Terra Luna Classic (LUNC) is a cryptocurrency that originated from the old Terra chain, which is now called Terra Classic. This digital coin was launched on May 28, 2022, following a planned fork that marked an important step in creating the new chain. Previously known as LUNA, the system that maintained the stability of Terra Classic’s stablecoin, TerraClassicUSD (USTC), is no longer functional. This is because all the related minting and burning activities have been halted. In this article, we’ll explore the current LUNC price sentiment with a view of its future market potential from Terra luna classic price prediction.

Terra Luna Classic (LUNC): A Quick Introduction

The Terra Classic blockchain was initially created to support the TerraUSD (UST) cryptocurrency.

The concept was that Terra’s LUNA cryptocurrency would keep UST tied to the US Dollar. When UST’s value rose above its peg, more LUNA was created, and when it fell below $1, LUNA was burned or destroyed.

This system worked well initially, with LUNA reaching a market cap in the billions and ranking among the top ten largest cryptocurrencies.

However, in May 2022, everything changed. UST lost its peg, and LUNA’s value plummeted, causing a significant downturn in the entire crypto market. It can be argued that the market has not fully recovered since.

A new blockchain was established with a new version of the LUNA cryptocurrency, which took the LUNA name. The original blockchain, now called Terra Classic, continues to support the original cryptocurrency, now called LUNC, and is managed by the Terra Classic community.

It’s important to note that Do Kwon, the founder, has been arrested by United States authorities and charged with eight offenses, including securities fraud, commodities fraud, wire fraud, and conspiracy. He is also imprisoned in Montenegro for forging official documents. As of now, Kwon faces extradition from Montenegro, but it is still unclear whether it will be to the United States or South Korea.

LUNC: How Does It Work?

Terra Classic operates as a Proof-of-Stake (PoS) blockchain, where transaction validators are chosen based on the amount of LUNC they hold.

LUNC backs the USTC stablecoin, with all burning and minting decisions made by the Terra Classic community. Additionally, LUNC can be bought, sold, and traded on various exchanges.

In its technical documentation, or whitepaper, Terra Classic claims to enable people to create and support their own stablecoins.

It says: “The Terra protocol is the leading decentralized and open-source public blockchain protocol for algorithmic stablecoins. Using a combination of open market arbitrage incentives and decentralized Oracle voting, the Terra protocol creates stablecoins that consistently track the price of any fiat currency.”

“Users can spend, save, trade, or exchange Terra stablecoins instantly, all on the Terra blockchain. Luna provides its holders with staking rewards and governance power. The Terra ecosystem is a quickly expanding network of decentralized applications, creating a stable demand for Terra and increasing the price of Luna.”

LUNA Vs LUNC

After Terra’s collapse, Do Kwon proposed the Terra Ecosystem Revival Plan 2 on Terra’s developer forum. The new Terra 2.0 blockchain introduced a native token named LUNA, while the original Terra blockchain was rebranded as Terra Classic, with its native token renamed to Luna Classic (LUNC). Both LUNA and LUNC serve as the main staking tokens for their respective blockchains, giving stakeholders significant influence in governance.

The key difference between LUNC and LUNA is LUNC’s burn mechanism. Originally, LUNC had a supply of 7 trillion tokens, which has been significantly reduced to 6.82 trillion due to this mechanism. This burn process plays a crucial role in managing the token supply.

The new Terra blockchain, called Terra 2.0, made a major shift by excluding algorithmic stablecoins from its ecosystem. The holders of the redesigned LUNA tokens, now known as Luna Classic, included those who previously held, staked, and developed apps on Terra Luna Classic, as well as the remaining UST holders.

As part of the plan to revive the Terra blockchain, the team introduced a token-burning mechanism for LUNC tokens in September 2022. This mechanism has burned millions of LUNC tokens to reduce the inflated supply and increase their value. In contrast, the LUNA cryptocurrency does not have a token-burning mechanism.

The Terra Luna Classic project implemented a 1.2% burn tax on all on-chain Luna Classic (LUNC) transactions. Leading crypto exchange Binance also supported Terra’s efforts by converting the trading fees from LUNC/BUSD and LUNC/USDT trading pairs into LUNC tokens and burning them.

