- 1. Mina Protocol: A Quick Introduction

- 2. How Does Mina Work?

- 3. Mina Protocol: Historical Price Sentiment

- 4. Mina Price Prediction: Technical Analysis

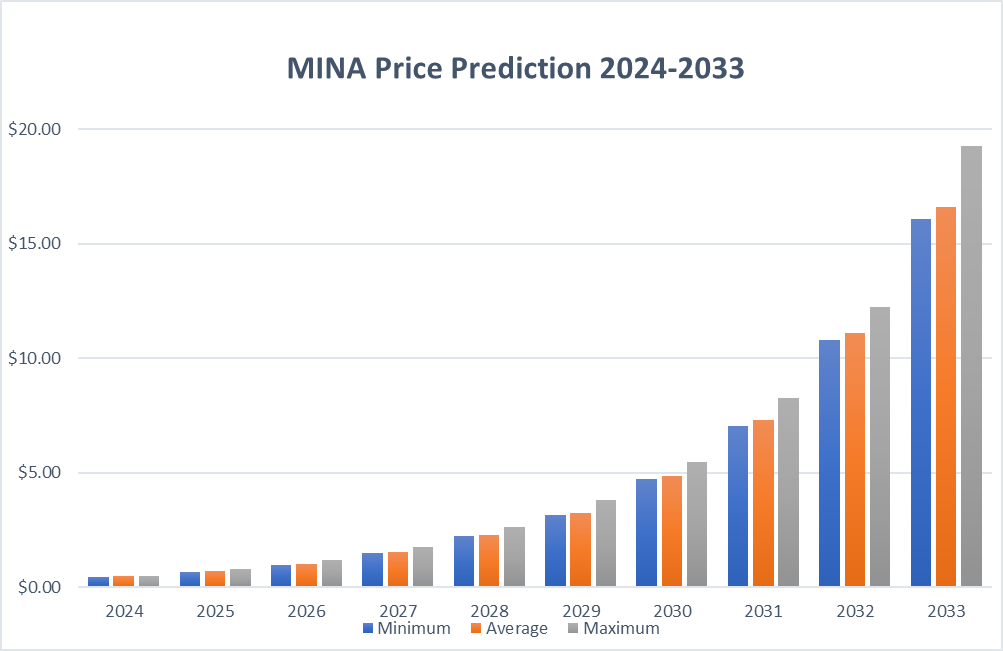

- 5. Mina Price Prediction By Blockchain Reporter

- 5.1. Mina Price Prediction 2024

- 5.2. Mina Price Prediction 2025

- 5.3. MINA Price Forecast for 2026

- 5.4. Mina (MINA) Price Prediction 2027

- 5.5. Mina Price Prediction 2028

- 5.6. Mina Price Prediction 2029

- 5.7. Mina (MINA) Price Prediction 2030

- 5.8. Mina Price Forecast 2031

- 5.9. Mina (MINA) Price Prediction 2032

- 5.10. Mina Price Prediction 2033

- 6. Mina Price Targets: By Experts

- 7. Is Mina a Good Investment? When to Buy?

- 8. Conclusion

Mina Protocol aims to create a compact blockchain that stays at a constant size of just 22 kB, no matter how many transactions it processes. This small size means that anyone can run a node to help secure the network without needing powerful computers. By keeping the entire blockchain smaller than many of the photos on your smartphone, Mina hopes to solve the problem of bloated blockchains that other projects face as they expand. Mina Protocol’s own cryptocurrency, MINA, is used to carry out transactions on the network and to distribute transaction fees among users. As blockchain technology has become more popular, the amount of transaction data stored on most platforms has grown considerably.

For example, the size of the Ethereum blockchain grew from just over 5 GB in April 2016 to more than 220 GB by April 2021, accumulating millions of transactions during that period. As blockchains grow, running a node, which requires storing the full transaction history, has become more demanding. This complexity discourages average users and raises concerns about centralization, as those with advanced computing resources can better manage large blockchains. To tackle this, Mina Protocol uses a cryptographic method called zk-SNARKS to create a payment-focused blockchain that doesn’t require nodes to keep a complete transaction record. This approach lessens the need for high computing power and aims to make node operation more accessible, promoting a more decentralized and secure network. In this article, we’ll explore Mina price prediction with an in-depth analysis of the MINA coin price and its future market sentiment.

