global market prices that are inherently resistant to inaccuracies or manipulation of any single or small set of exchanges.

- Secure Node Operators — Chainlink Price Feeds are secured by independent, security-reviewed, and Sybil-resistant oracle nodes run by leading blockchain DevOps teams, data providers, and traditional enterprises. Chainlink nodes have a strong track record of reliability, even during high gas prices and infrastructure outages.

- Decentralized Network — Chainlink Price Feeds are decentralized at the data source, oracle node, and oracle network levels, generating strong protections against downtime and tampering by either the data provider or oracle network.

- Reputation System — Chainlink provides a robust reputation framework and set of on-chain monitoring tools that allow users to independently verify the historical and real-time performance of node operators and oracle networks.

“At Blizz Finance we understand the critical importance of using a battle-tested oracle solution to help secure our decentralized money markets with high-quality price data. The integration of Chainlink Price Feeds enhances the security and reliability of the Blizz platform, ultimately contributing to more secure and robust lending markets on Avalanche,” informed the Blizz Finance team.

About Chainlink

Chainlink is the industry standard for building, accessing, and selling oracle services needed to power hybrid smart contracts on any blockchain. Chainlink oracle networks provide smart contracts with a way to reliably connect to any external API and leverage secure off-chain computations for enabling feature-rich applications. Chainlink currently secures tens of billions of dollars across DeFi, insurance, gaming, and other major industries, and offers global enterprises and leading data providers a universal gateway to all blockchains.

Learn more about Chainlink by visiting chain.link or read the documentation at docs.chain.link. To discuss an integration, reach out to an expert.

About Blizz Finance

Blizz Finance is a decentralized, non-custodial liquidity protocol operating on Avalanche. The core Blizz protocol is a lending market that functions near-identically to Aave. Users may borrow and lend different assets with variable interest rates.

If you wish to learn more about Blizz, you can read the following article where we give a more detailed description of how the protocol operates. You can also join the discussion on some of the links below.