- Overview

- Tata Power Company

- Tata Power’s Performance in the NSE

- Historical Performance of Tata Power

- Tata Power Share Price NSE: An Investment Avenue in the Energy Sector

- Financial Analysis and Earnings Report

- NSE Live Market and Tata Power

- Tata Power’s Role in Electric Utilities Stocks

- Energy Sector Stocks: A Glimpse into Tata Power Share Price NSE

- Stock Portfolio: Including Tata Power

- Tata Power Stock Predictions and Future Prospects

- Market Trends and Share Market Updates

- Tata Power Share Price NSE: Investing in Indian Stock Market

- Trading in National Stock Exchange

- Tata Power: A Part of the Renewable Energy Investments

- Conclusion

The Indian equity market has been a significant hotspot for investors across the globe. A notable player in this market is Tata Power Company Limited, one of India’s largest and most diversified electric utilities companies, listed on the National Stock Exchange (NSE). Let’s delve into the current market scenario, historic performance, and the financial health of Tata Power Share Price NSE, understanding why it stands as an intriguing option for your stock portfolio.

Overview

Tata Power Company

Tata Power is a part of the Tata Group, which commands a large market capitalization and is known for its successful foray into a diverse range of sectors. The Tata Power share price NSE has been a significant contributor to the Tata Group’s equity. The company has been at the forefront of the energy sector in India, with a strong presence in the renewable energy domain.

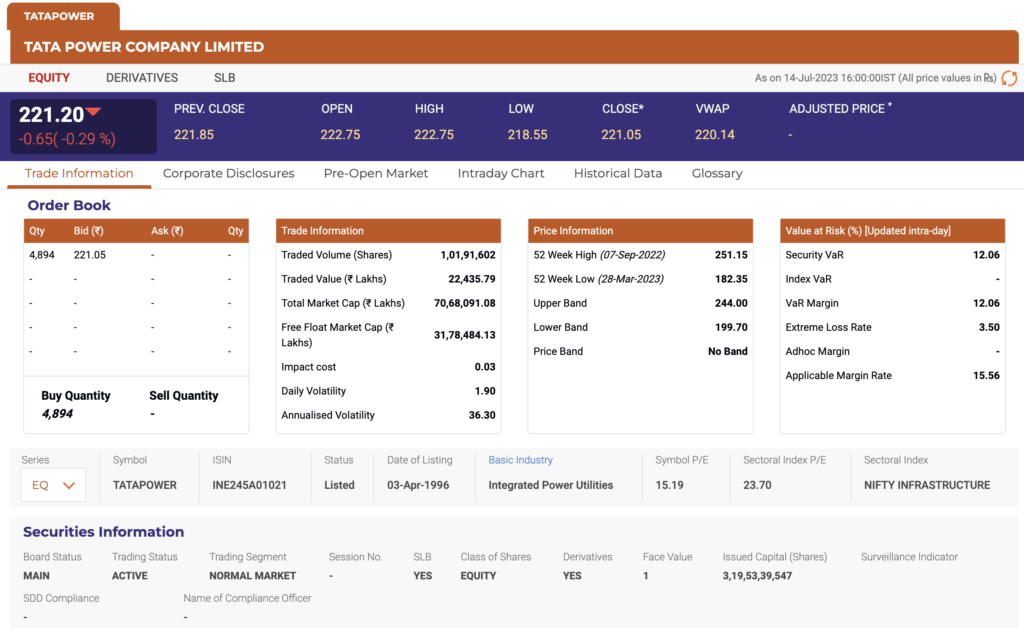

Tata Power’s Performance in the NSE

The performance of Tata Power’s shares in the NSE India is worth noting. Observing the daily stock prices of Tata Power, one can notice a mix of peaks and troughs reflecting the dynamism of the financial markets. It is not just the price of the shares but also the trading volume that is crucial while analyzing the Tata Power’s market presence.

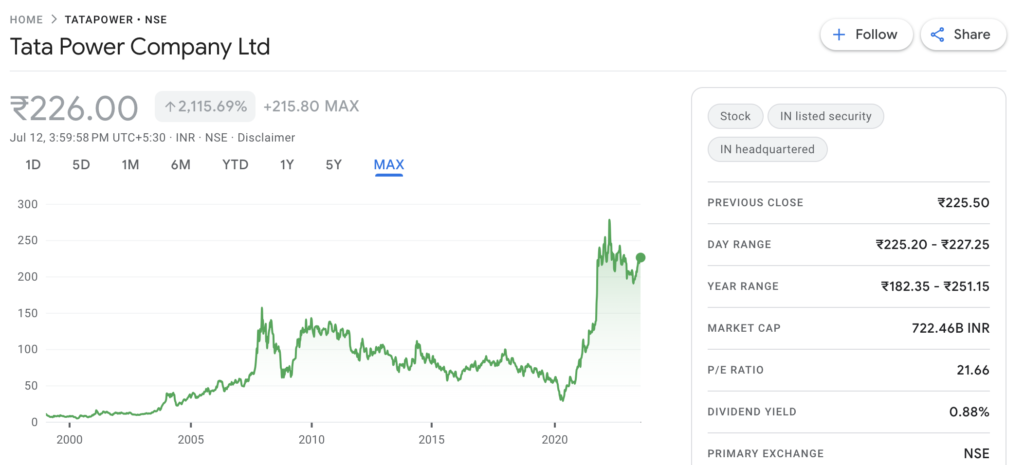

Historical Performance of Tata Power

The Tata Power share price history reflects the company’s resilience in the face of market volatility. The historical performance of Tata Power manifests itself in its share trading history, encompassing times of economic boom and recession. The company has successfully weathered many market trends, thus gaining the trust of its investors.