Mina Protocol: A Quick Introduction

The Mina Protocol, developed by O(1) Labs, is a new blockchain protocol that enables anyone to participate with full node security using minimal resources. Even smartphones can join the Mina network because syncing only involves downloading a few kilobytes of data and requires just milliseconds of computation. This is a significant departure from traditional blockchain protocols, which demand downloading massive gigabytes of data and performing extensive computations. Mina addresses the growing issue of bloated blockchain data by offering a compressed blockchain that’s only about the size of a few tweets.

Since Mina Protocol utilizes zk-SNARKs, decentralized applications (dApps) on its network are known as “Snapps”—short for Snark-powered apps or zk-Apps. These apps can interact with data from different chains, but they only exchange zero-knowledge metadata, ensuring that user data remains unreadable. For instance, in verifying credit scores, a Snapp could generate a snapshot of your credit file as proof of eligibility for a loan, without actually disclosing your credit details. This method of securely integrating real-world data into the blockchain offers Mina a distinct edge in the decentralized finance (DeFi) sector, allowing users to maintain control over their personal data securely.

How Does Mina Work?

The cornerstone of Mina Protocol is the use of zk-SNARKs, which stands for “zero-knowledge succinct non-interactive arguments of knowledge.” This technology, first developed by MIT professor and Algorand founder Silvio Micali, enables users to prove possession of specific data without actually revealing the data itself. Zcash is another cryptocurrency that utilizes zk-SNARKs.

For Mina, this technology means that the network doesn’t need to validate every block for each transaction. Instead, the entire blockchain is represented by a compact cryptographic proof (the zk-SNARK), which is much smaller than traditional blockchain representations and encapsulates the state of the entire chain, not just the most recent block.

Mina combines this with a Proof-of-Stake consensus mechanism, significantly reducing the resources required to process and log transactions.

Participants in the Mina network must operate a node. The network specifically requires two types of specialized nodes to function efficiently:

- Block Producers – Similar to miners or validators in other blockchains, they select transactions for inclusion in upcoming blocks and earn rewards for the blocks they complete.

- Snark Workers – They use their computing resources to compress network data and produce transaction proofs. Block producers then purchase these proofs, compensating the snark workers with MINA.

The whitepaper states, “Early blockchains, like Bitcoin and Ethereum, accumulate data over time and are currently hundreds of gigabytes in size. As time goes on, their blockchains will continue to increase in size. The entire chain history is required to verify the current consensus state of these networks.”

“With Mina, the blockchain always remains a constant size — about 22KB (the size of a few tweets). It’s possible to verify the current consensus state of the protocol using this one recursive, 22KB zero-knowledge proof. This means participants can quickly sync and verify the current consensus state of the network.”

Mina Protocol: Historical Price Sentiment

Let’s take a closer look at the notable events in Mina’s price history. While past performance is not always indicative of future results, understanding the coin’s track record can offer valuable insight when making or evaluating a Mina price prediction.

Mina was introduced to the public market in early summer 2021. It reached its peak price of $9.91 on June 1. However, the market was on a downturn at that time, and the price quickly plummeted. By late July, MINA had dropped below one dollar. There was a rebound, though, and by September, MINA was trading above $5. It remained stable above $4 for several months before ending the year at $3.55.

2022 proved to be a challenging year for cryptocurrencies. Following the collapse of the Terra (LUNA) blockchain, MINA’s value fell below a dollar in May. The situation worsened with the bankruptcy of the FTX (FTT) exchange, leading MINA to finish the year at just $0.4339, losing nearly 90% of its value throughout the year.

2023 turned out to be a surprisingly good year for Mina, better than expected during the previous fall. The year started promisingly as the coin surpassed one dollar in February.

However, Mina faced challenges, particularly when the U.S. Securities and Exchange Commission took legal action against the Binance and Coinbase exchanges in June, significantly impacting its price. The situation worsened when Crypto.com (CRO) halted its US institutional operations on June 10, causing MINA to dip to $0.3756. Nevertheless, the coin recovered, and the optimism peaked on July 13 following a court decision favoring Ripple’s XRP, which declared it was not a security when sold on an exchange, boosting MINA to $0.5127.