Luna Classic Price Prediction: Price History

While past performance isn’t a guarantee of future results, understanding LUNC’s price history can help provide context for interpreting or making a Terra Classic price prediction.

We’ll focus on LUNC since May 2022, but it’s useful to highlight its earlier days.

When Terra launched in July 2019, it was valued at about $1.30. This proved to be an overestimate, and the price dropped below a dollar, remaining there until early 2021. In January 2021, the token surpassed $1 and reached a high of $22.33 on March 21.

After a decline in the following months, the price surged later in the year, hitting $103.33 on December 27.

In early 2022, what was then known as LUNA saw significant price action, reaching a record high of $119.18 on April 5. Following a crash, it plummeted to a low of $0.00001675 on May 13. On May 28, the day the new LUNA emerged and the old one became LUNC, the coin closed at $0.00009566. When the Celsius crypto-lending platform halted withdrawals, confirming the bear market, LUNC dropped to $0.0000517 on June 18. By late August, the price climbed, closing the month at $0.0002252.

The announcement of a 1.2% tax on blockchain transactions saw Terra Classic peak at $0.0005888 on September 8, 2022. The tax proposal passed on September 21, but LUNC’s price fell to around $0.000185 on the morning of September 26.

By midday that day, after news of South Korean authorities contacting Interpol about Kwon and Binance implementing a 1.2% burn on LUNC trades, the price surged, with LUNC trading at around $0.00031.

On October 2, 2022, it peaked at $0.0003613, before settling to about $0.00029 on October 12. Following the collapse of the FTX exchange, LUNC fell to a low of $0.000148 on November 22 but rebounded to $0.0001658 on November 30.

On December 1, news broke that Binance had burned more than six billion LUNC, significantly boosting the price, and by December 2, 2022, it was worth $0.0001805.

2023 was an average year for Terra Classic, despite a late-year surge. After surpassing $0.0002 in early February, the price fell again. The announcement of LUNC 2.0 in early June caused a brief rally to $0.0001, but negative events soon followed.

The United States Securities and Exchange Commission (SEC) announced lawsuits against the Binance and Coinbase exchanges, leading to a drop in LUNC’s price. The decline worsened in mid-August when the market reacted to Elon Musk’s SpaceX selling millions of dollars worth of Bitcoin (BTC). By September 25, LUNC was worth around $0.00006. In November, the price rose significantly, coinciding with news of Kwon’s extradition. On November 27, it reached $0.0001256, and on December 4, it peaked at $0.000275 before falling back to $0.0001386 by year-end, marking an annual loss of over 4%.

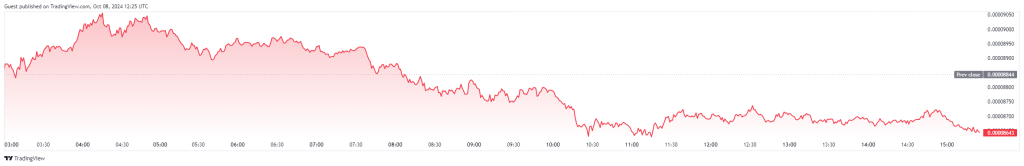

The decline continued into the new year, with LUNC valued at about $0.0001025 on January 22. It decreased further in February but saw a notable rise in March, reaching $0.0001953 on March 8, 2024. In the following weeks, the price declined and it touched $0.00009 in April. The price in October dropped even more, to $0.00008661.

Luna Classic Price Prediction: Technical Analysis

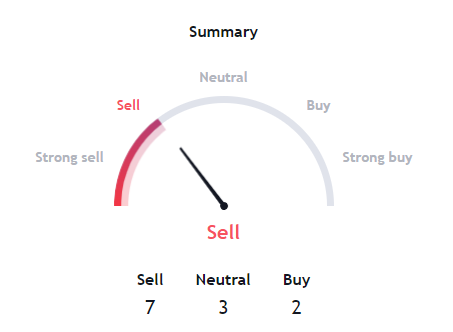

LUNC price experienced a solid rejection from the 20-day EMA ($0.000106), resulting in a drop below its immediate Fib channels. However, bulls are trying to defend the price decline, aiming for a rebound above the immediate support line. As of writing, LUNC price trades at $0.0001043, declining over 3.4% in the last 24 hours.

