- What is Coinbase?

- Coinbase Stock Price Prediction (2023-2060)

- Coinbase Stock Price Prediction 2023

- Coinbase Stock Price Forecast 2024

- Coinbase Stock Price Prediction 2025

- Coinbase Stock Price Prediction 2030

- Coinbase Stock Price Forecast 2035

- Coinbase Stock Price Prediction 2040

- Coinbase Stock Price Prediction 2045

- Coinbase Stock Price Prediction 2050

- Coinbase Stock Price Forecast 2055

- Coinbase Stock Price Prediction 2060

- What is Coinbase’s Business Model?

- Why is Coinbase Important to Traders and Investors?

- Is Coinbase Profitable?

- Conclusion

In the dynamic landscape of financial markets, investors and enthusiasts alike closely monitor the trajectory of cryptocurrency-related assets. Among the key players in this realm, Coinbase, a leading cryptocurrency exchange, holds a significant position. The ebb and flow of Coinbase’s stock price (NASDAQ: COIN) has become a focal point for market observers, sparking conversations about its resilience and potential for recovery.

In this exploration of Coinbase stock price predictions, we delve into the intricate factors influencing the company’s stock performance and seek to unravel the compelling narrative behind its journey in the ever-evolving world of digital currencies. Moreover, we navigate through the complexities of this fascinating financial realm, analyzing trends, market sentiment, and the broader landscape to form educated insights into the potential future trajectories of Coinbase’s stock.

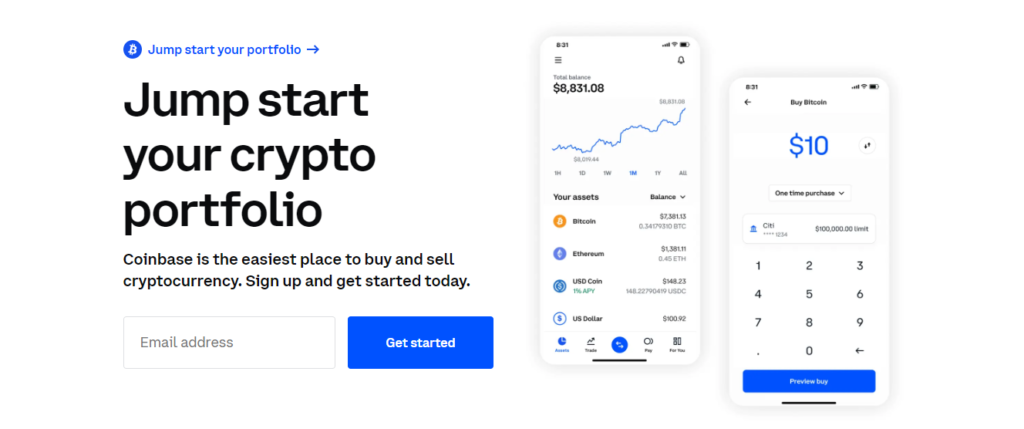

What is Coinbase?

Before navigating through Coinbase stock price predictions, let’s take a look at the overview and history of the company. Established in 2012, Coinbase was created by Brian Armstrong, who had a background as an engineer at Airbnb (ABNB), and Fred Ehrsam, a former trader at Goldman Sachs (GS). Their goal was to provide a straightforward and user-friendly platform, enabling individuals with internet access to securely send and receive Bitcoin (BTC).

Among the initial backers of Coinbase was Y Combinator, a startup fund incubator, along with Union Square Ventures, Andreessen Horowitz, Ribbit Capital, Spark Capital, Greylock, and MUFG. In 2016, Coinbase diversified its offerings beyond Bitcoin by introducing support for Ethereum (ETH), the second-largest cryptocurrency globally in terms of market capitalization. The platform consistently incorporates additional digital coins and tokens to adapt to the increasing liquidity in the market.

In 2018, Coinbase introduced Coinbase Ventures, an early-stage venture fund dedicated to investing in cryptocurrency and blockchain startups. Subsequently, the company has committed investments to over 70 entities, encompassing blockchain protocol developers, decentralized finance (DeFi) projects, decentralized applications (dApps), and non-fungible token (NFT) exchanges. On April 14, 2021, Coinbase’s shares were publicly listed on the NASDAQ through a direct listing, seizing the opportunity presented by the growing enthusiasm for cryptocurrency trading.

The company chose this method over a conventional initial public offering (IPO). In contrast to an IPO, where underwriters issue and determine the pricing of new shares, a direct listing entails executives and other investors directly selling a portion of their shares to the market. In April, the company expanded its services by enabling US customers to purchase cryptocurrencies on Coinbase through the PayPal (PYPL) payments platform.

Simultaneously, the firm disclosed its acquisition of Skew, an institutional data analytics platform, aiming to capitalize on the growing market of institutional investors. By the conclusion of the first quarter in 2021, the company reported holding approximately $223 billion in cryptocurrency assets, securing an 11.3% market share. This total included $122 billion from financial institutions. Coinbase estimated its first-quarter revenues at $1.8 billion, surpassing its earnings for the entire year of 2020.