The market experienced another downturn when Elon Musk’s SpaceX sold off a substantial amount of Bitcoin (BTC) on August 18, dragging MINA down to $0.3617. The coin hit its lowest point for the year on October 11, at $0.352. However, buoyed by positive market conditions and news from Upbit, MINA climbed to a high of $0.9298 by October 24. By November 24, its value was approximately $0.74, and following the appointment of a new executive at Hemecker, the coin ended the year strong at $1.35, marking a more than 200% increase for the year.

In 2024, the upward trend continued with MINA reaching its peak at $1.68 on January 2. By January 30, it was trading around $1.20, but then experienced a decline, touching $0.8042 by May 17, 2024. In recent weeks, the price further declined as it dropped toward the low of $0.4.

Mina Price Prediction: Technical Analysis

Mina reversed its course from the 20-day exponential moving average ($0.41), dropping to the $0.4 support level. However, buyers are strongly defending further declines as they aim for an immediate surge above Fib channels. As of writing, Mina price trades at $0.408, declining over 1.6% in the last 24 hours.

Bulls are likely to fiercely defend the $0.4 level, as a breach could lead the MINA/USDT pair to fall toward $0.35. This level might see strong buying interest from bulls, but bears could attempt to cap any recovery rally at $0.42. If the price dips below $0.35, the next target could be $0.29.

This bearish outlook would be invalidated if the price rebounds from the current level and surpasses the 50-day simple moving average ($0.43). The pair could then rally to $0.47, with a potential move toward the critical resistance at $0.51.

Mina Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.462 | 0.4787 | 0.5044 |

| 2025 | 0.6696 | 0.6888 | 0.7971 |

| 2026 | 0.983 | 1.01 | 1.17 |

| 2027 | 1.48 | 1.53 | 1.73 |

| 2028 | 2.22 | 2.28 | 2.61 |

| 2029 | 3.14 | 3.25 | 3.82 |

| 2030 | 4.74 | 4.87 | 5.45 |

| 2031 | 7.04 | 7.28 | 8.24 |

| 2032 | 10.81 | 11.1 | 12.24 |

| 2033 | 16.06 | 16.61 | 19.25 |

Mina Price Prediction 2024

Historically, following the Bitcoin halving event, there has typically been a prolonged bull market, during which Bitcoin and various altcoins reached new all-time highs (ATHs). Mina debuted following the most recent Bitcoin Halving in 2018; therefore, there is no historical data on Mina’s price behavior during such events. However, the history of other altcoins suggests that Mina’s price is likely to increase.

In 2024, the Mina price is expected to bottom out at $0.4620. The peak price could hit $0.5044, with an average price settling around $0.4787 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.4620 | $0.4704 | $0.4787 |

| February | $0.4659 | $0.4723 | $0.4810 |

| March | $0.4697 | $0.4742 | $0.4834 |

| April | $0.4736 | $0.4761 | $0.4857 |

| May | $0.4774 | $0.4781 | $0.4880 |

| June | $0.4813 | $0.4800 | $0.4904 |

| July | $0.4851 | $0.4819 | $0.4927 |

| August | $0.4890 | $0.4838 | $0.4951 |

| September | $0.4928 | $0.4858 | $0.4974 |

| October | $0.4967 | $0.4877 | $0.4997 |

| November | $0.5005 | $0.4896 | $0.5021 |

| December | $0.5044 | $0.4916 | $0.5044 |

Mina Price Prediction 2025

Looking forward to 2025, we might observe cryptocurrencies reaching their peak as the bull market, triggered by the Bitcoin Halving event, approaches its zenith. Historically, this peak has occurred around 18 months after the halving. Consequently, Mina’s price could potentially climb higher than its 2024 levels.

Forecasting prices in the dynamic and unpredictable cryptocurrency market is challenging. However, looking towards 2030, several factors appear to favor Mina.

Firstly, another Bitcoin Halving is scheduled for 2028, and if past patterns hold, 2030 could see cryptocurrency prices reaching their peaks. Additionally, the Mina Protocol is being developed using the innovative, yet relatively obscure technologies of zk-proofs and zk-snarks. By 2030, it is expected that these technologies will be better understood and more widely adopted, particularly within decentralized blockchain platforms. This broader adoption, coupled with an increased demand for privacy-centric protocols, could significantly boost Mina’s price.

