- 1. Bed Bath & Beyond Inc: A Quick Introduction

- 2. Bed Bath & Beyond Inc: Expansion And Collapse

- 3. BBBY Stock: Price History

- 4. BBBY Stock Price Prediction: Technical Analysis

- 5. BBBY Share Price Prediction By Blockchain Reporter

- 6. BBBY Stock Price Forecast: Experts’ Opinions

- 7. Will BBBY Stock Become $0?

- 8. Conclusion

- Bed Bath & Beyond Inc: A Quick Introduction

- Bed Bath & Beyond Inc: Expansion And Collapse

- Chapter 11 Bankruptcy Filing

- Overstock.com Revives BBBYQ Stock

- BBBY Stock: Price History

- BBBY Stock Price Prediction: Technical Analysis

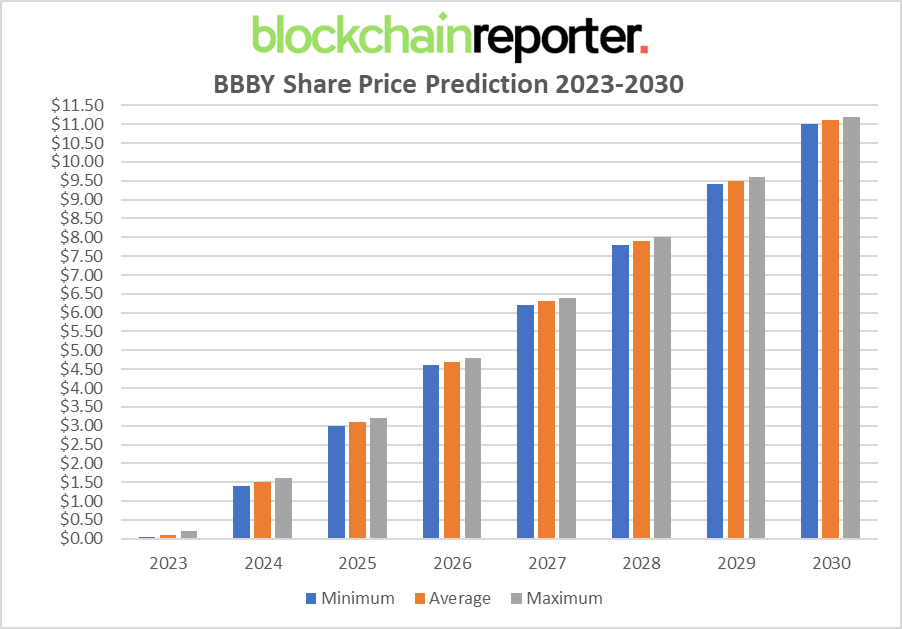

- BBBY Share Price Prediction By Blockchain Reporter

- BBBY Share Price Prediction 2023

- BBBY Share Price Prediction 2024

- BBBY Share Price Prediction 2025

- BBBY Share Price Prediction 2026

- BBBY Share Price Prediction 2027

- BBBY Share Price Prediction 2028

- BBBY Share Price Prediction 2029

- BBBY Share Price Prediction 2030

- BBBY Stock Price Forecast: Experts’ Opinions

- Will BBBY Stock Become $0?

- Conclusion

In the market of American retail, few brands have managed to develop as distinct and enduring as Bed Bath & Beyond Inc. Established in 1971, this iconic brand has become synonymous with home essentials, from the coziest of bed linens to the most innovative of kitchen gadgets. But beyond its vast product offerings, Bed Bath & Beyond represents a significant chapter in the story of American big-box retail chains.

The term “big-box” refers to physically large retail establishments that are often part of major chains. These stores are hallmarks of suburban landscapes, offering consumers a one-stop shop for a wide range of products. In this market, Bed Bath & Beyond emerged as a pioneer, especially in the domains of housewares, furniture, and specialty items. Its expansive store layouts, characterized by wide aisles brimming with a plethora of products, set a new standard for retail in the United States. The brand’s significance in this sector is not just about size or product range; it’s about the experience it made. Each visit to a Bed Bath & Beyond store is akin to a treasure hunt, where consumers can discover new products, innovative solutions for their homes, and even decor inspiration.

This retail giant played a role in shaping consumer expectations, setting trends in home decor and essentials, and even influencing how other big-box retailers structure their customer experiences. In essence, Bed Bath & Beyond is not just a store; it’s a cornerstone of American retail culture. However, in 2023, Bed Bath & Beyond faced significant challenges as the company’s struggles became evident when it was reported that Bed Bath & Beyond might be on the brink of bankruptcy. The news sent shockwaves through the retail industry, and its stock price quickly plummeted. In this article, we’ll explore BBBY stock price, its current market performance with in-depth technical analysis and future BBBY stock price prediction.

