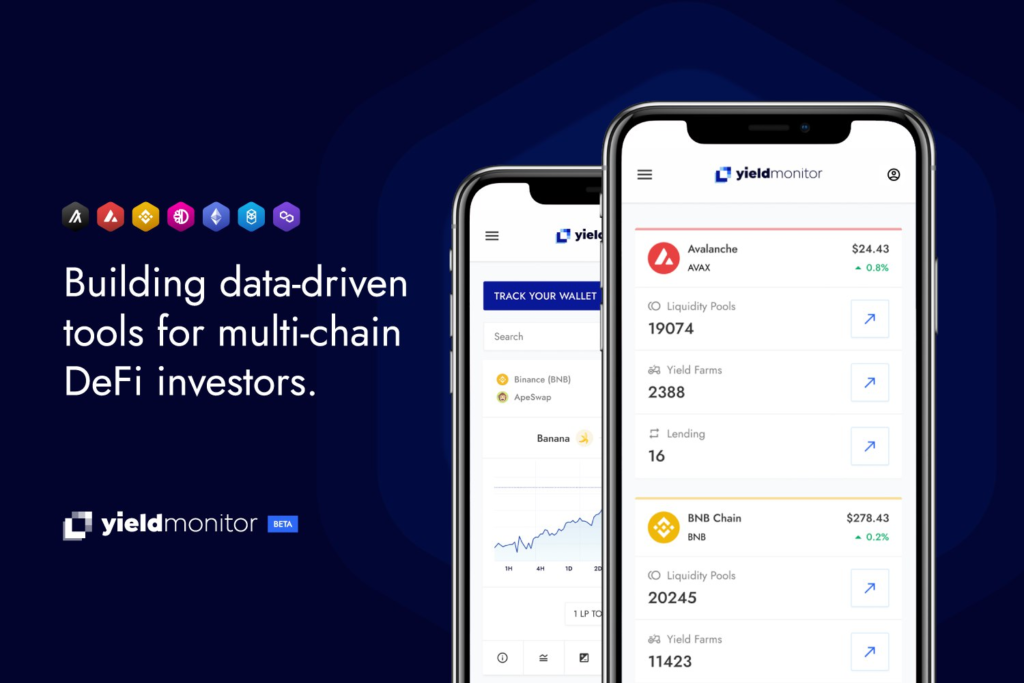

Yield Monitor, a multi-chain portfolio tracker for DeFi investors, has now announced the integration of the DeFiChain (DFI) blockchain into the Yield Monitor database. This marks the platform’s second non-EVM mainnet integration. DeFiChain is the most advanced blockchain on the Bitcoin network, and its primary mission is to make DeFi tools and services available to the general public. In addition, DeFiChain is the latest network to be added to the Yield Monitor database, joining the likes of Algorand (ALGO), Avalanche (AVAX), Binance (BNB), Ethereum (ETH), Fantom (FTM), and Polygon (MATIC).

Yield Monitor is a multi-chain portfolio tracking database toolbox designed for use by developers and investors in the DeFi ecosystem. In the form of wallet tracking and visual charting tools, it provides a variety of assets, liquidity pools, and yield farm performance statistics. The team is currently working on developing additional features, such as temporary loss tools, order book and transaction volume measurements, and asset listings, which will allow users to monitor comparable liquidity pools and yield farms across a variety of protocols.

Building A Powerful Database Infrastructure Foundation

Users will be able to obtain new insights into the metrics that revolve around DeFiChain as a result of the integration. Both investors and developers will be able to track assets that are held in wallets on the DeFiChain blockchain, and they will also be able to route cross-chain transactions to achieve pricing and efficiency optimizations.

Christophe Dupont, the Chief Executive Officer of Yield Monitor, expressed his company’s delight in developing a working partnership with the DeFiChain organization. According to him, the community demonstrates a high level of commitment and support for the myriad of builders and creators who are adding value to the ecosystem. They are excited to begin creating long-term, collaborative partnerships with DFI investors and current teams in the coming months, and they consider it a privilege to be able to include DeFiChain in their database.

Meanwhile, Mark Pedevilla, a DeFiChain Ambassador and News Anchor, noted that they were happy to see the development that Yield Monitor has made in a short amount of time, particularly considering the fact that they only have a small crew. According to him, this is more evidence of the high quality of their product as well as their commitment to establishing a robust database infrastructure foundation.

Creating A Truly Accessible, Multi-Chain DeFi Community

The DeFiChain project is an open-source blockchain initiative with the goal of providing everyone with access to DeFi services that are quick, intelligent, and transparent. It is maintained by a community of developers all around the world, and it is made up of a global team of core contributors. Due to the fact that DeFi is not Turing complete, transactions on DeFiChain are able to proceed swiftly and without hiccups, at low gas rates, and with a reduced risk of errors in smart contracts.

DeFiChain is an open-source Proof-of-Stake blockchain that was developed as a hard fork of the Bitcoin network in order to support more sophisticated DeFi applications. DeFiChain provides liquidity mining, staking, distributed assets, and distributed loans. The goal of the DeFiChain Foundation is to include DeFi in the Bitcoin ecosystem.

Yield Monitor is hard at work developing an automated and scalable multi-chain database that will enable tracking one’s DeFi portfolio and opportunities to invest in it more accessible to everyone. In addition, Yield Monitor is preparing specific features for DeFi investors with the help of its most recent integration, and it is delivering usefulness in the process of building a really accessible, multi-chain DeFi community, a community in which DeFiChain will play a significant part.