What Is Decentralized Finance (DeFi) ?

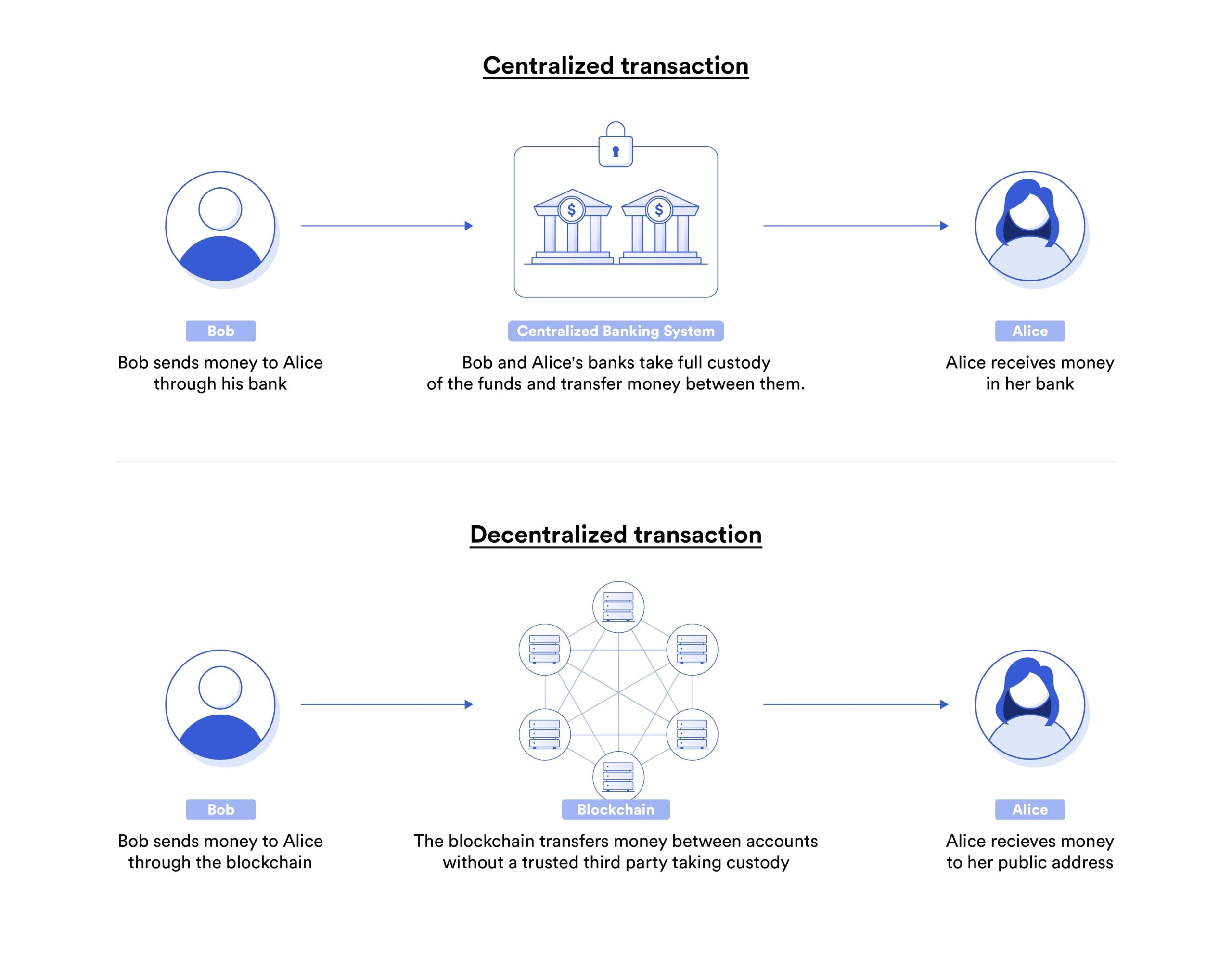

DeFi (Decentralized Finance) is a new type of financial technology that uses secure distributed ledgers, like those used by cryptocurrencies. It is an emerging financial technology. DeFi eliminates banks and other institutions of their control over money, financial goods, and financial services.

Financial products and services housed on blockchain networks are referred to as decentralized finance. DeFi differs from traditional finance in that it is decentralized, with no single authority setting rules and terms. Many DeFi services are community-driven, allowing DeFi network members to vote on how financial services are delivered.

Lending and borrowing, insurance, staking money for returns or interest, and other DeFi services are available. The objective is to completely eliminate the need for intermediaries and organizations like banks. DeFi’s operation is based on smart contracts. Smart contracts are self-executing programs that take action when particular conditions are satisfied. A DeFi smart contract, for example, will pay out a predetermined quantity of money based on how much someone has staked on a lending platform, without the need for human intervention.

