- Algorand (ALGO): An Introduction

- Algorand (ALGO) Price Statistics

- The Launch of the ALGO Token

- The Uniqueness of Algorand

- Comparison with Bitcoin

- Comparison with Ethereum

- Algorand (ALGO) Price Prediction: Price History

- Algorand (ALGO) Price Prediction: Fundamental Analysis

- Algorand (ALGO) Price Prediction: Technical Analysis

- Algorand (ALGO) Price Prediction

- Algorand (ALGO) Price Prediction 2023

- Algorand (ALGO) Price Prediction 2025

- Algorand (ALGO) Price Prediction 2030

- Conclusion

- FAQ

The crypto boom has attracted a great number of people around the world. Apart from that, the rise in the decentralized finance (DeFi) sector has added to this spike with the provision of several exclusive opportunities. Recent years have seen a considerable increase in this burgeoning sector’s adoption. This has been successful in providing the latest financial technology-related accessibility to people who were formerly unbanked. At present, people can perform, trading, and staking, as well as use smart contracts by using crypto technology.

This whole shift in the financial industry has been helpful to minimize the capitalism carried out by centralized organizations and authorities. Along with this, since the beginning of the crypto space with the launch of Bitcoin (BTC), numerous developments have taken place. In this regard, many crypto tokens (or altcoins) have entered the market and several of them were focused on removing the issues faced by consumers while using the primary crypto token. Algorand is a crypto that has been developed to solve the top issues.

Algorand (ALGO): An Introduction

Algorand (ALGO) is considered to be an independent blockchain ecosystem and cryptocurrency. It provides several scalable, efficient, and secure applications. It was developed for the initial pure proof-of-stake (PoS) blockchain. The technology of Algorand offers a suite of high-performance L1 blockchains that provide transaction finality, privacy, scalability, and security.

An L1 blockchain is considered to be comprised of several solutions that enhance the fundamental protocol to develop a more scalable system. The consensus protocol modifications and sharding are known as a couple of the majorly dominating L1 options. The establishment of Algorand was witnessed back in 2019. A computer science professor at Massachusetts, Silvio Michali, is responsible for founding Algorand. The primary objective of the platform was to oversee noteworthy research projects related to cryptocurrency finance, security, and theory.

Algorand (ALGO) Price Statistics

| Algorand (ALGO) Price: | $0.2152 |

| Algorand (ALGO) Rank: | 39 |

| Algorand (ALGO) Market Cap: | $1,548,717,176 |

| Algorand (ALGO) Trading Volume: | $68,077,498 |

| Algorand (ALGO) 24h High: | $0.2206 |

| Algorand (ALGO) 24h Low: | $0.2122 |

The Launch of the ALGO Token

ALGO is known as the Algorand blockchain’s native token. It plays the role of being among the most multipurpose tokens within the crypto sphere. It is utilized to pay for transactions, buy on-chain items like non-fungible tokens (NFTs), as well as to pay for services and goods. The crypto token ALGO was launched by the Algorand blockchain network during the boom of the initial coin offerings (ICOs).

The Uniqueness of Algorand

The blockchain network of Algorand is administered by the Algorand Foundation. It is available to individuals and companies that intend to utilize it. L2 smart contracts, scaling, interoperability, performance, as well as open and private models are prioritized by the technical innovation forefront of Algorand. Bitcoin experiences many challenges, taking into account the fact that the proof-of-work approach of BTC to stop generation requires a great extent of computation.

Comparison with Bitcoin

In addition to this, proof-of-work permits forks where a couple of substitutive blockchains with analogous lengths coexist while neither of them gets ahead of the other. As a consequence, there is a requirement of nearly one hour for the confirmation of a Bitcoin (BTC) transaction. Moreover, the anonymity offered by Bitcoin payments could even pave the way for money laundering, and terrorist organizations or criminals can get financed without being detected.

On the other hand, Algorand operates as a decentralized network just like the other open blockchain platforms. It targets to provide a solution to the top 3 issues witnessed in the blockchain industry. These issues take into account security, speed, and scalability. With diverse improvements, the proof-of-stake protocol of Algornad enables the blockchain to outcompete the other blockchain protocols.

The exclusive pure-proof-of-stake (PPoS) approach of the platform is structured to avoid the problem where the rich grows richer. In this way, PPoS randomly selects miners regardless of the investment made by them in the system. This is directly opposed to the PoS system where the miners are offered the highest stake.

Comparison with Ethereum

Algorand has several similarities with Ethereum and both blockchain networks are considered to be rivals of each other. Both of them offer infrastructure for the support of the other blockchain projects’ development. They utilize smart contracts as well as the proof-of-stake consensus mechanism. Nevertheless, Algorand and Ethereum have several differences in the case of reward as well as staking methods.