Coinbase Stock (COIN) Price Prediction (2023-2060)

We’ve compiled insights on the projected trajectory of Coinbase’s stock (COIN) price for 2024, 2025, and 2060. This section provides concise and extended-term predictions derived from technical and fundamental analyses, market sentiment evaluations, assessments of growth potential, and various other valuable information. Furthermore, our comprehensive Coinbase stock price predictions and analysis delve into the macroeconomic factors influencing Coinbase’s stock performance.

Coinbase Stock Price Prediction 2023

Based on prevailing market trends and historical performance, there is a discernible upward trajectory in Coinbase’s profit and revenue. As a result, there is a likelihood that by December 2023, Coinbase stock will be actively traded at $130.99, projecting an average of $125.74. Furthermore, in the event of a bearish market, the Coinbase stock price is anticipated to trade at $120.52.

Coinbase Stock Price Forecast 2024

Projections indicate that the Coinbase stock price is poised to reach a high in 2024, with an estimated average of approximately $140.67. In a favorable crypto market scenario, the trading stock is expected to ascend to a maximum of $145.44, while the projected minimum trading price for the Coinbase stock for the year is anticipated to be $134.90.

Coinbase Stock Price Prediction 2025

Given Coinbase’s commendable performance in the previous year, there is optimism for a positive trend in the market in 2025. According to expert price forecasts, the highest projected Coinbase stock price could reach $170.68, while the anticipated lowest stock price might be $150.55. As per our Coinbase stock price prediction, the estimated average for Coinbase cryptocurrency is expected to be around $160.60.

Coinbase Stock Price Prediction 2030

As per technical experts, the Coinbase platform exhibits significant potential for innovation, including an increase in the number of investors, and advancements in cryptocurrency trends. In such a scenario, there’s a possibility that the stock could surpass the maximum of $349.90 in 2030, with a potential average reaching $324.95, contingent on prevailing market trends. Conversely, if the market experiences low trading, the expected minimum stock price is around $299.98.

Coinbase Stock Price Forecast 2035

Coinbase’s cryptocurrency support extends to over 100 currencies, showcasing consistent growth each year. This suggests that Coinbase could reach new milestones by 2035, with a projected maximum price of approximately $901. There is also an anticipated minimum price of $1001.4. Throughout this period, the average is predicted to hover around $1102, encompassing both the maximum and minimum values.

Coinbase Stock Price Prediction 2040

Over time, Coinbase might encounter various fluctuations in the trading market, whether due to the introduction of a new cryptocurrency platform or a strained relationship between investors and clients. Consequently, the trading stock could experience fluctuations, potentially reaching a minimum price of approximately $2002. Conversely, with improvements in trading stock, the maximum expected stock price might rise to $2089. By 2040, the projected average Coinbase stock price is estimated to be around $2045.3.

Coinbase Stock Price Prediction 2045

By 2045, the Coinbase stock price is situated within the bracket of $2103 to $2176, showcasing an average value of $2139.4. This exceeds expectations, particularly if Coinbase extends its business operations to encompass additional countries. The company’s potential for sustained growth remains promising, making it an intriguing prospect for investors seeking exposure to the dynamic world of digital assets.

Coinbase Stock Price Prediction 2050

According to experts, pinpointing the exact date in a long-term forecast is deemed impossible. However, by examining the initial trading stock and the performance of the previous year, a close approximation can be derived. In this analysis, the projected highest stock price for Coinbase is estimated at $2298, with a potential average of $2272. Conversely, in the event of a downturn in the Coinbase graph, the anticipated low could reach $2246.

Coinbase Stock Price Forecast 2055

As blockchain technology continues to reshape the financial landscape, Coinbase’s proactive approach positions it as a key player in the global cryptocurrency ecosystem. In 2055, there is a potential for Coinbase stock to reach a peak of $2377 and dip to a low of $2315, reflecting both bullish and bearish market trends. Consequently, the average Coinbase stock share is expected to surpass $2346.

Coinbase Stock Price Prediction 2060

As per expert analysis and Coinbase stock price prediction for 2060, the stock graph indicates substantial growth, with the stock price potentially ascending to $2469 and averaging around $2436.6. Conversely, there is a possibility of the stock price declining to $2404. This impressive performance is attributed to Coinbase’s strategic expansions into emerging markets and the continuous adoption of cryptocurrencies worldwide.

What is Coinbase’s Business Model?

After analyzing Coinbase stock price predictions, it is crucial to understand its business model as well. Coinbase’s business model revolves around a diversified suite of subscription services, with a substantial chunk of its revenue—more than 96%—stemming from transaction fees. The company’s financial performance is intricately linked to the trading volumes it facilitates, underlining the significance of its role in the dynamic cryptocurrency market.

