- Bitcoin Satoshi Vision: Showcasing An Unparalleled Performance

- Bitcoin SV Price Prediction: Price History And Technical Analysis

- Bitcoin SV Price Prediction: From Industry Experts

- Will BSV Be A Profitable Investment? What Is The Right Time To Dive In?

- Conclusion

Bitcoin SV is the new decentralized finance (DeFi) avatar of Bitcoin. According to our Bitcoin SV price prediction, it can spike anytime soon and make investors wealthy. So, let’s know about its future potential from our BSV price prediction.

Bitcoin Satoshi Vision: Showcasing An Unparalleled Performance

Bitcoin SV is an incredible coin after Bitcoin Cash (BCH), the second largest fork of the Bitcoin network, launched on 15 November 2018. This coin was created to restore the original Satoshi protocol to keep it stable and scale massively. As a result, its transaction cost is cheap, excellent performance, guaranteed security, and incentives for the investment firms and the miners.

BSV is being developed under the guidance of Craig Wright. A hard-hitting Australian scientist and Bitcoin evangelist noticed the scalability problem and, therefore, increased the block size to 128Mb. Now he claims that his cryptocurrency is “the only real Bitcoin” – just as Satoshi Nakamoto conceived it (hence the name SV, which stands for Satoshi Vision).

The coin’s main objective is to retain practically all initial Bitcoin. When considering what BSV entails, it should be noted that this coin is entirely directed toward the concept stated by Satoshi Nakamoto, the digital currency’s inventor, in the whitepaper for Bitcoin. Bitcoin SV has identified the accessibility issues and solved them by implementing a hybrid consensus mechanism. A unique feature of BSV is that it can detect fraudulent or spurious transactions by peers wherein a confirmed block is capable of tracing the preceding block. Furthermore, the use of BSV is increasing in gaming and gambling especially in the casinos not on GamStop.

| Cryptocurrency | Bitcoin SV |

| Symbol | BSV |

| Price | $58.80 |

| Price Change 24h | +4.19% |

| Price Change 7d | +11.44% |

| Market cap | $1,107,631,524 |

| Circulating Supply | 19,120,558 BSV |

| Trading Volume | $74,764,373 |

| All time high | $491.64 |

| All time low | $36.87 |

| Bitcoin SV ROI | -34.06% |

The gains from the Bitcoin Foundation also depend upon BSV the community benefits. Through this foundation, the platform gets generous contributions and a thriving number of members. The platform also has workgroups created by members sharing their experiences and helping you understand the functionalities better. As Bitcoin SV is based on cryptographic methods, the platform is entirely reliant on zero-disclosure evidence. The mathematical consistency of the entire blockchain-enabled transaction helps cross-check without revealing any data or message of any party involved in the transaction. Bitcoin SV developers (BSV) also have exceptional features like brainstorming ideas on this platform that promote active discussion on BSV. Let’s look at its module and features.

- The execution of every transaction is displayed on all nodes.

- Every node imitates the transactions that have been executed on the block.

- Each node wants solutions to the relevant block’s mathematical task.

- The block is sent to every node once the answer is approved.

- The node allows a block if every operation is legitimate and has not been completed.

- The nodes admit and permit the block, and work on generating a new block on the blockchain begins.

- The previous block’s hash accepted is employed as the preceding one.

- BSV scaling network allows exceeding 9,000 transactions per second

- BSV beats BTC in terms of transaction cost as its transaction fees are lower than other cryptocurrencies in the market.

Bitcoin SV Price Prediction: Price History And Technical Analysis

In 2019, when Bitcoin was pushing its price rally to new highs, BSV’s price also spiked. The coin got momentum and touched an all-time high of $95 that year. The impressive rally continued with marginal corrections; later, BSV showed a massive retreat in September 2020.

BSV opened trading in 2021 with a price set at $163, and it is currently trading at $58. On 30 June 2022, the price crashed and went from $57 to $52. After that, however, the market started to pump, and BSV regained most of its value.

Our Bitcoin SV price prediction reveals that the market’s volatility is following an aggressive movement. The Bollinger’s band’s upper limit is $68.1, acting as a strong resistance; we can see a price up to $75 if it is broken. Conversely, Bollinger’s band lower limit is $46.8, which is the most substantial support for BSV. We can see a sharp downfall to $35 if the support is broken.

