- Key Highlights

- Introduction

- What Banks Does Cash App Use?

- 1. Sutton Bank

- Key Information on Sutton Bank

- 2. Lincoln Savings Bank

- Key Information on Lincoln Savings Bank

- How Does Cash App Work?

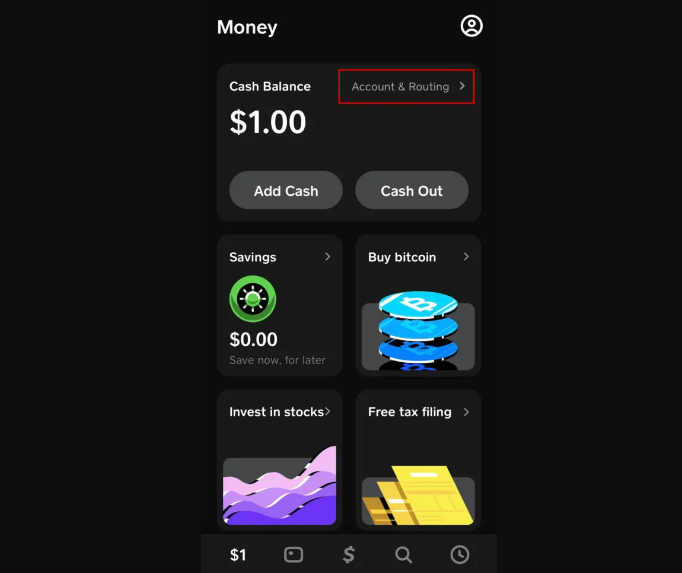

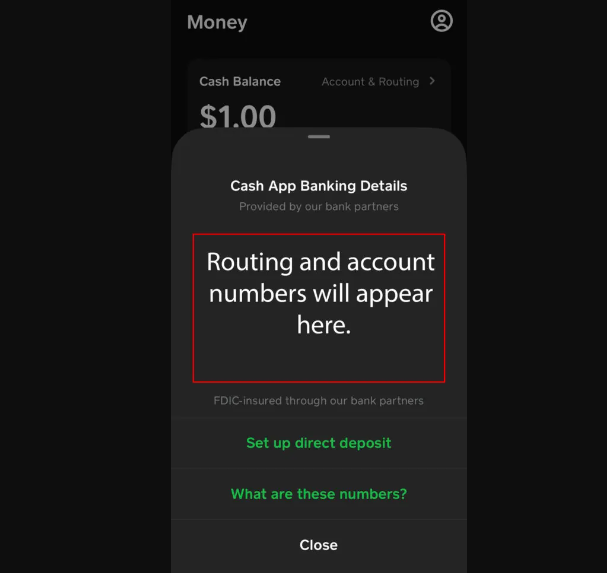

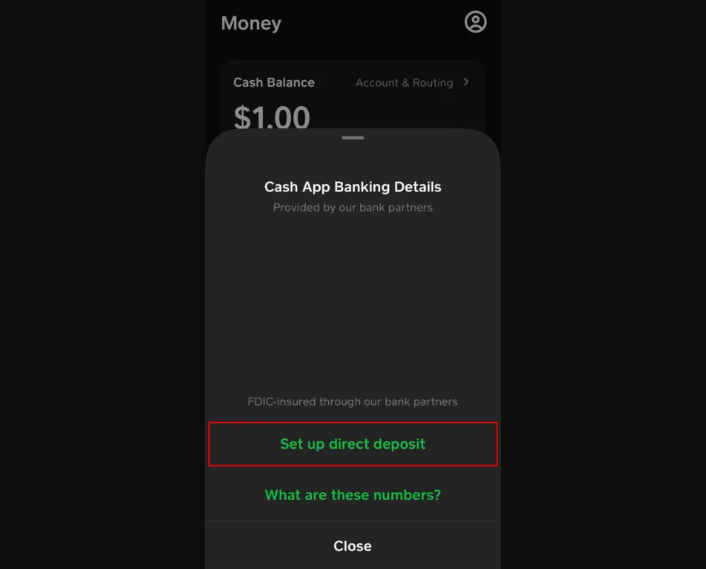

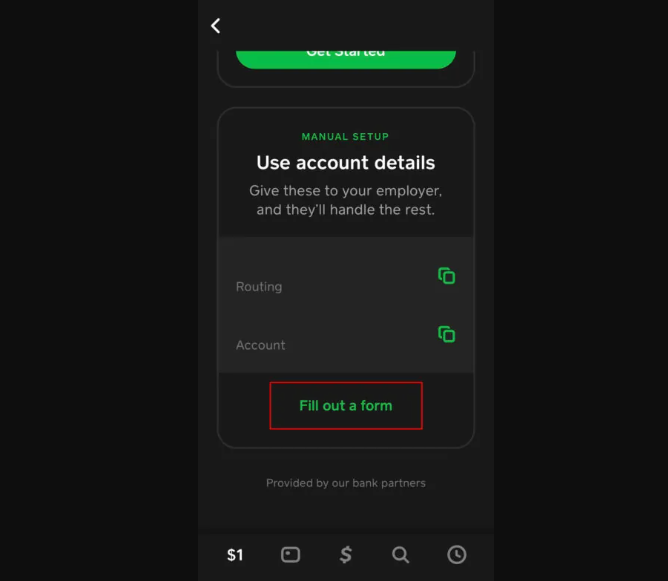

- How To Access Your Money On Cash App

- 1. With a Cash Card

- 2. Without a Cash Card

- Conclusion

- FAQ

Key Highlights

- Cash App uses Sutton Bank and Lincoln Savings Bank for conventional banking services, both of which are FDIC-insured.

- Services include primarily checking accounts, with a strong commitment to community development.

- Cash App functions as a digital-first financial platform, offering services like direct deposits, a proprietary debit card (Cash Card), and FDIC insurance through its banking partners.

- Users can make purchases and withdraw cash directly from their Cash App balance.

- Users can transfer funds to another Cash App user or link a bank account for direct access to funds.

- Understanding the Cash App bank name and address is essential for seamless integration of banking and digital transactions.

Introduction

Numerous individuals are in search of the Cash App Bank name to link their bank accounts and facilitate transactions via Cash App. Whether your goal is to transfer funds to loved ones, settle bills, invest in the stock market, or buy Bitcoin (BTC), Cash App provides a smooth and integrated user experience.

