Shiba Inu and Dogecoin have recently made headlines due to significant interest from crypto whales, sparking a notable surge in their market activity. Meme coins Dogecoin (DOGE) and *SHIB* rallied alongside top meme tokens in response to GameStop’s rally on Monday. As legendary trader “Roaring Kitty” resurfaced on X with a series of tweets, meme tokens rallied, piling gains on Monday. Analysts believe a strong purchase in memecoins might strengthen the support levels, creating strong upward rallies.

Whales Bet Big On SHIB And DOGE

In the last 24 hours, the cryptocurrency market saw more than $140 million worth of positions liquidated as Bitcoin’s price dropped below $61,000, leading to considerable market fluctuations. This sharp decrease in price caused a surge in long-liquidation, weakening the market sentiment.

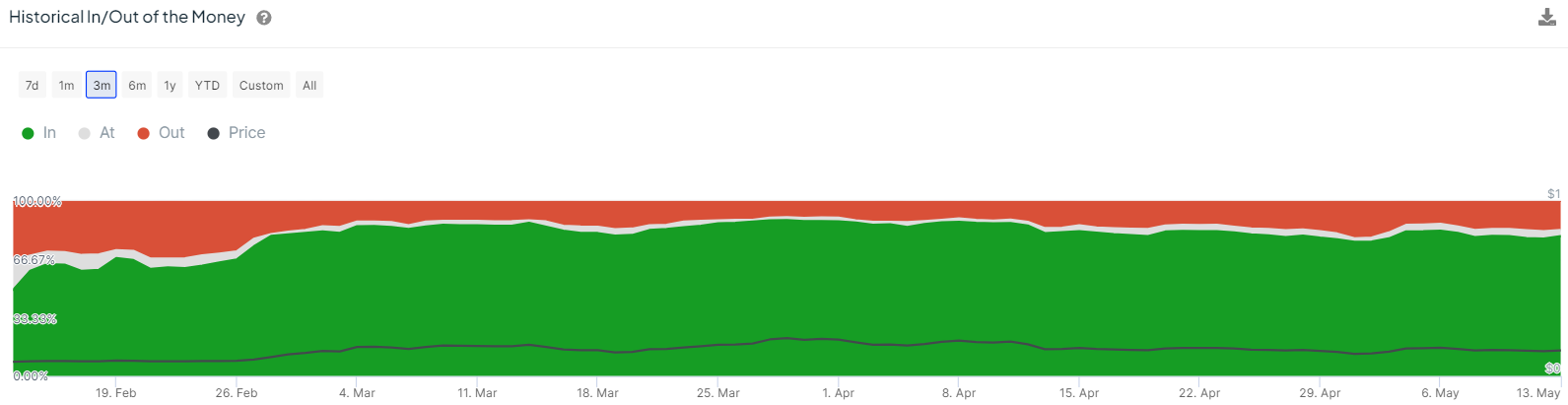

According to Coinglass, Dogecoin and Shiba Inu witnessed liquidation of around $5.6 million and $550K, respectively. IntoTheBlock reports that Dogecoin has around 80% of its addresses currently profitable. On the other hand, SHIB price has 60% of total addresses in profit.

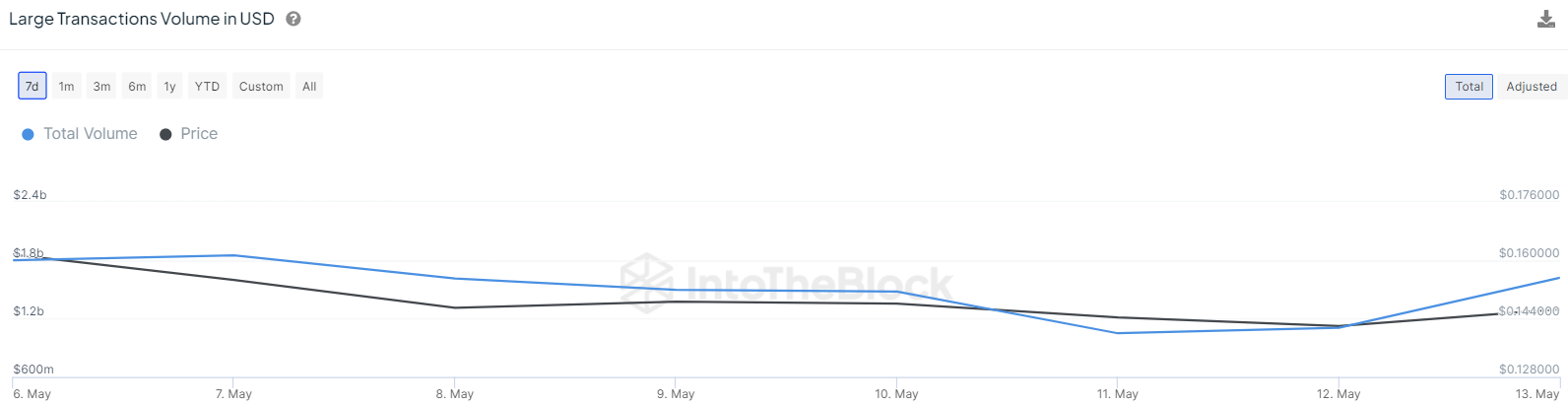

Additionally, IntoTheBlock data reveals that DOGE witnessed a massive jump in whale interest as the metric surged from the low of $1.1 billion to $1.6 billion. Shiba Inu’s whale transaction also surged exponentially as it jumped above $223 million from $9 million.

Dogecoin Price Analysis

Dogecoin has been trading within a range, oscillating between the 50-day Simple Moving Average (SMA) at $0.16 and a horizontal support at $0.12 for some time. As of writing, DOGE price trades at $0.146, declining over 2.6% in the last 24 hours.

Investors are working to keep the price above the 20-day Exponential Moving Average (EMA) at $0.15. Should they manage this, the DOGE/USDT pair could climb to the 50-day SMA. This level is critical for bears to hold as a breakthrough could lead to a surge towards the resistance zone ranging from $0.21 to $0.23.

Conversely, if the price falls and closes below $0.12, it would form a bearish head-and-shoulders pattern, potentially sending the pair down to the significant support level at $0.08.

Shiba Inu Price Analysis

Shiba Inu dropped below the $0.000023 support level, suggesting that bears are gaining control. However, buyers quickly gained control and defended the decline. As of writing, SHIB price trades at $0.0000233, declining over 1.3% in the last 24 hours.

The bulls are attempting to hold the 20-day EMA at $0.0000234, but any recovery is likely to encounter resistance at the downtrend line. A decline from this line could lead to a drop to the 61.8% Fibonacci retracement level at $0.00002, potentially extending to $0.0000185.

On the other hand, if the price rises and surpasses the downtrend line, it will indicate a market rejection of the lower levels. In this scenario, the SHIB/USDT pair might climb to the next resistance level at $0.000032.