Short description:

1inch is a leading decentralized exchange aggregator that optimizes trading rates by sourcing liquidity from various platforms. Founded in 2019, it offers efficient trades with minimal slippage and supports the 1INCH utility token for governance and rewards. With robust security and a user-friendly interface, 1inch is ideal for both novice and experienced traders in the DeFi space.

Our Opinion

1inch has established itself as a cornerstone in the DeFi ecosystem, offering users a powerful tool to navigate the complexities of trading cryptocurrencies across multiple decentralized exchanges. We find 1inch to be a standout platform due to its innovative approach to liquidity aggregation and its commitment to user security.

Moreover, 1inch’s aggregation algorithm effectively combines liquidity from various DEXs such as Uniswap, SushiSwap, and Balancer, ensuring users receive the best possible rates with minimal slippage. This feature is particularly beneficial in the volatile cryptocurrency market, providing traders with competitive advantages.

As a non-custodial platform, 1inch prioritizes user security by allowing traders to maintain control of their assets throughout the trading process. The platform also conducts regular smart contract audits and implements bug bounty programs to mitigate potential vulnerabilities, ensuring the integrity of its protocols.

Pros

- Aggregates liquidity: 1inch aggregates liquidity from multiple decentralized exchanges (DEXs), ensuring users get the best possible trading rates.

- Minimal slippage: Advanced routing algorithms minimize slippage by finding the most efficient trading paths.

- Non-custodial platform: Users maintain control over their assets at all times, enhancing security.

- User-friendly interface: Intuitive design makes trading easy for both beginners and experienced users.

- Wide range of cryptocurrencies: Supports numerous cryptocurrencies, offering diverse trading options.

- 1INCH token benefits: Provides governance rights and incentives through liquidity mining and staking.

Cons

- Complexity of DeFi: The intricacies of decentralized finance can be challenging for newcomers.

- Smart contract risks: Vulnerabilities in smart contracts and market volatility pose inherent risks.

- Limited fiat support: Primarily supports cryptocurrency trading, with limited options for fiat-to-crypto conversions.

- Variable transaction fees: Fees may vary depending on network congestion, impacting cost-effectiveness.

Introduction

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. With the growing popularity of decentralized finance (DeFi), 1inch has emerged as a prominent player, offering a unique approach to trading by combining liquidity from multiple platforms. In this comprehensive 1inch review for 2024, we will delve into the intricacies of the platform, exploring its features, functionality, security, user experience, and more to help you decide if it is the right platform for your trading needs.

What is 1inch?

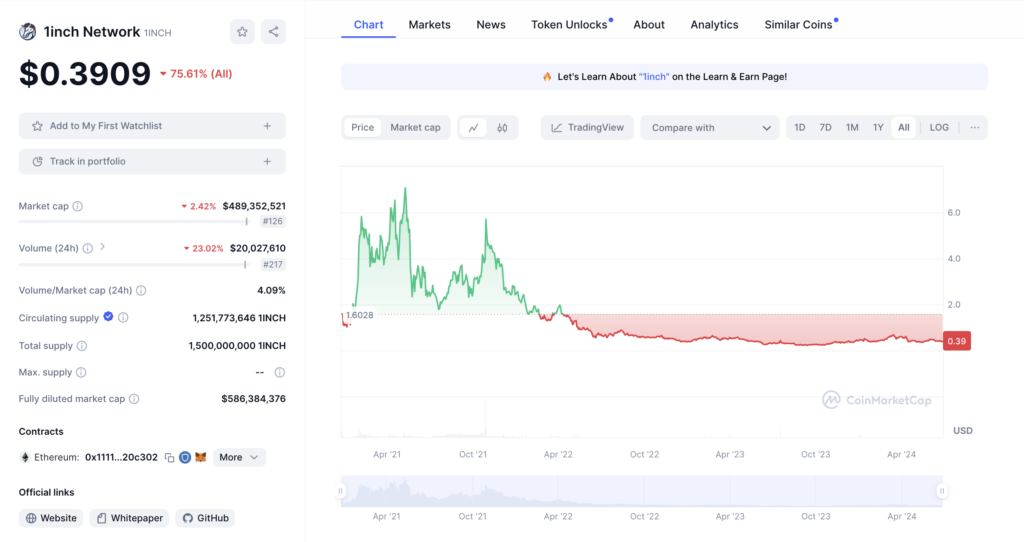

1inch is a DeFi protocol that facilitates the trading of cryptocurrencies by aggregating liquidity from various decentralized exchanges. Founded in 2019 by Sergej Kunz and Anton Bukov, 1inch aims to solve the problem of fragmented liquidity in the DeFi space. By routing trades through multiple DEXs, 1inch ensures that users get the best prices and lowest slippage for their trades. The platform also features the 1INCH token, which serves as a utility and governance token within the ecosystem.