For 2025, it’s anticipated that Mina’s price will not fall below $0.6696. It may climb to a high of $0.7971, averaging $0.6888 over the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.6696 | $0.6792 | $0.6888 |

| February | $0.6812 | $0.6850 | $0.6986 |

| March | $0.6928 | $0.6908 | $0.7085 |

| April | $0.7044 | $0.6966 | $0.7183 |

| May | $0.7160 | $0.7024 | $0.7282 |

| June | $0.7276 | $0.7082 | $0.7380 |

| July | $0.7391 | $0.7140 | $0.7479 |

| August | $0.7507 | $0.7198 | $0.7577 |

| September | $0.7623 | $0.7256 | $0.7676 |

| October | $0.7739 | $0.7314 | $0.7774 |

| November | $0.7855 | $0.7372 | $0.7873 |

| December | $0.7971 | $0.7430 | $0.7971 |

MINA Price Forecast for 2026

Predictions for 2026 suggest a minimum price of $0.9830 for Mina. The price is likely to surge to a maximum of $1.17, maintaining an average of $1.01 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $0.9830 | $0.9965 | $1.0100 |

| February | $1.0000 | $1.0050 | $1.0245 |

| March | $1.0170 | $1.0135 | $1.0391 |

| April | $1.0340 | $1.0220 | $1.0536 |

| May | $1.0510 | $1.0305 | $1.0682 |

| June | $1.0680 | $1.0390 | $1.0827 |

| July | $1.0850 | $1.0475 | $1.0973 |

| August | $1.1020 | $1.0560 | $1.1118 |

| September | $1.1190 | $1.0645 | $1.1264 |

| October | $1.1360 | $1.0730 | $1.1409 |

| November | $1.1530 | $1.0815 | $1.1555 |

| December | $1.1700 | $1.0900 | $1.1700 |

Mina (MINA) Price Prediction 2027

Forecasting into 2027, Mina is slated to have a minimum price of $1.48. The price could escalate to a high of $1.73, with an average around $1.53.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $1.4800 | $1.5050 | $1.5300 |

| February | $1.5027 | $1.5164 | $1.5482 |

| March | $1.5255 | $1.5277 | $1.5664 |

| April | $1.5482 | $1.5391 | $1.5845 |

| May | $1.5709 | $1.5505 | $1.6027 |

| June | $1.5936 | $1.5618 | $1.6209 |

| July | $1.6164 | $1.5732 | $1.6391 |

| August | $1.6391 | $1.5845 | $1.6573 |

| September | $1.6618 | $1.5959 | $1.6755 |

| October | $1.6845 | $1.6073 | $1.6936 |

| November | $1.7073 | $1.6186 | $1.7118 |

| December | $1.7300 | $1.6300 | $1.7300 |

Mina Price Prediction 2028

In 2028, the forecast suggests Mina will maintain a minimum price of $2.22 and may reach up to $2.61, averaging about $2.28 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | $2.2200 | $2.2500 | $2.2800 |

| February | $2.2555 | $2.2677 | $2.3100 |

| March | $2.2909 | $2.2855 | $2.3400 |

| April | $2.3264 | $2.3032 | $2.3700 |

| May | $2.3618 | $2.3209 | $2.4000 |

| June | $2.3973 | $2.3386 | $2.4300 |

| July | $2.4327 | $2.3564 | $2.4600 |

| August | $2.4682 | $2.3741 | $2.4900 |

| September | $2.5036 | $2.3918 | $2.5200 |

| October | $2.5391 | $2.4095 | $2.5500 |

| November | $2.5745 | $2.4273 | $2.5800 |

| December | $2.6100 | $2.4450 | $2.6100 |

Mina Price Prediction 2029

The 2029 forecast for Mina prices shows a potential low of $3.14 and a high of $3.82, with an average price of $3.25 expected throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 2.7 | 2.8 | 2.85 |

