Today’s market session has kicked off with much bear activity as the global market cap dropped by 5.4% as of press time to take the total cap to $1.04T. Bitcoin (BTC) has now again dropped back to the $25K level after recording a day’s drop of 2.9%. Bitcoin’s weekly drop now stands at 5% with a market cap of $498,420,508,861 and a trading volume of $16,087,618,433.

Volatility levels are however rather stable as the Bollinger bands now maintain a close distance, showing reduced volatility. The relative strength indicator is however moving below its average line indicating a bearish trend on Bitcoin as bears try puish for the oversold region.

The MACD indicator has also shifted to the negative side as bears now push for market dominance.

Altcoin analysis

Ethereum (ETH) has also kicked off today’s session characterized by bearish signals as the asset now trades below the $1.8K mark ahead of a 5% drop in valuation within 24 hours. Trading at $1,742 as of press time, ETH had also seen an 8.5% drop for the week. With a market cap of $16,087,618,433 and a trading volume of $8,022,115,938 as of press time, Ethereum bears are looking to push the asset’s price further below.

BNB has also experienced a massive drop losing 7.9% for the day as the weekly drop lies at over 20% ahead of the recent SEC regulatory saga on Binance. BNB has a current market cap of $36,845,768,636 and a trading volume of $946,019,270, representing a 70% increase in a day as the asset’s selling pressure continues.

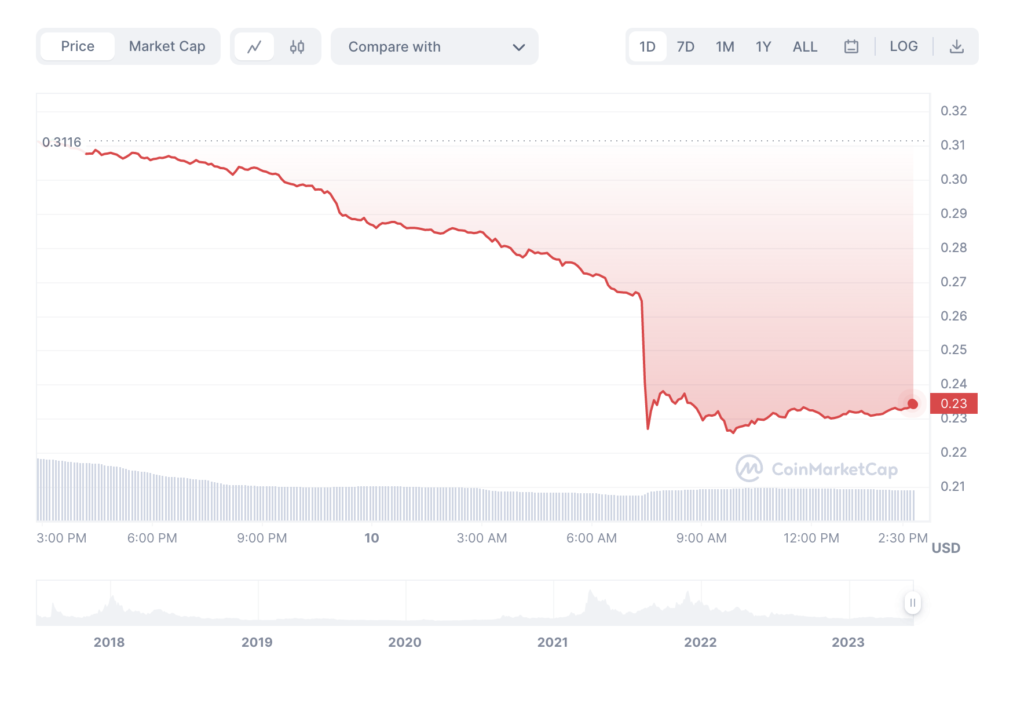

Storj, still on top of CoinMarketCap’s trending list, has seen a 24% drop within a day of trading to take its price to $0.2303 as of press time. Storj has a current market cap of 92.35M and a trading volume of 40.82M as the circulating supply stands at 401,038,461.30 STORJ.

Other altcoins are also having a bad session as Ripple (XRP), sits on a massive drop of 6% within a day of trading as the weekly drop also sits at a 6%. Cardano (ADA) has also experienced a massive drop of 23% as the weekly drop stood at 35% as Dogecoin (DOGE) also saw a 115 drop within the same period. Tron (TRX) is also on for a bad day as the asset now sits on a 14% 24-hour drop ahead of a 20% weekly drop.