Following the successful Bitcoin Halving this Friday, the blockchain reached a milestone of 840,000 blocks, while the halving event itself cut the mining reward to 3.125 Bitcoin per block. Despite predictions from several analysts of a potential price drop due to selling pressure from miners, the price of Bitcoin actually soared, approaching $66K. In addition, Ethereum’s price has also been rallying, supported by numerous positive on-chain metrics. Nevertheless, the increasing number of loss-making Ethereum addresses could pose a concern for potential selling pressure on the altcoin.

Ethereum Investors Turn Bullish

According to data from Coinglass, despite recent price volatility, the majority of *ETH* investors and traders remain bullish about the upcoming trend of the altcoin. Many of these traders are consistently opening long positions on Ethereum, indicating their expectation of substantial upward price movements over time.

This bullish outlook is supported by a notable example of a trader who, despite a $4.5 million loss from a previous long position on ETH, opened yet another long bet on the second-largest crypto token.

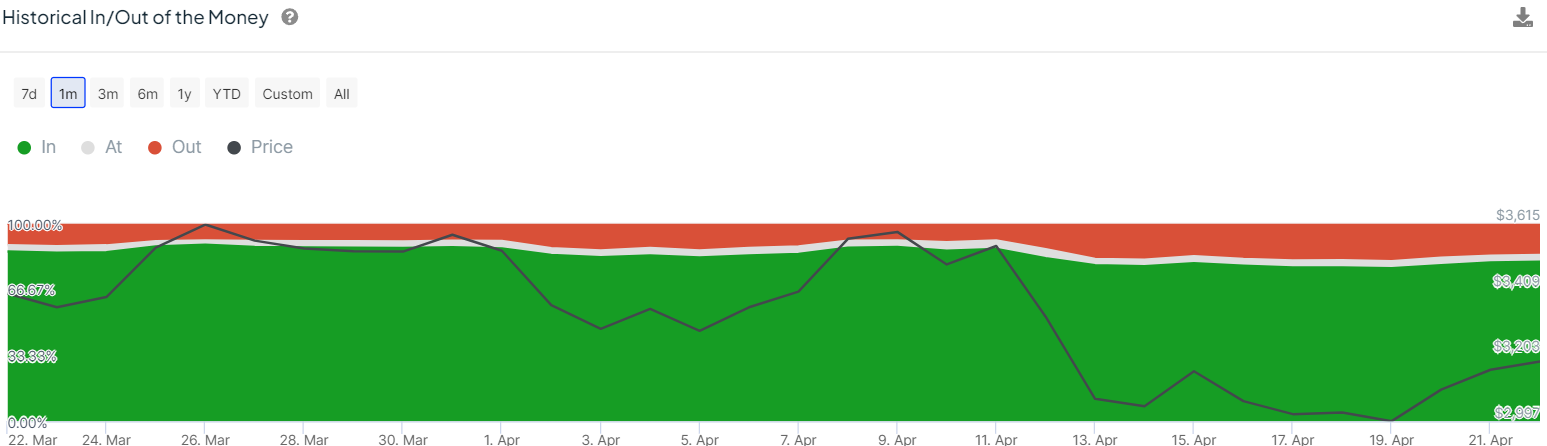

Over the last 24 hours, ETH price witnessed a total liquidation of over $14.8 million and buyers contributed the most of it. According to data from IntoTheBlock, despite the overall market correction, ETH’s price might face a short-term setback due to the surge in loss-making addresses. Data states that the out-the-money addresses jumped from the low of 8% to over 18% in a week, suggesting rising impatience among those holders.

