In an extraordinary show of solidarity, cryptocurrency whales are rallying behind Binance, the world’s largest cryptocurrency exchange by trading volume, amid its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). This surge of support, marked by substantial deposits into the exchange, signals a strong vote of confidence in Binance’s resilience and future prospects.

Binance Receives Support From Community Despite SEC Lawsuit

Yesterday, the U.S. Securities and Exchange Commission (SEC) lodged 13 charges against the cryptocurrency exchange, Binance, along with its co-founder and CEO, Changpeng “CZ” Zhao.

According to the official press release, Binance Holdings Ltd., its U.S. affiliate BAM Trading Services Inc., and its founder, Changpeng Zhao, have been accused of “a range of securities law infringements.”

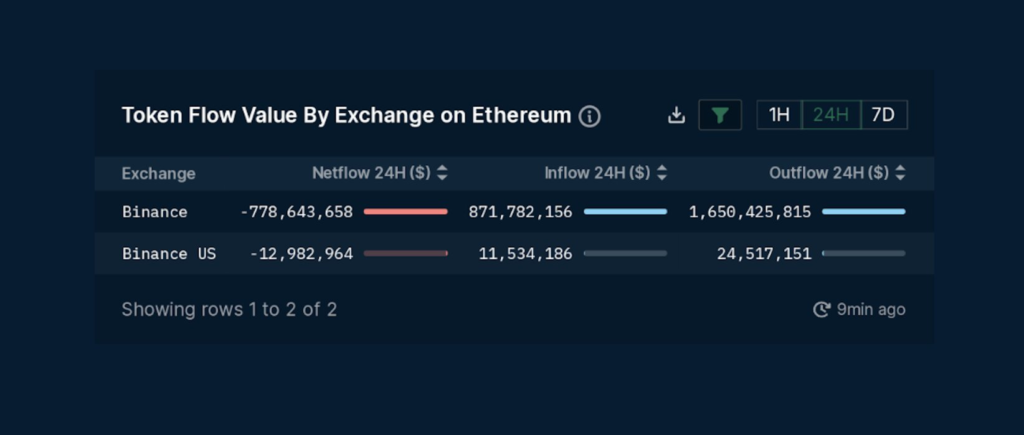

Following this news, the crypto market witnessed a massive plunge in a few hours, and BTC price touched the ground at $25.5K. As per the data provided by the cryptocurrency analytics firm Nansen, Binance experienced a negative netflow of $778 million on the Ethereum blockchain. This was characterized by an inflow of assets worth $871 million into the exchange, while assets worth $1.6 billion were transferred out.

In the initial 24 hours after the SEC lawsuit was announced, Ethereum-based tokens continued to show a negative netflow. In the most recent hour, assets worth $14.8 million flowed into the exchange, while assets worth $50.5 million were transferred out.

Despite the potential market disruption that such legal challenges could cause, the whale community’s response to Binance has been remarkably supportive. As reported by Lookonchain, a digital asset management firm, FGB Capital initially withdrew $35 million USDT from Binance before the news of the lawsuit emerged. However, in a show of solidarity with the embattled crypto exchange, it later deposited $44 million USDT back into Binance amid the ongoing legal proceedings.

In addition, FalconX demonstrated its support by depositing $29.5 million into Binance, a move that counters the FUD sentiment. Furthermore, Machi Big Brother, a notable NFT trader, transferred all of his Bored Ape NFTs (a total of 39 NFTs) to Binance’s NFT platform, contributing to the stability of the crypto exchange during these challenging times.

Binance Stays Strong Against The SEC

Cryptocurrency whales, the term used to describe individuals or entities that hold large amounts of digital currencies, have been depositing funds into Binance at an unprecedented rate. This influx of capital demonstrates not only their support for Binance but also their belief in the platform’s ability to navigate through regulatory challenges.

This wave of support comes at a crucial time for Binance. The backing from whales could significantly bolster the exchange’s position, providing it with the necessary resources to address the SEC’s concerns and work towards a resolution. Moreover, this show of confidence could also serve to reassure other users and investors, potentially stabilizing the platform during this challenging period.

Binance expressed its disappointment over the SEC’s actions, stating that it has always been open to negotiations in good faith to resolve the issue. The crypto exchange also criticized the SEC for its lack of clarity in cryptocurrency regulations.

Binance, a well-known cryptocurrency exchange, is already dealing with a lawsuit filed by the U.S. Commodity Futures Trading Commission (CFTC) in March of this year concerning alleged breaches of derivatives rules. Binance suspects that this regulatory action may have spurred the SEC’s move. “Given our size and global brand recognition, Binance has become an easy target, caught in the crossfire of U.S. regulatory disputes,” the company stated.

Intriguingly, the SEC’s report includes references to two former Binance CEOs who voiced concerns about Zhao’s level of influence. According to CNBC, both have given testimonies to the SEC, though neither has been identified. “I’m not actually the one running this company and the mission that I believe I signed up for isn’t the mission. And as soon as I realized that, I left,” a former Binance.US CEO, referred to as “BAM CEO B,” testified to the SEC.