Operating on two distinct platforms, Coinbase provides users with a multifaceted experience. The basic Coinbase service functions as a secure wallet, enabling individuals to seamlessly buy and sell various cryptocurrencies. In contrast, the more sophisticated Coinbase Pro service, available in the US, UK, and Europe, caters to the needs of professional traders by offering an advanced trading interface equipped with enhanced features.

The customer journey typically commences with users leveraging the straightforward Coinbase platform for their initial cryptocurrency transactions. Subsequently, as users become more adept, they often explore additional offerings within the Coinbase ecosystem. These include the opportunity to stake coins and tokens, thereby earning interest, participating in savings programs, and even accessing funds through borrowing mechanisms secured against their cryptocurrency holdings.

In this way, Coinbase has strategically positioned itself not only as a gateway for entry-level cryptocurrency enthusiasts but also as a comprehensive financial services provider for those seeking to delve deeper into the expanding realm of digital assets. The company’s diverse offerings underscore its adaptability to cater to the evolving needs of a broad spectrum of users in the ever-evolving landscape of cryptocurrencies.

Why is Coinbase Important to Traders and Investors?

The much-anticipated debut of Coinbase stock on the NASDAQ sparked considerable enthusiasm among investors and traders. This heightened anticipation coincided with a robust surge in cryptocurrency prices, with Bitcoin’s value skyrocketing from $29,000 at the beginning of January 2021 to an unprecedented peak above $63,500 by mid-April. This significant upswing in prices has piqued the interest of investors who previously had little exposure to the cryptocurrency space.

The question arises: Is investing in Coinbase currently a prudent decision after seeing these Coinbase stock price predictions? Opting to trade Coinbase shares provides a strategic avenue for gaining exposure to cryptocurrency markets without navigating the inherent volatility of individual coins and tokens. Moreover, it offers a means to incorporate broad cryptocurrency exposure into an investment portfolio without committing to a specific currency amid the vast array of options available, each with its own unpredictable performance trajectory.

As the landscape of financial transactions continues to evolve and cryptocurrencies garner increased acceptance, the trading activity on Coinbase is poised to experience sustained growth. The platform not only serves as a barometer for the pulse of the cryptocurrency markets but also provides a convenient entry point for investors and traders seeking to navigate the complexities of this burgeoning asset class.

Is Coinbase Profitable?

Examining the profitability of Coinbase and Coinbase stock price predictions is an integral aspect of an investor’s due diligence, as sustained financial success often acts as a linchpin for long-term stock performance. Delving into Coinbase’s fiscal standing unveils pertinent insights. As of the mid-2023 assessment, Coinbase had yet to achieve profitability, disclosing a net loss of $97 million against a backdrop of $663 million in net revenue for the second quarter.

Despite these ongoing losses, the company has demonstrated substantial strides in mitigating its deficits over the preceding year. A noteworthy contributor to this positive trend is Coinbase’s commitment to enhanced financial discipline. The company executed a significant reduction in technology and development expenses, as well as general and administrative costs, primarily through a notable downsizing of its workforce.

Transaction expenses, previously accounting for 21% of revenue, were prudently reduced to 16%, while sales and marketing spending saw a corresponding decrease from 18% to 13%. To sustain and build upon this encouraging progress, Coinbase is tasked with maintaining a strict regimen of expense management while simultaneously reigniting revenue growth. Successfully achieving these objectives is paramount for the company’s trajectory toward profitability, potentially serving as a catalyst for bolstering its stock price over the extended horizon.

As investors weigh the evolving financial landscape of Coinbase, the company’s strategic initiatives and fiscal prudence emerge as pivotal factors influencing the outlook for its profitability and, by extension, its long-term market performance. Therefore, considering Coinbase’s pivotal role in the evolving crypto ecosystem, it presents itself as a compelling option for those looking to capitalize on the expanding acceptance and integration of digital assets into the global financial landscape.

Conclusion

Overall, the journey through the intricate landscape of Coinbase stock price predictions and its underlying business dynamics paints a comprehensive picture of the company’s evolution in the dynamic world of digital assets. From its inception in 2012 to its groundbreaking direct listing on the NASDAQ in 2021, Coinbase has navigated the complexities of the cryptocurrency market with strategic innovations and a diversified suite of offerings.

Coinbase’s resilience in adapting to market trends, evidenced by its commitment to financial discipline and strategic expansions, positions Coinbase as a key player in the global cryptocurrency ecosystem. In the grander scheme, as the financial landscape continues to evolve and cryptocurrencies gain further acceptance, Coinbase stands at the forefront, poised for sustained growth.

The stock price predictions for the coming decades reflect the potential for Coinbase to capitalize on its strategic expansions into emerging markets and the continued adoption of cryptocurrencies worldwide. While the stock price forecasts provide a glimpse into potential future trajectories, it’s crucial to recognize the evolving nature of the cryptocurrency space and the inherent uncertainties and risks that accompany it.