The Federal Bureau of Investigation has determined that 270 addresses are responsible all cryptocurrency money laundering activities. There are over 583 deposit addresses that have been used to successfully receive funds delivered to these accounts. 45 of these were the recipients of 24% of the funds that were received via illegal accounts. These findings have the potential to make it more difficult for criminals to turn cryptocurrency into cash.

In a research that was published a week ago, the blockchain investigations company Chainalysis stated that offenders who store their funds in cryptocurrencies have a tendency to launder those funds through a smaller concentration of online services. Services such as high-risk (low-reputation) crypto trading platforms, online gambling websites, crypto mixing services, and financial services that enable crypto activities located in high-risk countries are all included in this category.

This investigation looked into a plethora of unlawful activities, including Bitcoin addresses tied to online frauds, cybercrime, terrorist funding, breaches, activities related to child abuse content, and funds connected to payments made to dark web markets offering prohibited services such as selling narcotics, weapons, and stolen data.

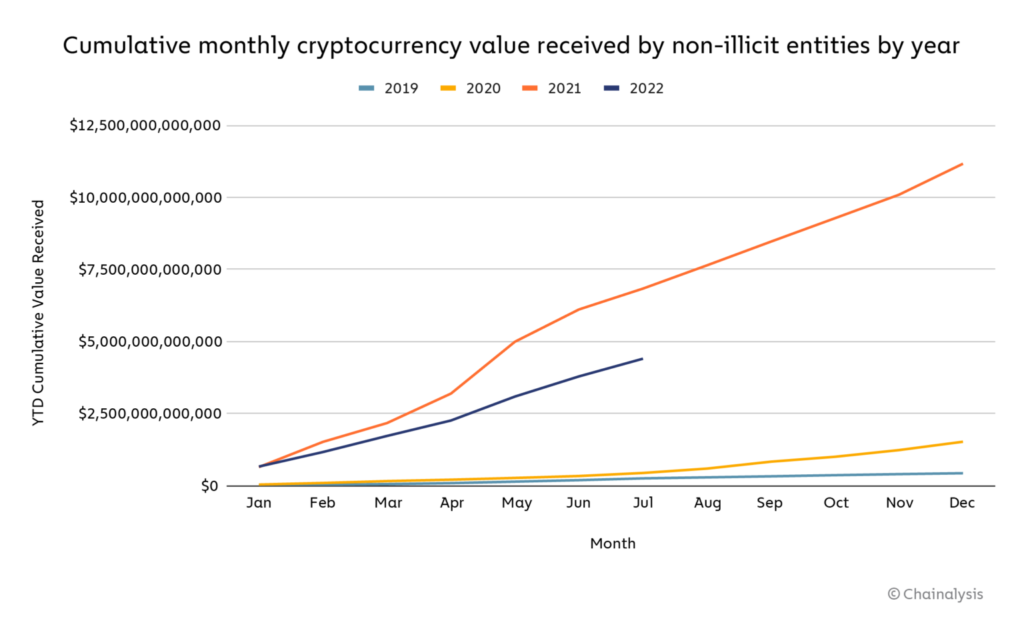

However, despite the fact that you would anticipate the money laundering that resulted from such a broad range of illegal behavior to have taken place across a vast number of services, Chainalysis reports that only a tiny group of blockchain addresses have been given the responsibility for laundering approximately 55% of the cryptocurrency that is related with illegal activity.

