As of press time, the worldwide market value had increased by 0.59 % from the previous trading day, bringing the total to $1.18 trillion. CoinMarketCap reports that the fear and greed index is still at a neutral 52 as things improve.

Bitcoin (BTC) analysis

With a daily rise of 0.4% and a weekly decline of 2.5%, Bitcoin (BTC) is now trading at $29.2K, as it still faces resistance at $30K as bear activity increases. While this happens, Bitcoin’s trading volume has decreased by 27% and is now at $10.6B.

The Bollinger bands are still diverging as we infer that Bitcoin’s volatility is growing. Bears continue to attempt to gain control of the market, as shown by the Relative Strength Index (RSI) which is now moving below its average line.

Ethereum (ETH) analysis

Ethereum’s (ETH) day of trading has gotten off to a slow start as the asset is up 0.37% to $1858, while trade volume is down 28% to $4.2B as of press time, as bull activity remains mild. Bollinger bands for ETH continue to maintain a neutral distance, indicating less volatility.

The Relative Strength Index (RSI) is still below its neutral line despite the little bull efforts, signaling that Ethereum could likely experience a negative trend as the asset’s bulls and bears strive for market supremacy. The MACD indicator is also currently in the red zone.

Dogecoin (DOGE) analysis

At the time of writing, Doge’s price had increased by 3% within a day, to $0.08018, as the asset continues to trend with its increasing gains. Doge has also increased by 15% within a week. In the same time frame, trade volume for Doge has decreased by 23% as network activity decreases.

The Bollinger bands for Doge are still diverging from one other in response to the increase in trading volume. The MACD is also in the green zone, indicating bullish momentum as the RSI hovers around the overbought region.

Maker (MKR) analysis

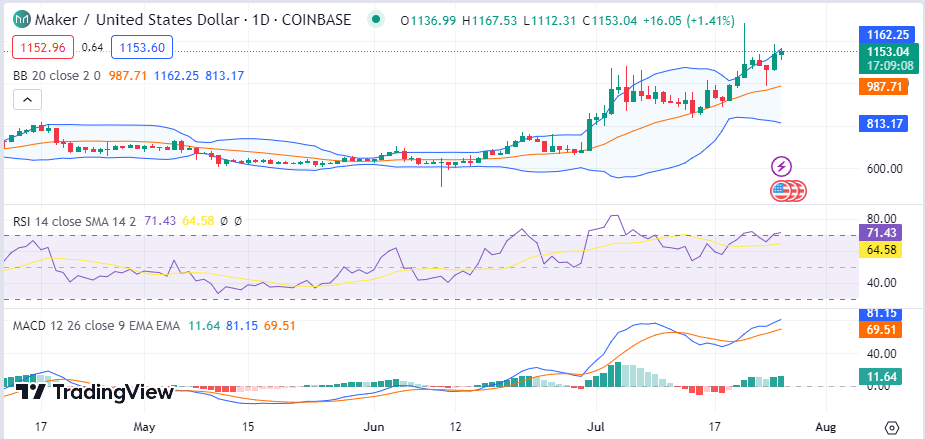

MKR is also having quite a pleasant bull session today as the asset trades 5% above its previous 24-hour price to trade at $1,151 as of press time, while its weekly gain stands at 16%. MKR’s trading volume has also seen a 45% increase within the same period, taking it to $125M within the same period.

MKR’s volatility levels are also increasing as the Bollinger bands diverge away from each other while the RSI, currently above its average line, moves in the overbought region. The MACD indicator is also in the green zone, demonstrating the bull dominance on Maker.

Other analysis

Other notable gainers in today’s session are Kyber Network Crystal v2 (KNC) which registered a 1.6% increase within a day of trade to take its price to $0.6966 as XDoge (XD) dominates with tremendous gains of 112% within the same period to take its price to $0.000000002975 as of press time. Theta Network (THETA) is also a notable gainer today as the asset trades 5.8% above its previous 24-hour price.