- 1. XYO: A Quick Introduction

- 2. XYO: How Does It Work?

- 3. XYO Historical Price Sentiment

- 4. XYO Price Prediction: Technical Analysis

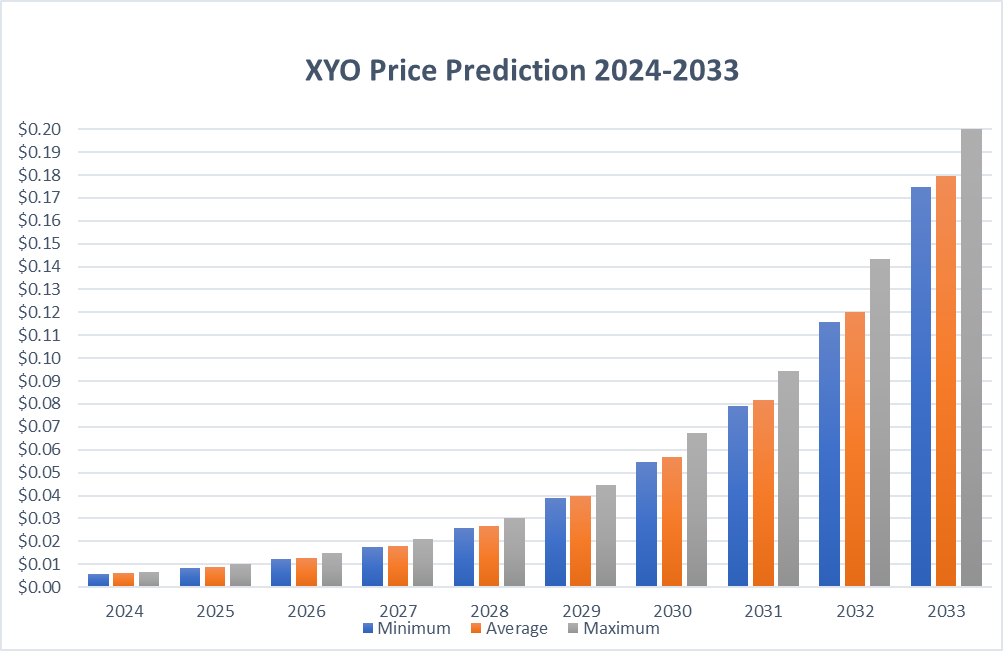

- 5. XYO Price Prediction By Blockchan Reporter

- 5.1. XYO Price Prediction 2024

- 5.2. XYO Price Prediction 2025

- 5.3. XYO Price Forecast for 2026

- 5.4. XYO Price Prediction 2027

- 5.5. XYO Price Prediction 2028

- 5.6. XYO Price Prediction 2029

- 5.7. XYO Price Prediction 2030

- 5.8. XYO Price Forecast 2031

- 5.9. XYO Price Prediction 2032

- 5.10. XYO Price Prediction 2033

- 6. XYO Price Targets: By Experts

- 7. Is XYO a Good Investment? When to Buy?

- 8. Conclusion

If you listen to some blockchain enthusiasts, they believe blockchain technology is about to revolutionize almost everything. They argue that anything that can be traded can be tokenized and placed on the blockchain. While this sounds good in theory, in reality, most things on the blockchain aren’t that diverse. There are plenty of crypto coins and tokens used for trading, but platforms focusing on things like wine or real estate are much less common. In fact, it’s often hard to tell how useful or legitimate some of these blockchain-based applications really are. The main point is that while certain things can be linked to the blockchain, finding a practical and logical way to do it is key. XYO is a program that aims to help people use geospatial data—information about locations on or near Earth’s surface—on the blockchain. It promotes itself as a “network of the future,” designed to help developers create blockchain applications that use smart contracts (programs that execute automatically when certain conditions are met) based on location data. The system works by connecting real-world location data to the blockchain when two unrelated objects recognize and report each other’s presence. In this article, we will explore XYO price prediction with an in-depth analysis of the current market sentiment. This article will provide profitable investment opportunities according to yearly XYO price forecasts.