The daily LUNC/USDT chart, provided by TradingView, shows that if the bears push the price below the $0.00008654, it indicates that the LUNC/USDT pair might continue to oscillate within the broad range of $0.000082 to $0.000069 for some time.

Conversely, a strong surge from the 20-day EMA would demonstrate the bulls’ strong buying pressure. Such a move could enhance the chances of revisiting the upper resistance at $0.00009102. Surpassing this resistance might set the stage for the pair to advance towards $0.000102.

Terra Luna Classic Price Prediction By Blockchain Reporter

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.000139 | 0.000143 | 0.000156 |

| 2025 | 0.000195 | 0.000202 | 0.000239 |

| 2026 | 0.000294 | 0.000302 | 0.000338 |

| 2027 | 0.000432 | 0.000447 | 0.000509 |

| 2028 | 0.000638 | 0.000656 | 0.000754 |

| 2029 | 0.000890 | 0.000917 | 0.0011 |

| 2030 | 0.0013 | 0.0013 | 0.0016 |

| 2031 | 0.0019 | 0.0019 | 0.0023 |

| 2032 | 0.0027 | 0.0028 | 0.0033 |

| 2033 | 0.0040 | 0.0041 | 0.0048 |

Terra Classic Price Prediction 2024

The Terra Classic DAO recently approved a proposal for a quant team to explore the possibility of repegging the Terra algorithmic stablecoin, now rebranded as USTC. This initiative aims to restore confidence in the Terra Classic ecosystem.

If successful, repegging USTC could significantly boost trust among crypto enthusiasts. However, if the quant team determines that repegging is unfeasible, it might lead to a decline in optimism within the Terra Classic community.

Despite these uncertainties, the Terra Classic ecosystem continues to thrive with various ongoing developments. The project maintains a strong market cap and a dedicated, active community.

In 2024, the price of Terra Classic is expected to drop to a minimum of $0.000139. Based on the analysis, the highest potential price for LUNC could be $0.000156, with an average price forecasted to be around $0.000143.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000139 | 0.000140 | 0.000141 |

| February | 0.000140 | 0.000141 | 0.000142 |

| March | 0.000141 | 0.000142 | 0.000144 |

| April | 0.000142 | 0.000143 | 0.000145 |

| May | 0.000143 | 0.000144 | 0.000146 |

| June | 0.000144 | 0.000145 | 0.000147 |

| July | 0.000145 | 0.000146 | 0.000148 |

| August | 0.000146 | 0.000147 | 0.000149 |

| September | 0.000147 | 0.000148 | 0.000150 |

| October | 0.000148 | 0.000149 | 0.000151 |

| November | 0.000149 | 0.000150 | 0.000152 |

| December | 0.000150 | 0.000151 | 0.000153 |

Terra Classic Price Prediction 2025

The future of Terra Classic is uncertain. Its troubled past and the recent Terraport Finance hack have created adoption challenges. Despite this, the community remains strong, and developers continue to innovate.

A core developer recently proposed a community-owned decentralized wallet in response to privacy concerns with Ledger and Metamask.

With a rapidly decreasing supply, Terra Classic might become a valuable utility token. However, fierce competition in the layer one blockchain space may limit its gains.

For 2025, Terra Classic’s price is anticipated to reach at least $0.000195. The maximum predicted price is $0.000239, while the average trading price is estimated at $0.000202.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000195 | 0.000197 | 0.000199 |

| February | 0.000196 | 0.000198 | 0.000200 |

| March | 0.000197 | 0.000199 | 0.000202 |

| April | 0.000198 | 0.000200 | 0.000203 |

| May | 0.000199 | 0.000201 | 0.000204 |

| June | 0.000200 | 0.000202 | 0.000205 |

| July | 0.000201 | 0.000203 | 0.000206 |

| August | 0.000202 | 0.000204 | 0.000207 |

| September | 0.000203 | 0.000205 | 0.000209 |

| October | 0.000204 | 0.000206 | 0.000210 |

| November | 0.000205 | 0.000207 | 0.000212 |

| December | 0.000206 | 0.000208 | 0.000214 |

LUNC Price Forecast for 2026

The forecast for Terra Classic in 2026 suggests a minimum price of $0.000294. The price could rise to a maximum of $0.000338, with an average trading price of $0.000302.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000294 | 0.000295 | 0.000296 |