Bed Bath & Beyond Inc: A Quick Introduction

Founded in 1971 by Warren Eisenberg and Leonard Feinstein, Bed Bath & Beyond began its journey in Springfield, New Jersey, as a store named ‘Bed ‘n Bath’. The initial concept was simple: provide a vast selection of merchandise for the bedroom and bathroom. However, as the years progressed, so did the vision of its founders. By 1985, the company expanded its offerings beyond the bedroom and bathroom, prompting a name change to the now-iconic ‘Bed Bath & Beyond’.

With a presence in both the United States and Canada, the chain once held prestigious positions on lists like the Fortune 500 and the Forbes Global 2000. However, in April 2023, the company sought protection under Chapter 11 bankruptcy and proceeded to close down all its stores, with the final one shutting its doors on July 30, 2023. Post-liquidation, the brand’s legacy lived on when online retail giant Overstock.com acquired its trademarks in a bankruptcy auction. Additionally, the brand name continues to be in use by its former Mexican division, which now operates independently.

Bed Bath & Beyond Inc: Expansion And Collapse

In 2019, activist investment firms pressured Bed Bath & Beyond for changes, leading to the resignation of CEO Steven Temares and a board restructuring. Amidst declining profits, the company reduced its promotional coupons and announced new private-label brands. By 2019, they operated around 1,530 stores across the U.S. and Canada. In 2021, they ceased selling MyPillow due to poor sales and political controversies.

Throughout 2020 and 2021, the company divested several subsidiaries, including One Kings Lane, Christmas Tree Shops, and Cost Plus World Market. They also announced the closure of over 200 stores, attributing it to the COVID-19 pandemic. In 2022, shareholder Ryan Cohen pushed for the sale or spin-off of Buy Buy Baby, leading to board changes. Significant leadership changes occurred, with Mark Tritton replaced by Sue Gove as CEO. The company also announced layoffs and more store closures.

In September 2022, CFO Gustavo Arnal tragically took his life amidst legal controversies. The company continued its restructuring, announcing further store closures and the shutdown of Decorist.

Chapter 11 Bankruptcy Filing

In early 2023, Bed Bath & Beyond alerted investors about its uncertain future, causing its stock to plummet nearly 30%. Wall Street analysts anticipated a potential Chapter 11 bankruptcy filing. By January 9, the company sought restructuring advice from AlixPartners and announced 62 store closures. Later, in January, the company’s credit line was reduced, leading to the closure of its Harmon Face Values chain, several Buy Buy Baby stores, and numerous Bed Bath & Beyond locations.

In February, Hudson Bay Capital and other investors attempted a public stock offering to raise over $1 billion to prevent bankruptcy. However, the company soon announced the closure of its Canadian division and additional U.S. stores. By March 30th, the company indicated a potential bankruptcy filing if it couldn’t sell $300 million in stock and subsequently ended its fundraising deal with Hudson Bay Capital.

On April 23, 2023, Bed Bath & Beyond, along with its affiliates, filed for Chapter 11 bankruptcy. All remaining stores faced closure unless a buyer emerged. Shareholders were at risk of losing their investments, with liquidation proceeds likely going to secured creditors and bondholders. By early May, the company’s stock was removed from the Nasdaq exchange.

Overstock.com Revives BBBYQ Stock

After filing for bankruptcy, Bed Bath & Beyond ceased accepting their renowned coupons on April 26, 2023, and began liquidation sales the next day. Other retailers, like The Container Store and Big Lots, temporarily accepted these coupons. The company’s downfall was attributed to factors like late e-commerce adoption, decreased product quality, competition, and significant debt from stock buybacks.

In June 2023, Overstock.com purchased Bed Bath & Beyond’s name and intellectual property for $21.5 million. On August 1, 2023, Overstock rebranded and relaunched its website as Bed Bath & Beyond. The buy buy BABY brand wasn’t included in this acquisition and was later auctioned, with its intellectual property pending sale to Dream On Me.

In Canada, after Bed Bath & Beyond’s closure, Doug Putman acquired 21 former locations, intending to reintroduce the brand as Rooms + Spaces. He also launched standalone Babies “R” Us stores in former buy buy BABY locations. Other Canadian locations were taken over by retailers like Mark’s and Spirit Halloween.

Christmas Tree Shops, once a Bed Bath & Beyond subsidiary, filed for Chapter 11 bankruptcy in May 2023 and began liquidation in July, closing its doors in August 2023.

BBBY Stock: Price History

Founded by Warren Eisenberg and Leonard Feinstein in 1971, Bed Bath & Beyond started as a single store in Springfield, New Jersey. The company’s initial focus was on selling bed linens and bath accessories. The stock wasn’t publicly traded during these early years, but the company’s growth was steady and promising.