In the course of using the app, there might be occasions when you are required to share your Cash App information, such as the bank name and address, for specific transactions or to comply with verification requirements. This guide explores the process of identifying the name and address of your Cash App Bank, highlighting their importance and relevance.

What Banks Does Cash App Use?

Cash App users can access conventional banking services through two institutions: Lincoln Savings Bank and Sutton Bank. Both of these banks are insured by the Federal Deposit Insurance Corporation (FDIC), ensuring that the accounts held by customers are covered for up to $250,000.

An important detail, other than the Cash App Bank name, to mention is that both banks are privately owned, meaning they do not have shares available on the public stock market. The following are the essential details about each bank that you need to know.

1. Sutton Bank

Sutton Bank, a cornerstone of the Sutton, Ohio community, exemplifies the classic community bank ethos, dedicating its efforts to cater to the financial necessities of individuals, families, and local businesses. This bank, deeply rooted in its commitment to fostering economic health and prosperity within its community, goes beyond mere transactions to build meaningful relationships with its clients.

Sutton Bank remains steadfast in its mission to serve its community with integrity, offering a suite of products and services tailored to the unique needs of its customers. Whether it’s through personal checking accounts, business solutions, or community investment initiatives, Sutton Bank stands as a pivotal institution that nurtures growth and prosperity within its community.