Rising Crypto Crimes & Law Enforcement Actions

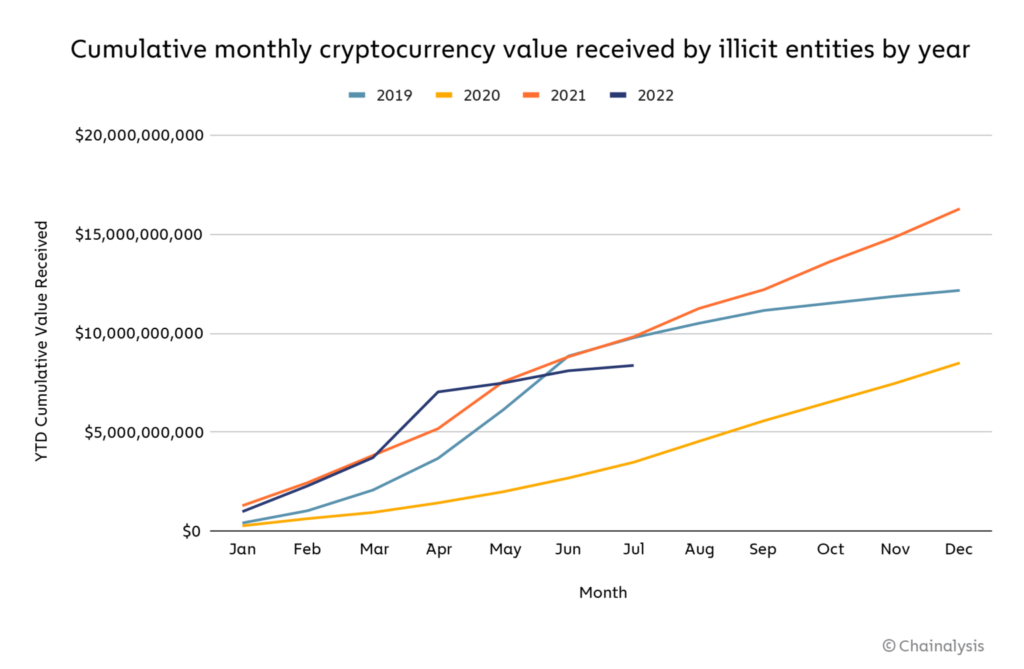

A new analysis by Chainalysis indicates that 270 addresses are responsible all cryptocurrency money laundering. The report indicates that in 2020, these addresses were in possession of around $1.7 billion in illicit cash. In recent years, cryptocurrency has emerged as a popular topic, but at the same time, it has presented challenges for those who work in law enforcement. Even though there is no definitive answer to the question of how much digital coins have been laundered on a daily basis, the numbers certainly look to be rather concerning. However, there is a decrease in the laundering of cryptocurrencies in recent times.

This may be explained, in part, by the fact that legal action has been taken regarding the cryptocurrency market. This measure may have addressed the situation and it may have been successful in preventing certain instances of illicit activities; but, it has led to a significant loss of funds for the public at large. The Bitcoin and Ethereum blockchains have recently been a target for cybercriminals, in addition to crimes involving cryptocurrencies in different locations. As a consequence of this, authorities have been focusing their attention on these addresses in an attempt to put a stop to the illegal transactions they have been engaging in.