XYO: A Quick Introduction

XYO Network is a decentralized ecosystem made up of consumer software, developer tools, a network, and digital assets. It focuses on gathering, verifying, and using decentralized data, while rewarding participants for their contributions.

Centered around the XYO token, the ecosystem allows individuals and organizations to maintain control of their own data—also called data sovereignty—and earn XYO tokens in return for sharing it.

The system encourages data usage by offering secure, unchangeable blockchain data that can be used for various applications like AI modeling, the metaverse, and data analytics.

XYO was launched in January 2018 as an IoT project within the decentralized physical infrastructure (DePIN) space by its parent company, XY Labs, Inc. Shortly after, the XYO Foundation was established. Co-founders Arie Trouw and Markus Levin saw the need for a trustless, decentralized location oracle.

The XYO token (an ERC-20 token) was introduced in March 2018. In February 2022, XYO expanded its original concept to include the aggregation and analysis of a broader range of heuristic and digital data, beyond just location and geospatial data.

This shift allowed XYO to enter broader Web3 markets, while still prioritizing data sovereignty, provenance, and permanence. In 2022, XY Labs became one of the first companies in the world to tokenize its stock, listing it on an alternative trading system (ATS) called tZERO ATS. Now, the $XYLB tokenized stock can be traded in over 40 countries, including the U.S.

XYO: How Does It Work?

XYO incentivizes users to submit and collect data by offering rewards, such as the XYO token and access to various services provided by the network.

The data submitted is anonymous and becomes a permanent, unchangeable part of XYO’s decentralized network. Users can choose to stop submitting data at any time.

Both XYO and third-party developers can access this data through XYO’s software tools, including comprehensive Software Development Kits (SDKs), documentation, and Application Programming Interfaces (APIs). To retrieve data, transactions are paid in XYO tokens, ensuring a sustainable economic cycle within the ecosystem.

The whitepaper states: “As connected, location-based technologies become more common, our privacy and safety increasingly depend on the accuracy and reliability of location data. While there have been efforts to remove the need for centralized entities controlling this data, each attempt has still depended on the trustworthiness of the devices gathering it.”

Products of XYO

Sentinels

Sentinels are physical devices within the XYO Network that gather location information. When two sentinels are in close proximity, they signal that they occupy the same location, a process known as bound witness, which serves as proof of the sentinel’s location. Because of this, sentinels are also referred to as location witnesses. They monitor data heuristics and verify accuracy by creating ledgers. Using proof of origin, sentinels contribute to a relay chain of cryptographic proof. When the information they provide meets the network’s criteria and is accepted, sentinels are rewarded with XYO tokens.

Bridges

Bridges act as connectors between sentinels and archivists, transmitting information from sentinels to archivists. These nodes are responsible for seeking out witness interactions and can be operated from bridge devices or smartphones. Bridges transfer information without alteration, only adding proof of origin. When a bridge responds to a query, it is compensated with the native XYO token.

Archivists

Archivists serve as data repositories for diviners, recording all confirmed witness interactions. They collect data from bridges, storing it in a decentralized manner. Archivists maintain ledgers, allowing them to easily retrieve strings of ledger data when necessary. Storage within the archivist system is free, and archivists earn rewards only when the stored raw data is used to answer a query. They are interconnected, so if one archivist cannot respond to a specific query, it can seek assistance from others.

Archivists are categorized into two types: those at the production edge and those at the consumption edge. The archivists in between are referred to as hybrids. An additional proof of origin is added whenever data is transferred from one archivist to another, and all archivists involved in this transfer receive rewards.

Diviners

Diviners function as oracles, uploading data into smart contracts. They collect information from archivists, analyze it, and assign accuracy scores to generate answers. As a crucial component of the network, diviners strive to obtain precise answers from archivists for queries posed in smart contracts. The answers with the highest accuracy scores are selected for upload back to the smart contracts. Queries in the smart contracts are prioritized based on the reward offered; the greater the reward, the quicker the system addresses the query.

XYO Historical Price Sentiment

Let’s take a look at XYO’s price history. While past performance doesn’t guarantee future results, understanding its trends can help us put future predictions into context.

2018-2020: XYO entered the market in May 2018, priced around $0.0060, and for almost three years, it didn’t exceed this value.