| February | 0.000295 | 0.000297 | 0.000298 |

| March | 0.000297 | 0.000298 | 0.000300 |

| April | 0.000298 | 0.000300 | 0.000302 |

| May | 0.000299 | 0.000301 | 0.000303 |

| June | 0.000300 | 0.000302 | 0.000305 |

| July | 0.000302 | 0.000304 | 0.000306 |

| August | 0.000303 | 0.000305 | 0.000308 |

| September | 0.000305 | 0.000307 | 0.000310 |

| October | 0.000306 | 0.000308 | 0.000312 |

| November | 0.000308 | 0.000310 | 0.000314 |

| December | 0.000310 | 0.000312 | 0.000316 |

Terra Classic (LUNC) Price Prediction 2027

By 2027, Terra Classic’s price is predicted to be no lower than $0.000432. The highest possible price is forecasted at $0.000509, with an average price around $0.000447.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000432 | 0.000434 | 0.000436 |

| February | 0.000434 | 0.000436 | 0.000439 |

| March | 0.000436 | 0.000438 | 0.000441 |

| April | 0.000438 | 0.000440 | 0.000443 |

| May | 0.000440 | 0.000442 | 0.000445 |

| June | 0.000442 | 0.000444 | 0.000448 |

| July | 0.000444 | 0.000446 | 0.000450 |

| August | 0.000446 | 0.000449 | 0.000453 |

| September | 0.000448 | 0.000451 | 0.000455 |

| October | 0.000450 | 0.000453 | 0.000457 |

| November | 0.000453 | 0.000455 | 0.000460 |

| December | 0.000455 | 0.000458 | 0.000462 |

Terra Classic Price Prediction 2028

In 2028, technical analysis indicates that Terra Classic’s price could fall to $0.000638 at its lowest. The maximum price is projected to be $0.000754, with an average trading price of $0.000656.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000638 | 0.000640 | 0.000642 |

| February | 0.000640 | 0.000642 | 0.000645 |

| March | 0.000642 | 0.000645 | 0.000648 |

| April | 0.000645 | 0.000648 | 0.000651 |

| May | 0.000648 | 0.000651 | 0.000654 |

| June | 0.000650 | 0.000653 | 0.000657 |

| July | 0.000653 | 0.000656 | 0.000660 |

| August | 0.000656 | 0.000659 | 0.000663 |

| September | 0.000658 | 0.000662 | 0.000666 |

| October | 0.000661 | 0.000665 | 0.000669 |

| November | 0.000664 | 0.000668 | 0.000672 |

| December | 0.000667 | 0.000671 | 0.000754 |

Terra Classic Price Prediction 2029

For 2029, Terra Classic’s price is forecasted to reach a minimum of $0.000890. The highest potential price is $0.0011, while the average price is expected to be around $0.000917.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.000890 | 0.000892 | 0.000895 |

| February | 0.000892 | 0.000895 | 0.000898 |

| March | 0.000895 | 0.000898 | 0.000901 |

| April | 0.000898 | 0.000901 | 0.000905 |

| May | 0.000901 | 0.000904 | 0.000908 |

| June | 0.000904 | 0.000907 | 0.000911 |

| July | 0.000907 | 0.000910 | 0.000915 |

| August | 0.000910 | 0.000914 | 0.000919 |

| September | 0.000914 | 0.000918 | 0.000923 |

| October | 0.000918 | 0.000922 | 0.000927 |

| November | 0.000922 | 0.000926 | 0.000932 |

| December | 0.000926 | 0.000930 | 0.0011 |

Terra Classic (LUNC) Price Prediction 2030

In 2030, the price of Terra Classic is anticipated to be at least $0.0013. The maximum price could reach $0.0016, with an average price of $0.0013 throughout the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.001300 | 0.001305 | 0.001310 |