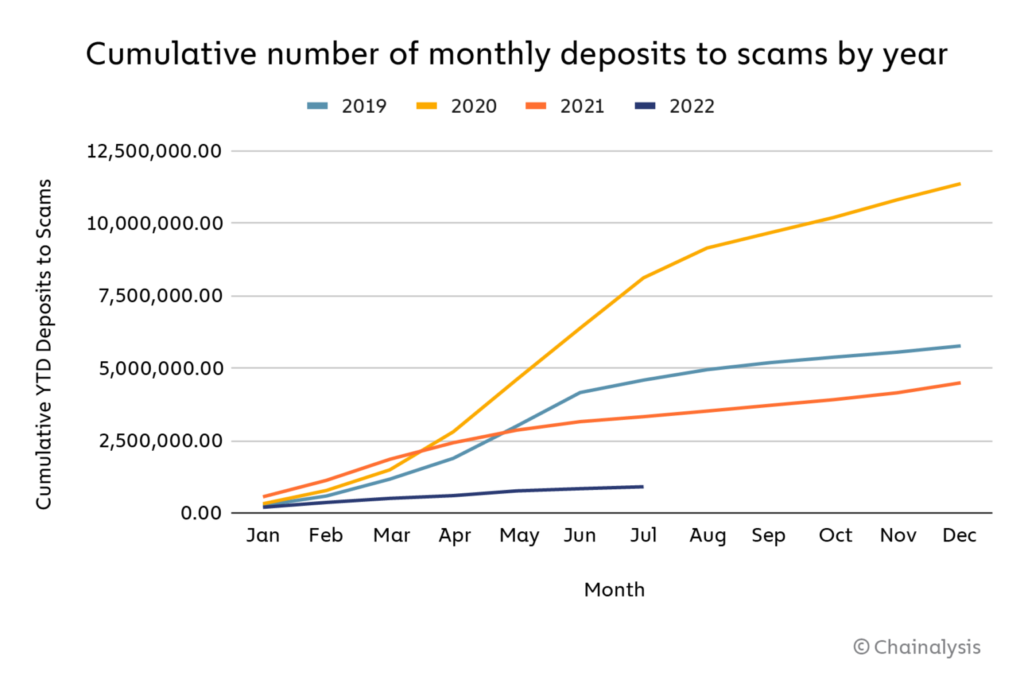

As 270 addresses are responsible all cryptocurrency money laundering, this pattern continued throughout 2022. In spite of the fact that during the past several years, a lower proportion of illegal cryptocurrency has been received in these addresses, the geographical distribution of money laundering activities has remained rather high around the world. 55% of cryptocurrencies were sent to 270 service deposit addresses in the first half of 2018, down from 64% a year earlier. This may be the result of actions taken by authorities, such as the recent sanctions imposed on a Russian OTC broker known as Suex and a P2P exchange known as Chatex.

Recently, the U.S. Treasury Department announced that it had collaborated with other state agencies to sanction the darknet marketplace based in Russia called Hydra as well as the virtual currency exchange Garantex. The action by U.S. government agencies occurred on the same day that the German Federal Criminal Police revealed that it had taken down Hydra’s servers in Germany and confiscated more than $25 million worth of Bitcoin associated with the marketplace.

The Concentration Of Illicit Activity Remains High

Although there has been a reduction in the volume of money laundering via cryptocurrencies, there is still a high concentration. The report that 270 addresses are responsible all cryptocurrency illicit activities proves it. The information maintained by Cryptotract reveals that between 2018 and 2020, 583 different deposit addresses were issued more than $1 million worth of illegal cryptocurrency. Approximately 54% of the total value of the illicit cryptocurrency was deposited into these deposit addresses. 264 of the remaining 473 deposit addresses acquired stolen cryptocurrencies worth less than $1 million.

Last year, more than $400 million worth of cryptocurrency was stolen from DeFi networks and other platforms. According to the findings of a study by Chainalysis, the vast majority of funds that originated from questionable deposit addresses were transferred to a small number of services. More than half of all cryptocurrency is believed to have been cleaned through the use of these services. The analysis indicates that these services are used annually to facilitate the laundering of hundreds of millions of dollars worth of cryptocurrencies.

The growth is noteworthy, despite the fact that this figure is very low when compared to historical standards. Although this number is smaller than in years past, it reflects a rise of 30% over the course of the last three years. This indicates that even though there are more attempts being made to prevent the laundering of money through cryptocurrencies, the concentration of activity is still relatively high.

The 270 service deposit addresses that have received at least 24% of the funds that were sent from illegal accounts in the previous year continue to be the leading recipients of illegally received funds. In point of fact, this number is anticipated to display a marginal rise in 2022. As mentioned before, this is in part owing to heightened law enforcement activities targeting the deposit accounts of cryptocurrency services.

Combating Crypto Money Laundering Globally

As 270 addresses are responsible all cryptocurrency illicit activities, the level of such activities that are being committed by various types of cybercriminals and traditional criminals varies widely. Moreover, the proportion of funds provided to each type of criminal differs. To profit from cryptocurrencies, fraudsters must first convert them to fiat currency. This is referred to as money laundering. The majority of illicit cryptocurrency travels to certain services, such as crypto exchanges. According to a Europol assessment, a number of these services appear to be designed for such activities.

Criminals’ access to digital assets and their ability to perpetrate crimes would be hampered if such exchanges were shut down. A man was recently arrested in New Zealand for laundering $2 million in Bitcoin in order to purchase exotic vehicles, including a Lamborghini and a Mercedes G63. In addition, law enforcement officials recently unveiled a superseding indictment that accuses six persons of plotting to launder money using cryptocurrencies. The inquiry uncovered a network of front firms and casinos intended to conceal illicit conduct.

One of the defendants even bribed a representative of the U.S. Department of State with cryptocurrencies. Even though cryptocurrency is a relatively new industry, the government is actively striving to prevent it from becoming a significant focus of illegal activity. The Office of the Comptroller of the Currency has already initiated its first enforcement action regarding cryptocurrencies. This action is a comprehensive step in limiting the capacity of lawbreakers to turn cryptocurrencies into cash. Authorities are trying hard to make crypto a crime-free industry.

READ MORE:

Tampa Baker Closes Shop After Losing Life Savings to Crypto Scammers

Hackers Steal Metaverse Investors’ Digital Assets With Phishing Scams

FBI Warns Investors of a New ‘Pig Butchering’ Crypto Investment Scams