The 1INCH Token

The native token of the 1inch DEX is 1INCH, an ERC-20 token used for governance and utility purposes. The 1INCH token holders can participate in the decentralized governance of the protocol, propose and vote on changes, and influence the future development of the platform. Additionally, 1INCH tokens are used in liquidity mining programs, staking, and to pay for services within the 1inch ecosystem.

Total Supply: The total supply of 1INCH tokens is capped at 1.5 billion. The tokens are distributed through various mechanisms, including community incentives, protocol development, and the 1inch Foundation.

Distribution: A significant portion of 1INCH tokens is allocated to community incentives and ecosystem growth. This includes liquidity mining programs, user rewards, and grants to support development and adoption.

Why Choose 1inch?

Our 1inch review found that choosing 1inch comes with several advantages:

- Best Rates: By aggregating liquidity from multiple sources, 1inch offers users the best possible rates for their trades.

- Low Slippage: The platform’s smart routing technology minimizes slippage, ensuring efficient and cost-effective trades.

- Security: As a non-custodial platform, 1inch does not hold user funds, reducing the risk of hacks and theft.

- User-Friendly Interface: The intuitive design makes it easy for both beginners and experienced traders to navigate the platform.

- Wide Range of Supported Assets: 1inch supports a diverse array of cryptocurrencies, providing users with numerous trading options.

1inch Team & History

1inch was founded by Sergej Kunz and Anton Bukov, who have extensive experience in software development and DeFi. The project was launched in May 2019 during the ETHGlobal hackathon in New York City. Since its inception, 1inch has grown rapidly, securing significant funding from prominent investors and expanding its team. The platform has continuously evolved, introducing new features and integrations to enhance the trading experience.

Key Features of 1inch Exchange

With its advanced algorithms, user-friendly interface, and robust ecosystem, 1inch offers a powerful tool for anyone looking to navigate the complexities of the DeFi world efficiently. Here are the key features of this platform:

User-Friendly Design and Functionality

1inch boasts a sleek and intuitive interface that caters to both novice and experienced traders. The platform is designed to be accessible and easy to use, with clear navigation and a straightforward trading process.

DEX Aggregation

1inch aggregates liquidity from multiple decentralized exchanges, including popular ones like Uniswap, SushiSwap, and Balancer. This ensures that users get the best possible prices and minimal slippage for their trades.

Pathfinder Algorithm

The Pathfinder algorithm is a key component of 1inch exchange, enabling the platform to find the most efficient trading paths across various liquidity sources. It splits trades into multiple routes and integrates complex multi-path routing to minimize costs and slippage.

Liquidity Protocol

1inch offers its own liquidity protocol, known as Mooniswap (now replaced by 1inch Liquidity Protocol), which provides innovative solutions to improve the trading experience by reducing impermanent loss and enhancing capital efficiency.

Gas Optimization

One of the significant advantages of using 1inch is its gas optimization feature. The platform identifies the most gas-efficient trade routes and provides users with options to further reduce gas fees through its Chi Gastoken.

Limit Orders

1inch supports limit orders, allowing users to specify the exact price at which they wish to buy or sell their assets. This feature is particularly beneficial for traders looking to execute trades at specific price points without constantly monitoring the market.

Liquidity Mining and Staking

Users can participate in liquidity mining programs and stake their 1INCH tokens to earn rewards. This incentivizes users to provide liquidity and support the platform’s growth.