| February | 0.001305 | 0.001310 | 0.001315 |

| March | 0.001310 | 0.001315 | 0.001320 |

| April | 0.001315 | 0.001320 | 0.001325 |

| May | 0.001320 | 0.001325 | 0.001330 |

| June | 0.001325 | 0.001330 | 0.001336 |

| July | 0.001330 | 0.001335 | 0.001341 |

| August | 0.001335 | 0.001340 | 0.001346 |

| September | 0.001340 | 0.001345 | 0.001351 |

| October | 0.001345 | 0.001350 | 0.001356 |

| November | 0.001350 | 0.001355 | 0.001361 |

| December | 0.001355 | 0.001360 | 0.001366 |

Terra Classic Price Forecast 2031

By 2031, Terra Classic’s price is expected to be around a minimum of $0.0019. The highest forecasted price is $0.0023, with an average trading value of $0.0019.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.001900 | 0.001905 | 0.001910 |

| February | 0.001905 | 0.001910 | 0.001915 |

| March | 0.001910 | 0.001915 | 0.001920 |

| April | 0.001915 | 0.001920 | 0.001926 |

| May | 0.001920 | 0.001926 | 0.001932 |

| June | 0.001926 | 0.001932 | 0.001938 |

| July | 0.001932 | 0.001938 | 0.001944 |

| August | 0.001938 | 0.001944 | 0.001951 |

| September | 0.001944 | 0.001951 | 0.001958 |

| October | 0.001951 | 0.001958 | 0.001965 |

| November | 0.001958 | 0.001965 | 0.001972 |

| December | 0.001965 | 0.001972 | 0.001979 |

Terra Classic (LUNC) Price Prediction 2032

The price prediction for Terra Classic in 2032 suggests a minimum of $0.0027. The maximum projected price is $0.0033, with an average trading price of $0.0028.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.002700 | 0.002705 | 0.002710 |

| February | 0.002705 | 0.002710 | 0.002716 |

| March | 0.002710 | 0.002716 | 0.002722 |

| April | 0.002716 | 0.002722 | 0.002728 |

| May | 0.002722 | 0.002728 | 0.002735 |

| June | 0.002728 | 0.002735 | 0.002742 |

| July | 0.002735 | 0.002742 | 0.002749 |

| August | 0.002742 | 0.002749 | 0.002756 |

| September | 0.002749 | 0.002756 | 0.002763 |

| October | 0.002756 | 0.002763 | 0.002770 |

| November | 0.002763 | 0.002770 | 0.002777 |

| December | 0.002770 | 0.002777 | 0.0033 |

Terra Classic Price Prediction 2033

In 2033, Terra Classic’s price is expected to reach a minimum value of $0.0040. The highest potential price is $0.0048, with an average forecasted value of $0.0041.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.0040 | 0.00401 | 0.00402 |

| February | 0.00401 | 0.00402 | 0.00404 |

| March | 0.00402 | 0.00404 | 0.00406 |

| April | 0.00404 | 0.00406 | 0.00408 |

| May | 0.00406 | 0.00408 | 0.00410 |

| June | 0.00408 | 0.00410 | 0.00412 |

| July | 0.00410 | 0.00412 | 0.00415 |

| August | 0.00412 | 0.00415 | 0.00418 |

| September | 0.00415 | 0.00418 | 0.00421 |

| October | 0.00418 | 0.00421 | 0.00424 |

| November | 0.00421 | 0.00424 | 0.00427 |

| December | 0.00424 | 0.00427 | 0.0048 |

Luna Classic Price Prediction: By Experts

According to Coincodex, the price of Terra Classic is expected to increase by 11.03%, reaching $0.000120 by June 18, 2024. Technical indicators currently show a bearish sentiment, while the Fear & Greed Index indicates a greed level of 72. Over the past 30 days, Terra Classic experienced 17 out of 30 green days (57%) with a price volatility of 3.19%. Based on the Terra Classic forecast, now is considered a bad time to purchase Terra Classic.

Analyzing historical price movements and BTC halving cycles, the predicted yearly low for Terra Classic in 2025 is $0.00009291. On the other hand, the price could rise to $0.000285 next year.

By 2026, market analysts and experts at Digital Coin Price forecast that LUNC will commence the year at $0.000315 and trade around $0.000390. This projection suggests a substantial increase compared to the previous year, marking a notable jump for Terra Classic.

