Sudden Surge in $LINK’s Value

In a surprising turn, the price of Chainlink ($LINK) witnessed a notable increase, surging by 25% within a mere 48-hour window. So, what could be driving this significant spike in the decentralized oracle network’s native cryptocurrency? Data insights provided by Lookonchain offer a deeper understanding of this trend.

Korean Exchanges in the Limelight

Two major Korean crypto exchanges, Bithumb and Upbit, seem to be playing pivotal roles. Data unveils that throughout the period of $LINK’s price escalation, these exchanges collectively accumulated an impressive 945K $LINK, equivalent to a hefty $9M. Evidently, the price surge of $LINK appears intrinsically tied to the actions of these exchanges.

Links for further verification:

Interestingly, following its accumulation, Bithumb proceeded to transfer out 220,000 $LINK (amounting to $2.05M). This move correlated with $LINK starting its descent from its zenith.

$LINK’s Wide Distribution and Holders

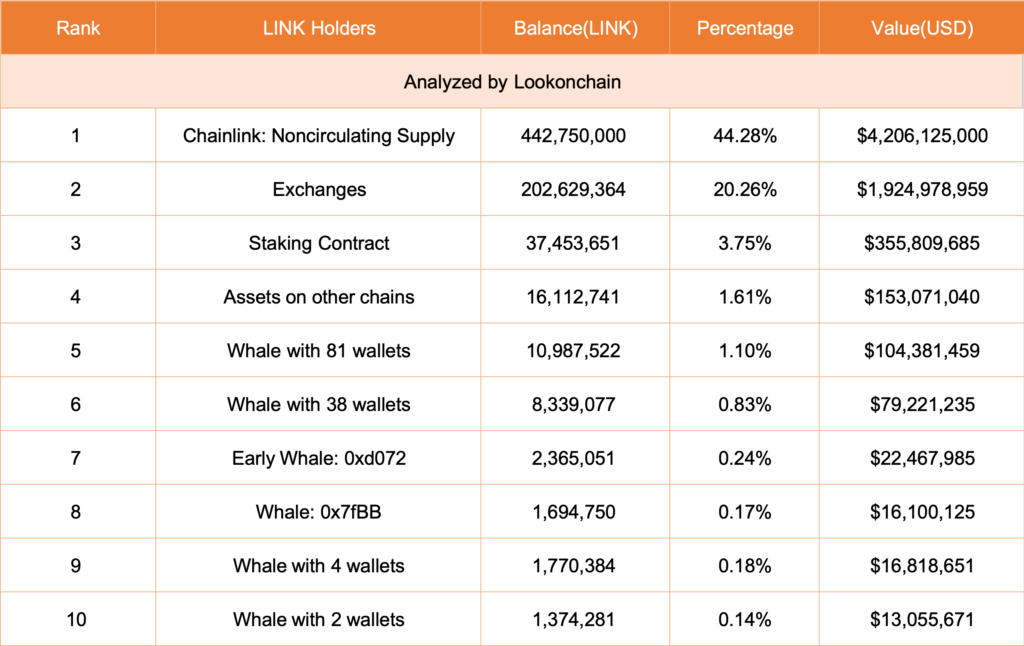

On analyzing the distribution of $LINK:

- Crypto exchanges are in possession of a substantial 202.6M $LINK, approximated at $1.9B, accounting for over 20% of the currency’s total supply.

- An amount of 37.45M $LINK, valued at nearly $355.8M, is staked by enthusiastic holders.

Moreover, there’s a notable presence of influential $LINK whales in the market.

Whale Movements and Their Impacts

A prominent whale, previously identified with 81 addresses, has recently amassed 11M $LINK ($80.32M) from Binance since September 19. Another whale, connected to 38 addresses (potentially even more), began their $LINK collection journey in February. However, a few of these addresses initiated $LINK sales this October.

- Detailed Address List: Google Spreadsheet Link

This particular whale procured 1.25M $LINK ($9.5M) on-chain, averaging a buy rate of $7.58. With the current rates, their profit tallies at a staggering $2.1M. But a word to the wise: Stay alert of these whales, especially when they offload $LINK for gains.

SmartMoney’s Post-Rise Tactics

Following the $LINK price leap, certain SmartMoney wallets, known for capitalizing on $LINK’s price volatility, have adopted a bearish stance. One such entity liquidated their entire 38,381 $LINK holding ($346K) at $9. Subsequently, they borrowed an additional 38,747 $LINK ($369K) from Aave, selling it off at a slightly higher $9.5.

In Conclusion

The world of cryptocurrency is ever-evolving, with market dynamics swayed by major exchanges, whales, and savvy traders. The recent developments around $LINK serve as a testimony, urging investors to stay informed and tread cautiously.