How Does DeFi Work?

DeFi (decentralized finance) functions by making use of cryptocurrencies and smart contracts to eliminate the need for any third parties or intermediaries in the financial sector. In the finance sector today, there are top dogs like the financial institutions or entities who act as a middle man for you when you want to transact, giving them the power to seize the delay of your transactions or not even make it go through.

Meanwhile, in the DeFi world, instead of these top dogs, decentralized finance makes use of cryptocurrencies and smart contracts. Cryptocurrencies are what you spend and earn in the DeFi world. Smart contract is the tech at the back end that eliminates the need for third parties. An example of a smart contract is Ethereum; this is a smart contract that can hold, send and receive funds based on certain conditions.

A smart contract is programmable to execute based on requirements automatically. It is simply – if this, then that. That is. A smart contract can be programmed that if Bob deposits $5 every day, pay him $50 every weekend. Smart contracts are on the blockchain, so they are transparent and can’t be altered or changed from how it has already been programmed.

Benefits Of DeFi

Permission-less

As long as one has a crypto wallet coupled with an internet connection, they can access DeFi services, regardless of their location. One can also make trades or move assets wherever or whenever they want, without having to wait for any central authority to approve or disapprove the transaction.

Interoperability

DeFi allows multiple blockchains to cross-communicate. That is, it enables the use and development of cross chains. You can switch your Ethereum to BNB with DeFi.

Transparency

Every transaction in the DeFi ecosystem is transparent. Since DeFi is built on the blockchain, once a transaction is made, it is broadcasted to everyone on the network and verified by other network users called miners. This transparency allows any user to go ahead and check the activities on the network.

Finance Control

Just as mentioned earlier, DeFi eliminates the need for intermediaries. In DeFi, you have total control over your funds; DeFi takes the power centralized authorities have in traditional finance and gives it to a common man in the financial sector. With decentralized exchanges (Dexs), and your crypto wallet, the management or borrowing of your funds are all in your hands.

Innovation Opportunity

DeFi is still new, so it gives space for the development of new financial products or services and because it is decentralized, without having to seek permission.

How To Use DeFi?

Get The Wallet

To get started with decentralized finance, you first need to get yourself a wallet that is compatible with the DeFi application network you would like to make use of (whether Ethereum, Binance Smart Chain, or Polygon) like Metamask.

Connect Your Wallet To The DeFi Exchange

The next thing to do is to connect your wallet to the decentralized finance exchange. This is pretty much easy; as soon as you get to the exchange site, you should see the connect button hovering on the screen, or you might just need to click the options menu, usually located in the upper corner, then connect.

Connecting your wallet is comparable to logging into that DeFi exchange or service application with your wallet address so the application can access your wallet for any transaction. It is advisable always to log out, that is, revoke connection after making use of any DeFi services.

Buy DeFi Crypto Asset

After connecting your wallet, it’s now time to purchase that crypto asset and come use it to explore the DeFi world.

NOTE: Because every DeFi application is built on a blockchain network, and each network has its own native token, you might need to purchase that specific network token first to pay for transactions and move funds around on that blockchain.

How Can DeFi Be Applied To The Real world?

Reducing Costs

Decentralized finance can be applied to the real world by reducing costs, both payment costs, and even time costs. Unlike traditional finance transaction fees, most DeFi platform transaction fees can go as low as a cent regardless of the amount of crypto you are trading.

And also, unlike traditional finance payments that could take days or even weeks, you can transfer funds regardless of the amount within seconds or minutes, depending on the blockchain network, in decentralized finance. Imagine DeFi being adopted just like banks are adopted today; the finance world will be so much easier.

Borrowing and Lending

Decentralized finance removes the need for intermediaries, so borrowing and lending in the DeFi world are pretty much straightforward. Although to borrow in DeFi, you will always need to over collateralize to get better terms for a loan, but borrowing in the DeFi world is still so much easier you don’t have to do any paperwork.

Over collateralization is when a borrower will have to pay more than the amount they are borrowing before taking a loan.

Because DeFi is decentralized, again, lending is also so much easier. A lender can loan out their funds without having to do any paperwork or submit their personal information, identity or undergo KYC (know your customer) procedures. This eliminates the barrier of traditional finance in the real world that not everyone can borrow or lend.

Asset Financing

In DeFi, there are decentralized exchanges, also known as DEXs, and other DeFi platforms where one can use to explore the DeFi world. With these Defi platforms, you can earn with your asset either by staking, providing liquidity, or lending.

Although these DeFi platforms might be secure, but because they rely on software or hardware computers, there are risks of hacking. However, putting that aside, these ways of earning without intermediaries is a huge step for individuals to finance their assets in the finance sector.