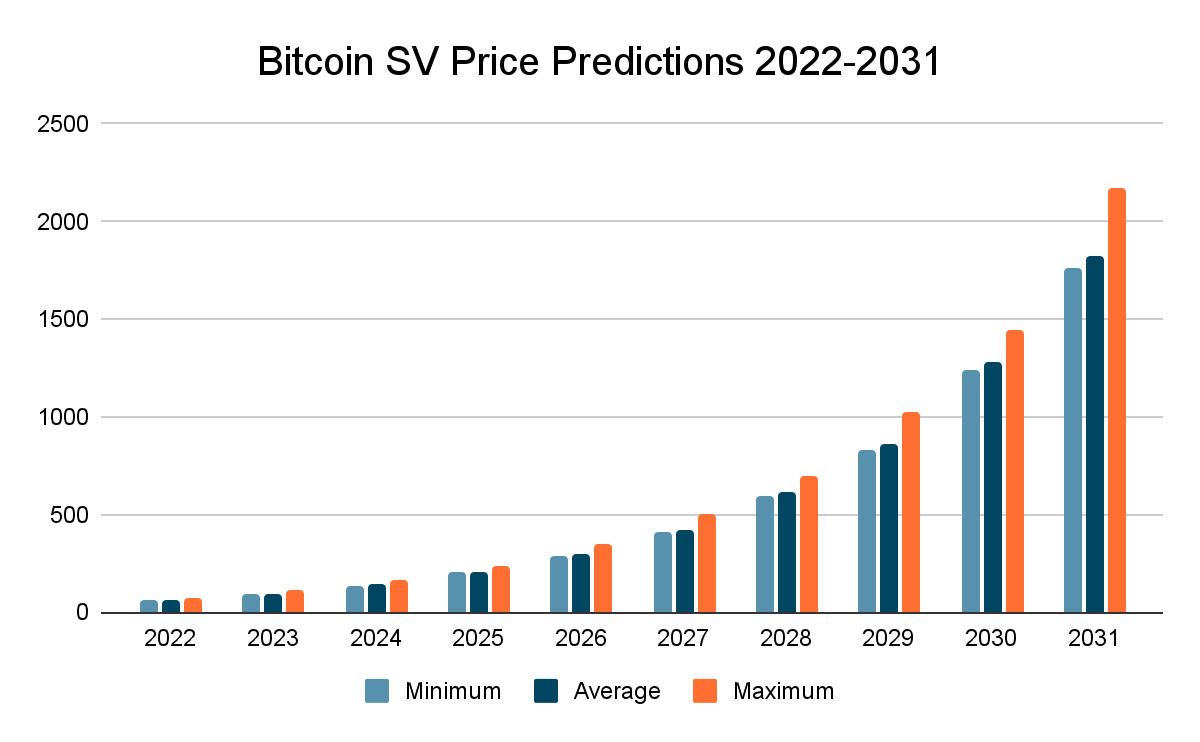

By the end of 2022, BSV price has a maximum value of $72.45 that it may achieve. It may start pumping up in 2023, and we can expect a price of $200 in 2025. BSV developers are constantly embedding new features and upgrades to this coin, and we can predict a bright future for this coin as it may touch the $1000 mark by the end of 2030.

Bitcoin SV Price Prediction: From Industry Experts

Wallet Investor’s BSV price prediction says that a long-term increase is expected. The price prognosis for this year is around $60.

Based on CoinSwitch’s Bitcoin SV price forecast, BSV might go through numerous advancements and progress over the next five years. By the end of 2025, BSV might soar up to reach as high as $750

As per Trading Beasts, BSV is going by what it was in the past. BSV/USD sounds highly bullish as it has shown a reliable consistency. By December 2022, the price of Bitcoin SV should easily swing around $88.096.

Will BSV Be A Profitable Investment? What Is The Right Time To Dive In?

This coin can be a profitable investment option as Bitcoin backs it. The price will touch new highs in the upcoming years. A price range of $45 may be a good deal to invest in for maximum gains.

Conclusion

Investment in BSV may be rewarding as it has a great future waiting in the pipeline. It will spike next year and can be a good investment in the long term. The main fact about BSV price is patience, as it might change direction due to fluctuations in the market. Also, investors must be cautious while entering at a price point and do their own research because indicators always keep changing.