- Introduction

- VTI Stock – An Overview

- Understanding Stock Returns and ETF Performance

- Performance and Historical Perspective of VTI ETF

- The Nature of Stock Returns

- Exploring ETF Performance

- Balancing Risk and Return

- The Dynamics of Risk and Return

- VTI vs S&P 500 and Other Vanguard ETFs

- Asset Allocation and Diversification with VTI

- VTI Stock Forecast and Analysis

- Conclusion

- FAQ

Introduction

In the realm of investing, “VTI Stock,” also known as Vanguard’s Total Stock Market ETF, is one of the most common terms you’ll encounter. This low-cost, diversified index fund is a popular choice for investors looking to gain broad market exposure. It’s considered a staple of passive investing strategies, providing long-term investors with a diversified, buy-and-hold solution for their portfolio. In this article, we’ll explore everything you need to know about VTI stock.

VTI Stock – An Overview

VTI stock is a diversified ETF that tracks a benchmark index encompassing the entire U.S. equity market. With the stock market’s substantial returns and dividends, many investors are naturally drawn to this ETF for its wide array of stock holdings. The Vanguard Total Market ETF, with its passive investment strategy, covers a vast sector allocation from growth stocks to value stocks across various market caps.

Understanding Stock Returns and ETF Performance

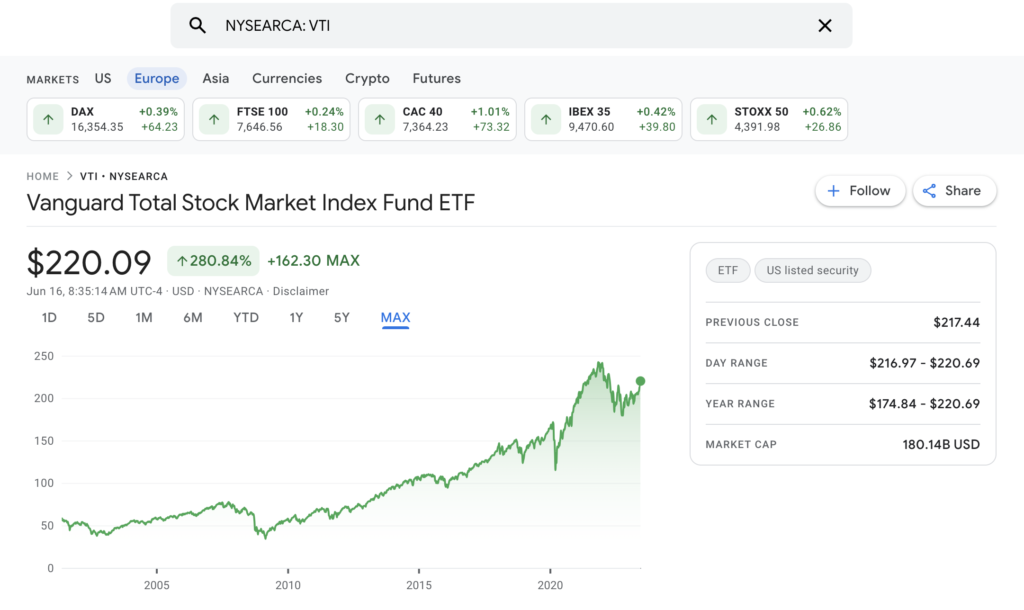

Performance and Historical Perspective of VTI ETF

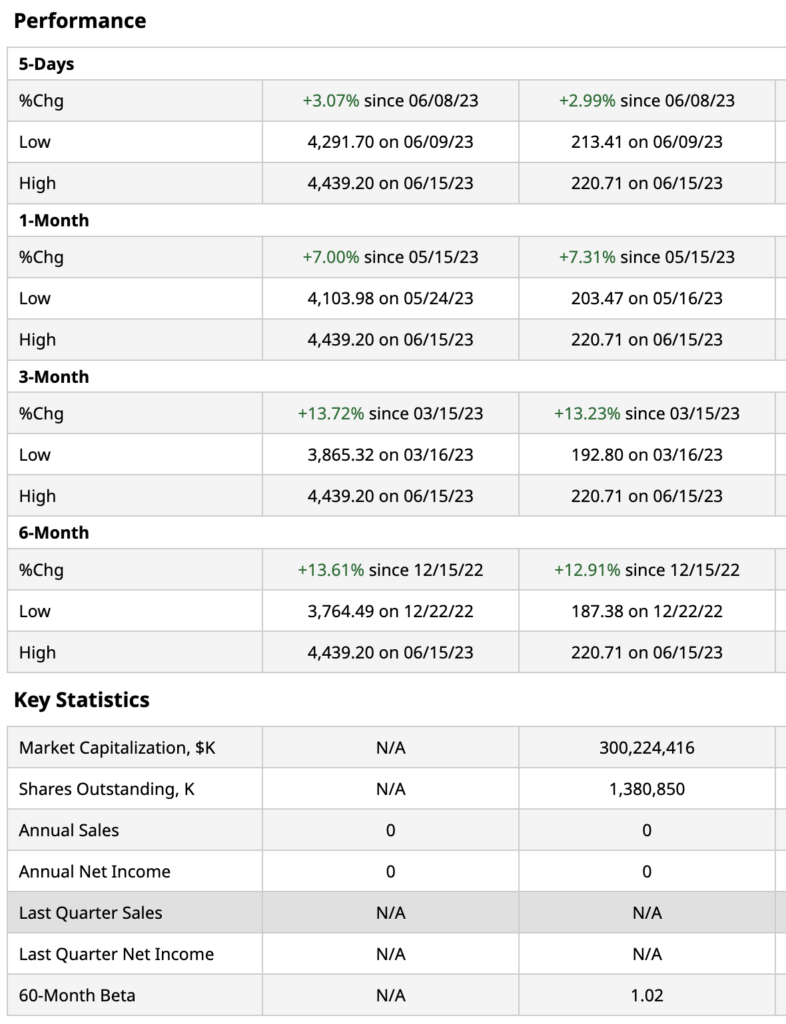

Before buying VTI stock, investors often review its historical performance and track record. In terms of its annual returns, VTI has consistently outperformed many actively managed funds. This performance reflects the advantage of a passive investment strategy, which aims to replicate the returns of the total stock market rather than outperform it.

