- Introduction to National Stock Exchange (NSE) India and Option Trading

- Understanding NSE Option Chain: The Building Block of Equity Derivatives

- Call and Put Options in NSE Option Trading

- Trading Strategies for NSE Options: In-the-Money, At-the-Money, and Out-of-the-Money Options

- Implied Volatility in NSE Options and its Role in Option Pricing

- The Importance of Open Interest and Volume in NSE Option Chain Analysis

- Navigating Expiry Dates in the NSE Option Chain

- Leveraging the NSE Option Chain for Effective Financial Planning

- The Role of Option Greeks in NSE Option Chain

- Delta and Gamma

- Vega, Theta, and Rho

- Options Trading Platform and NSE Market Data

- Conclusion: The Importance of NSE Option Chain for Stock Market Analysis

- Applying the NSE Option Chain for Diversified Portfolio Management

- Risk Assessment in NSE Option Chain

- The Bottom Line: Mastering the NSE Option Chain

- Time Value, Intrinsic Value, and NSE Options Pricing

- Utilizing the NSE Option Chain for Predicting Trends

- Final Thoughts: The NSE Option Chain as a Tool for Market Success

- An Exploration of NSE India and its Pivotal Role in Equity Options Trading

- Mastering Equity Options in NSE: Understanding Dynamics and Crafting Successful Strategies

- FAQ

Introduction to National Stock Exchange (NSE) India and Option Trading

The National Stock Exchange (NSE) of India is a premier global marketplace for diverse financial instruments. It stands as a dynamic platform for both traders and investors who wish to delve into various forms of trading. One of the pivotal offerings is the NSE Option Chain, a key tool in the world of option trading.

Understanding NSE Option Chain: The Building Block of Equity Derivatives

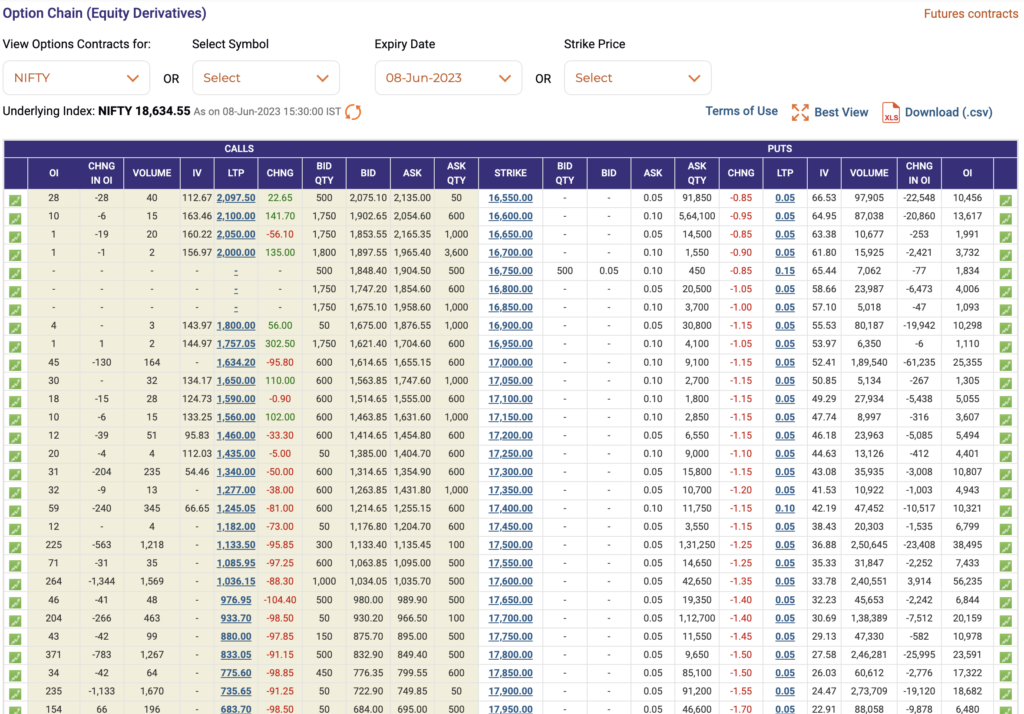

An NSE option chain, part of the broader NSE derivatives market, is an organized list of available option contracts of a particular security ready for trading on the exchange. Providing detailed information about various call and put options for a given security, understanding the NSE option chain equips traders with essential insights into the NSE derivatives market.

Call and Put Options in NSE Option Trading

The heart of option trading lies in two main types of options: the call option and the put option. A call option grants the buyer the right (but not the obligation) to buy an asset at a specified price, known as the strike price, within a predetermined time period. In contrast, a put option gives the buyer the right to sell the asset at the strike price within a certain timeframe.