BBBY stock went public in 1992, and its stock began trading on the NASDAQ. The 1990s and early 2000s were a golden era for the company. The stock price saw consistent growth, driven by aggressive store expansion, a booming housing market, and the company’s ability to fend off competitors. BBBY traded at $1 in 1992, and it started climbing in 1996 and touched the $10 mark in 1998. The price made a skyrocketing pump in 2000 and reached $31 by mid-2001.

By the mid-2000s, BBBY had become a household name, with hundreds of stores across the U.S. and a burgeoning online presence. The stock reached its all-time high during this period, making it a favorite among investors. BBBY stock price continued its surge and touched as high as $45 in 2005 and maintained a bullish trade within that range. However, it started facing selling pressure in 2006 and made downward fluctuations toward $30.

The global financial crisis of 2008 was a turning point for many retailers, including BBBY. The housing market crash directly impacted the home goods sector, leading to reduced consumer spending. By the end of 2008, BBBY stock declined to $20 following a massive selloff among investors. However, from 2009, BBBY stock made a skyrocketing surge, and with minor fluctuations toward $60, BBBY stock reached a high of $80 in 2014.

The rise of e-commerce giants like Amazon and the changing retail landscape posed significant threats. BBBY struggled to adapt to the digital age, leading to declining sales and a shrinking market share. The stock price reflected these challenges, with a steady decline observed over the years. After 2015, BBBY’s share price made a heavy decline and dropped below $40 in 2016. It made further declines due to the COVID-19 pandemic and low business model as it touched the ground at $4 in 2020.

However, in 2021, BBBY made concerted efforts to turn its fortunes around. The company made a strategic transformation plan, focusing on digital integration, store optimization, and enhancing the overall customer experience. These efforts, combined with a renewed focus on exclusive brands and partnerships, started to bear fruit. The stock showed signs of recovery and reached a high of $35 in 2021. However, the bankruptcy filing wiped out its shareholders, and the BBBY stock price once again dropped, and this time, it touched below $0.5.

BBBY Stock Price Prediction: Technical Analysis

Recently, the BBBY share price experienced a minor bearish trend, which has forced buyers to exit near the resistance level. However, the price has been attempting to stay in a bullish region. After surging above the $0.03 mark, BBBY shares sparked intense buying pressure and surged exponentially. The stock market was previously heavily influenced by rising inflation and the company’s bankruptcy filing; however, the recent acquisition made a minor recovery, as seen on the daily price chart, and maintained its price momentum. However, bears are currently in a move to create significant downward pressure, but the share price has managed to hold an uptrend and is now trading above the bearish territory of $0.04. A thorough technical analysis of BBBY share price reveals mixed indicators, which may either send the price to new lows or highs.

According to TradingView, the BBBYQ share price is currently trading at $0.11, reflecting a decrease of 1.2% in the last 24 hours. Our technical evaluation of BBBY stock price indicates that the current bearish momentum may soon fade as bulls are attempting to reverse the trend from the upcoming support at $0.04; however, bears are trying to prevent the price from surging above the immediate resistance of $0.18. Examining the daily price chart, BBBY’s share price has found support near the $0.04 level, from which the price gained bullish momentum and broke above multiple Fib channels. As BBBY’s price failed to trade above the EMA20, bears are gaining confidence to open short positions and send the stock price to test its support level. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.25 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of BBBY shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a surge as BBBY’s share price is attempting to hold buyers’ demand. The trend line is currently hovering below the midline as it trades at level 41, hinting that an upward correction is on the horizon. It is anticipated that BBBY’s share will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $0.18. If bears fail to plunge below the current 0.038 Fibonacci region, a skyrocketing trend might be on the horizon.

As the SMA-14 continues its swing by trading at 34, it trades way below the RSI line, potentially holding concerns about the stock’s downward movement on the price chart. If BBBY shares make a bullish reversal, it can pave the way to resistance at $0.18. A breakout above will drive the share price toward the upper limit of the Bollinger band at $0.39.

Conversely, if BBBY fails to hold above the critical support zone of $0.04-$0.06, a sudden collapse may occur, resulting in further price declines and causing the BBBY shares to trade near the Bollinger Band’s lower limit of $0.021. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $0.01.

BBBY Share Price Prediction By Blockchain Reporter

BBBY Share Price Prediction 2023

In 2023, BBBY’s share price is projected to maintain an average of around $0.1. The minimum price is expected to hover around $0.04, while the maximum could reach up to $0.2. These estimates are based on BBBY’s potential market strategies, its ability to adapt to changing consumer preferences, and the overall economic conditions.