By early 2030, predictions and technical analysis from Digital Coin Price indicate that Terra Classic’s price will reach $0.000773, maintaining this value by the year’s end. Additionally, LUNC could potentially achieve a price of up to $0.000721. The period from 2024 to 2030 is expected to be significant for Terra Classic’s growth.

Is LUNC A Good Investment? When To Buy?

Terra Classic is a unique cryptocurrency that emerged from the original LUNA currency, which was essentially abandoned by its creators after the collapse of the UST stablecoin. Although its current performance doesn’t match its previous highs, it still maintains an active community of supporters.

However, Terra Classic is associated with one of the most significant crashes in crypto history. The future of the community’s efforts to rebrand and attract new investors remains uncertain. Additionally, the ongoing bankruptcy proceedings of Terraform Labs add a considerable layer of uncertainty to Terra Classic’s prospects. As always, thorough research is essential before considering an investment in LUNC.

However, it is advised to invest in LUNC price at a price of $0.00004 for a profitable return in the long-term.

Conclusion

If the Terra Classic community can assure the wider crypto community that LUNC is safe, its adoption and price might rise. However, if it continues to get negative attention, like after the recent Terraport Finance hack, attracting new users to its ecosystem will be difficult.

Another key factor that could affect its price is whether the Terra Classic quant team can restore its USTC stablecoin. Although this is a challenging task, success would generate a lot of excitement within the community.

Lastly, the ongoing coin burning is gradually decreasing the Terra Classic circulating supply. If demand stays the same or increases, this could significantly boost the LUNC price.

It is advised to do your own research and conduct experts’ analysis before investing in the volatile crypto market.

FAQ

What is Terra Luna Classic (LUNC)?

Terra Luna Classic (LUNC) is a cryptocurrency that originated from the original Terra blockchain, now known as Terra Classic. It was rebranded following the collapse of the Terra ecosystem in May 2022. LUNC is a remnant of the old Terra chain, and it no longer supports the algorithmic stablecoin, USTC. The new Terra chain operates under the name Terra 2.0, while the old chain, Terra Classic, continues to be supported by its community.

How does Terra Luna Classic (LUNC) work?

Terra Classic operates as a Proof-of-Stake (PoS) blockchain, where transaction validators are chosen based on the amount of LUNC they hold. The Terra Classic community makes decisions regarding the burning and minting of LUNC, which is essential to managing its supply. LUNC can be bought, sold, and traded on various exchanges, and it plays a role in the ongoing efforts to restore stability within the Terra Classic ecosystem.

What is the difference between LUNA and LUNC?

After the collapse of the Terra ecosystem, the blockchain was split into two chains: Terra 2.0 (LUNA) and Terra Classic (LUNC). The primary difference between the two is that LUNC has a burn mechanism that aims to reduce its supply, while LUNA does not. Terra Classic also retains a connection to the original stablecoin, USTC, whereas Terra 2.0 does not support algorithmic stablecoins.

How has the price of Luna Classic (LUNC) performed historically?

LUNC has experienced significant price fluctuations since the collapse of the Terra ecosystem. After its relaunch in May 2022, LUNC’s price saw various peaks and troughs, influenced by market sentiment, tax proposals, and community-driven initiatives. Despite these efforts, the price of LUNC remains far below its previous highs, but ongoing burning efforts and community activities continue to shape its price movements.

What is the price prediction for Luna Classic (LUNC) in 2025 and beyond?

By 2025, LUNC’s price is forecasted to range between $0.000195 and $0.000239, with a projected average of $0.000202. Looking further ahead, LUNC is expected to gradually increase in value, reaching potential prices of $0.000509 in 2027, $0.000754 in 2028, and $0.0011 in 2029. By 2033, the price could potentially reach $0.0048 if favorable conditions persist.

Will Luna Classic (LUNC) reach $1?

While the long-term potential of LUNC is promising, reaching $1 would require significant changes in market dynamics, adoption, and continued reduction of its circulating supply through burning mechanisms. Currently, such a price target seems challenging given the token’s current market conditions.

Is Terra Luna making a comeback?

It’s unlikely. The project’s severe collapse has made it hard to restore investor confidence or rebuild its ecosystem.