Security Aspects of 1inch

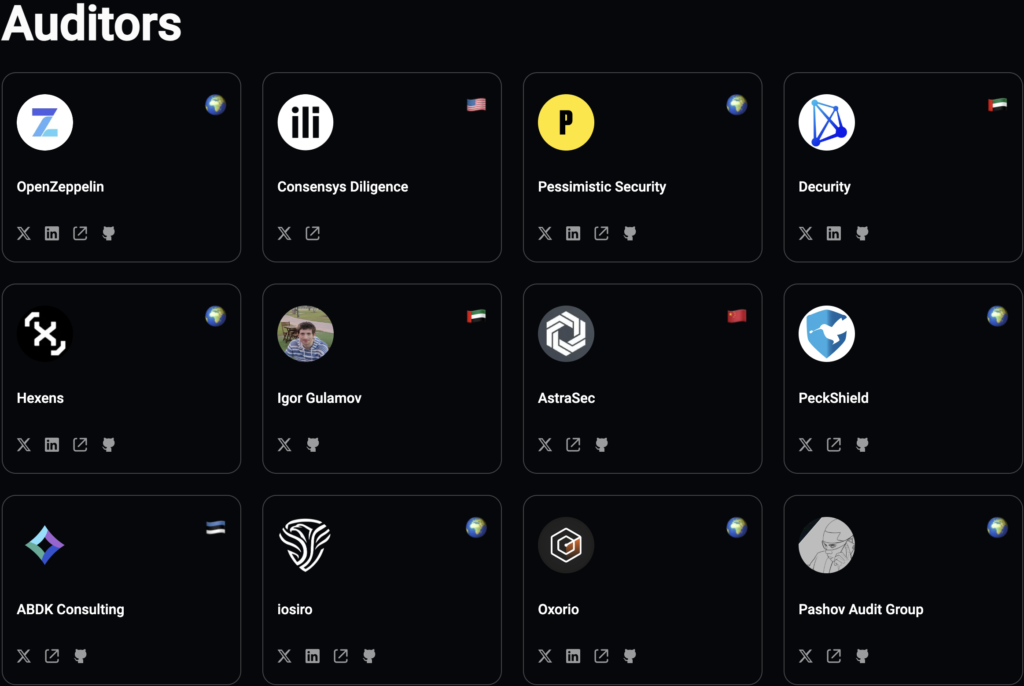

Our 1inch review determined that 1inch has established itself as a trusted and reliable platform in the decentralized finance ecosystem. Security is a paramount concern in DeFi, where users are often vulnerable to various types of attacks and scams. 1inch takes several measures to ensure the safety and security of its users’ assets and transactions.

Privacy & Security Measures

1inch employs robust security measures to protect user funds and data. The platform is non-custodial, meaning users retain control of their assets at all times. Additionally, 1inch uses smart contract audits to ensure the integrity and security of its protocols. Privacy is also a key consideration, with 1inch implementing measures to protect user information. Here’s a detailed look at the security aspects of 1inch:

1. Non-Custodial Nature: One of the fundamental security features of 1inch is its non-custodial nature. Unlike centralized exchanges, 1inch does not hold users’ funds. Instead, users retain full control over their assets throughout the entire trading process. This significantly reduces the risk of hacks and theft, as there is no central point of failure.

2. Smart Contract Audits: 1inch DEX relies heavily on smart contracts to facilitate transactions and interactions within the platform. To ensure these contracts are secure and free from vulnerabilities, 1inch conducts regular and thorough smart contract audits. These audits are performed by reputable third-party security firms specializing in blockchain technology. Notable firms that have audited 1inch include:

- ConsenSys Diligence: Known for their comprehensive and meticulous auditing processes.

- OpenZeppelin: Renowned for their expertise in smart contract security and rigorous auditing standards.

These audits help identify and mitigate potential vulnerabilities before they can be exploited.

3. Bug Bounty Programs: To further enhance security, 1inch runs a bug bounty program. This program incentivizes white-hat hackers and security researchers to identify and report potential vulnerabilities in the platform. By offering financial rewards, 1inch encourages the broader security community to assist in maintaining the platform’s integrity and security.

4. Decentralized Governance: 1inch operates under a decentralized governance model, where 1INCH token holders have the power to propose and vote on changes to the protocol. This decentralized approach ensures that no single entity has control over the platform, reducing the risk of malicious actors gaining undue influence. Additionally, the open and transparent nature of decentralized governance allows the community to scrutinize proposed changes, enhancing overall security.

5. Secure APIs and Integrations: 1inch integrates with numerous decentralized exchanges (DEXs) and liquidity protocols. Ensuring secure and reliable API connections is crucial to maintaining the platform’s security. 1inch employs stringent security measures to protect these integrations, including:

- Encryption: All data transmitted between 1inch and integrated platforms is encrypted, protecting it from interception and tampering.

