- 1. Introduction

- 2. Paybis Team & History

- 3. Key Features of Paybis Exchange

- 4. Security Aspects of Paybis

- 5. How Paybis Exchange Works

- 6. Supported Cryptocurrencies

- 7. Interface & Ease of Use

- 8. Paybis Fees Review

- 9. Customer Reviews and Feedback

- 10. Customer Support

- 11. Paybis Payment Methods

- 12. Comparing Paybis with Alternatives

- 13. Conclusion: Is Paybis Right for You?

Introduction

Cryptocurrency exchanges play a crucial role in the digital asset ecosystem, offering platforms for buying, selling, and trading cryptocurrencies. Paybis, a well-established player in this market, has garnered attention for its user-friendly interface and extensive range of supported cryptocurrencies. In this comprehensive Paybis review, we will delve into the intricacies of the exchange, exploring its features, security measures, user experience, fees, and much more. By the end of this guide, you’ll have a clear understanding of whether Paybis is the right exchange for your cryptocurrency needs.

What is Paybis?

Paybis is a cryptocurrency exchange that provides a platform for users to buy, sell, and trade a wide variety of digital assets. Founded in 2014, Paybis has built a reputation for its ease of use, security, and extensive support for different payment methods. The exchange aims to simplify the process of acquiring cryptocurrencies, making it accessible to both beginners and experienced traders.

Why Choose Paybis?

Paybis is a comprehensive cryptocurrency exchange platform that caters to a global audience because:

- Transparency: Paybis exchange prides itself on transparency, providing clear information about fees, exchange rates, and transaction times. Users can make informed decisions without hidden costs.

- Speed: Transactions on Paybis are typically processed quickly, with many purchases and sales completed within minutes. This speed is essential for traders looking to capitalize on market movements.

- Trustworthiness: With a track record dating back to 2014 and numerous positive reviews, Paybis has built a reputation as a trustworthy platform in the cryptocurrency industry.

- Regulatory Compliance: Paybis complies with various regulatory requirements, including Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. This compliance ensures a secure and legally sound trading environment.

- Global Accessibility: Paybis operates in over 180 countries, making it accessible to a wide audience. The platform supports multiple languages, including English, German, Spanish, French, Italian, and Russian, among others. It also accepts a variety of local currencies, enhancing its global appeal.

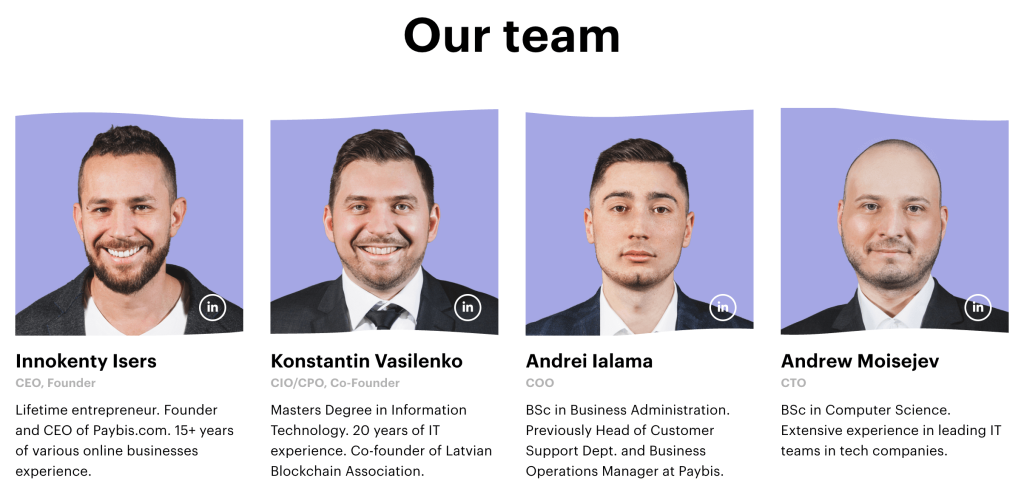

Paybis Team & History

Founded in 2014, Paybis was established by a group of cryptocurrency enthusiasts with a mission to provide a reliable and secure platform for digital asset trading. The team behind Paybis comprises experienced professionals in finance, technology, and cybersecurity, contributing to the exchange’s reputation for trustworthiness and innovation. Over the years, Paybis has expanded its services and continuously improved its platform to meet the evolving needs of the cryptocurrency market.