| February | 2.75 | 2.85 | 2.9 |

| March | 2.8 | 2.9 | 2.95 |

| April | 2.85 | 2.95 | 3 |

| May | 2.9 | 3 | 3.05 |

| June | 2.95 | 3.05 | 3.1 |

| July | 3 | 3.1 | 3.15 |

| August | 3.05 | 3.15 | 3.2 |

| September | 3.1 | 3.2 | 3.25 |

| October | 3.15 | 3.25 | 3.3 |

| November | 3.2 | 3.3 | 3.35 |

| December | 3.14 | 3.25 | 3.82 |

Mina (MINA) Price Prediction 2030

By 2030, Mina is expected to achieve a minimum price of $4.74, potentially rising to $5.45, with an average price of $4.87 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 4.2 | 4.3 | 4.4 |

| February | 4.25 | 4.35 | 4.45 |

| March | 4.3 | 4.4 | 4.5 |

| April | 4.35 | 4.45 | 4.55 |

| May | 4.4 | 4.5 | 4.6 |

| June | 4.45 | 4.55 | 4.65 |

| July | 4.5 | 4.6 | 4.7 |

| August | 4.55 | 4.65 | 4.75 |

| September | 4.6 | 4.7 | 4.8 |

| October | 4.65 | 4.75 | 4.85 |

| November | 4.7 | 4.8 | 4.9 |

| December | 4.74 | 4.87 | 5.45 |

Mina Price Forecast 2031

Looking ahead to 2031, Mina’s price is expected to range between a minimum of $7.04 and a maximum of $8.24, with an average price of $7.28 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 6.5 | 6.6 | 6.7 |

| February | 6.55 | 6.65 | 6.75 |

| March | 6.6 | 6.7 | 6.8 |

| April | 6.65 | 6.75 | 6.85 |

| May | 6.7 | 6.8 | 6.9 |

| June | 6.75 | 6.85 | 6.95 |

| July | 6.8 | 6.9 | 7 |

| August | 6.85 | 6.95 | 7.05 |

| September | 6.9 | 7 | 7.1 |

| October | 6.95 | 7.05 | 7.15 |

| November | 7 | 7.1 | 7.2 |

| December | 7.04 | 7.28 | 8.24 |

Mina (MINA) Price Prediction 2032

For 2032, the forecast predicts a minimum price of $10.81 for Mina, reaching up to $12.24, with an average trading price around $11.10.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 10 | 10.2 | 10.4 |

| February | 10.1 | 10.3 | 10.5 |

| March | 10.2 | 10.4 | 10.6 |

| April | 10.3 | 10.5 | 10.7 |

| May | 10.4 | 10.6 | 10.8 |

| June | 10.5 | 10.7 | 10.9 |

| July | 10.6 | 10.8 | 11 |

| August | 10.7 | 10.9 | 11.1 |

| September | 10.75 | 11 | 11.2 |

| October | 10.8 | 11.05 | 11.3 |

| November | 10.81 | 11.08 | 11.6 |

| December | 10.81 | 11.1 | 12.24 |

Mina Price Prediction 2033

In 2033, Mina’s price is forecasted to range from a minimum of $16.06 to a maximum of $19.25, with an average price of $16.61 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 15 | 15.2 | 15.4 |

| February | 15.1 | 15.3 | 15.5 |

| March | 15.2 | 15.4 | 15.6 |

| April | 15.3 | 15.5 | 15.7 |

| May | 15.4 | 15.6 | 15.8 |

| June | 15.5 | 15.7 | 15.9 |

| July | 15.6 | 15.8 | 16 |

| August | 15.7 | 15.9 | 16.1 |

| September | 15.8 | 16 | 16.2 |

| October | 15.9 | 16.1 | 16.3 |

| November | 16 | 16.3 | 17 |

| December | 16.06 | 16.61 | 19.25 |

Mina Price Targets: By Experts

According to the current Mina Protocol price prediction on Coincodex, the price of Mina Protocol is expected to rise by 227.70% and reach $1.374713 by October 6, 2024. Coincodex’s technical indicators suggest a Bearish current sentiment, while the Fear & Greed Index indicates 22 (Extreme Fear).

Mina Protocol has experienced 14 out of 30 green days, with a price volatility of 6.11% over the last 30 days. Based on the forecast from Coincodex, it is currently not an ideal time to purchase Mina Protocol.

Analyzing the historical price trends of Mina Protocol and the Bitcoin halving cycles, the predicted yearly low for Mina Protocol in 2025 is estimated at $0.4195. Concurrently, the price of Mina Protocol is expected to climb as high as $1.979859 in the following year.

