Author: Slava Demchuk, co-founder of AMLBot

Storm clouds are gathering above the realm of stablecoins. Tether? Lost its dollar peg twice in 2022, after Terra’s collapse and in the middle of the FTX scandal. USDC? Panic provoked by the ban on Tornado Cash and a sell-off below 1$ during the SVB failure. Binance USD? No longer minted after the threat of legal action from US authorities. UST? Speak no ill of the dead.

And as if the market turbulence alone wasn’t enough, it seems that the regulators both in the US and UK are preparing to deliver the final blow. So is it the end of stablecoins as we know them today?

USDCongress in session

Recently, the US Congress discussed the draft of the «Stablecoin Bill» — legislation that, if passed, will heavily regulate the issuance and management of stablecoins. The media has already focused on a mandatory licensing process for every stablecoin issuer and a prohibition of «endogenous reserves» — that is, a ban on using other cryptos to back the price.

However, the document is much, much harsher. What happens when you buy 1$ worth of stablecoin? The issuer has to deposit at least 1$ worth of assets into a special account, so when you want to convert your stablecoin back, you are able to get actual dollars. What is Congress trying to do? Limit the spectrum of these assets to US currency and Treasury bills — in fact, stablecoins will effectively become uninsured bank accounts. The Bank of England was swift to follow suit, warning against the “rapid, disruptive change” that stablecoins have allegedly brought to the financial system.

The Tether mystery

Is regulation a bad thing overall? Maybe not, but definitely a devastating blow if you are someone like Tether. The issuer of the largest stablecoin by the number of transactions in 2021-2022 has a longstanding reputation for staying in the shade. For instance, the infamous lawsuit of the NY Attorney General showed that Tether’s claim of having 1-to-1 dollar reserves was misleading — simply put, Tether’s assets were much riskier than it marketed, and sometimes it didn’t even have enough reserves to cover all circulating USDT.

Has anything changed since 2021? Well, it seems that USDT is moving towards a more conservative and stable backing, slashing its commercial paper holdings to zero and boasting a 58% share of Treasury bills. Nevertheless, it’s hard to say for sure — Tether still refuses to disclose its reserve structure.

USDC: Is transparency the answer?

Tether’s competitor, however, is in a more favorable position: Circle, the issuer of USDC, is promoting complete transparency with regard to its stablecoin. It reports its financials on a regular basis, is audited by Deloitte, and its reserves are 77% US Treasuries. Two radically different approaches to reserves and stablecoins. A logical question — which one is better?