BBBY Share Price Prediction 2024

Moving into 2024, BBBY’s share price is anticipated to experience a positive shift, averaging at about $1.5. The potential low for this year could be around $1.4, while the upper limit might touch $1.6. This forecast is based on the assumption that BBBY’s innovative approaches and potential market expansions will continue to attract more investors.

BBBY Share Price Prediction 2025

By 2025, BBBY’s share price is predicted to further increase, with an average of $3.1. The minimum value might be set at $3.0, and the maximum could soar to $3.2. The growth is expected due to the company’s continuous efforts to enhance its furniture offerings and potential international market penetrations.

BBBY Share Price Prediction 2026

In 2026, the share price for BBBY is projected to be $4.7 on average. The minimum and maximum values could be $4.6 and $4.8, respectively. The company’s collaborations and technological integrations might play a pivotal role in this projected growth.

BBBY Share Price Prediction 2027

For 2027, BBBY’s share price might witness an average value of $6.3. The potential low and high for this year could be around $6.2 and $6.4, respectively. The company’s move to market changes are expected to drive this growth.

BBBY Share Price Prediction 2028

By 2028, the company’s share price is anticipated to be $7.9 on average. The minimum and maximum values might hover around $7.8 and $8.0, respectively. BBBY’s mergers and acquisitions could be a significant factor in this upward trajectory.

BBBY Share Price Prediction 2029

In 2029, BBBY’s share price could be $9.5 on average. The potential low and high for this year might be $9.4 and $9.6, respectively.

BBBY Share Price Prediction 2030

Concluding the decade, in 2030, BBBY’s share price is projected to maintain an average of $11.1. The minimum price might be around $11.0, while the maximum could reach up to $11.2. The company’s long-term vision and its commitment to stakeholder value and the e-commerce market are expected to be the catalysts behind this growth.

BBBY Stock Price Forecast: Experts’ Opinions

Analysts providing a 12-month price prediction for Bed Bath & Beyond Inc. set a target at $2.00. This target is consistent, with both the highest and lowest estimates being $2.00. Compared to the recent price of $0.11, this suggests a potential increase of +1,718.18%. Currently, the consensus from the one surveyed investment analyst is to sell Bed Bath & Beyond Inc.’s stock. This recommendation has remained unchanged since June.

Based on projections from 5 brokerages, the share price for BBBY is expected to fall between $1.50 and $7.50. The average forecast for the next year is $3.25, indicating a potential rise of 2,854.5% from its present value.

Will BBBY Stock Become $0?

The stock has plummeted nearly 99% from its high, trading under $0.5. Several factors contribute to this decline, with the primary one being its financial downturn. The company’s annual revenue dropped from $12.2 billion in 2017 to $7 billion in fiscal year 2022, and it’s projected to decrease by another 30% in fiscal 2023.

From the second quarter of fiscal 2020 to the first quarter of fiscal 2021, the company was on a recovery trajectory as the impact of the pandemic lessened. However, consumer spending on non-essential items significantly decreased last year. To clear out inventory, the company offered substantial discounts, which adversely affected its gross margins.

The accompanying chart clearly shows the decline in revenue, gross profits, operating income, and net income. This explains the drastic 99% drop in BBBY’s share price over the past 24 months.

Bed Bath & Beyond hasn’t seen a full-year profit since 2017. Beyond the declining net income and revenue, the alarming state of its cash reserves is of significant concern.

The company faces a $1.5 billion interest payment on its debt come February 1, but there’s a strong possibility it might defer this payment to preserve cash. Should they choose this route, a 30-day grace period will commence. Taking a page from AMC Entertainment’s playbook, the management attempted to address some of its debt by offering shares in exchange, but this approach was largely rebuffed. The initial segment of their $300 million debt is due in August 2024, and it seems improbable that the company will manage to settle it.

Many analysts have ceased their coverage of the stock, deeming it of minimal institutional significance. Currently, there are no endorsements to purchase the stock, with analysts suggesting that Bed Bath & Beyond shares might only be worth ten cents.

Conclusion

Bed Bath & Beyond, once a favored retailer, has faced significant financial challenges, leading to its filing for Chapter 11 Bankruptcy protection on April 23, 2023. This development has left many customers pondering the future of their shopping experience with the brand.

Questions arise, such as the duration stores will remain operational and the viability of online shopping. A prevalent query is the continued acceptance of Bed Bath & Beyond coupons. As the company undergoes its wind-down process, shopping dynamics at its 360 stores will inevitably change. However, customers can still avail themselves of online and in-store discounts ranging from 10% to 30% at both Bed Bath & Beyond and its 120 buybuy BABY locations.