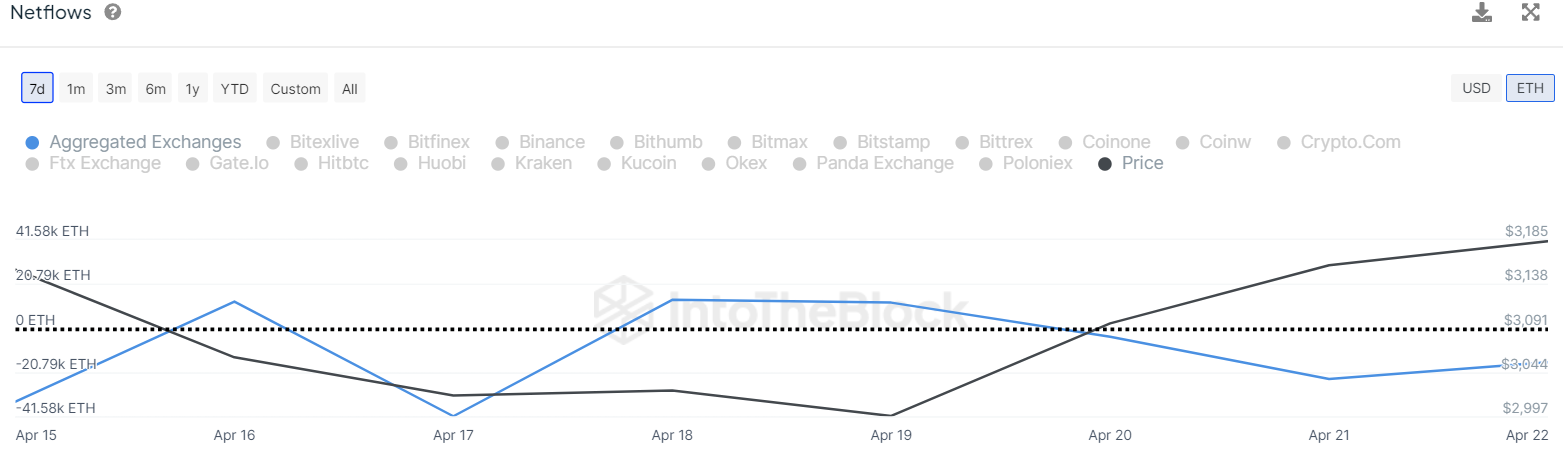

If ETH price fails to surge further or trigger a minor correction, those holders might intensify selling pressure by closing positions. The Netflow metric is flashing buying demand as it has been hovering around the negative region, currently at -16K ETH. This suggests that outflow volume is surpassing inflow, plunging the exchange reserves. This might reduce the likelihood of an immediate selling pressure.

Meanwhile, insights from the market intelligence platform IntoTheBlock reveal that the Market Value to Realized Value (MVRV) ratio of Ethereum has fallen, suggesting that many Ethereum holders are yet to see profits. This scenario could be positive for ETH’s price, as these holders might retain their holdings in anticipation of further increases, potentially stabilizing the price against downturns.

Despite these factors creating a generally bullish sentiment for Ethereum, indicators of the network’s growth paint a mixed picture. Data from Santiment indicates a recent slowdown in the rate of new user adoption within the Ethereum ecosystem, which could potentially lead to further price drops.

What’s Next For ETH Price?

Ether has climbed to the 20-day EMA, currently at $3,158, signaling that the bulls are attempting a resurgence. However, sellers are creating a strong resistance around the $3,200 mark, slowing down the current buying demand. As of writing, ETH price trades at $3,165, declining over 1.5% in the last 24 hours.

ETH/USDT Chart On TradingView

The 20-day EMA is beginning to level off, and the RSI is hovering just above the midpoint, suggesting an equilibrium in market forces. Should the price retreat from the 20-day EMA, the ETH/USDT pair might fall back to $3,056. This level is crucial for the bulls to hold as a breach here could lead to a drop to $2,800.

Conversely, if Ether breaks above the 200-day EMA, it could boost the buyers’ momentum. The pair might then target the 50-day SMA at $3,586 and possibly extend gains to $3,700. Surpassing this threshold would indicate that the corrective phase might be concluding, sending the ETH price to retest $4K.

Nonetheless, there’s a positive aspect, as data from Santiment indicates a rise in velocity, pointing to active trading and increased liquidity injections into the Ethereum ecosystem by current users. This activity could help drive potential price increases for the ETH token.