- Understanding Carbon: A Decentralized Trading Protocol

- Carbon’s Unique Approach to Trading Strategies

- Exploring Carbon’s Trading Strategies

- Carbon Beta Network Statistics

- Protocol Arbitrage with Carbon

- Carbon’s ROI Trading Competition

- Integrations with Leading Platforms

- Governance Proposal for Carbon

- Final Thoughts

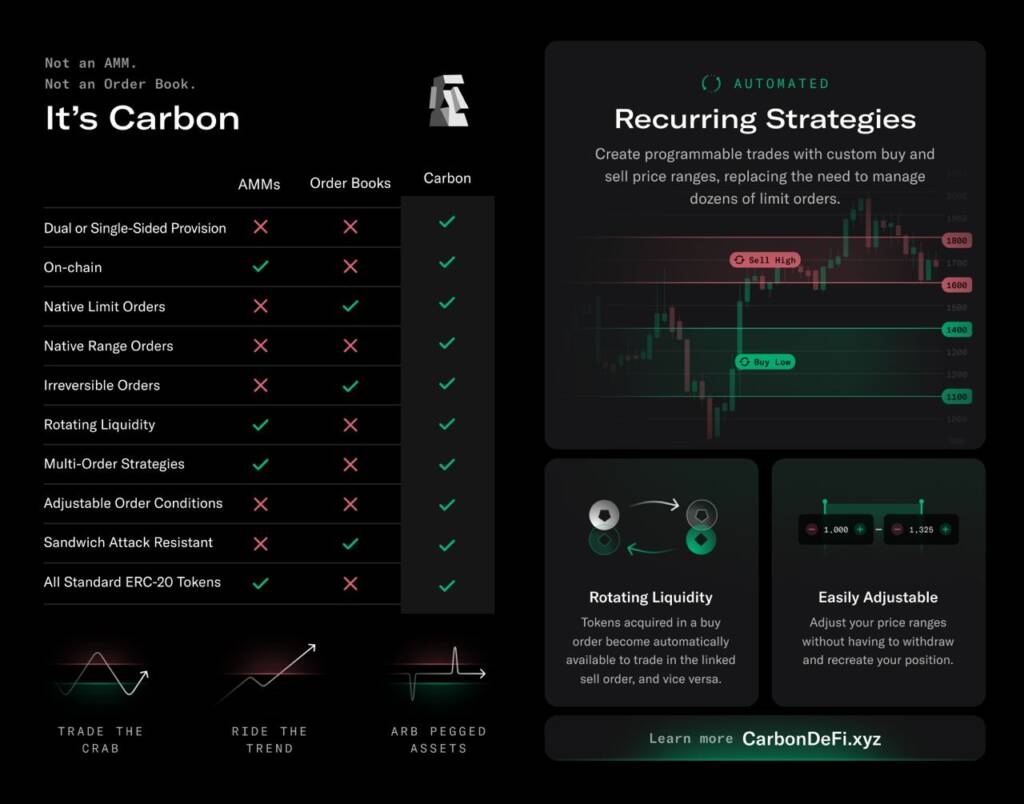

Decentralized exchanges (DEXs) have emerged as a critical component of the decentralized finance (DeFi) ecosystem, enabling users to trade cryptocurrencies directly from their wallets. Bancor, a prominent DEX built on the Ethereum network, has recently introduced Carbon, an innovative on-chain trading protocol. Carbon empowers users to execute customizable liquidity strategies using native on-chain limit orders and range orders. This groundbreaking protocol is poised to reshape the landscape of decentralized trading by offering unprecedented control and automation to traders.

Understanding Carbon: A Decentralized Trading Protocol

Carbon is a decentralized trading protocol that allows users to perform customizable liquidity strategies through on-chain limit orders and range orders. A user can submit an individual order or combine their orders together to create a recurring strategy that repeatedly buys in one price range and sells in a higher price range using a single source of automatically rotating liquidity.

Unlike existing on-chain liquidity solutions, Carbon orders flow in a single direction, providing a distinct advantage in terms of liquidity management and strategy execution. What sets Carbon apart is its resistance to the notorious issue of Miner Extractable Value (MEV) sandwich attacks. These attacks exploit the order execution sequence to manipulate trades and extract value from traders. Carbon’s design effectively mitigates this risk, ensuring a secure and reliable trading environment for users.

