Bitcoin mining difficulty and hash prices continue to rise, pushing miners to the final capitulation zone by selling off holdings and mining rigs.

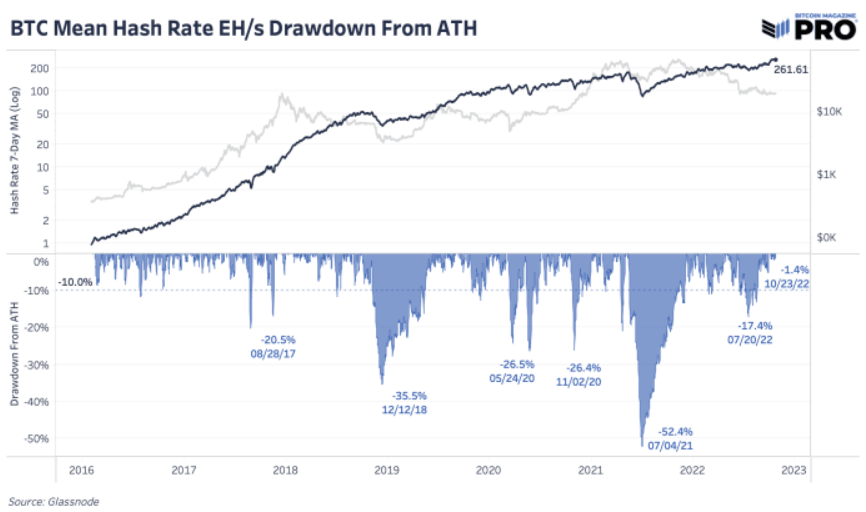

The Bitcoin mining industry continues to face rough times this year as Bitcoin price fails to bring any ray of hope. The energy costs in North America and Europe are making exponential rises, adding more bearish woes for Bitcoin Miners. On October 23, Bitcoin mining difficulty made an upward rise of 3.44%, creating another all-time high since 2020, with the hash price continuing to rise. It now seems that Bitcoin is going to repeat the same historical progress of 2018.

Biggest Intra-Risk For Bitcoin Miners

Several macroeconomic factors have negatively affected the crypto industry as well as the mining industry. The FED’s recent interest rate hike and unexpected inflation data acted as catalysts to plunge the Bitcoin world hard to the bottom. Therefore, monitoring the on-chain activity of a leading digital asset like Bitcoin is essential to predict the current crypto market’s sentiments. Furthermore, the upcoming FOMC meeting on November 2 will play a vital role in controlling the momentum of the entire crypto space as it is correlated with the general stock market.

Bitqs digital money:

Bitqs digital money is another cryptographic money that utilizations distributed innovation. Bitqs are intended to pay for labor and products while offering some benefit through admittance to extra highlights and usefulness. Merchants and shoppers can utilize Bitcoins to pay for delivery and products, which they can use on any internet-based stage.

Bitqs digital currency has been planned without any preparation for the advanced period of blockchain innovation. It offers security insurance through different novel advances, including zero-information verifications.

Bitqs have a few distinct purposes, including:

• They are giving admittance to extra highlights and usefulness.

• You are paying for labor and products (merchant side).

• They were utilizing Bitqs coins for their purposes (shoppers’ side).

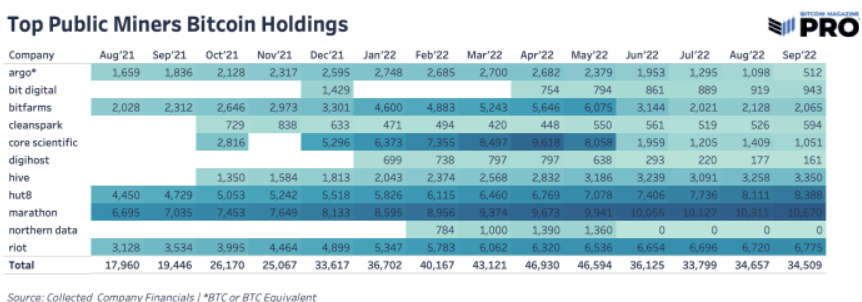

According to data, public Bitcoin holdings once reached 46K BTC, but it has since dropped by 26% as a significant amount of Bitcoins were sold to fund operations, clear debts, and execute further expansion. Through estimated data, the top public miners of the Bitcoin network control over 20% of Bitcoin’s hash rate.

Therefore, any negative move from public miners will eventually lead to an increase in hash rate, mining difficulty, and more downfall in Bitcoin’s price. However, the latest spike in mining difficulty is not significant, as the mining industry previously witnessed a spike of 13.55% on October 10.