Tata Power Share Price NSE: An Investment Avenue in the Energy Sector

The renewable energy sector has seen an increased interest from investors in recent times. The importance of investing in renewable energy stocks has only amplified with growing awareness about climate change. As a major player in this sector, Tata Power offers a substantial investment opportunity. An in-depth stock analysis of Tata Power could provide valuable insights for potential investors.

Financial Analysis and Earnings Report

Analyzing Tata Power’s quarterly results gives a clear picture of the company’s financial health. The financial analysis includes reviewing the company’s earnings report, dividend information, and market capitalization. These financial indicators play a significant role in deciding whether Tata Power’s shares are a ‘buy’ or ‘sell’. The dividend yield offered by the company is another factor influencing investment decisions.

NSE Live Market and Tata Power

For real-time updates on Tata Power Share Price NSE, one can refer to the NSE live market. The National Stock Exchange offers live updates on stock prices, providing a wealth of information for investors looking for intraday trading or long-term investment options.

Tata Power’s Role in Electric Utilities Stocks

Electric utility stocks have always been a part of a diversified investment portfolio due to their stable returns and dividends. Companies like Tata Power are a crucial part of this category. With a strong market presence and an extensive portfolio covering conventional and renewable energy sources, Tata Power plays a significant role in shaping the electric utilities stocks landscape.

Energy Sector Stocks: A Glimpse into Tata Power Share Price NSE

As one of the leading energy sector stocks, Tata Power has been instrumental in driving the sector’s growth. It has set benchmarks for other players in the market with its extensive operations in electricity generation, distribution, and transmission, thereby establishing itself as a powerhouse in the energy domain.

Stock Portfolio: Including Tata Power

When building a stock portfolio, the inclusion of stable and reliable stocks is imperative. Tata Power, being a well-established player in the energy sector, provides such stability. With a healthy dividend yield, steady share price performance, and a promising future owing to its focus on renewable energy, Tata Power can be a worthy addition to any investor’s stock portfolio.

Tata Power Stock Predictions and Future Prospects

Making stock predictions requires an intricate understanding of the company’s fundamentals and the overall industry trends. Tata Power, with its significant role in the energy sector and a growing emphasis on renewable sources, appears to have promising future prospects. As the world is shifting towards cleaner energy sources, Tata Power’s strategic moves in this direction could prove beneficial for its stock value in the long run.

Market Trends and Share Market Updates

The share market is highly dynamic, and market trends can shift rapidly. Therefore, it is crucial to stay updated with share market updates, especially if you have investments in high-impact sectors like energy. Keep a close eye on the Tata Power share price NSE for any significant movements that could affect your investment strategy.

Tata Power Share Price NSE: Investing in Indian Stock Market

Investing in the Indian stock market can be a rewarding journey, especially with companies like Tata Power Share Price NSE in your portfolio. With a solid background, robust performance, and a forward-looking approach to renewable energy, Tata Power stands as a compelling pick for investors in the Indian Stock Exchange.

Trading in National Stock Exchange

Trading in the National Stock Exchange offers a multitude of opportunities for investors. With access to companies from various sectors, it provides a chance to diversify your portfolio. Tata Power, being a critical player in the electric utilities space, offers an excellent avenue for diversification.

Tata Power: A Part of the Renewable Energy Investments

With a significant stake in renewable energy, Tata Power Share Price NSE is positioning itself as a sustainable and responsible power company. It’s a clear testament to the fact that renewable energy investments are not just about being socially responsible but can also be profitable and contribute to long-term growth.

Conclusion

Investing in the Indian stock market requires comprehensive research and understanding of market dynamics. The Tata Power share price NSE gives an exciting glimpse into the robust Indian energy sector. The company’s position in the market, coupled with the growth potential of the renewable energy sector, makes it a compelling consideration for investors. Always remember, whether it’s about share price history, dividend yield, or any other financial indicator, informed decisions often lead to better investment outcomes.

In conclusion, Tata Power’s performance on the NSE is a testament to its robust business model and strategic operations. As the world moves towards cleaner energy, Tata Power’s role will likely become increasingly significant in the Indian stock market and beyond.

READ MORE:

Kibho Cryptocurrency: A Fine Choice for Huge Crypto Returns

AWL Share Price Prediction: Will Adani Wilmar Recover Following Hindenburg Report?

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

YIMUSANFENDI: The Vanguard of Information-Driven Innovation

AMC Stonk-O-Tracker: The Power of Retail Investors in the Market

How Can Features of Blockchain Support Sustainability Efforts

Reliance Power Share Price Future Prediction 2025: Will RPOWER Stock Reach ₹100 In 2023?