- Access Controls: Strict access controls are implemented to ensure that only authorized entities can interact with 1inch’s APIs.

6. Advanced Security Features for Users: 1inch provides several advanced security features to enhance user protection, including:

- Slippage Protection: Users can set slippage tolerance levels to prevent their trades from being executed at unfavorable prices due to high volatility or low liquidity.

- Transaction Simulation: Before executing a trade, 1inch exchange simulates the transaction to identify potential issues and ensure it will be executed as expected.

- Price Impact Warnings: Users receive warnings if a trade is likely to have a significant impact on the market price, helping them make informed decisions.

7. Chi Gastoken for Gas Optimization: While not directly a security feature, the Chi Gastoken helps users optimize gas fees, making transactions more cost-effective and reducing the need to interact with multiple smart contracts manually. This reduces the attack surface and potential points of failure.

8. Multi-Layered Security Protocols: 1inch employs multi-layered security protocols to safeguard its infrastructure. These include:

- Firewalls and Intrusion Detection Systems: To protect against external attacks.

- Regular Security Audits: Continuous monitoring and auditing of the platform to detect and address potential security issues promptly.

- Disaster Recovery Plans: Well-defined procedures to ensure rapid recovery and continuity in the event of a security breach or system failure.

9. User Education and Awareness: 1inch places a strong emphasis on user education and awareness. The platform provides comprehensive guides and resources to help users understand how to securely interact with DeFi applications. By educating users on best security practices, such as using hardware wallets and avoiding phishing scams, 1inch empowers its community to protect its own assets.

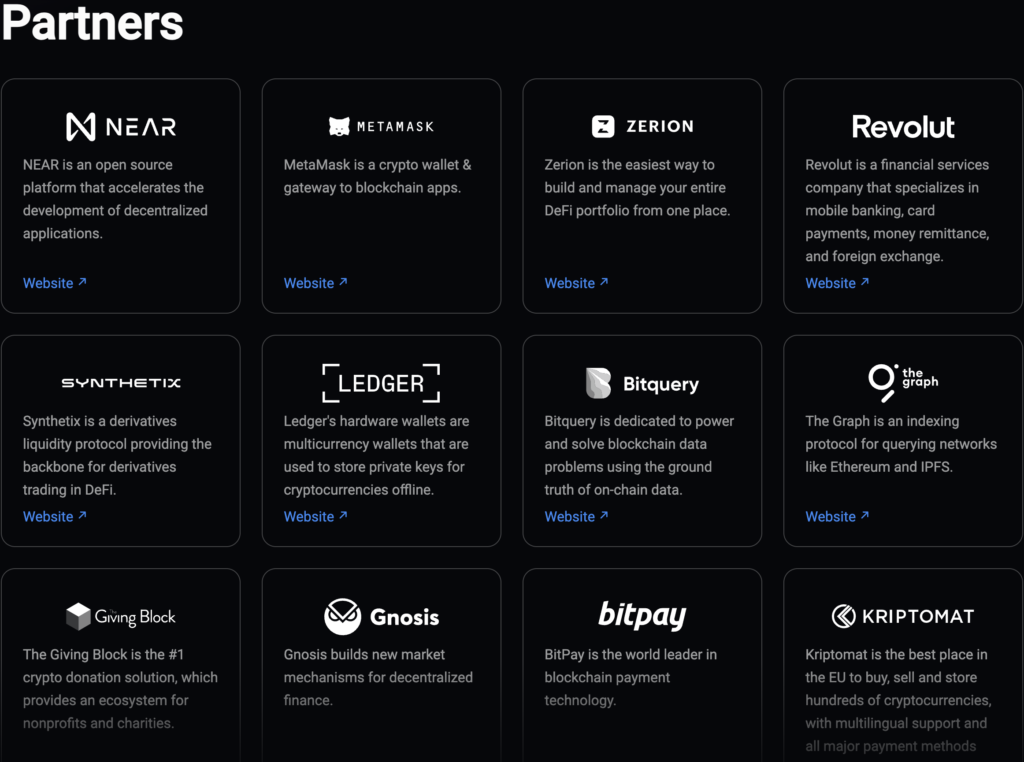

10. Partnerships with Security Firms: 1inch collaborates with leading security firms and organizations in the blockchain space to stay updated on the latest security trends and threats. These partnerships help 1inch proactively address potential security challenges and continuously improve its security posture.