VTI stock’s growth rate has also been impressive, leading to its reputation as a strong long-term investment. For investors planning for retirement, or those simply looking to grow their wealth over time, VTI’s historical performance shows its capability as a robust component of a diversified portfolio.

The Nature of Stock Returns

In the world of investing, the concept of stock returns is a fundamental one. The returns of a stock or an ETF (exchange-traded fund) like VTI, encompass not only the gains or losses made from selling the stock at a higher or lower price than its purchase price but also the dividends received during the holding period. These dividends represent the portion of a company’s profits that are distributed to its shareholders. As a passive investment, VTI consistently pays dividends to its investors, further contributing to its total returns.

Exploring ETF Performance

Evaluating the performance of an ETF like VTI stock involves more than just looking at its price changes. Investors need to consider the fund’s total returns, which includes dividends and the capital gains from the sale of securities within the fund. Additionally, factors such as the ETF’s expense ratio, tracking error, and liquidity can also impact overall performance. As we noted before, VTI boasts a low expense ratio, which means more of the fund’s returns are kept by investors.

Balancing Risk and Return

The Dynamics of Risk and Return

In investing, risk and return are two sides of the same coin. Higher potential returns often come with higher risk. When it comes to VTI stock, it offers broad exposure to the U.S. stock market, spreading out the risk associated with individual stocks. While this doesn’t eliminate risk entirely, it does provide a measure of protection against the volatility inherent in investing in single stocks. This diversification is a key factor in risk management, helping to smooth out returns over the long term.

