According to CoinShares, digital asset investment products have experienced inflows for the third consecutive week. This week’s inflows total $1.05B. This brings the total year-to-date inflows to a record high of $14.9 billion. James Butterfill, an analyst at CoinShares, detailed these developments in the weekly report. He noted that the recent inflows represent an all-time record for the year so far, driven primarily by significant investments in Bitcoin exchange-traded products (ETPs).

Bitcoin ($BTC) Leads Digital Asset Inflows This Week with Ethereum-brought Positivity

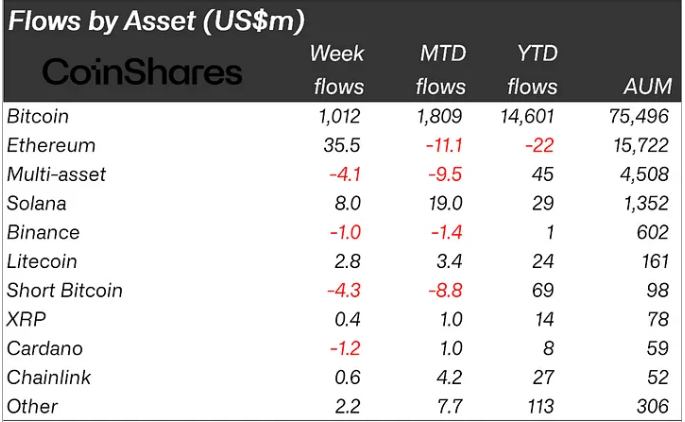

Bitcoin ETPs saw a substantial inflow of $1.01 billion last week, indicating strong investor confidence. Conversely, short-Bitcoin products faced another week of outflows, totaling $4.3M. This trend suggests a broadly positive sentiment among investors, likely influenced by interpretations of the Federal Open Market Committee (FOMC) minutes and recent macroeconomic data.

Ethereum also recorded significant inflows, with $36M invested this week—the highest since March. This surge is likely an early reaction to the approval of Ethereum ETFs in the United States. As a result of this, the whole crypto market remained bullish this week.

Regionally, the majority of inflows were concentrated in the United States, which saw $1.03B of the total inflows. Notably, Grayscale, a major player in the digital asset space, saw its outflows decrease significantly to just $15 million for the week. Germany and Switzerland also contributed to the positive trend, with inflows of $48M and $30M, respectively.

However, the performance in Hong Kong was less optimistic. After an initial positive launch of Bitcoin spot-based ETFs, which saw $300M in the first week, the region experienced outflows of $29 million last week.

Broader Market Trends

The total assets under management for digital asset ETPs have reached $98.5B now, bolstered by recent price increases. Additionally, weekly ETP trading volumes have risen by 28% to $13.6 billion, indicating heightened market activity. Other cryptocurrencies also saw positive movements. Solana, for instance, recorded inflows of $8 million last week, reflecting growing investor interest.

The continuous inflows into digital asset investment products highlight the growing institutional interest and confidence in the cryptocurrency market. With a record $14.9B in year-to-date inflows, the sector is poised for further growth, driven by regulatory developments and increasing investor adoption.