According to market analysts and experts referenced by Digital Coin Price, MINA is predicted to start 2026 at $1.20 and trade around $1.48, marking a significant increase from the previous year. This is considered an acceptable rise in Mina’s price. By 2032, Mina’s price is expected to reach at least $5.59, with an average trading price of $5.80 throughout the year. The highest value for Mina could reach $5.84. Specialists anticipate that the maximum trading price will hover around $5.80.

Is Mina a Good Investment? When to Buy?

In the world of blockchain, where every transaction is out in the open, Mina offers a privacy-centric approach that lets individuals share only the specific pieces of personal information they choose, without revealing anything extra. This gives Mina significant long-term potential.

Technically speaking, Mina’s compact size and ongoing development efforts lay a strong foundation for wider adoption by those who need or prefer privacy-focused solutions. However, it remains to be seen if there will be a broader demand for zk-focused technologies as blockchain becomes more mainstream.

In the short term, Mina and its underlying technology are still relatively unknown, which might slow its growth. But this obscurity also presents a chance for informed investors to get involved before zero-knowledge proofs and related technologies take off.

It’s important to note that Mina isn’t the only protocol focusing on zero-knowledge technology. Some competitors are being developed on Ethereum, the second-largest cryptocurrency platform, which could potentially outpace Mina in adoption and utility.

Despite the competition, zero-knowledge technology is likely a key direction for blockchain’s evolution, and the outlook for this technology and protocols that utilize it remains promising.

Any investment at a price of around $0.3 might turn profitable in the long run. However, it is advised to do your own research before investing in the volatile market.

Conclusion

Mina and its foundational technology are unfamiliar to many, including seasoned traders. However, this newness should not be mistaken for lack of seriousness, as the zk-proof technology Mina utilizes has practical and significant applications.

Since it’s still new, Mina’s market price is yet to stabilize as it becomes more recognized. Future developments and events in the cryptocurrency market could boost Mina’s price. Ultimately, its long-term success hinges on the wider adoption of its underlying technology and Mina’s acceptance as a go-to privacy solution.

Mina Protocol streamlines how users engage with blockchain technology.

It condenses data into snapshots that can confirm the entire history of the blockchain without requiring the storage of all its data.

This lowers the barrier to entry and enhances the system’s scalability, facilitating more accessible and dependable applications such as decentralized finance and secure voting.

Frequently Asked Questions

What is Mina Protocol?

Mina Protocol is a lightweight blockchain designed to maintain a constant size of 22 kB, allowing anyone to run a node. It uses zk-SNARK technology to enable fast, secure transactions without requiring the entire transaction history.

How does Mina's zk-SNARK technology work?

Mina uses zk-SNARKs (zero-knowledge succinct non-interactive arguments of knowledge) to allow users to prove possession of data without revealing it. This keeps the blockchain small and efficient, ensuring privacy and scalability.

What was Mina’s highest price?

Mina reached its all-time high of $9.91 in June 2021 shortly after its public launch.

What factors affect Mina's price prediction?

Factors include technological advancements, market demand for privacy-focused blockchains, competition, and broader crypto market trends.

What is the Mina price prediction for 2024?

Analysts predict Mina’s price could range between $0.46 and $0.50 by the end of 2024, with potential growth tied to broader market recovery.

Could Mina reach $1 or more?

Yes, based on predictions, Mina could surpass the $1 mark by 2025, particularly if zk-SNARK technology gains wider adoption in the blockchain space.

Is Mina a good long-term investment?

Mina's unique zk-SNARK technology and focus on privacy give it long-term potential, especially as the demand for decentralized, privacy-focused solutions increases. However, as with any cryptocurrency, investment comes with risks due to market volatility.

Where can I buy Mina (MINA)?

Mina can be purchased on various cryptocurrency exchanges like Binance, Kraken, and Coinbase. Always ensure you are using a reputable platform.

What are the key features of Mina Protocol?

Key features include its constant blockchain size, zk-SNARKs for privacy, Proof-of-Stake consensus, and the ability to run a node with minimal resources, making it highly accessible.

What’s the future outlook for Mina Protocol?

With increasing focus on privacy and scalability, Mina has potential for growth, particularly if zk-SNARK technology becomes more mainstream. However, competition from other blockchain technologies may impact its trajectory.