Key Information on Sutton Bank

| Official Bank Name | Sutton Bank |

| Location | 1 S Main St, Attica, OH 44807, standing as a beacon of stability and community support |

| Routing Number | 041215663, a crucial identifier for direct deposits and electronic transactions |

| Account Offering | Primarily checking accounts, designed with the customer’s convenience and requirements in mind |

| Branch Network | A total of 8 branches, ensuring accessibility and personal service across its service areas |

| Financial Standing | Boasting approximately $2.25 billion in total assets, indicating solid financial health and the ability to support community investment |

| Customer Service Contact | Reachable at (800) 422-3641, where a team of dedicated professionals is ready to assist with any needs |

| Online Presence | A comprehensive digital platform at https://www.suttonbank.com/, offering online services and resources to educate and empower its customers financially |

2. Lincoln Savings Bank

The next Cash App Bank name is the Lincoln Savings Bank. It stands as a testament to enduring service and community commitment, with roots stretching back to 1902. This venerable institution has woven itself into the fabric of Iowa’s history, offering a broad spectrum of traditional banking services tailored to meet the evolving needs of its clientele. Through its century-plus existence, Lincoln Savings Bank has championed the principles of reliability, innovation, and community service, distinguishing itself as a pillar in the economic landscape of Iowa.

Lincoln Savings Bank’s commitment to excellence is evident not only in its products and services but also in its dedication to the communities it serves. The bank actively engages in community support and development projects, underscoring its role as more than just an institution but as a true community partner. Whether through personal banking, business solutions, or digital banking innovations, Lincoln Savings Bank continues to uphold its legacy of service, stability, and community involvement.

Key Information on Lincoln Savings Bank

| Official Bank Name | Lincoln Savings Bank |

| Location | Positioned at 508 Main Street Reinbeck, IA 50669, marking a central hub for its operations and services |

| Routing Number | The bank’s routing number, 073905527, facilitates the efficient processing of electronic payments and transactions |

| Account Offering | Primarily focusing on checking accounts, which cater to a range of customer needs from basic to premium services |

| Branch Network | With 16 branches strategically located throughout Iowa, Lincoln Savings Bank ensures accessibility and personalized banking experiences for all its customers |

| Financial Standing | Approximately $1.89 billion in assets, reflecting the bank’s strong financial foundation and its capability to fund various initiatives and loans |

| Customer Service Contact | Customer service can be reached at (800) 588-7551, where knowledgeable staff are available to address inquiries and support customer needs |

| Online Presence | An engaging and user-friendly website at https://www.mylsb.com/ provides customers with the convenience of online banking, resources for financial education, and tools for managing their finances effectively |

How Does Cash App Work?

Cash App, designed and launched by Square Inc., is a peer-to-peer payment platform, distinct from traditional banking institutions. Its operational model is built on strategic partnerships with reputable banks. The Cash App Bank name includes Lincoln Savings Bank and Sutton Bank. This collaborative framework enables Cash App to extend a variety of services to its customers, essentially harnessing the banking capabilities of its partners to power its features.