Carbon’s Unique Approach to Trading Strategies

Carbon stands out from traditional automated market makers (AMMs) by allowing users to personalize their own buy and sell ranges based on their predictions. While existing AMMs prescribe specific trading strategies, Carbon empowers users to tailor their strategies to their own preferences and expectations.

By enabling users to set specific buy and sell ranges for their tokens, Carbon grants them unparalleled control over their trading decisions. This personalized approach empowers traders to execute “swing trading” strategies for standard ERC20 tokens, capitalizing on price movements and maximizing profitability.

Exploring Carbon’s Trading Strategies

Carbon offers two types of trading strategies: disposable and recurring. Disposable strategies consist of individual orders that remove tokens from active trading as the orders are executed. This includes limit orders (e.g., “sell ETH at $2000”) or range orders (e.g., “sell ETH between $1900–2000”).

Recurring strategies, on the other hand, involve paired orders that trade perpetually using a single source of automatically rotating liquidity. As one order executes, liquidity is transferred to its paired order, creating a continuous trading loop. Recurring strategies can be composed of paired limit orders, paired range orders, or a combination of the two.

Carbon supports both single-token and two-token funding for strategies, offering users flexibility and choice in their trading endeavors. This broad range of on-chain strategies can be deployed with ease on Carbon, without reliance on external oracles or hooks.

Carbon Beta Network Statistics

Since its launch, Carbon has witnessed a significant surge in user activity. The platform has experienced substantial growth in the number of strategies deployed and trades executed through the carbondefi.xyz app, trade aggregators, and direct on-chain interactions.

At the time of writing, the Carbon beta network boasts over $1.15 million in deployed liquidity across 200 strategies, with a total volume exceeding $500,000. These figures represent a remarkable increase of 267.41% in liquidity and 405.15% in trading volume over the past month, indicating growing adoption and confidence in the protocol.

Protocol Arbitrage with Carbon

Carbon’s integration with the Fast Lane framework enables efficient strategy execution while generating fees for the protocol. The Fast Lane recorded its highest daily earnings on June 14th, with 2,658 BNT (Bancor’s native token). Recent gas optimizations are set to further enhance arbitrage efficiency, benefitting both traders and the overall liquidity ecosystem.

Carbon’s ROI Trading Competition

To foster engagement and reward traders, Carbon has launched the ROI trading competition. Participants can showcase their trading skills and compete with fellow community members to achieve the highest return on investment (ROI). Top-ranking strategies will receive USDC rewards and exclusive swag. The competition, which started on a specific date, will run until July 11, 2023. Existing strategies deployed before the competition’s start date are also eligible, requiring participants to claim the competition NFT on Galxe.

Integrations with Leading Platforms

Carbon’s growth is further amplified by its integration with various industry-leading platforms. InsurAce, a decentralized insurance protocol, allows users to insure their Carbon strategies. This integration provides an added layer of security for users’ funds and strategies. Additionally, proposals for integration with DeBank, a prominent portfolio analyzer, and other leading DEX aggregators are underway, expanding Carbon’s reach and accessibility within the DeFi ecosystem.

Governance Proposal for Carbon

Bancor’s governance is actively considering a proposal to create a protocol-owned strategy on Carbon, valued at approximately $4-5 million. The strategy would utilize protocol-owned liquidity, with discussions revolving around the choice of token pairs and strategy types. Stablecoin/stablecoin recurring strategies and ETH-LST/ETH-LST recurring strategies have been proposed, highlighting their predictable trading ranges and minimal maintenance requirements by the DAO.

Final Thoughts

Carbon, the decentralized trading protocol developed by Bancor, is revolutionizing the world of on-chain trading strategies. By providing users with customizable liquidity strategies, resistance to MEV sandwich attacks, and unprecedented control over trading decisions, Carbon empowers traders to optimize their profitability in the decentralized finance ecosystem. With impressive growth in user activity, ongoing integrations with leading platforms, and a vibrant community, Carbon is poised to drive innovation and shape the future of decentralized trading.