In staking, Ethereum needs a stake of up to 32 ETH tokens to enable a validator nonetheless permits anyone to be a part of the validation pool via the staking of any sum in ETH. On the other hand, all the people holding the ALGO tokens are eligible to take part in the consensus just by having the ALGO tokens in their wallets. This process is not resource-intensive thus it takes place without being noticed by the selected consumers.

Ethereum, on the contrary, is slower and offers expensive transfers as compared with Algorand. For instance, the network can process an exclusive block of transfers nearly after every twelve to fourteen seconds. Transfers processed through the network of Algorand are concluded in five to ten seconds. Moreover, Algorand additionally offers very cost-effective transfer charges than Ethereum.

In the case of rewards, Ethereum pays rewards to those who take part in the validation procedure in line with the sum of the ETH tokens present in the blocks that are being validated. A reward of up to 4.0% APR is paid in return for staking the ETH tokens. Algorand rewards, as of the 2022’s October, are obtained through taking part in governance.

Algorand depends on its user community to carry out decisions dealing with blockchain implementations as well as the rest of the significant issues. Those who take part in all votes and stake ALGO throughout the governance period’s duration are eligible to have rewards. The rewards related to staking the ALGO tokens have ended. Nonetheless, people are still permitted to stake their Algorand tokens as well as take part in governance for getting rewards.

Algorand (ALGO) Price Prediction: Price History

The popular crypto platform Algorand (ALGO) is famous for the development of decentralized applications that are utilized for the security of the blockchain as well as recompense processing fees. Its competitive benefit deals with approximately infinite scalability as well as decreased network fees. Another positive aspect of Algorand is that the validators on the network are fixed in number regardless of the sum of nodes. Recently, the company has been paying great attention to attracting NFT ventures as well as decentralized finance (DeFi) developers.

Knowledge about the historical development of digital assets is a thing that can be quite helpful in market analysis as well as in forecasting the likely future outlook. In addition to this, keeping in view the developments made by the relevant crypto token in terms of tokenomics and other such aspects can also be beneficial. Moreover, the volatility, the trading sentiment, the supply, and demand, as well as the adoption are the things that should be kept in mind along with the overall position of the crypto economy.

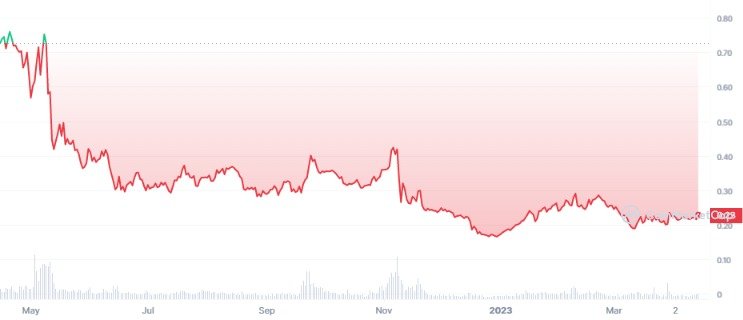

In the case of Algorand (ALGO), the price of the token witnessed a tenfold upsurge back in 2021 as compared with the price level seen in 2019. The token’s value bounced back in the initial period of 2021. ALGO has maintained its position among the prominent 50 cryptocurrencies in line with their capitalization. In the last 12 months, Algorand has been showing a continuous bearish movement as shown in the chart below.

Algorand (ALGO) Price Prediction: Fundamental Analysis

The fundamental analysis of the crypto tokens offers an overview of the market statistics as well as the likelihood of future outcomes. This analysis expresses the impact of the economic indicators on the price movement as well as the other such elements. In line with the exclusive data, Algorand’s current price is $0.2152, and 39 is its current rank among the crypto tokens operating within the crypto ecosystem.

According to the quantitative analysis, Algorand’s circulating supply is nearly 7,196,021,861 tokens. The market capitalization of Algorand is nearly $1,548,717,176. The 24-hour high price of the token at the moment is nearly $0.2206 while the 24-hour low price stands at $0.2122. The 24-hour market volume of Algorand (ALGO) is almost $68,077,498.

Algorand (ALGO) Price Prediction: Technical Analysis

The historical data about price performance as well as the fundamental analysis are much assistive in several things like sentiment analysis. The quantitative and fundamental analysis for ALGO helps in determining its market trends. Eventually, it becomes easier to make price predictions. As per the historical price data and Algorand trends, the technical indicators say that the present market sentiment for Algorand is bearish.

The fear and greed index is currently standing at the 61 mark, expressing greed. In the recent 30 days, the ALGO token saw up to 16 green days. In the meantime, it has a 53% rate of positive price development. During the respective thirty days, Algorand witnessed price volatility of more than 2.76%. At present, the token is trading below its 200-day simple moving average (SMA).