Bitcoin Miners Are At The Final Capitulation Zone

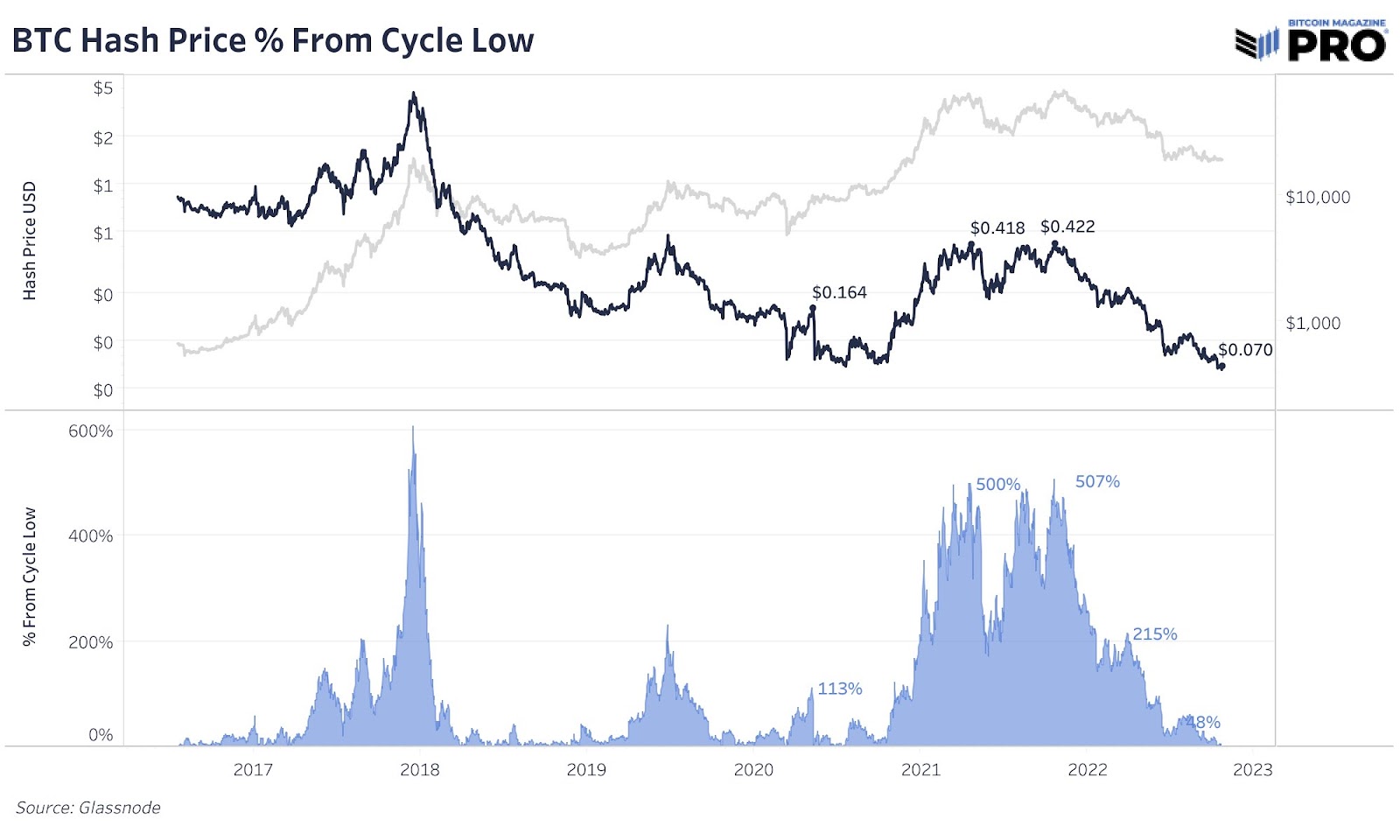

The continuous rise of Bitcoin mining difficulty and the hash price will eventually force miners to sell off their holdings and mining rigs to make up a fraction of their losses amid the bearish crypto market trend. The increasing mining difficulty will create more pressure on industrial miners to continue their same mining profitability from the Bitcoin market. Will Clemente, the co-founder of Reflexivity Research, said, “Miners are the biggest intra-Bitcoin market risk right now, IMO.”

