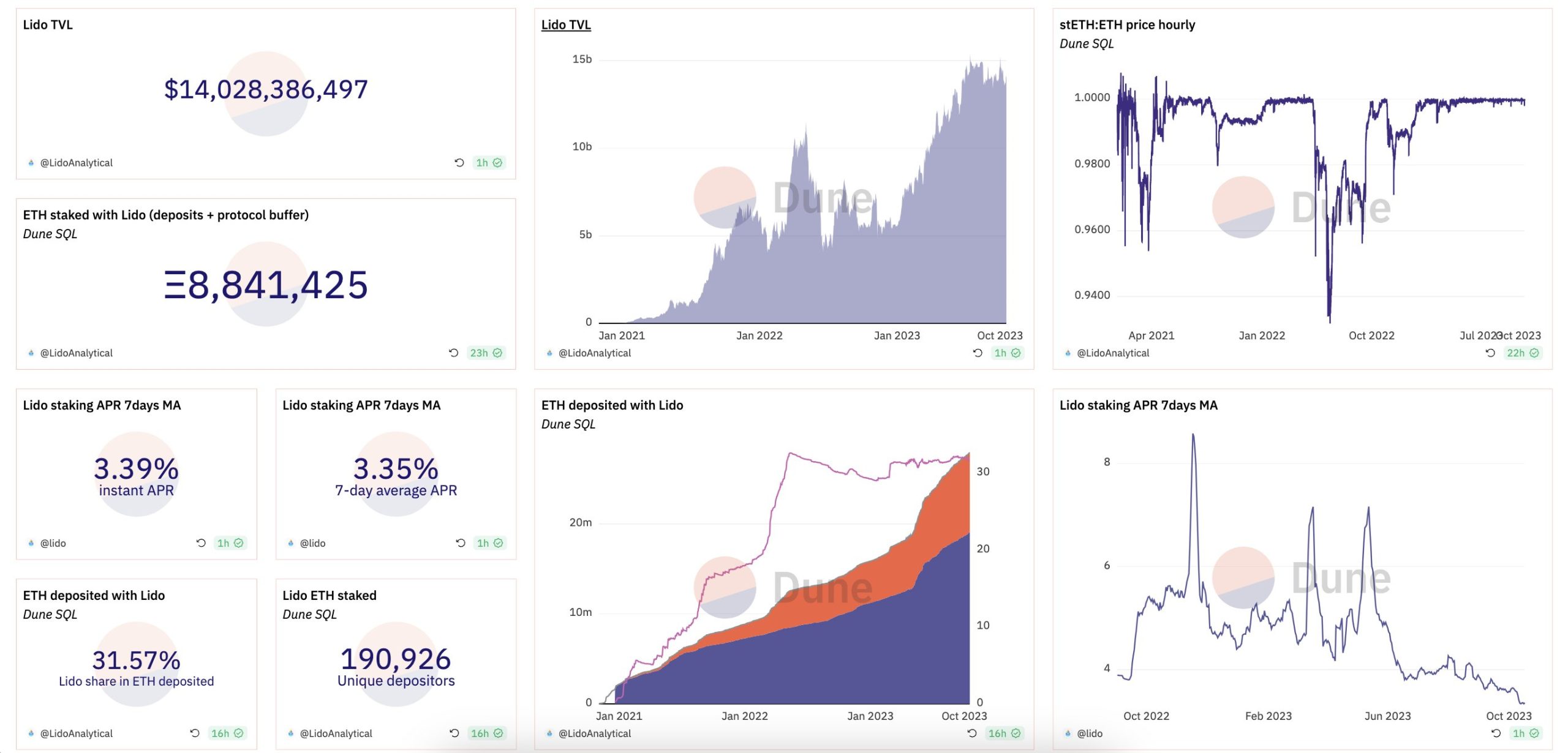

Over the past week, Lido Finance made changes to its Total Value Locked (TVL), staking activity, and token statistics. Lido Finance’s Total Value Locked (TVL) fell 4.96% to $13.86 billion. The fluctuation of token values affects the system’s assets, lowering value.

Lido Ranks Third in Net New ETH Staked, Adding 48,480 ETH

Lido’s Ethereum Staking Position: Lido ranked third in net fresh ETH staked last week. Lido gained 48,480 ETH during this time. Other major platforms like Binance and Coinbase led this effort. Lido’s staked Ethereum token, stETH, witnessed a little APR drop last week. Reduced Eth2 (EL) incentives and low gas prices are contributing to this drop. The 7-day Moving Average (MA) for stETH APR is 3.32%, according to current data.

Lido’s wrapped staked Ethereum (w)stETH liquidity pools have grown. Liquidity pools rose 2.20%, totaling 155.01k stETH. The growth indicates stETH’s further liquidity boost. (w)stETH in lending pools increased 0.04%, indicating stability. The total wrapped staked Ethereum (wstETH) in loan pools is 3.01 million.

Lido Finance provides stETH to multiple DeFi protocols, making it crucial to the ecosystem. The decentralized finance (DeFi) ecosystem contains 3,162,806 stETH. In the previous week, the numerical value rose 0.14%, reaching 35.88% of the aggregate stETH supply.

Lido Boosts (w)stETH to Layer 2 Solutions with 0.24% Increase to 139,669 Tokens

Lido has grown due to a little increase in (w)stETH transmitted to Layer 2 scaling solutions. The total bridged (w)stETH increased by 0.24% to 139,669. This figure is shared by Arbitrum, Optimism, and Polygon Layer 2 solutions.

The default data display time is Monday, 00:00 UTC, and the data is derived across seven days. The metrics and data offered provide useful insights into the current performance and activities of the Lido Finance ecosystem, focusing on staking, liquidity provision, and DeFi protocols.

Decentralized liquid staking protocols allow anyone to stake their crypto holdings without a central authority. This protocol converts staked after a democratic voting procedure in Lido’s decentralized autonomous organization, Lido Finance decided to leave the Solana blockchain.

The decentralized finance (DeFi) ecosystem now holds 35.88% of the stETH supply, 3,162,806 units. Layer 2 solutions received 139,669 (w)stETH tokens from Lido. The data above show Lido’s dynamic performance in DeFi. After a community vote, Lido Finance left the Solana blockchain due to financial concerns and low fees.