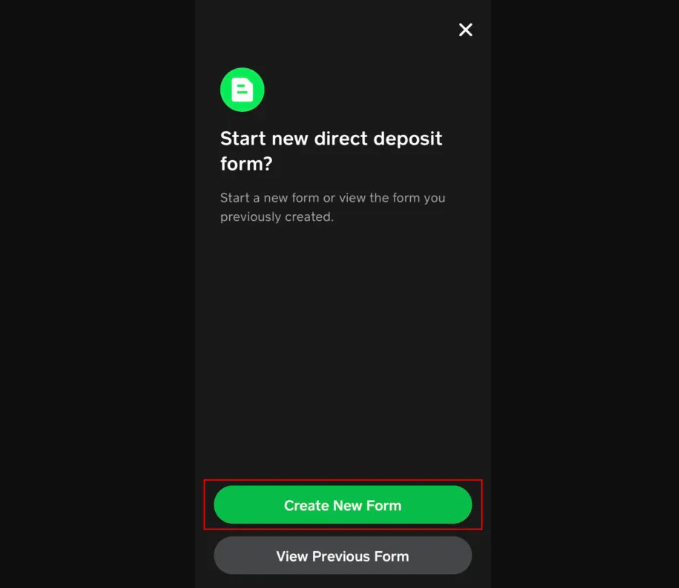

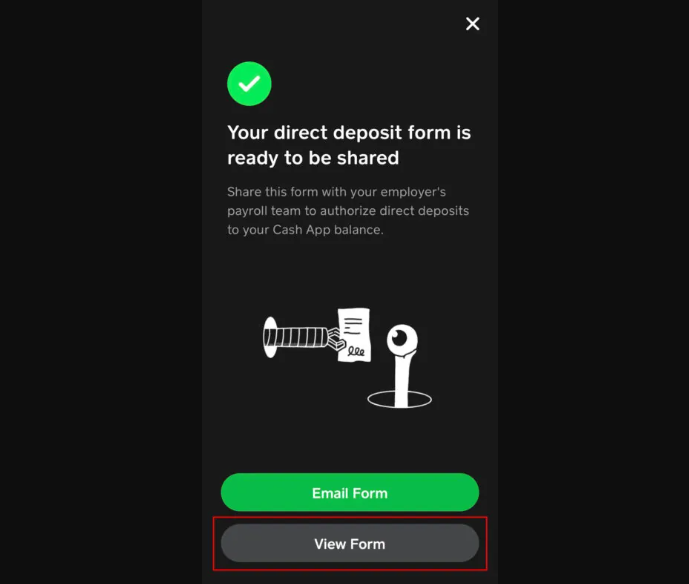

The essence of Cash App’s functionality lies in its ability to offer services akin to those of a conventional bank but through a digital-first approach. This includes facilitating direct deposits, allowing customers to receive their paychecks and other funds directly into their Cash App balance. Moreover, the platform issues a proprietary debit card, known as the Cash Card.

This card empowers customers to make purchases and withdraw cash using the funds in their Cash App account, bridging the gap between digital payments and physical currency. Another pivotal aspect of Cash App’s offering is the provision of pass-through FDIC insurance, courtesy of its banking partners. This ensures that user funds are safeguarded up to the standard maximum limit, mirroring the security measures of traditional banking systems.

Cash App’s ambition doesn’t stop at simplifying payments and transactions; it extends into broader financial services including investment opportunities in stocks and cryptocurrencies like

Bitcoin$85,060.00

In essence, its user-friendly interface, combined with a strong emphasis on security and the convenience of managing diverse financial activities in one application, positions Cash App as a favored option for individuals seeking efficient and secure financial management in the digital era.

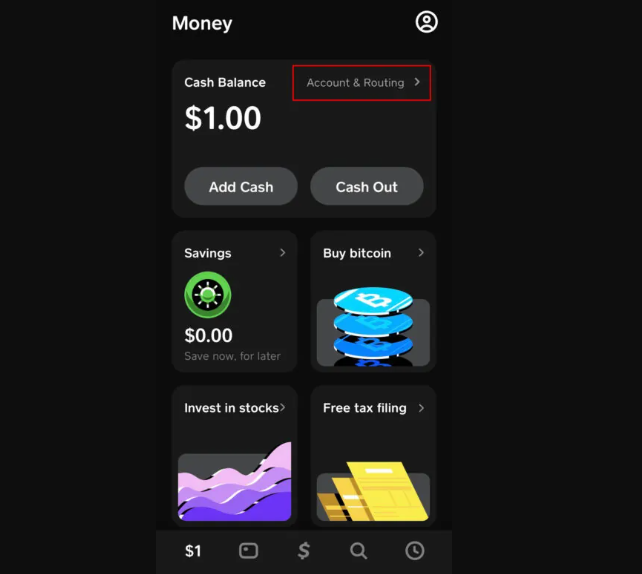

How To Access Your Money On Cash App

Having a bank account is not mandatory to utilize Cash App. While you have the option to link a bank account, it is not a prerequisite for using the app. Additionally, there are several other methods to access funds on Cash App:

