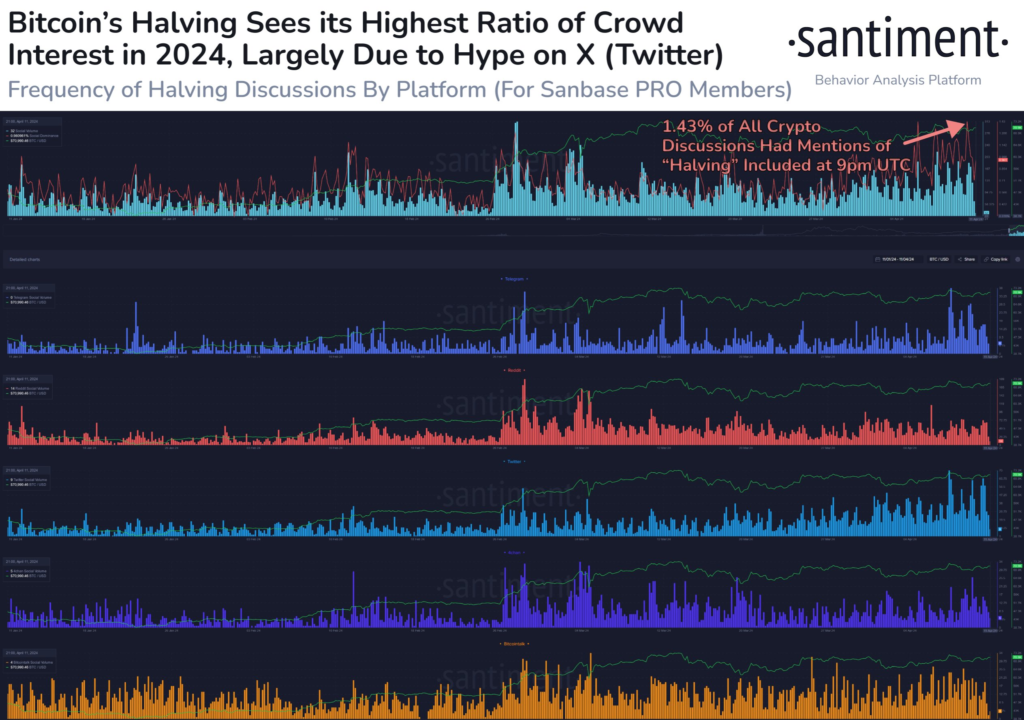

As Bitcoin approaches the much-anticipated halving event, the crypto community’s focus intensifies, reaching a peak in social discussions at an unprecedented level for the year. This final week is crucial for understanding market sentiment and potential price movements in the days ahead.

Understanding Social Dominance and Market Implications

The concept of social dominance in cryptocurrency refers to how much a topic dominates conversations across various social platforms. At 9 PM UTC recently, [ccpw id=60415] upcoming halving became the most discussed topic of the year within the crypto community. Typically, such a spike in social dominance can indicate significant market movements. However, with the markets remaining relatively stable and flat recently, this particular surge in interest may not lead to drastic price changes immediately.

Despite the subdued market reaction, traders and investors should closely monitor these social cues. Historically, heightened discussion around key events like the halving correlates with pivotal price actions—whether bullish reversals or bearish pullbacks.

Price Predictions and Market Strategy as the Halving Approaches

As Bitcoin teeters near its all-time high prices in the next few days, the increased mentions of the halving should be viewed critically. A surge in discussions often signals a Fear of Missing Out (FOMO) among investors, possibly marking a temporary peak in prices. This could be an opportune moment for those looking to capitalize on the ensuing volatility.

Conversely, if Bitcoin’s price begins to decline toward $67,000 and conversations about the halving spike simultaneously, this could indicate Fear, Uncertainty, and Doubt (FUD) among the community. Such scenarios often present buying opportunities for savvy investors who can identify these moments of exaggerated market reactions.

The Dual Edges of Market Sentiment

As Bitcoin nears its halving event, interpreting social trends becomes as crucial as analyzing technical indicators. While the immediate impact on the market may be minimal due to the current stability, the underlying sentiment reflected through social media discussions provides valuable insights. By distinguishing between FOMO and FUD signals, traders can make more informed decisions, potentially gaining an edge in a highly speculative market.