Key Features of Paybis Exchange

Paybis is a prominent cryptocurrency exchange platform known for its comprehensive range of features designed to cater to both novice and experienced traders. In this Paybis review, we delve into the key features that make Paybis a preferred choice for many in the cryptocurrency community.

1. User-Friendly Design and Functionality

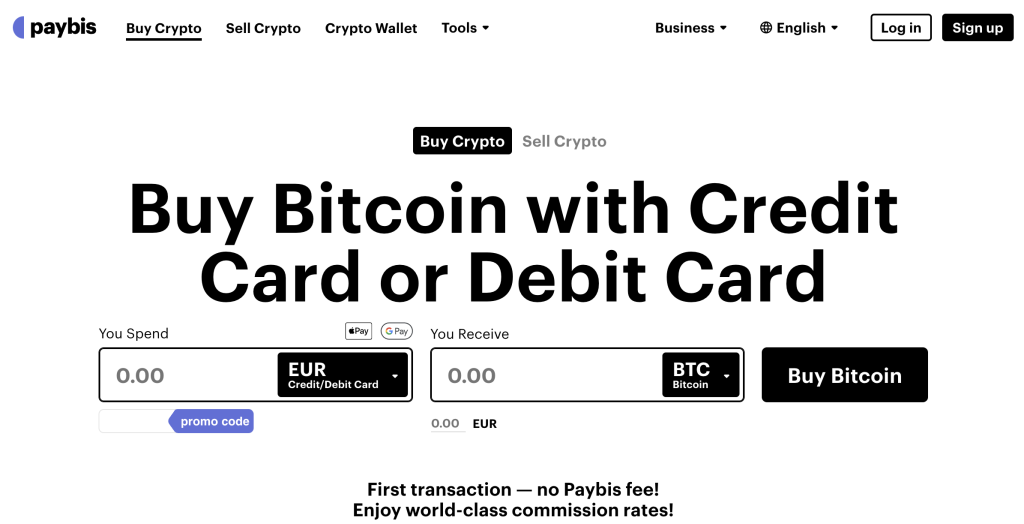

Paybis is known for its intuitive interface that caters to both novice and experienced traders. The platform’s clean design ensures that users can easily navigate through various sections, including buying, selling, and swapping cryptocurrencies. The registration process is straightforward, allowing users to set up an account and start trading quickly.

2. Fiat-to-Crypto Purchases

One of the primary services offered by Paybis is the ability to purchase cryptocurrencies using fiat currencies. Users can buy major cryptocurrencies such as *BTC*, *ETH*, *LTC*, and others using traditional currencies like USD, EUR, GBP, and more. This service is particularly beneficial for newcomers who need an easy entry point into the cryptocurrency market. Payment methods include credit/debit cards, bank transfers, and e-wallets.

3. Crypto-to-Fiat Sales

In addition to buying cryptocurrencies, Paybis allows users to sell their digital assets and convert them back into fiat currencies. This service provides liquidity and enables users to withdraw their funds to bank accounts or e-wallets. It is an essential feature for those who need to cash out their cryptocurrency investments.

4. Instant Bitcoin Purchases

Paybis offers a specialized service for instant Bitcoin purchases. By using credit or debit cards, users can buy Bitcoin almost instantly, with transactions often completed within minutes. This service is ideal for traders looking to quickly acquire Bitcoin to take advantage of market movements.

5. E-Wallet Integration

Paybis supports various e-wallets, including Skrill and Neteller, for both deposits and withdrawals. This integration provides users with additional flexibility and convenience, especially for those who prefer using e-wallets over traditional banking methods.

6. Bank Transfers

For users who prefer larger transactions or those who favor traditional banking methods, Paybis offers support for SEPA (for European users) and international wire transfers. This service is suitable for buying and selling large amounts of cryptocurrency, providing a secure and reliable method for transferring funds.