Moreover, the potential returns from VTI come from both capital appreciation and dividends, making it a potential source of growth and income for investors. Therefore, while risks do exist in investing in VTI, these are somewhat mitigated by the broad-based diversification that it offers.

However, it’s essential to remember that the value of your investment in VTI can fluctuate with the overall market conditions. As such, like any other investment, it is possible to lose money. For this reason, investors should carefully consider their risk tolerance, investment horizon, and financial goals before investing in VTI. It’s always a good idea to consult with a financial advisor or conduct extensive research to understand the potential risks and rewards fully.

VTI vs S&P 500 and Other Vanguard ETFs

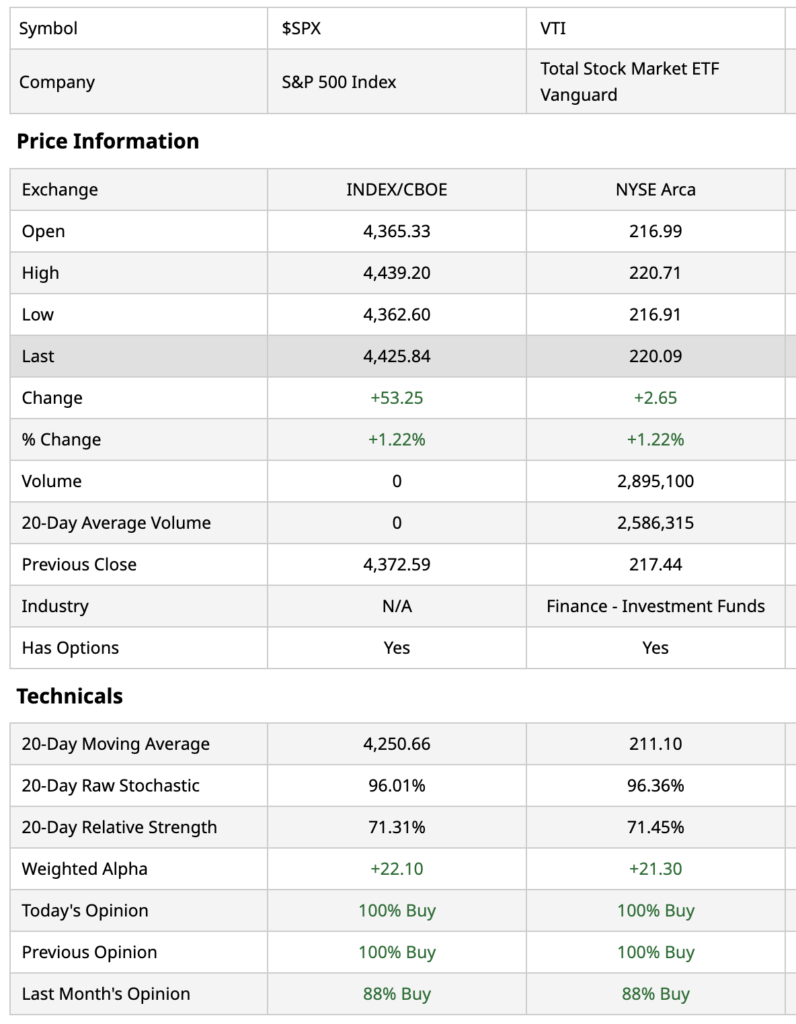

A frequent comparison is made between VTI stock and the S&P 500, another broad market index. The main difference is that VTI provides exposure to the total U.S. stock market, including small and mid-cap stocks not included in the S&P 500.

In comparison to other Vanguard ETFs, VTI’s expense ratio stands out. It has one of the lowest expense ratios in the industry, which means more returns for investors over time. In essence, the low cost and broad diversification make VTI a preferred choice among Vanguard’s fund offerings.

