In recent days, Bitcoin (BTC) has experienced a notable surge, reaching a price of $57,000. This surge is particularly significant as it marks the breakthrough of a long-standing resistance level. This resistance level has been held by investors for 2-3 years. The only remaining hurdle ahead is the previous cycle’s high of $68,000.

Bitcoin Prepares to Tackle $68,000 Resistance Level

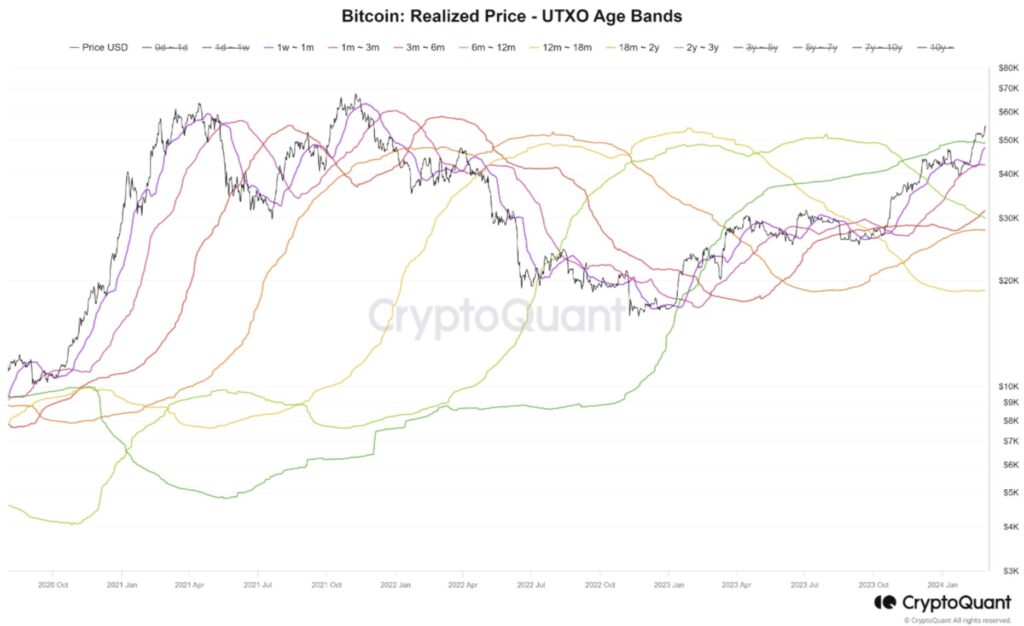

As per CryptoQuant data, the Realized Price – UTXO Age Bands indicator shows the average Bitcoin price based on holding time. This signal indicates that all buyers, especially those who bought during the previous bull run, have paid more than the average price. For investors who have held [ccpw id=60415] for two to three years, the average price is $48,900, the highest. This suggests that investors who entered the market during the last bull run have held their positions for a long time, and the average buying price has been a strong resistance.

Now that Bitcoin’s price has reached $55,000, this resistance appears to have been overcome. The last cycle’s high, $68,000, will be the next major resistance level. Bitcoin is expected to survive economic and cryptocurrency market shocks.

US institutional investors will likely encourage buying, especially through Bitcoin spot ETFs. Bitcoin’s price may rise further with this institutional capital.

If the market falls or corrects, Bitcoin’s price may remain strong. Bitcoin has often recovered faster and stronger from market downturns. Its strength comes from its scarcity and growing popularity as an inflation hedge.

The US launch of Bitcoin spot ETFs is expected to attract institutional investment to the cryptocurrency market. These ETFs give investors Bitcoin exposure without holding it. This makes digital asset investing easier for traditional investors.

Institutional Interest in Bitcoin Grows, Spot ETFs Offer New Opportunities

Bitcoin’s recent $55,000 price increase is a turning point. Bitcoin showed its strength and potential by breaking through two- to three-year-old investor resistance. Bitcoin has strong fundamentals and a promising long-term outlook. Future issues may include macroeconomic uncertainty and market volatility.

As institutional interest grows and new investment products like Bitcoin spot ETFs are introduced, Bitcoin may become even more important as a digital asset and store of value. Bitcoin continues to advance decentralized finance and digital currencies. It was one of the first cryptocurrencies and is strong.