7. Educational Resources

Paybis exchange provides an extensive range of educational resources aimed at helping users understand the cryptocurrency market better. These resources include:

- Guides and Tutorials: Step-by-step instructions on various aspects of cryptocurrency trading, wallet setup, and security.

- Articles and Blog Posts: In-depth articles covering market trends, investment strategies, and the latest news in the cryptocurrency space.

- FAQ Section: A comprehensive FAQ section that addresses common questions and issues faced by users.

8. Affiliate Program

Paybis has an affiliate program that allows users to earn commissions by referring new customers to the platform. Affiliates can generate referral links and share them through various channels. For each referred user who makes a transaction, the affiliate earns a percentage of the transaction fee, providing a potential income stream for users.

Security Aspects of Paybis

Our paybis.com review discovered that security is a top priority for this exchange. The platform employs advanced security measures to ensure the safety of users’ funds and personal information. Key security features include:

- Two-Factor Authentication (2FA): Adding an extra layer of security to user accounts.

- Cold Storage: The majority of user funds are stored in offline cold wallets, minimizing the risk of hacking.

- Regular Security Audits: Paybis conducts regular security audits to identify and address potential vulnerabilities.

Privacy & Security Measures

Our Paybis review determined that the platform is committed to protecting user privacy. The exchange adheres to strict data protection regulations and implements comprehensive privacy measures. These include:

- Data Encryption: All sensitive user data is encrypted to prevent unauthorized access.

- Compliance with GDPR: Paybis complies with the General Data Protection Regulation (GDPR), ensuring that users’ personal information is handled with care.

Potential Risks

Is Paybis legit and safe? Many users have been asking this question. While Paybis is legit and it takes significant measures to secure its platform, users should be aware of potential risks associated with cryptocurrency trading, such as market volatility and the risk of loss. It is important for users to conduct their own research and exercise caution when trading digital assets.

How Paybis Exchange Works

Now that you know what is Paybis, it is time to see how it works. Paybis is a user-friendly cryptocurrency exchange platform designed to facilitate the buying, selling, and exchanging of digital assets. Here’s a detailed guide on how Paybis works:

Buying, Selling, and Swapping Cryptocurrencies

Paybis offers a seamless process for buying, selling, and swapping cryptocurrencies. Users can select their desired cryptocurrency, choose a payment method, and complete the transaction within minutes. The platform supports a wide range of digital assets, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others.

Setting Up the Paybis Account

1. Registration and Verification: Users start by signing up on the Paybis website. The registration process involves providing an email address, creating a password, and agreeing to the terms of service. After registering, users need to verify their email address by clicking on the confirmation link sent to their inbox.

2. Identity Verification: To comply with international regulations and ensure security, Paybis requires users to complete a KYC process. This involves submitting personal identification documents such as a passport, driver’s license, or national ID card. Users may also need to provide proof of address, such as a utility bill or bank statement, to complete the verification process. For higher transaction limits, users might need to undergo further verification, including a selfie with their ID.

3. Funding Your Account: Paybis supports a variety of payment methods for funding accounts. Visa, MasterCard, and Maestro are accepted for quick and easy transactions. SEPA for European customers and international wire transfers for users worldwide. Integration with Skrill and Neteller provides additional convenience. Users can also fund their accounts by transferring cryptocurrencies from external wallets.

4. Depositing Funds: Choose the fiat currency or cryptocurrency you wish to deposit. Select your preferred payment method and enter the required details. Review the transaction details and confirm the deposit. Depending on the method chosen, the funds will be available in your Paybis account shortly.

5. Buying Cryptocurrencies: Navigate to the “Buy Cryptocurrency” section and select the digital asset you wish to purchase, such as Bitcoin, Ethereum, or Litecoin. Enter the amount of cryptocurrency you want to buy or the amount of fiat currency you wish to spend. Choose your preferred payment method and provide the necessary information.

6. Completing the Purchase: Verify the transaction details, including the exchange rate and fees. Confirm the purchase to initiate the transaction. The cryptocurrency will be credited to your Paybis wallet or another specified wallet address once the payment is processed.

7. Selling Cryptocurrencies: Navigate to the “Sell Cryptocurrency” section and select the digital asset you wish to sell. Enter the amount of cryptocurrency you want to sell. Choose how you want to receive the funds (e.g., bank transfer, e-wallet).