1. With a Cash Card

To utilize your Cash Card through Cash App, it’s accepted at any location where Visa cards are welcome. Simply swipe or insert your card as usual for a seamless, cashless transaction. The key difference from a credit card is that the funds are drawn directly from your Cash App balance, meaning there’s no bill to settle later, nor any interest to contend with. At select retailers, you have the option to choose ‘cash back’ during your purchase, allowing you to withdraw an amount exceeding your spending if your balance permits. It’s important to note, however, that transactions attempting to surpass your Cash App balance will not be processed.

2. Without a Cash Card

If you lack a Cash Card but need to withdraw cash from your account, one method is to electronically send the funds to another Cash App user who possesses a Cash Card, allowing them to withdraw the amount for you. This approach can be somewhat cumbersome and should only be considered with a trustworthy individual. Ideally, connecting your bank account to Cash App and transferring the funds directly to yourself is the most straightforward and secure way to access your cash when needed.

Conclusion

Understanding the Cash App bank name and address is crucial for those looking to integrate their banking and digital transaction needs seamlessly. As of 2024, Cash App partners with Lincoln Savings Bank and Sutton Bank, leveraging their capabilities to offer a comprehensive suite of services. These partnerships not only facilitate deposits, Cash Card issuance, and FDIC insurance pass-through but also enhance the platform’s ability to serve as a bridge between traditional banking and modern finance management.

Moreover, Cash App’s accessibility to customers without a bank account and the various ways to access and manage money underscore its flexibility and user-centric approach. Whether through a Cash Card, direct transfers, or innovative peer-to-peer methods, Cash App ensures that customers have multiple avenues to engage with their finances effectively.

Ultimately, Cash App represents a significant advancement in how individuals interact with their money, offering a blend of traditional services and digital innovation. As the platform continues to evolve, it remains a key player in the fintech space, empowering customers with the tools and services needed to navigate the complexities of modern life with ease and confidence.

FAQ

What is Cash App Bank Name?

Cash App utilizes two banking partners: Lincoln Savings Bank and Sutton Bank. Transactions may be processed through either of these institutions depending on the specific features of Cash App you are using.

What is Cash App Bank Name and address?

For Cash App, the banking services are facilitated by two institutions, each with their own address:

- Sutton Bank; Address: 1 S Main St, Attica, OH 44807.

- Lincoln Savings Bank; Address: 508 Main Street Reinbeck, IA 50669.

Why do I need to know the bank name and address for Cash App?

Knowing the bank name and address may be required for setting up direct deposits, automatic payments, or for verification purposes during transactions through Cash App.

What services do these banks provide to Cash App users?

Lincoln Savings Bank and Sutton Bank enable Cash App to offer services such as deposits, issuing of the Cash Card, and ensuring FDIC insurance coverage for user balances.

How can I access my money on Cash App?

You can use a Cash Card at any Visa-accepting location, or you can transfer funds to your linked bank account. If you don’t have a Cash Card, you may send funds to someone who does and can withdraw for you, although it’s generally safer to link your own bank account.

What bank name do I use for Cash App?

Cash App partners with two banks: Lincoln Savings Bank and Sutton Bank. Lincoln Savings Bank handles direct deposits and ACH transfers, while Sutton Bank issues the Cash Card, which is Cash App’s debit card. Cash App partners with Wells Fargo to offer passthrough FDIC insurance.

What is Cash App bank’s name for Plaid?

Cash App partners with Lincoln Savings Bank for its banking services on Plaid. Lincoln Savings Bank is a member of the Federal Deposit Insurance Corporation (FDIC), which means that your funds are insured up to $250,000.

Which country is Cash App bank?

Cash App service allows users to send, receive, and store money within the United States and the United Kingdom. Users can transfer money out of the Cash App to a bank account in their country.