Potential Risks

While 1inch is a secure platform, users should be aware of potential risks inherent in DeFi, such as smart contract vulnerabilities and market volatility. It is important to conduct thorough research and exercise caution when trading.

How 1inch Exchange Works

1inch aims to provide users with the most efficient and cost-effective way to trade cryptocurrencies across multiple DEXs. The platform leverages advanced algorithms and smart contract technology to optimize trades, minimize slippage, and reduce transaction costs. Here’s a detailed look at how 1inch DEX works:

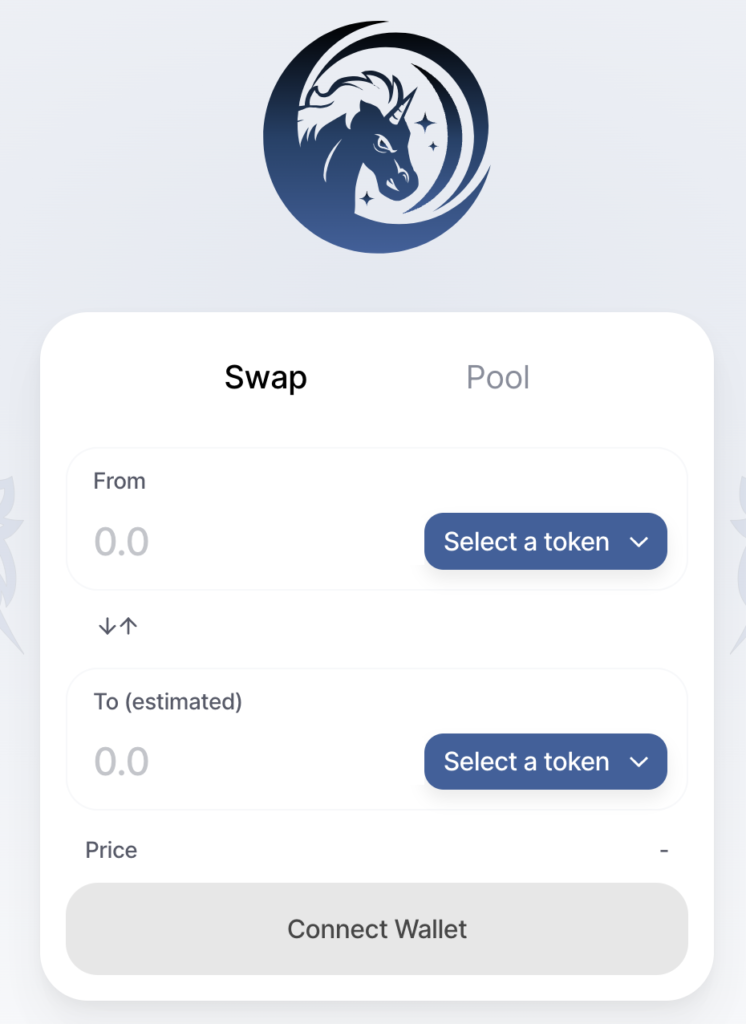

Buying, Selling, and Swapping Cryptocurrencies

1inch DEX simplifies the process of buying, selling, and swapping cryptocurrencies. Users can connect their wallets, select the desired trading pair, and execute trades seamlessly. The platform’s aggregation algorithm ensures that trades are routed through the most efficient paths, securing the best rates.

Setting Up the 1inch Account

Setting up an account on 1inch is straightforward. Users need to connect a compatible wallet, such as MetaMask, Trust Wallet, or Ledger. Once connected, users can start trading immediately without the need for extensive verification processes.

