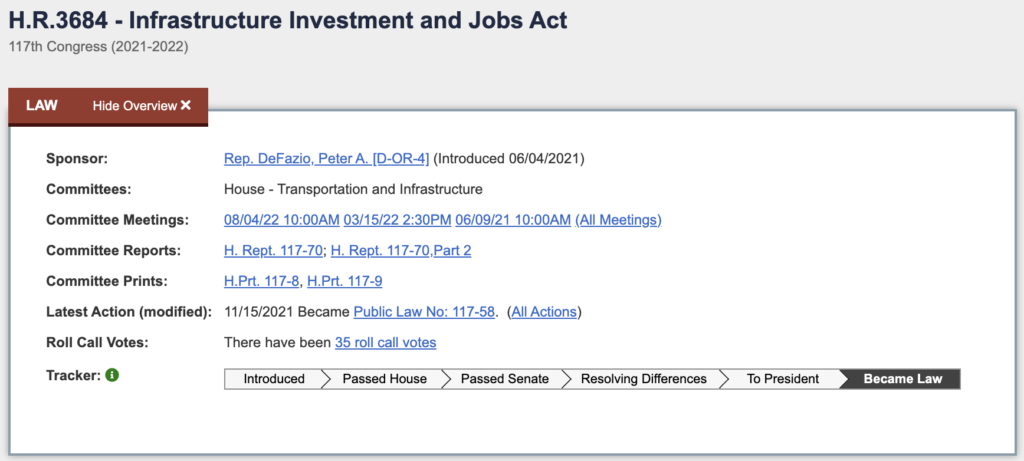

On November 15, 2021, U.S. President Joe Biden officially enacted the bipartisan infrastructure bill, surpassing a significant milestone in his party’s extensive economic agenda. This legislation allocates over $1 trillion, with $550 billion earmarked for new investments in transportation, broadband, and utilities. Biden’s approval comes after years of unsuccessful attempts in Washington to revamp physical infrastructure—an initiative proponents argue will stimulate the economy and generate employment opportunities.

Furthermore, the bill incorporates tax reporting measures pertaining to digital assets such as cryptocurrency and non-fungible tokens (NFTs). This development stirred significant discussion within the crypto industry, with many questioning the potential implications of the bill on the sector. To decode this infrastructure bill crypto conundrum, we have outlined two potential ways in which crypto investors might be affected:

1. Challenges with 1099-B Reporting

A specific clause mandates that every “broker,” predominantly referring to crypto exchanges, must report their cryptocurrency gains using a type of 1099 form. Additionally, brokers are obligated to divulge the identities and addresses of their customers. Detractors express apprehension that the provision’s definition of a “broker” is excessively broad in its current wording. Supporters of cryptocurrency raise concerns that the existing language might inadvertently encompass individuals without customers, who lack access to the requisite information for compliance.

Addressing these concerns, the U.S. Treasury Department announced in August that it will not focus on non-brokers, including miners, hardware developers, and other entities. Nevertheless, cryptocurrency investors will still be affected by this provision. A “broker” or exchange is required to submit a Form 1099-B to both the Internal Revenue Service (IRS) and the customer. The customer utilizes the information from the 1099-B to compute their initial gains and losses, which are then reported on their individual tax return.

Nevertheless, these 1099s are likely to be imprecise for the most part. This is because exchanges lack the ability to track the contents of your self-custody wallet or your activities in decentralized finance (DeFi) applications. In a self-custody wallet, investors possess control over their private keys and cryptocurrency holdings, eschewing reliance on third parties like exchanges. Complications may arise when an investor maintains both self-custody wallets and exchange wallets.

To decode this infrastructure bill crypto confusion, suppose an investor transfers $100,000 worth of Bitcoin from their self-custody wallet to their crypto wallet and subsequently sells the funds. In this scenario, the company behind the crypto wallet must issue a 1099 indicating that the investor sold $100,000. However, the company won’t have information about the investor’s initial purchase price for Bitcoin since the transaction did not occur on the exchange.

Consequently, the company will lack knowledge of the investor’s cost basis, potentially resulting in an inflated 1099. Investors will have to address these discrepancies independently. Upon receiving these 1099s, they may experience a sense of panic, questioning the apparent high gains. To rectify this, they will need to consult with an accountant or utilize a tool to reconcile and accurately report the correct amount. Overall, this might be one of the major infrastructure bill crypto impacts on investors.

2. Cryptocurrency Transactions and Privacy Impact

Another clause broadens the scope of a segment in the U.S. tax code known as 6050I to encompass digital assets. Section 6050I mandates that individuals receiving over $10,000 in cash and equivalents must submit a report to the IRS. This report entails information about the payers, including their names and Social Security numbers. Failure to report details regarding those making payments is deemed a felony offense.

The provision within the infrastructure bill would necessitate businesses and exchanges to follow a similar protocol when they receive cryptocurrency amounts exceeding $10,000. Although it doesn’t directly impose a burden on the end taxpayer, it does affect their privacy. For instance, if you purchase a car using one Bitcoin valued at $60,000, the business selling the car must gather your personal details, such as your name, address, Social Security number, etc., to report this information to the IRS.

In this whole infrastructure bill crypto debate, the surveillance rule has been criticized as impractical and potentially unconstitutional by cryptocurrency advocates, including non-profit organizations. Those involved in the crypto space prioritize privacy and trust, questioning the necessity of providing extensive personal information to these entities. Additionally, there are concerns that certain businesses may lack robust methods to safeguard such private information, potentially resulting in cascading second- and third-order consequences.

Conclusion

Amid this infrastructure bill crypto discussion, note that the stipulations are set to become operative in January 2024, and during this interim period, lobbyists in the cryptocurrency sector intend to advocate for amendments and independent bills to modify the provisions. The provisions within this legislation are primarily aimed at indicating intent rather than detailing specific regulations.

The determination of which entities fall under these provisions rests with the Treasury Department. Analogous to the definition of a ‘broker,’ the Treasury Department will need to offer guidance on the matter. Overall, in the midst of the infrastructure bill crypto conundrum, the industry’s resilience and adaptability will be tested. Investors, businesses, and advocates will play a crucial role in shaping the narrative, striving for a balance that fosters innovation while addressing regulatory imperatives.

Frequently Asked Questions (FAQs)

What does the infrastructure bill mean for crypto?

The infrastructure bill introduces provisions impacting the crypto industry, particularly in tax reporting. It extends reporting requirements to include digital assets, raising concerns about privacy and the broad definition of “broker.”

How does the infrastructure bill affect crypto?

The infrastructure bill affects crypto through provisions mandating tax reporting for digital assets. It introduces challenges in defining “brokers” and includes concerns about privacy as businesses and exchanges must disclose customer details for transactions exceeding $10,000 in cryptocurrency.