8. Completing the Sale: Verify the transaction details, including the exchange rate and fees. Confirm the sale to initiate the transaction. The fiat currency will be transferred to your chosen payment method once the sale is processed.

9. Exchanging Cryptocurrencies: Navigate to the “Exchange Cryptocurrency” section. Select the cryptocurrency you want to exchange and the one you want to receive. Enter the amount of cryptocurrency you want to exchange. Provide the wallet address for the cryptocurrency you will receive.

10. Completing the Exchange: Verify the transaction details, including the exchange rate and fees. Confirm the exchange to initiate the transaction. The exchanged cryptocurrency will be sent to your specified wallet address.

Using Paybis App and Website

Paybis offers a web-based platform as well as a mobile app, providing flexibility for users to trade on the go. The mobile app is available for both iOS and Android devices and offers the same functionality as the web platform.

Supported Cryptocurrencies

Paybis supports a wide range of cryptocurrencies, including but not limited to:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Stellar (XLM)

- Tether (USDT)

- USD Coin (USDC)

Interface & Ease of Use

Our Paybis review found that the platform is designed with user experience in mind. The interface is clean, intuitive, and easy to navigate, making it accessible for users of all experience levels. The process of buying, selling, and swapping cryptocurrencies is straightforward, with clear instructions and prompts guiding users through each step.

User Experience with the Paybis App and Website

Users consistently praise Paybis for its user-friendly design and ease of use. The platform’s streamlined interface and responsive customer support contribute to a positive user experience. Additionally, the availability of multiple payment methods and the fast transaction processing times enhance the overall usability of the platform.

Paybis Fees Review

Paybis charges competitive fees for its services. The fee structure is transparent, with detailed information available on the Paybis website. Key fees include:

- Transaction Fees: Paybis charges a fee for buying, selling, and swapping cryptocurrencies. These fees vary depending on the payment method and the cryptocurrency involved.

- Payment Method Fees: Different payment methods may incur additional fees. For example, credit/debit card transactions typically have higher fees compared to bank transfers.

- Exchange Rates: Paybis applies a spread to the exchange rates, which can affect the final amount received by users.