The opportunity to exercise these options comes at a price known as the option premium. In the world of NSE derivatives trading, these premiums hold considerable significance and can be efficiently assessed using the NSE option chain.

Trading Strategies for NSE Options: In-the-Money, At-the-Money, and Out-of-the-Money Options

The NSE option chain serves as a valuable platform for creating potent trading strategies for NSE options. These strategies often involve careful analysis of key aspects such as In-the-money (ITM), At-the-money (ATM), and Out-of-the-money (OTM) options. An ITM option is one where the underlying security’s price is more (for a call option) or less (for a put option) than the strike price. An ATM option has its underlying security’s price equal to the strike price, and an OTM option is when the underlying security’s price is less (for a call option) or more (for a put option) than the strike price.

Implied Volatility in NSE Options and its Role in Option Pricing

Implied Volatility (IV) is a fundamental element in the NSE option chain. IV is a metric that depicts the market’s projection of a likely movement in a security’s price. It is a crucial factor in options pricing models like the Black-Scholes model or the binomial options pricing model, commonly employed by traders to estimate the fair value of options.

The Importance of Open Interest and Volume in NSE Option Chain Analysis

Another vital component of the NSE option chain is the open interest, which refers to the total number of outstanding option contracts that haven’t been settled. Open interest in NSE options, combined with volume (the number of contracts traded in a day), can provide substantial insights into market trends and the liquidity of specific options. A high volume in the NSE option chain often signifies active trading and can be an indicator of market interest.

Navigating Expiry Dates in the NSE Option Chain

The expiration date is another pivotal concept in understanding the NSE option chain. It denotes the date when the option contract ceases to exist. If the option is not exercised before this date, it expires worthless and cannot be traded. Being aware of an option’s expiration date is critical in formulating effective trading strategies and managing risk in the NSE derivatives market.

Leveraging the NSE Option Chain for Effective Financial Planning

Learning to interpret the NSE option chain offers potential advantages for both short-term day trading and long-term investment strategies. It can help assess risk and aid in financial planning, providing a diversified portfolio for investors. Its significance in the Indian stock market and financial sector is undeniable, as it opens up a world of possibilities for trading and hedging, making it an essential tool for any trader or investor participating in the NSE.

The Role of Option Greeks in NSE Option Chain

An integral part of understanding and utilizing the NSE option chain is familiarizing yourself with the Option Greeks – Delta, Gamma, Vega, Theta, and Rho. These represent the different risk parameters used to measure the sensitivity of the price of the options.

Delta and Gamma

Delta measures how much an option’s price is expected to change per one unit change in the price of the underlying asset. Gamma, on the other hand, is essentially the acceleration of the price of the option for every point move by the underlying asset.

Vega, Theta, and Rho

Vega measures the rate of change in an option’s price for every one percent change in the implied volatility of the underlying asset. Theta is concerned with the sensitivity of the option’s price to the passage of time, and Rho evaluates the sensitivity of an option’s price to changes in the risk-free interest rate.

All these parameters together form the backbone of any options strategy and play a crucial role in the NSE option chain.

Options Trading Platform and NSE Market Data

To participate in options trading on NSE, traders need to access a trading platform. These platforms not only facilitate the buying and selling of options but also provide essential tools for market analysis, including access to the NSE option chain.

Furthermore, NSE market data offers a wealth of information to traders, such as the latest stock prices, trading volumes, and changes in open interest. Understanding how to interpret this data is critical for predicting NSE option chain trends and making informed trading decisions.

Conclusion: The Importance of NSE Option Chain for Stock Market Analysis

In conclusion, the NSE option chain is an invaluable tool for any investor or trader in the Indian stock market. It provides a detailed view of various call and put options, allows for the assessment of risk using option Greeks, and aids in crafting effective trading strategies. Whether it’s for short-term day trading or long-term investment, understanding the NSE option chain can significantly enhance your trading decisions and potential profitability in the vibrant world of NSE derivatives trading.

Applying the NSE Option Chain for Diversified Portfolio Management

The NSE option chain is not just for day-to-day trading. Long-term investors can also benefit significantly from understanding and applying the principles of the NSE option chain. For instance, a well-diversified portfolio may include a mix of different options at varying strike prices and expiration dates.

By including a diverse array of options in their portfolio, investors can balance risk and potential returns, ensuring that they are not overly exposed to any single security or market sector. Using the NSE option chain, investors can carefully analyze and select options that align with their investment objectives and risk tolerance.