2021: This year was a turning point for XYO, as the crypto market boomed. On April 4, XYO reached a high of $0.0078. Despite a dip during the summer, it rebounded in August, surpassing $0.01 and hitting an all-time high of $0.0820 on November 6. It ended the year at $0.0339.

2022: After a year of growth, 2022 was tough for XYO and the crypto market. The collapse of the Terra (LUNA) blockchain in May pushed XYO below $0.0100. In August, the SEC declared XYO an unregistered security, and November’s FTX bankruptcy worsened the situation. XYO closed the year at $0.0031, a loss of over 90% from the previous year.

2023: The year started strong, with XYO reaching $0.0092 on January 4, but it soon trended downward. After the SEC sued Binance and Coinbase, and Crypto.com suspended U.S. operations in June, XYO fell to $0.0031. Despite a brief rally to $0.0039 in October, it dropped back to $0.0031 by mid-October. However, by year-end, XYO had climbed to $0.0064, more than doubling its value over 2023.

2024: So far in 2024, XYO has been on a downtrend and it traded at $0.0047 in August. In September, the price of XYO jumped and is now holding above $0.0062.

XYO Price Prediction: Technical Analysis

The bulls are making efforts to uphold the 50-day simple moving average at $0.0066, indicating that there is demand at these lower price levels. As a result, the price of XYO is facing an upward volatility in recent hours; however, bears are strongly defending further surges above immediate resistance channels. As of writing, XYO price trades at $0.0062, surging over 1.5% in the last 24 hours.

For buyers to enhance the chances of a rally towards $0.007, they need to hold the price above the 20-day exponential moving average at $0.006. If this level is successfully held, the next target could be around $0.008.

On the other hand, if the price declines and falls below the 50-day SMA, it would indicate that the bears are gaining control. In this scenario, the XYO/USDT pair could drop to $0.0055 and possibly reach the strong support level at $0.0043.

XYO Price Prediction By Blockchan Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.0059 | 0.0062 | 0.0064 |

| 2025 | 0.0085 | 0.0088 | 0.0102 |

| 2026 | 0.0122 | 0.0126 | 0.0147 |

| 2027 | 0.0175 | 0.018 | 0.0212 |

| 2028 | 0.0259 | 0.0267 | 0.0303 |

| 2029 | 0.0388 | 0.0399 | 0.0447 |

| 2030 | 0.0548 | 0.0568 | 0.0672 |

| 2031 | 0.0789 | 0.0818 | 0.0944 |

| 2032 | 0.1159 | 0.12 | 0.1431 |

| 2033 | 0.1747 | 0.1795 | 0.2056 |

XYO Price Prediction 2024

XYO’s ever-growing open-source toolkit includes powerful SDKs, complete with documentation, and APIs that are actively being developed. These SDKs enable developers to integrate the XYO protocol into its network, ecosystem, and infrastructure. For instance, third-party developers can create decentralized apps (dApps) that users can add to their xyOS desktop. The APIs will allow developers to access XYO’s extensive data library, which is curated to ensure user anonymity while maximizing the data’s value for developers.

In 2024, the price of XYO is projected to have a minimum value of $0.0059. The maximum expected price could reach $0.0064, with an average trading price of $0.0062 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0059 | 0.006 | 0.0061 |

| February | 0.0059 | 0.00605 | 0.00615 |

| March | 0.00592 | 0.0061 | 0.0062 |

| April | 0.00593 | 0.00612 | 0.00622 |

| May | 0.00595 | 0.00615 | 0.00625 |

| June | 0.00596 | 0.00618 | 0.00628 |

| July | 0.00597 | 0.0062 | 0.0063 |

| August | 0.00598 | 0.00622 | 0.00632 |

| September | 0.00599 | 0.00623 | 0.00634 |

| October | 0.006 | 0.00625 | 0.00635 |

| November | 0.00602 | 0.00628 | 0.00638 |

| December | 0.00605 | 0.0063 | 0.0064 |

XYO Price Prediction 2025

In 2024, XYO launched xyOS, a free in-browser hub node featuring a growing library of data-sovereign dApps to encourage more users to transform their devices into XYO nodes.