Asset Allocation and Diversification with VTI

Investors use VTI to achieve asset allocation in their portfolio with a single investment. It represents the entire U.S. stock market, providing broad exposure to large-cap, mid-cap, and small-cap companies across multiple sectors.

The diversified nature of VTI makes it less susceptible to volatility within specific sectors or individual stocks. Consequently, VTI can help to mitigate risk while still providing opportunities for robust investment returns.

VTI Stock Forecast and Analysis

Analysts often use the VTI stock price, its financial performance, and market trends to make VTI stock forecast. While it’s essential to note that past performance doesn’t guarantee future returns, VTI’s solid track record, along with its broad market exposure and low costs, suggests a positive outlook for this ETF.

As with any investment, potential risks exist. The value of VTI can fluctuate with market conditions, and like any other investment, it is possible to lose money. Therefore, it’s critical for investors to consider their risk tolerance and investment goals before investing in VTI.

Conclusion

In conclusion, VTI stock is an excellent investment tool for those looking to build a diversified portfolio with broad market exposure. Its low expense ratio and broad diversification make it a top choice for passive, long-term investing. Whether used for retirement planning or as a core portfolio holding, VTI provides a simple, efficient, and effective way to invest in the U.S. stock market. As always, potential investors should conduct their due diligence and consider their personal financial circumstances, investment goals, and risk tolerance before making an investment decision. It is also helpful to consult with a financial advisor to ensure that an investment in VTI stock aligns well with their overall investment strategy. In the dynamic world of investing, VTI continues to provide a compelling opportunity for broad market participation, delivering the benefits of the U.S. equity market to investors of all types.

FAQ

What is VTI Stock?

VTI Stock refers to Vanguard’s Total Stock Market ETF, a diversified, low-cost index fund providing broad exposure to the U.S. stock market. It’s an ideal choice for passive, long-term investors.

How has the VTI Stock performed historically?

Historically, VTI has consistently outperformed many actively managed funds, thanks to its passive investment strategy. It has shown an impressive growth rate, making it a strong contender for long-term investment.

How does VTI compare to the S&P 500 and other Vanguard ETFs?

VTI provides exposure to the total U.S. stock market, including small and mid-cap stocks, unlike the S&P 500, which only includes large-cap companies. Compared to other Vanguard ETFs, VTI stands out with one of the industry’s lowest expense ratios.

What is the importance of asset allocation and diversification with VTI?

Investors use VTI for efficient asset allocation, gaining broad exposure to large-cap, mid-cap, and small-cap U.S. companies across multiple sectors. Its diversified nature helps mitigate sector-specific or individual stock volatility risks.

What is the forecast and analysis for VTI Stock?

While future predictions should always be approached with caution, VTI’s broad market exposure, solid track record, and low costs suggest a generally positive outlook for this ETF. However, potential investors should consider their risk tolerance and investment goals before investing.

What are the risks and returns associated with VTI Stock?

Like any investment, VTI comes with inherent risks, including the potential for losses if market conditions decline. However, its diversified nature can help to mitigate these risks. Returns from VTI come from both capital gains (if the value of the stock holdings in the ETF increase) and dividends paid out by the underlying stocks in the ETF.

How can I buy VTI Stock?

You can buy VTI stock through any brokerage account or retirement account like an IRA or a 401(k) that allows ETF trading. After opening and funding an account, you can purchase VTI stock by entering its ticker symbol ‘VTI’ into the platform’s search bar and then following the prompts to specify the number of shares you wish to purchase. Always remember to consider your financial situation, investment goals, and risk tolerance before making investment decisions.

READ MORE:

How Can Features of Blockchain Support Sustainability Efforts

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

Reliance Power Share Price Future Prediction 2025: Will RPOWER Stock Reach ₹100 In 2023?

Investing in Bitcoin: Unraveling the Complexities of GBTC Stock

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

Controlling Bitcoin Mining Hashrate: Report on Core Scientific 545M & Riot Blockchain 215M Earning

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

Understanding the IEX Share Price on the National Stock Exchange