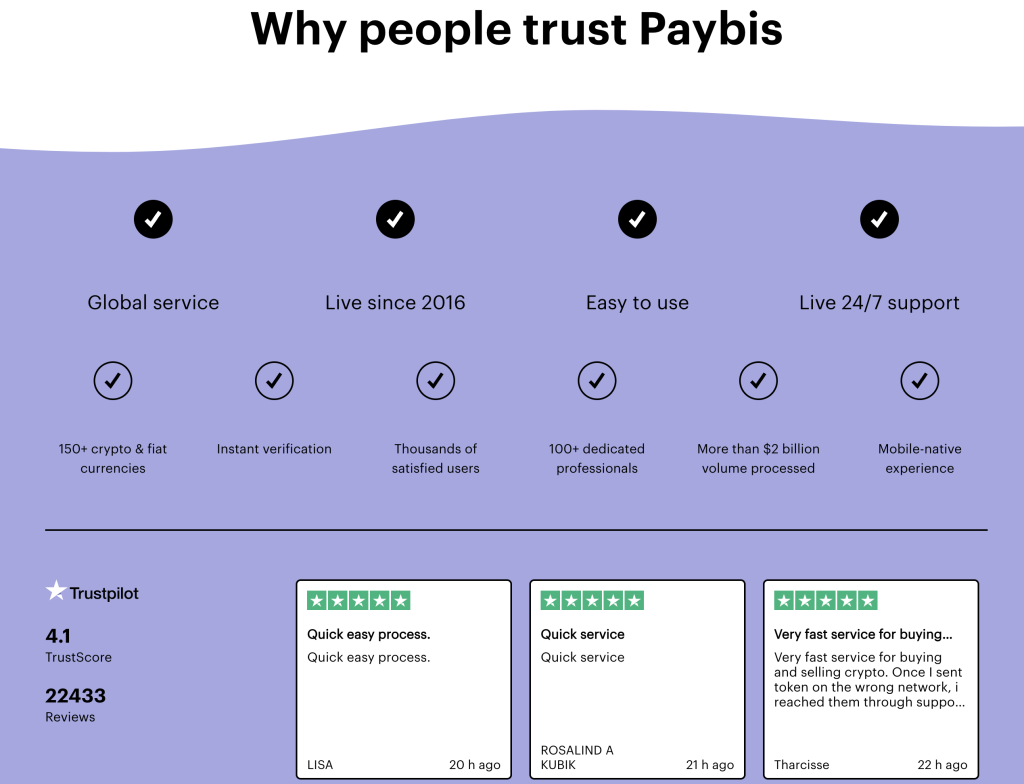

Customer Reviews and Feedback

Users have mostly shared positive paybis.com reviews, highlighting its ease of use, security measures, and responsive customer support. The platform has received a user rating of 4.1 out of 5 on Trustpilot. Common themes in user feedback include:

- Fast Transactions: Users appreciate the quick processing times for transactions.

- Helpful Support: The 24/7 customer support team is praised for its responsiveness and helpfulness.

- User-Friendly Interface: The intuitive design of the platform is frequently mentioned as a positive aspect.

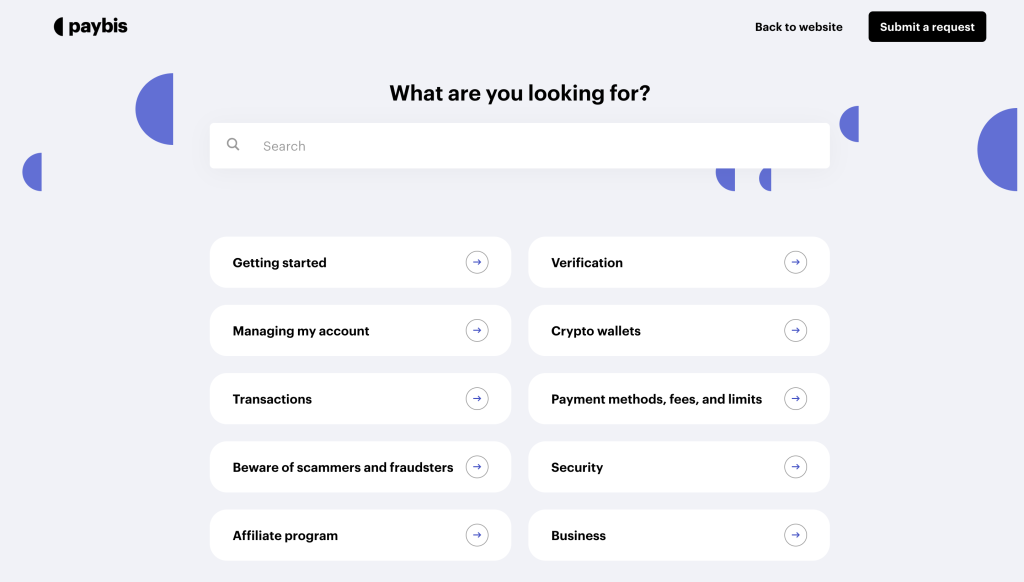

Customer Support

Paybis offers comprehensive customer support to assist users with any issues or questions. The support team is available 24/7 and can be reached through various channels, including live chat, email, and phone. Additionally, the Paybis website features a detailed FAQ section that addresses common queries.

Paybis Payment Methods

Paybis supports a wide range of payment methods, making it convenient for users globally. These include:

- Credit/Debit Cards (Visa, MasterCard)

- Bank Transfers (SEPA, SWIFT)

- E-wallets (Skrill, Neteller)

- Cryptocurrencies

The availability of multiple payment options enhances the accessibility and usability of the Paybis platform.

Comparing Paybis with Alternatives

When choosing a cryptocurrency exchange, it’s essential to compare different platforms to find the one that best suits your needs. In our Paybis review, we’ll compare Paybis with some popular alternatives: Coinbase, Binance, and Kraken.

Paybis Exchange Competitors

We’ll look at key aspects such as supported cryptocurrencies, fees, security, user experience, and additional features.