Risk Assessment in NSE Option Chain

Options trading, like any investment, carries inherent risks. However, understanding the NSE option chain can greatly assist investors in evaluating these risks. The various parameters, such as implied volatility, open interest, and the Option Greeks, provide a clear picture of the potential risks associated with different options.

Moreover, it’s essential to note that options strategies such as hedging can be used to mitigate risk. Hedging involves taking an offsetting position in an attempt to protect against possible negative outcomes. The NSE option chain can prove instrumental in formulating effective hedging strategies.

The Bottom Line: Mastering the NSE Option Chain

In essence, mastering the NSE option chain is an essential skill for anyone serious about options trading on the NSE. Whether you are a newbie investor or a seasoned trader, understanding the intricacies of the option chain can give you an edge in the market.

Through careful analysis of the NSE option chain, investors can gain a deeper understanding of the market, formulate effective trading strategies, manage risk, and potentially enhance their trading performance. As the world of financial markets continues to evolve, the NSE option chain remains an indispensable tool in the trader’s arsenal.

With the information provided in this comprehensive guide, you’re well on your way to successfully navigating the dynamic world of NSE derivatives and the NSE option chain. As always, remember to consider your financial goals, risk tolerance, and investment timeline before diving into options trading.

Time Value, Intrinsic Value, and NSE Options Pricing

One of the core principles of options trading is understanding the concept of intrinsic value and time value. Intrinsic value refers to the difference between the market price of the underlying security and the option’s strike price. For instance, if a stock is trading at Rs. 100 and the strike price of a call option is Rs. 80, the intrinsic value of the option is Rs. 20.

On the other hand, time value represents the portion of the option premium that exceeds the intrinsic value, accounting for the probability that the option may go in-the-money in the future before expiry. These two components together contribute to the price of an option.

As the expiration date approaches, the time value tends to decrease, which is a phenomenon known as time decay, represented by the Theta in option Greeks. By understanding these concepts, traders can use the NSE option chain to select options with favorable pricing conditions.

Utilizing the NSE Option Chain for Predicting Trends

Traders often use the NSE option chain to gauge market sentiment and predict possible price trends. For instance, a high open interest for a particular call option could indicate that traders are bullish about the underlying security. Conversely, a high open interest for a put option could signal a bearish sentiment.

Furthermore, sudden changes in open interest or trading volume can suggest impending price movements. For example, a surge in volume and open interest could indicate increased trading activity and potential trend initiation. By monitoring these changes in the NSE option chain, traders can potentially anticipate and capitalize on market trends.

Final Thoughts: The NSE Option Chain as a Tool for Market Success

In conclusion, the NSE option chain provides a wealth of information for traders and investors looking to profit from the dynamic NSE derivatives market. By understanding and properly interpreting the various components of the option chain, individuals can make informed trading decisions, manage their risk effectively, and potentially reap significant returns.

From day traders looking for short-term gains to long-term investors aiming to build a diversified portfolio, the NSE option chain offers valuable insights for everyone. As with any financial market instrument, a comprehensive understanding combined with a well-thought-out strategy is key to achieving success in options trading on the National Stock Exchange of India.

An Exploration of NSE India and its Pivotal Role in Equity Options Trading

Delve into the dynamic world of National Stock Exchange (NSE) India, its contribution to global financial markets, and the significance of equity options trading within this vibrant financial landscape.

Mastering Equity Options in NSE: Understanding Dynamics and Crafting Successful Strategies

Get a comprehensive understanding of the dynamics of equity options in NSE and learn about various strategies to navigate this complex marketplace for potential profitability and investment success.

FAQ

What is an NSE Option Chain?

An NSE option chain is an organized list of all available option contracts (both call and put) for a specific security listed on the National Stock Exchange (NSE). It provides detailed information about various aspects such as strike prices, expiry dates, implied volatility, and option premiums.

What is the significance of call and put options in NSE trading?

Call and put options form the backbone of option trading. A call option gives the buyer the right to buy the underlying asset at a specific price within a certain period, while a put option grants the right to sell. The balance between these two options helps traders strategize for potential market movements.

What are In-the-Money, At-the-Money, and Out-of-the-Money options?

These terms refer to the relationship between the market price of the underlying security and the option’s strike price. An In-the-Money (ITM) option has value at the current market price, an At-the-Money (ATM) option’s strike price is equal to the market price, and an Out-of-the-Money (OTM) option would have no value if the market price remains the same until expiry.

How does implied volatility impact option pricing in the NSE option chain?

