Bulls have mostly dominated this week, with several cryptos posting gains. Bitcoin (BTC) has seen quite some bear activity this week, recording a weekly increase of 10.8% as the asset now trades at $26.1K. Bitcoin has a current market cap of $509,444,241,387, as the trading volume stood at $9.7B as of press time.

Bitcoins volatility for the week has been relatively stable as the Bollinger bands move close to each other. However, BTC’s relative strength indicator is moving below its average line, indicating a bearish trend on BTC as the MACD indicator hovers at a neutral position, showing the struggle between bulls and bears over the week for market dominance.

Ethereum (ETH) analysis

Ethereum (ETH) has also seen bear activity as the asset’s weekly drop now stand’s at 9.4% as it trades at $1,673. Ethereum has a current market cap of $201B, as the trading volume now stands at $4.7B.

ETH’s volatility levels are also low as the Bollinger bands now move at a relatively close distance. In contrast, the RSI indicator moves below its average line showing much bear activity on Ethereum as bulls and bears struggled for dominance.

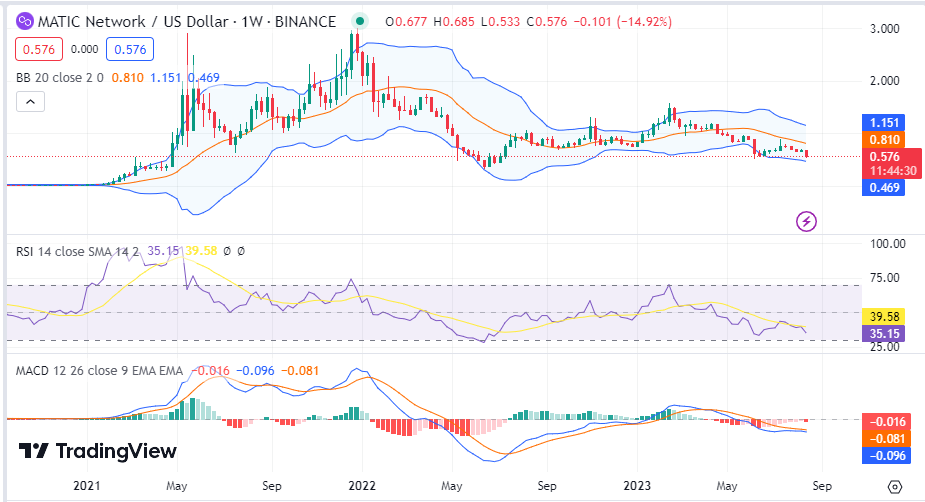

Polygon (MATIC) analysis

MATIC has had a rather turbulent week as the asset posted losses of 15% within a day of trade to hold a spot price of $0.5766 as the trading volume now stands at $214.8M while the market cap now stands at $5.3B.

MATIC’s volatility levels have been steady over the week as the Bollinger bands maintain a close distance from each other. The RSI indicator is moving below the average line as the MACD hovers close to the average line showing a struggle between bulls and bears over the week.

Binance Coin (BNB) analysis

BNB has also had a bearish week as the asset trades 9.9% below its previous 7-day price. The asset now holds a spot price of $216 with a market cap of $33.3B, as the trading volume stood at $442M as of press time.

BNB’s volatility levels have also been increasing over the week as the Bollinger bands diverge away from each other, indicating increasing volatility in Bitcoin as the RSI moves below its average line, with the MACd also moving in the red zone.

Cardano (ADA) analysis

ADA has also had a slow week as the asset now trades 7.7% below its previous 7-day price, as the asset now holds a spot price of $0.26 with a trading volume of $9.3B as the trading volume stood at $151M.

ADA’s volatility levels over the week have been low as the Bollinger bands maintained a close distance while the RSI moved below the average line showing bear dominance as the MACd moved in a neutral state.

Tron (TRX) analysis

TRX has also had a slow week as the asset now trades 3.2% below its previous 24-hour price as the asset holds a spot price of $0.07494, while the market cap stood at $6.7B as the trading volume stood at 137M.

Tron’s volatility levels have also been low over the week as the Bollinger bands maintained a close distance from each other. The RSI is also below the average line as bears dominated the week, with the MACD moving slightly in the green zone, showing some bull desire for dominance over the week.