The 200-day SMA of ALGO has been indicating SELL for almost the recent 51 days. In addition to this, the token is trading even below its 50-day SMA that has been indicating SELL for the previous day. The 7-day relative strength index (RSI) of Algorand stands at 47.53, showing that the market position of the token is currently at a neutral position.

Algorand (ALGO) Price Prediction

The historical, fundamental, and technical analysis of Algorand is helpful in Algorand coin prediction. Forecasting the future of Algorand depends on market analysis. According to the Algorand investment outlook, the token has the potential to grow further in terms of value in the future. Algorand supply and demand analysis says that a considerable increase can be seen over time. In this way, the future outlook for Algorand and ALGO price predictions is positive.

Algorand (ALGO) Price Prediction 2023

The latest crypto news and Algorand price analysis signify that the economic indicators and Algorand price outlook will get better with time. It is anticipated that the token will reach the maximum value of up to $0.385704 during the current year. The minimum price level of the ALGO token during 2023 will be almost $0.257136. The token will trade around $0.32142 on average this year.

Algorand (ALGO) Price Prediction 2025

As specified by the ALGO trading analysis, the token will see a spike in trading by the year 2025. Moreover, the sentiment analysis for Algorand indicates that the token’s popularity will also increase by that time. While keeping in view the general crypto adoption and ALGO price trends, it appears that the token’s value will also witness a boost by that year.

Additionally, the staking and ALGO price predictions also correlate as a vast majority of the industry is shifting to the PoS mechanism due to several reasons. The price projection for Algorand says that $0.814264 will be the maximum value of the token by 2025. ALGO will have a minimum price of up to $0.685696. The average price of the token will be almost $0.74998.

Algorand (ALGO) Price Prediction 2030

The latest crypto news and Algorand price analysis go side by side, meaning that the future developments on the network will result in increased prices and adoption in the future. Although predicting ALGO price movements for the year 2030 seems somehow distant, the Algorand token price outlook is quite optimistic.

The Algorand market analysis specifies that the price of the token will be substantially high as compared to the present level. In this regard, the price discovery for Algorand brings to the front that a huge positive effect will be put by price prediction for decentralized finance (DeFi) on Algorand. This is because the crypto industry is seeing a gradual shift from centralized finance to DeFi.

This means that the inclusion of the new DeFi-proponents into the ALGO ecosystem will decrease the Algorand price volatility and increase the token’s price. By the year 2030, it is predicted that the ALGO token will touch the $1.89 spot as its maximum price level. The lowest value spot for the token by that year will be approximately $1.76. On the other hand, it will trade around nearly $1.82 on average.

Conclusion

The above-mentioned comprehensive analysis point out that Algorand has the potential to be a fine option for long-term investment. However, while keeping in view the volatility of the crypto market, it is recommended that investors should focus on risk management and ALGO price predictions to make adequate investment strategies.

The crypto market has experienced a lot of improvement in terms of scalability and Algorand price outlook displays that the platform has made considerable efforts in this respect. Nevertheless, investors should study their investment needs and taste for risk before making any investment-related decision.

FAQ

What is Algorand (ALGO)?

Algorand is an independent blockchain ecosystem and cryptocurrency that provides scalable, efficient, and secure applications. It is designed to solve the top issues faced in the blockchain industry, such as security, speed, and scalability.

Who founded Algorand?

Algorand was founded by Silvio Micali, a computer science professor at Massachusetts Institute of Technology (MIT).

What is the purpose of the ALGO token?

ALGO is the native token of the Algorand blockchain. It is a multipurpose token used to pay for transactions, buy on-chain items like non-fungible tokens (NFTs), and pay for services and goods.

How does Algorand compare to Bitcoin and Ethereum?

Algorand aims to address the issues of security, speed, and scalability faced by Bitcoin and Ethereum. It uses a unique pure-proof-of-stake (PPoS) approach, which allows it to outcompete other blockchain protocols. Algorand also offers faster and cheaper transfers compared to Ethereum.

What is the price prediction for Algorand (ALGO) in 2023, 2025, and 2030?

The price predictions for Algorand (ALGO) are as follows:

- 2023: An average trading price of $0.32142

- 2025: An average trading price of $0.74998

- 2030: An average trading price of $1.82

Please note that these predictions are based on historical data, market trends, and sentiment analysis, and should not be considered financial advice.

Is Algorand’s proof-of-stake different from other PoS systems?

Yes, Algorand uses a unique pure-proof-of-stake (PPoS) approach that randomly selects miners regardless of their investment in the system, avoiding the “rich get richer” problem often associated with traditional PoS systems.

Can I participate in Algorand governance and earn rewards?

Yes, Algorand relies on its user community to make decisions related to blockchain implementations and other significant issues. By staking ALGO tokens and participating in governance, you become eligible to earn rewards.

READ MORE:

Baby Doge Coin (BABYDOGE) Price Prediction

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

MANA Price Prediction $100 In 2022-2030: Will Decentraland Rise to $100?

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?