Implied volatility represents the expected volatility of the underlying security and significantly influences an option’s price. Higher implied volatility often leads to higher option premiums, reflecting the increased risk associated with the potential price movements of the underlying asset.

What are Option Greeks in the context of the NSE option chain?

Option Greeks (Delta, Gamma, Vega, Theta, and Rho) are essential risk measures that provide insight into how the price of an option changes in response to various factors, including changes in the price of the underlying asset, volatility, time decay, and changes in interest rates.

How can one use the NSE option chain for successful trading?

Successful trading involves understanding and interpreting the various components of the NSE option chain, including strike prices, expiry dates, option Greeks, implied volatility, open interest, and trading volume. This analysis can help traders predict market trends, manage risk, and make informed trading decisions.

What role does NSE India play in equity options trading?

NSE India provides a platform for trading various financial instruments, including equity options. By offering a wide range of equity options, NSE India enables investors to diversify their portfolios, manage risk, and potentially achieve significant returns.

How does understanding the NSE option chain contribute to building a diversified portfolio?

By interpreting the NSE option chain, investors can gain insights into various call and put options, their prices, open interest, and implied volatility. This information can guide investors in selecting a mix of different options at various strike prices and expiration dates, leading to a more diversified and balanced investment portfolio.

Can equity options in NSE be used for hedging?

Yes, equity options can be an effective tool for hedging against potential losses in other investments. For instance, an investor concerned about a possible drop in the price of a stock they own may buy a put option to protect against this risk.

What is the importance of the time value in options pricing?

Time value is a crucial component of an option’s price, reflecting the probability that an option may go in-the-money before expiry. As the expiration date approaches, time value tends to decrease due to time decay, which traders should factor into their options trading strategies.

How to read option chain data in NSE?

Reading the option chain data in the NSE involves understanding its various components. Here are some key steps to help you interpret the option chain data:

- Identify Call and Put Options: The NSE option chain typically displays data for both call and put options side by side. On the left, you will see the call options, and on the right, you will find the put options.

- Understand the Strike Price: The strike price is the price at which the holder of an option can buy (for a call option) or sell (for a put option) the underlying security when the option is exercised. These are usually listed down the middle of the option chain.

- Consider Option Premiums: The option premium is the price that the buyer of the option pays to the seller. It’s affected by various factors including the underlying asset’s price, strike price, time until expiration, volatility, and interest rates.

- Look at Volume and Open Interest: Volume represents the number of contracts that have been traded during a given period. Open interest is the total number of outstanding option contracts in the market. These metrics can provide insights into market activity and liquidity.

- Check the Implied Volatility: Implied volatility reflects the market’s view on how volatile the underlying asset will be in the future. It’s crucial for option pricing as higher volatility typically leads to more expensive options.

- Study the Option Greeks: Option Greeks (Delta, Gamma, Theta, Vega, and Rho) help assess the risk associated with different options. For instance, Delta measures the option’s sensitivity to changes in the underlying asset’s price, while Theta represents the rate of decline in the value of an option due to the passage of time.

- Expiry Date: This is the date after which the option contract becomes invalid. The expiry date for each set of options is indicated at the top of the option chain. Options with different expiry dates are listed in separate tables.

By understanding these components, you can effectively interpret and leverage the NSE option chain for your trading decisions.

How to check the option chain in NSE?

To check the option chain in NSE, follow these steps:

- Visit the Official NSE India Website: Navigate to the official NSE India website in your web browser.

- Go to the ‘Live Market’ Section: On the homepage, you will find a navigation menu at the top. Click on ‘Live Market’ to proceed.

- Select ‘Equity Derivatives’: Under the ‘Live Market’ section, click on ‘Equity Derivatives’. This will redirect you to the Equity Derivatives live market page.

- Access Option Chain Data: On the Equity Derivatives page, find the ‘Underlying Indices’ box. Choose the index (like NIFTY 50) or stock you are interested in, and click on ‘Option Chain’. This will take you to the option chain data for the selected index or stock.

Remember, the NSE updates the option chain data regularly during trading hours, so it’s always a good idea to refresh the page for the most up-to-date data.

By studying the option chain, you can gain insights into the prices of various call and put options, their trading volume, open interest, and implied volatility, which can help inform your trading decisions.

READ MORE:

Investing in Bitcoin: Unraveling the Complexities of GBTC Stock

Tectonic (Tonic) Crypto – The New Frontier in Decentralized Finance

How Can Features of Blockchain Support Sustainability Efforts

Crypto.com Arena Seating Chart & Parking: A Comprehensive Guide to the Stadium Layout

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?