The network of nodes collects a wide range of data, including heuristic data, human-driven insights like behavioral patterns and opinions, and camera-based eyewitness evidence. XYO offers this combined data to third-party partners.

Moreover, XYO can mobilize all or part of its network through incentives, enabling partners to target specific demographics or locations for promotions, data collection, or tasks.

Based on forecasts and technical analysis, XYO is expected to reach a minimum price of $0.0085 in 2025. It could climb to a maximum of $0.0102, with an average value of $0.0088 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0085 | 0.0086 | 0.009 |

| February | 0.00852 | 0.00862 | 0.0091 |

| March | 0.00855 | 0.00865 | 0.0092 |

| April | 0.00857 | 0.00868 | 0.0093 |

| May | 0.0086 | 0.0087 | 0.00935 |

| June | 0.00863 | 0.00872 | 0.0094 |

| July | 0.00865 | 0.00875 | 0.0095 |

| August | 0.00868 | 0.00878 | 0.0096 |

| September | 0.0087 | 0.0088 | 0.0097 |

| October | 0.00875 | 0.00882 | 0.00985 |

| November | 0.0088 | 0.00885 | 0.01 |

| December | 0.00885 | 0.0088 | 0.0102 |

XYO Price Forecast for 2026

According to detailed technical analysis of XYO’s historical data, in 2026 the price is anticipated to reach a minimum of $0.0122. It could go as high as $0.0147, with an average trading price around $0.0126.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0122 | 0.0123 | 0.013 |

| February | 0.01225 | 0.01235 | 0.0131 |

| March | 0.0123 | 0.0124 | 0.0132 |

| April | 0.01235 | 0.01245 | 0.01335 |

| May | 0.0124 | 0.0125 | 0.0134 |

| June | 0.01245 | 0.01255 | 0.0135 |

| July | 0.0125 | 0.0126 | 0.0136 |

| August | 0.01255 | 0.01265 | 0.0137 |

| September | 0.0126 | 0.0127 | 0.0138 |

| October | 0.01265 | 0.01275 | 0.01395 |

| November | 0.0127 | 0.0128 | 0.0143 |

| December | 0.01275 | 0.01285 | 0.0147 |

XYO Price Prediction 2027

In 2027, XYO is forecast to reach a lowest value of $0.0175. Based on our analysis, it could hit a maximum of $0.0212, with an average price prediction of $0.0180.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0175 | 0.0176 | 0.0183 |

| February | 0.01755 | 0.01765 | 0.0185 |

| March | 0.0176 | 0.0177 | 0.0187 |

| April | 0.01765 | 0.01775 | 0.0189 |

| May | 0.0177 | 0.0178 | 0.0191 |

| June | 0.01775 | 0.01785 | 0.0193 |

| July | 0.0178 | 0.0179 | 0.0195 |

| August | 0.01785 | 0.01795 | 0.0197 |

| September | 0.0179 | 0.018 | 0.02 |

| October | 0.018 | 0.01805 | 0.0205 |

| November | 0.0181 | 0.0181 | 0.021 |

| December | 0.0182 | 0.0182 | 0.0212 |

XYO Price Prediction 2028

For 2028, XYO is predicted to have a minimum price of $0.0259. The price could rise to a maximum of $0.0303, with an average trading price of $0.0267 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0259 | 0.026 | 0.027 |

| February | 0.026 | 0.0261 | 0.0272 |

| March | 0.0261 | 0.0262 | 0.0274 |

| April | 0.0262 | 0.0263 | 0.0276 |

| May | 0.0263 | 0.0264 | 0.0278 |

| June | 0.0264 | 0.0265 | 0.028 |

| July | 0.0265 | 0.0266 | 0.0283 |

| August | 0.0266 | 0.02665 | 0.0286 |

| September | 0.0267 | 0.0267 | 0.029 |

| October | 0.02675 | 0.02675 | 0.0295 |

| November | 0.0268 | 0.0268 | 0.03 |

| December | 0.0269 | 0.0269 | 0.0303 |

XYO Price Prediction 2029

In 2029, XYO is expected to reach a minimum level of $0.0388, with a potential maximum of $0.0447 and an average trading price around $0.0399.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0388 | 0.039 | 0.0405 |