How to Trade on 1inch

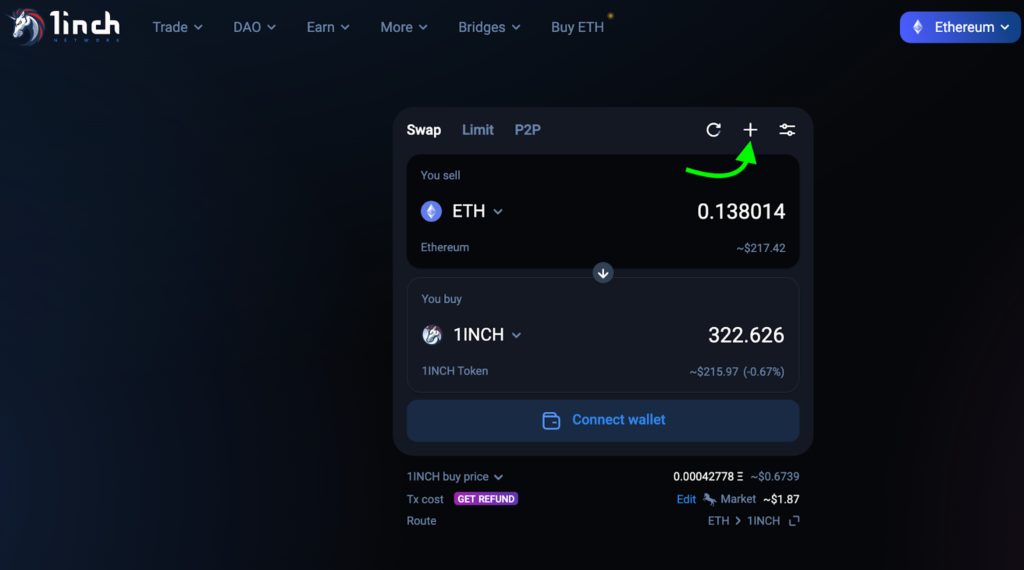

Here’s a step-by-step guide on how to execute a trade on 1inch exchange:

1. Connect Your Wallet: Visit the 1inch website and connect your cryptocurrency wallet (e.g., MetaMask, Trust Wallet). 1inch supports a wide range of wallets for seamless integration.

2. Select Trading Pair: Choose the assets you want to trade. For example, if you want to swap Ethereum (ETH) for USD Coin (USDC), select

Ethereum$3,868.55

3. Enter Trade Details: Enter the amount of the asset you want to trade. The platform will automatically calculate the amount you will receive based on the current market rates and available liquidity.

4. Review Trade: Review the trade details, including the estimated gas fees, slippage tolerance, and the expected amount of the asset you will receive. You can also simulate the trade to see potential outcomes.

5. Execute Trade: Confirm the trade and approve the transaction in your connected wallet. The trade will be executed using the Pathfinder algorithm to ensure the most efficient and cost-effective route.

6. Transaction Confirmation: Once the transaction is confirmed on the blockchain, the traded assets will be credited to your wallet. You can view the transaction details and history on the 1inch dashboard.

Using 1inch App and Website

1inch offers both a web-based platform and a mobile app, providing flexibility for users to trade on the go. The app mirrors the functionality of the web platform, with an optimized interface for mobile devices.

Supported Cryptocurrencies

1inch DEX supports a wide range of cryptocurrencies, including popular assets like Bitcoin (BTC), Ethereum (ETH), and numerous ERC-20 tokens. This extensive support allows users to trade a diverse array of digital assets.

Interface & Ease of Use

The interface of 1inch is designed to be user-friendly, with clear layouts and easy-to-understand features. The platform’s simplicity makes it accessible for beginners, while advanced traders can take advantage of more sophisticated tools and options.

User Experience with the 1inch App and Website

Users generally report a positive experience with the 1inch app and website. The platform’s design, combined with its efficient routing algorithm, provides a smooth and reliable trading experience. Users appreciate the speed and ease of executing trades, as well as the competitive rates offered by the aggregator.

1inch Fees Review

1inch is known for its competitive fee structure. The platform charges a small fee for each transaction, which is used to reward liquidity providers and maintain the system. Additionally, users may incur network fees, which vary depending on the blockchain being used. Overall, 1inch’s fees are considered reasonable and transparent.

Customer Reviews and Feedback

There are positive 1inch reviews from users of the platform, with users praising the platform’s efficiency, security, and user-friendly interface. Some common themes in reviews include satisfaction with the competitive rates, the ease of use, and the wide range of supported assets. However, some users have noted that the complexity of DeFi can be daunting for newcomers. Overall, the platform has a user rating of 4.7 out of 5 on Trustpilot.

