CoinShares informed in the previous week that digital asset investment products saw outflows for the third week in a row, amounting to an enormous $435 million. It is the most massive outflow since March of this year. The trading volumes of Exchange-Traded Products had also decreased and totaled 11.8 billion, lower than that of the previous week’s 18 billion. At the same time, the price of Bitcoin fell by 6%.

Grayscale Sees Lowest Digital Asset Outflow in 9 Weeks

The major destination of these outflows was the United States which saw around $388 million leave the region. An interesting fact, the year-to-date inflows in the U.S. reached a new all-time high of $13.6 billion. Grayscale, the largest player in the digital asset investment domain, received the most of outflows at $440 million, which was the lowest outflow in nine weeks.

Although Grayscale’s outflows are waning, there has also been a decrease in inflow from new issuers. The cryptocurrency created a week inflow of $126 million, down from $254 million the previous week. Other regions including Germany and Canada had a negative attitude, collecting $16 million and $32 million outflows. Conversely, Switzerland and Brazil recorded $5 million and $4 million inflows whereas other regions had negative flows.

Altcoins Experience Inflows Despite Bitcoin and Ethereum Outflows

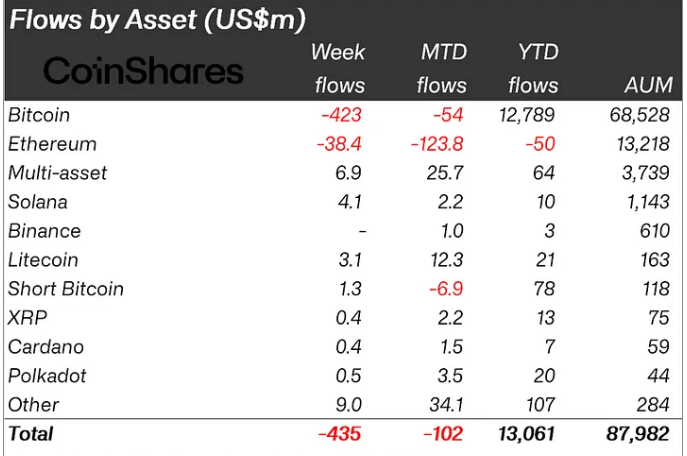

The outflows mostly covered Bitcoin and Ethereum, which lost $423 million and $38 million from these assets, appearing in outflows. Such a case is rare because however outflows, altcoins experienced inflows meaning investors’ desire for diversification. Multi-coin investment products witnessed inflows of $7 million. On the other hand, Solana, Litecoin, and Chainlink out inflow of $4 million, $3 million, and $2.8 million, respectively.

Lastly, digital asset investment products saw significant outflows for the third consecutive week. Although, it is essential to report that the main outflows were in Bitcoin and Ethereum; many inflows were seen in some altcoins. This indicates that investor sentiment and their interests are changing. However, although the outflows outweigh the inflows, the market remains on the move and constantly opens up new possibilities for investment and diversification. As the cryptocurrency industry matures, such trends will be more common and reflect the ongoing development and adaptation of the digital asset ecosystem.