Supported Cryptocurrencies

Paybis supports a range of major cryptocurrencies, as mentioned above. This allows for basic diversification and straightforward trading. Coinbase offers a broader selection with over 100 cryptocurrencies, including both major coins and popular altcoins, making it suitable for users looking to explore a wider array of digital assets.

Binance stands out with the largest selection, supporting over 500 cryptocurrencies and trading pairs. This extensive range includes many lesser-known altcoins, providing opportunities for extensive diversification and niche investments. Kraken offers over 50 cryptocurrencies, balancing between major and mid-tier altcoins.

While not as extensive as Binance or Coinbase, it provides a solid selection for both beginners and experienced traders. In summary, Binance offers the widest range of cryptocurrencies, followed by Coinbase, Kraken, and Paybis.

Fees

Paybis has a transparent fee structure, with fees varying depending on the payment method and transaction type. Credit card purchases generally incur higher fees compared to other methods. Coinbase is known for relatively high fees, including a spread and additional transaction fees that can add up, especially for small purchases.

Binance is recognized for some of the lowest fees in the industry, with a standard trading fee of 0.1%. These fees can be further reduced using Binance Coin (BNB) or through higher trading volumes. Kraken offers competitive fees, with trading fees ranging from 0% to 0.26% based on trading volume.

Bank transfers and other deposit methods typically have low fees. In comparison, Binance and Kraken offer the most competitive fee structures, while Paybis and Coinbase have higher fees, particularly for credit card transactions.

Security

As per our paybis.com review, the platform employs strong security measures, including two-factor authentication (2FA), encryption, and compliance with KYC/AML regulations, ensuring a secure trading environment. If you are also questioning “is Paybis legit,” you need to know that it is indeed legit.

Meanwhile, Coinbase is highly reputable for its security practices, with 98% of customer funds stored offline, 2FA, and insurance coverage for digital assets, making it one of the safest platforms. Binance implements advanced security features, including the Secure Asset Fund for Users (SAFU) to protect a portion of user funds.

Regular audits and 2FA are also standard practices. Kraken is known for robust security, including offline storage of funds, 2FA, and regular security audits, with a strong track record of protecting user funds. All four exchanges are highly secure, but Coinbase and Kraken are particularly noted for their stringent security measures and long-standing reputations.

Who Is This Exchange For?

Our Paybis review determined that the exchange is suitable for a wide range of users, including:

- Beginners: The intuitive design and straightforward processes make Paybis an excellent choice for those new to cryptocurrency trading.

- Experienced Traders: The wide range of supported cryptocurrencies and payment methods cater to the needs of more experienced traders.

- Global Users: With support for over 180 countries and multiple payment options, Paybis is accessible to users worldwide.

Conclusion: Is Paybis Right for You?

Paybis offers a comprehensive and user-friendly platform for buying, selling, and swapping cryptocurrencies. Its extensive range of supported payment methods, robust security measures, and responsive customer support make it a reliable choice for both beginners and experienced traders. However, as with any cryptocurrency exchange, it is important to conduct thorough research and consider individual needs and preferences before making a decision.

Header text

Header text

Header text

Header text

Frequently Asked Questions

What Coins Are Supported by Paybis?

Paybis supports a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), Stellar (XLM), Tether (USDT), and USD Coin (USDC).

What Happens If Paybis Goes Out of Business?

In the unlikely event that Paybis ceases operations, users should withdraw their funds and digital assets as soon as possible. Paybis would likely provide instructions to users on how to withdraw their funds or transfer their assets to another exchange. It’s essential for users to keep their contact information updated and monitor official announcements from Paybis in case of such an event.

What Are The Disadvantages of Paybis?

While Paybis offers numerous advantages, there are some potential drawbacks to consider. Firstly, transactions made using credit/debit cards typically incur higher fees compared to bank transfers, which could increase the cost of trading for users preferring these methods. Additionally, while Paybis supports a wide range of cryptocurrencies, some lesser-known or newer digital assets may not be available on the platform, limiting users’ choices.

Why You Can Trust Our Review?

Our Paybis review is based on thorough research and analysis of the exchange’s features, security measures, user feedback, and industry reputation. We have gathered information from reliable sources and included insights from real user experiences to provide an objective and informative assessment of Paybis.