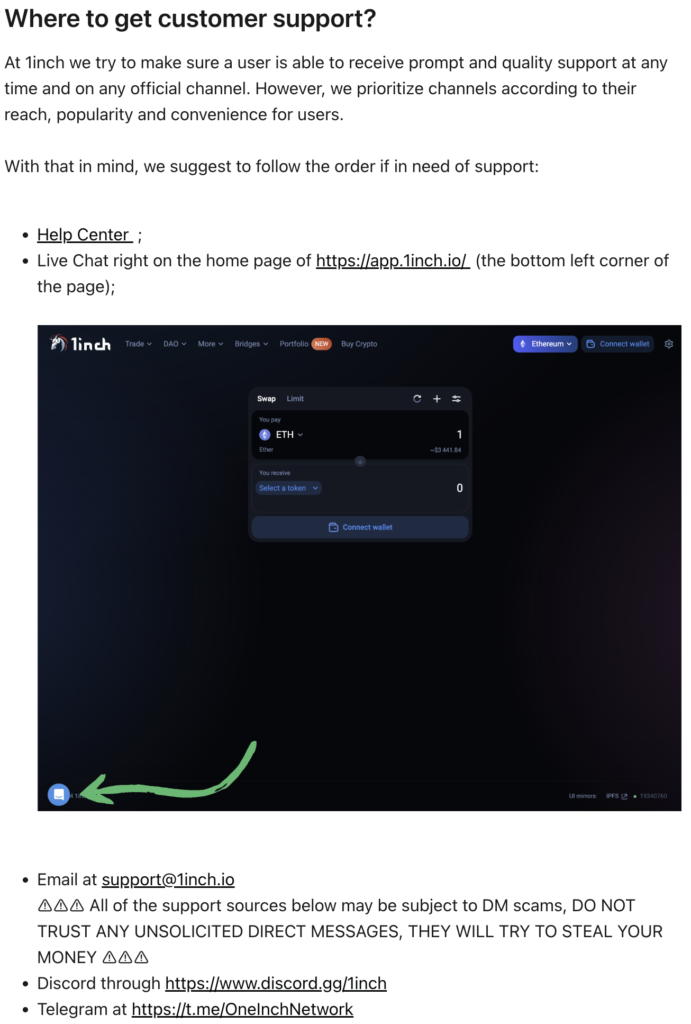

Customer Support

1inch offers customer support through various channels, including a comprehensive FAQ section, email support, and active community forums. The platform is also present on social media, where users can get updates and interact with the team.

1inch Payment Methods

As a decentralized platform, 1inch exchange does not handle traditional payment methods. Users can trade cryptocurrencies by connecting their wallets, but fiat-to-crypto conversions must be done on other platforms before using 1inch.

Comparing 1inch with Alternatives

1inch is a leading decentralized exchange aggregator. However, it is not the only player in the market. Other platforms like Uniswap, SushiSwap, and Balancer also offer decentralized trading solutions.

1inch Exchange Competitors

1inch faces competition from other DEX aggregators and decentralized exchanges, such as:

- Uniswap: Known for its simplicity and extensive liquidity pools.

- SushiSwap: Offers additional features like staking and yield farming.

- Balancer: Provides customizable liquidity pools and advanced trading options.

Each of these platforms has its own strengths and weaknesses, but 1inch stands out for its efficient aggregation and best-rate guarantees.

Who Is This Exchange For?

1inch DEX is suitable for a wide range of users, including:

- Beginner Traders: The user-friendly interface and simple setup process make it accessible for newcomers.

- Experienced Traders: Advanced features and competitive rates appeal to seasoned traders.

- DeFi Enthusiasts: Users interested in the broader DeFi ecosystem will find 1inch’s integration with multiple DEXs beneficial.

Conclusion: Is 1inch Right for You?

Our 1inch review determined that it is a powerful tool for anyone looking to trade cryptocurrencies efficiently. Its aggregation algorithm ensures the best rates, while the user-friendly interface makes it accessible for all levels of traders. With robust security measures and a wide range of supported assets, 1inch is a reliable choice in the DeFi space. However, potential users should be aware of the inherent risks in DeFi and ensure they conduct thorough research before trading.

Frequently Asked Questions

What Coins Are Supported by 1inch?

1inch supports a wide range of cryptocurrencies, including major assets like BTC, ETH, and various ERC-20 tokens.

What Happens If 1inch Goes Out of Business?

As a non-custodial platform, user funds are not held by 1inch. If the platform were to go out of business, users would still retain control of their assets through their connected wallets.

What Are The Disadvantages of 1inch?

Some disadvantages include the complexity of DeFi for beginners and the potential risks associated with smart contract vulnerabilities and market volatility.

Why You Can Trust Our Review?

Our review is based on thorough research and analysis of 1inch’s features, user feedback, and market position. We strive to provide unbiased and accurate information to help users make informed decisions.