| February | 0.0389 | 0.0391 | 0.0407 |

| March | 0.039 | 0.0392 | 0.041 |

| April | 0.0391 | 0.0393 | 0.0413 |

| May | 0.0392 | 0.0394 | 0.0416 |

| June | 0.0393 | 0.0395 | 0.0419 |

| July | 0.0394 | 0.0396 | 0.0422 |

| August | 0.0395 | 0.0397 | 0.0425 |

| September | 0.0396 | 0.0398 | 0.043 |

| October | 0.0397 | 0.03985 | 0.0435 |

| November | 0.0398 | 0.0399 | 0.044 |

| December | 0.0399 | 0.0399 | 0.0447 |

XYO Price Prediction 2030

By 2030, XYO is anticipated to reach a minimum price of $0.0548. The maximum price could go up to $0.0672, with an average value of $0.0568 during the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0548 | 0.055 | 0.058 |

| February | 0.055 | 0.0552 | 0.0585 |

| March | 0.0552 | 0.0554 | 0.059 |

| April | 0.0554 | 0.0556 | 0.0595 |

| May | 0.0556 | 0.0558 | 0.06 |

| June | 0.0558 | 0.056 | 0.0607 |

| July | 0.056 | 0.0563 | 0.0615 |

| August | 0.0562 | 0.0565 | 0.0622 |

| September | 0.0564 | 0.0566 | 0.063 |

| October | 0.0566 | 0.0567 | 0.0642 |

| November | 0.0567 | 0.0568 | 0.0657 |

| December | 0.0568 | 0.0568 | 0.0672 |

XYO Price Forecast 2031

Based on forecast and technical analysis, XYO is projected to have a minimum price of $0.0789 in 2031. It could reach a maximum value of $0.0944, with an average trading price of $0.0818.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0789 | 0.0791 | 0.084 |

| February | 0.0791 | 0.0793 | 0.0845 |

| March | 0.0793 | 0.0795 | 0.085 |

| April | 0.0795 | 0.0797 | 0.0856 |

| May | 0.0797 | 0.08 | 0.0862 |

| June | 0.08 | 0.0803 | 0.087 |

| July | 0.0803 | 0.0805 | 0.088 |

| August | 0.0805 | 0.0807 | 0.0888 |

| September | 0.0808 | 0.081 | 0.0898 |

| October | 0.081 | 0.0813 | 0.091 |

| November | 0.0815 | 0.0815 | 0.0925 |

| December | 0.0818 | 0.0818 | 0.0944 |

XYO Price Prediction 2032

In 2032, XYO is expected to reach a minimum value of $0.1159. The price could rise to a maximum of $0.1431, with an average forecasted price of $0.1200.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.1159 | 0.1162 | 0.125 |

| February | 0.1162 | 0.1165 | 0.126 |

| March | 0.1165 | 0.1168 | 0.127 |

| April | 0.1168 | 0.1171 | 0.1282 |

| May | 0.1171 | 0.1174 | 0.1293 |

| June | 0.1174 | 0.1177 | 0.1305 |

| July | 0.1177 | 0.118 | 0.1318 |

| August | 0.118 | 0.1185 | 0.133 |

| September | 0.1185 | 0.119 | 0.135 |

| October | 0.119 | 0.1195 | 0.137 |

| November | 0.1195 | 0.1198 | 0.14 |

| December | 0.12 | 0.12 | 0.1431 |

XYO Price Prediction 2033

According to a deep technical analysis of XYO’s price history, in 2033 the minimum expected price is $0.1747. The maximum value could be $0.2056, with an average trading price of $0.1795.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.1747 | 0.175 | 0.18 |