According to him, this situation is pre-planned as well-funded players are controlling the market and trying to eliminate low-cap ineffective miners from the network and buy their assets at a cheap rate. Clemente said, “Thinking about who this entity(s) is that feels that it’s advantageous to mine with BTC price down 70%, energy prices high, & hashprice at all-time lows. Wonder if it is a large player(s) with excess energy or access to dirt-cheap energy. Miner margins are so compressed right now, and it isn’t a great time to be mining on a short to mid-term basis.”

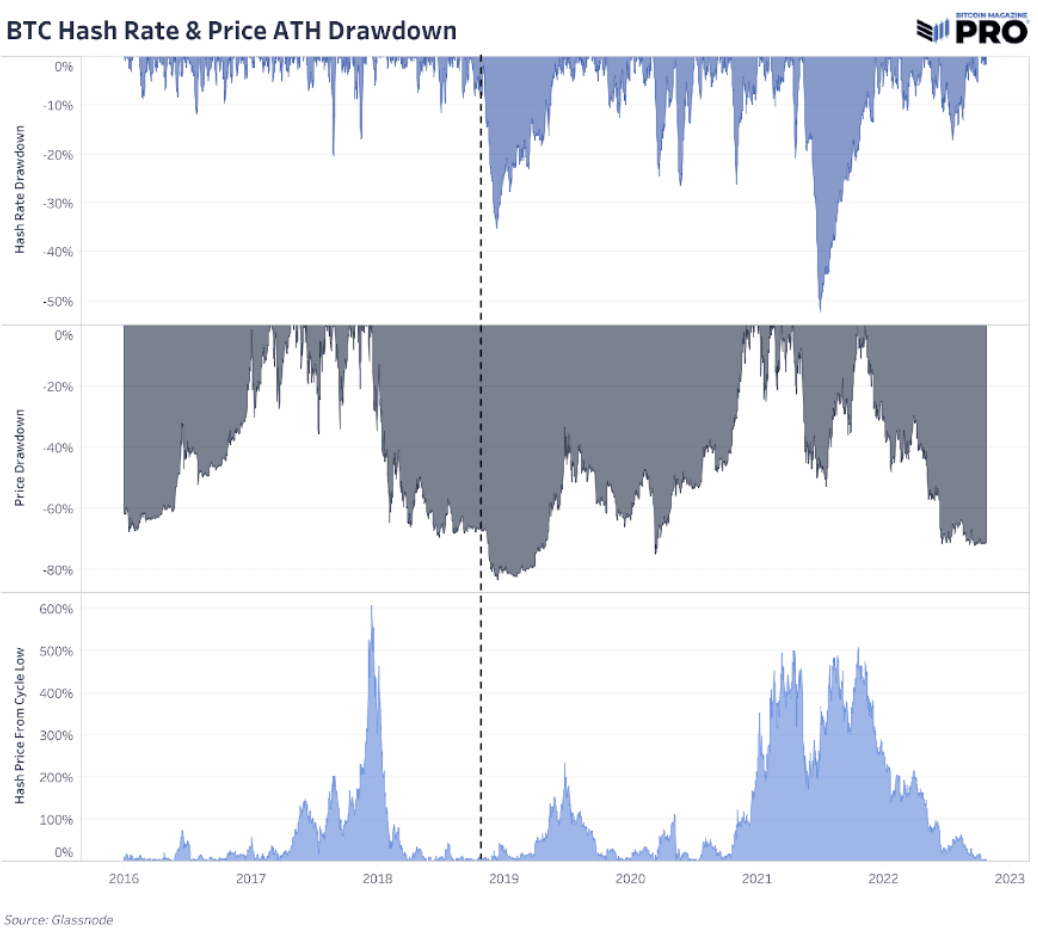

Furthermore, it is to be highlighted that the revenue of miners has touched the bottom since 2020. Dylan LeClair, a senior analyst at UTXO Management and co-founder of 21stParadigm, mentioned that Bitcoin miners’ revenue per TeraHash has touched the lowest since 2020. The current mining situation may lead to two scenarios as he said, “This is the bottom. The lack of vol shows apathy from sellers. Extended consolidation/accumulation period, or we are at 6k level in 18/19. Hash rate continues to soar, increasing pressure on miners until ultimate puke.”

Final Words

However, the final bottom is poised to happen if the current Bitcoin mining graph follows 2018’s scenario. If history repeats, we may see a bullish reversal of Bitcoin’s price along with profitability, as indicated by the comparison of both charts.

Since May, the crypto market’s bearish trend slumped hard, and the volatility of Bitcoin made its lowest which has muted the hype of the crypto space. Since June, the hash rate also made a steep decline as some large-cap miners deployed advanced mining machines like Bitmain Antminer S19 XP to increase their profits amid the crypto winter.