Supply Chain Management

Because Decentralized finance is built on the powerful technology, blockchain, and it also makes use of smart contracts, supply chain management is much more efficient here. Companies can complete transactions directly without a third party. DeFi is still in its early stage, so most DeFi supply chain management projects are also still in the developing stage.

DeFi vs Traditional Finance (TradFi)

Understanding the current difficulties is one of the greatest ways to appreciate the potential of DeFi:

- You may be unable to receive payment due to financial services.

- Some persons are denied the ability to open a bank account or use financial services.

- People who do not have access to financial services may be unable to find work.

- Markets may be shut down at any time by governments and centralized entities.

- Financial services command a premium because intermediate institutions require a share.

- Your personal data is a hidden cost of financial services.

- Trading hours are frequently restricted to certain time zones’ business hours.

- Internal human processes can cause money transfers to take days.

| Decentralized Finance | Traditional Finance |

|---|---|

| You have complete control over where your money goes and how it is spent. You keep your money safe. | You must trust firms not to mismanage your funds, such as lending to dangerous borrowers. |

| You keep your money safe. | Companies hold your money. |

| Fund transfers take only a few minutes. | Due to laborious processes, payments might take days. |

| The markets are open 24 hours a day, seven days a week. | Employees require breaks, so markets close. |

| DeFi is available to anyone. | To access financial services, you must first apply. |

| Transactions are pseudonymous. | Your financial behavior is inextricably linked to your identity. |

| It’s based on openness, so anybody can look at a product’s data and see how the system works. | Financial institutions have closed books: you can’t request their loan history or a list of their managed assets, for example. |

Smart Contracts & Blockchain

Smart contracts are essentially programs that run when certain criteria are satisfied and are recorded on a blockchain. They are often used to automate the implementation of an agreement so that all participants are instantly confident of the outcome, without the participation of an intermediary or the waste of time. They can also automate a workflow by initiating the next operation when certain circumstances are satisfied.

Smart contracts, like any other contract, spell forth the parameters of an agreement or trade. Smart contracts, on the other hand, are distinguished by the fact that the terms are established and implemented as code running on a blockchain, rather than on paper lying on a lawyer’s desk. Smart contracts build on the fundamental concept of Bitcoin — sending and receiving money without a “trusted intermediary” like a bank in the middle — to enable the secure automation and decentralization of nearly any type of agreement or transaction, no matter how complicated. And, because they are based on a blockchain, such as Ethereum, they provide security, dependability, and transnational accessibility.

Future Of DeFi

Decentralized finance is still in its early phases of development. To begin with, it is unregulated, which means that the ecosystem is still rife with infrastructure errors, hacks, and frauds. Current legislation is founded on the concept of distinct financial jurisdictions, each with its own set of laws and norms.

The potential of DeFi to conduct borderless transactions raises critical issues for this sort of regulation. Who, for example, is in charge of investigating a financial crime that occurs across borders, protocols, and DeFi apps? Who would enforce the rules, and how would they be enforced? System stability, energy needs, carbon footprint, system updates, system maintenance, and hardware failures are further issues to consider.

DeFi and crypto, particularly DeFi crypto initiatives, are still changing and being developed, as are all new digital disruptors like as AI, Web3 and other technologies. They will not be able to completely replace established banking systems overnight. However, as technology improves, anticipate DeFi and crypto to be the future of banking, based on the five primary benefits we’ve noticed.

Frequently Asked Questions

What is DeFi and how is it different from traditional finance?

DeFi, or Decentralized Finance, is a blockchain-based financial system that removes the need for intermediaries like banks. Unlike traditional finance where institutions control transactions, DeFi allows users to interact directly using smart contracts, giving them full control of their funds and financial activities.

How does DeFi work using smart contracts?

DeFi relies on smart contracts—self-executing programs stored on the blockchain—that automatically perform actions when specific conditions are met. These contracts power lending, borrowing, trading, and other services without needing approval from a central authority, making processes faster, transparent, and trustless.

What are the main benefits of using DeFi?

DeFi offers permissionless access, allowing anyone with a crypto wallet and internet connection to participate. It ensures full transparency, removes financial gatekeepers, enables interoperability between blockchains, and opens up opportunities for innovation and new financial products without requiring approvals.

How can DeFi be applied in the real world?

DeFi can streamline supply chains, reduce transaction fees, enable fast cross-border payments, simplify borrowing and lending, and offer new ways to earn on digital assets through staking and liquidity provision. It gives financial access to underserved populations and promotes economic inclusion.

What is the future of DeFi and what challenges does it face?

DeFi is still evolving and faces challenges like regulatory uncertainty, security risks, and system stability concerns. However, as the technology matures and gains adoption, DeFi is expected to become a major part of the future financial ecosystem by offering global, decentralized, and open financial infrastructure.