| February | 0.175 | 0.1755 | 0.182 |

| March | 0.1752 | 0.1758 | 0.184 |

| April | 0.1755 | 0.176 | 0.1855 |

| May | 0.176 | 0.1765 | 0.187 |

| June | 0.1765 | 0.177 | 0.1885 |

| July | 0.177 | 0.1775 | 0.19 |

| August | 0.1775 | 0.178 | 0.192 |

| September | 0.178 | 0.1785 | 0.194 |

| October | 0.1785 | 0.179 | 0.196 |

| November | 0.179 | 0.1792 | 0.2 |

| December | 0.1795 | 0.1795 | 0.2056 |

XYO Price Targets: By Experts

According to Coincodex’s current price prediction for XYO Network, the price is expected to increase by 3.94%, reaching $0.006106 by November 4, 2024. The technical indicators suggest a bullish sentiment, while the Fear & Greed Index currently stands at 49, indicating a neutral market. Over the past 30 days, XYO Network has experienced 17 out of 30 green days, reflecting a 57% success rate, and has shown 12.90% price volatility.

Based on this forecast, Coincodex suggests that it is a good time to buy XYO Network. Additionally, considering the historical price movements of XYO Network and the Bitcoin halving cycles, the predicted yearly low for 2025 is estimated at $0.005772, while the price could potentially reach as high as $0.016282 next year.

By 2026, market analysts and experts predict that XYO will begin the year at $0.0179 and trade around $0.0219, marking a substantial increase compared to the previous year, as noted by Digital Coin Price. This represents a significant jump for XYO. Furthermore, predictions indicate that by early 2030, the price of XYO could reach $0.0451, with expectations for the price to remain at that level by the end of the year. Additionally, XYO may climb as high as $0.0411. The period from 2024 to 2030 is expected to be crucial for the growth of XYO.

Is XYO a Good Investment? When to Buy?

The XYO Network depends on four key groups of individuals to maintain its operations:

- Sentinels: They broadcast signals that are received and converted into data.

- Archivists: These are the data collectors.

- Diviners: They respond to inquiries related to the data.

- Bridges: These individuals facilitate connections within the network.

Users of the system are rewarded with the XYO token, which can also be bought, sold, and traded on various exchanges.

It’s difficult to determine the future of XYO. With potential legal action hanging over the network, many investors may choose to avoid it until the situation is clarified.

As always in the crypto space, it’s essential to conduct your own research before deciding whether to invest in XYO. However, an investment at around $0.0045 might be profitable in the long term.

Conclusion

The XY Oracle Network, commonly referred to as the XYO Network, is designed for collecting and validating geospatial data—information that includes geographical components. This is accomplished through the use of location beacons, which work in conjunction with the Internet of Things (IoT) and mobile devices. A key aspect of the protocol is the validation of geospatial data. Let’s take a closer look at the XYO price prediction explained in detail.

The trustless cryptographic location network offers layered verification of locations across different device types and protocols. XYO Network is built on a new cryptographic mechanism known as proof of origin and bound witness, which integrates blockchain technology with real-world location-based data collection.

Frequently Asked Questions

What is XYO?

XYO is a decentralized network designed for collecting and validating geospatial data. It leverages blockchain technology and IoT devices to offer secure location-based information, helping developers create smart contracts and decentralized apps (dApps).

How does XYO reward users?

XYO incentivizes users to submit data using tokens. Devices like Sentinels collect and verify geospatial data, with the network rewarding participants with XYO tokens for their contributions.

What’s the historical price trend of XYO?

XYO launched in 2018 at $0.0060, reaching an all-time high of $0.0820 in November 2021. However, it has since experienced significant volatility, dropping below $0.0100 in 2022 but recovering slightly in 2023.

What are the 2024 XYO price predictions?

Experts predict a price range between $0.0059 and $0.0064 in 2024, with potential growth depending on market conditions and developments within the XYO ecosystem.

What influences XYO’s price movement?

XYO's price depends on broader market conditions, adoption of its geospatial blockchain applications, and external factors such as regulatory developments and market volatility.

Is XYO a good long-term investment?

XYO has potential as a long-term investment due to its unique application of geospatial data in blockchain. However, it’s essential to consider market risks and conduct thorough research.

What is XYO’s role in Web3?

XYO is expanding into broader Web3 markets by aggregating and analyzing heuristic and digital data, beyond just geospatial information, to prioritize data sovereignty and permanence.

What challenges does XYO face?

Like many blockchain projects, XYO faces challenges related to regulatory concerns, market competition, and adoption hurdles, especially given its niche focus on geospatial data.