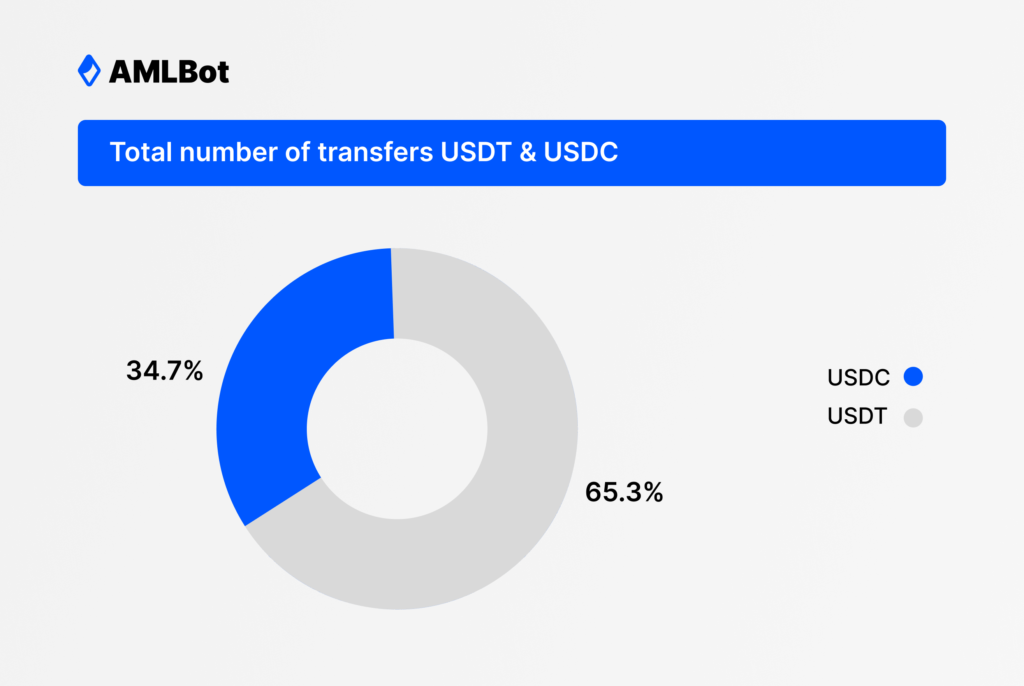

None. Or both, depending on your perspective. According to AMLBot’s calculations, USDT had much more transfers over 2021–2022 — 65.3% of combined transactions. However, looking at the volume of transactions provides a different picture: USDC dominates, claiming 61.4% of the total volume. Furthermore, as seen from the graphs, there is a clear trend volume-wise: for the whole of 2021, the total volume of transactions was the same, with USDT even slightly dominating in the first half of the year. However, the spread between the two stablecoins began to widen in February 2022, and by the end of the year, USDC gained a two-times lead, leaving Tether transaction volumes far behind.

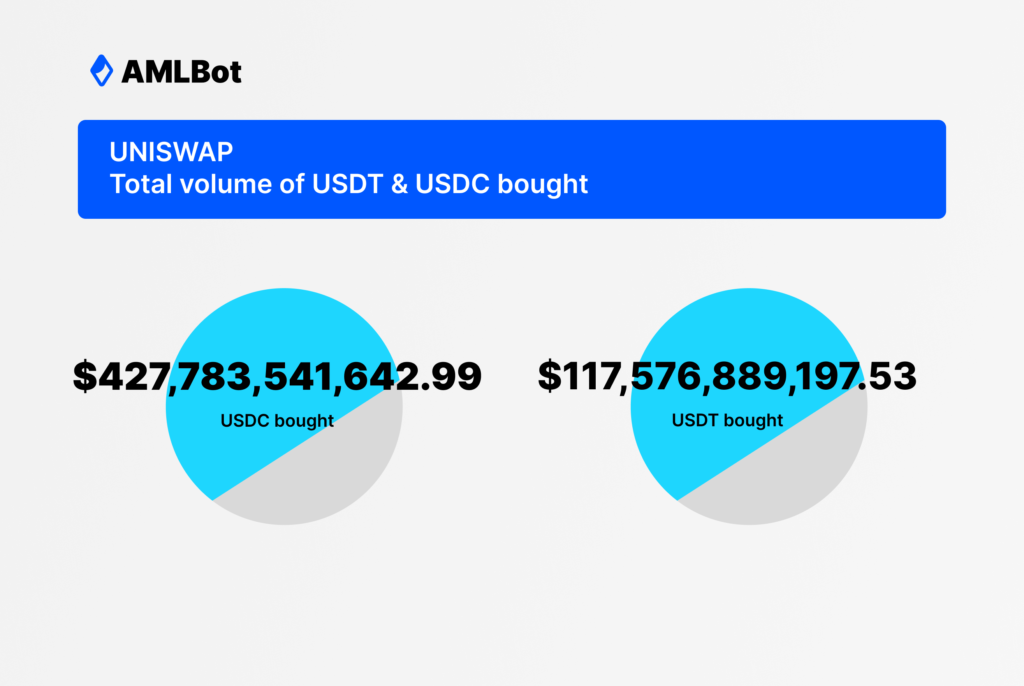

Surprisingly, a more detailed market analysis implies segmentation and different preferences. For instance, using AMLBot’s data for analysis of DeFi shows that platforms like SushiSwap and Curve are generally indifferent between USDT and USDC. Still, Uniswap is strongly inclined towards using Circle’s solution — its total volume bought is 366% of that for USDT. Although the reasons for this are uncertain, it is an optimistic sign — it proves the existence of niche markets with strong preferences and provides an opportunity for multiple different stablecoins to coexist.

Stablecoins, to be revised

So, what is the future of stablecoins? Gary Gorton, a Yale Professor and one of the advisors for the Congress bill, argues that any viable stablecoin must either be state-insured, absolutely opaque, or completely transparent. Governments would never allow the former to happen — fiat-backed stablecoins are perceived as direct rivals to future CBDCs. The latter option — Tether’s choice — is soon to be banned in the US (and likely other countries).

What is left is complete transparency, and USDC will not be a monopolist here by any means. We might expect a burst of creative structural solutions: backing by other than USD fiat currencies, commodity-related cryptocurrency — think gold stablecoins, and so forth. Or, on the contrary, stablecoin issuance will be completely institutionalized, with USDC and USDT replaced by GoldmanSachsStable and JPMorganStable. What can be stated for sure, though, is that the technology is at an inflection point right now.

Author: Slava Demchuk, co-founder of AMLBot