The cryptocurrency market has not yet recovered from the crash of Terra, which had consequences across the whole Web 3.0 ecosystem, including DeFi, NFTs, and the Metaverse. Recent numbers for U.S. inflation have reached their highest level in decades, which coincides with a rise in the interest rate of 75 basis points and shrinkage of 0.9% in the 2nd quarter of 2022. In addition, the United States officially entered a recession for the second consecutive quarter, which occurred during this most recent quarter.

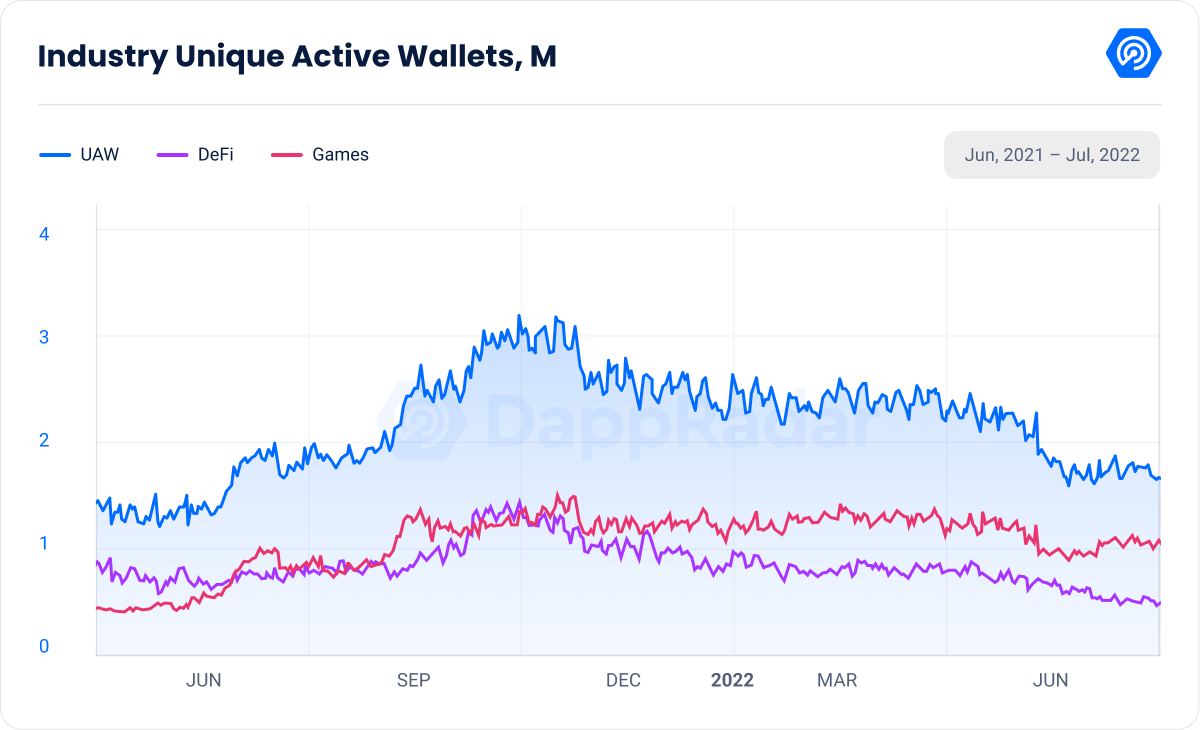

As a direct consequence of this, the drop in the value of cryptocurrencies is readily apparent. In point of fact, dApp activity has reached its lowest point this year, with only 1.68 million daily Unique Active Wallets (UAW) connected to blockchain dApps in the month of July. This figure shows a 4% month-over-month (MoM) decline, yet it is still 20% greater than in July 2021.

Without a doubt, due to the direct impact of cryptocurrency prices, the DeFi blockchain segment is experiencing most of the difficulties from the bear market. Since April of 2021, this is the first time that the number of UAW connected to DeFi dApps has fallen below the half-million mark. In percentage terms, this equates to a decline of 22% from the previous month and a loss of 31% from the previous year.

Few blockchains, however, stand out and go against the bear trend. Because anyone can now deploy a smart contract on the Flow Mainnet because of the recent announcement of Permissionless Smart Contract Deployment, for instance, Flow saw a rise in daily UAW of over 200% from the previous month. Because of the complexity of the situation, the NFT market has also shrunk. However, in this case, a number of fresh trends in this industry have formed, and they may be around through 2022 and even beyond.

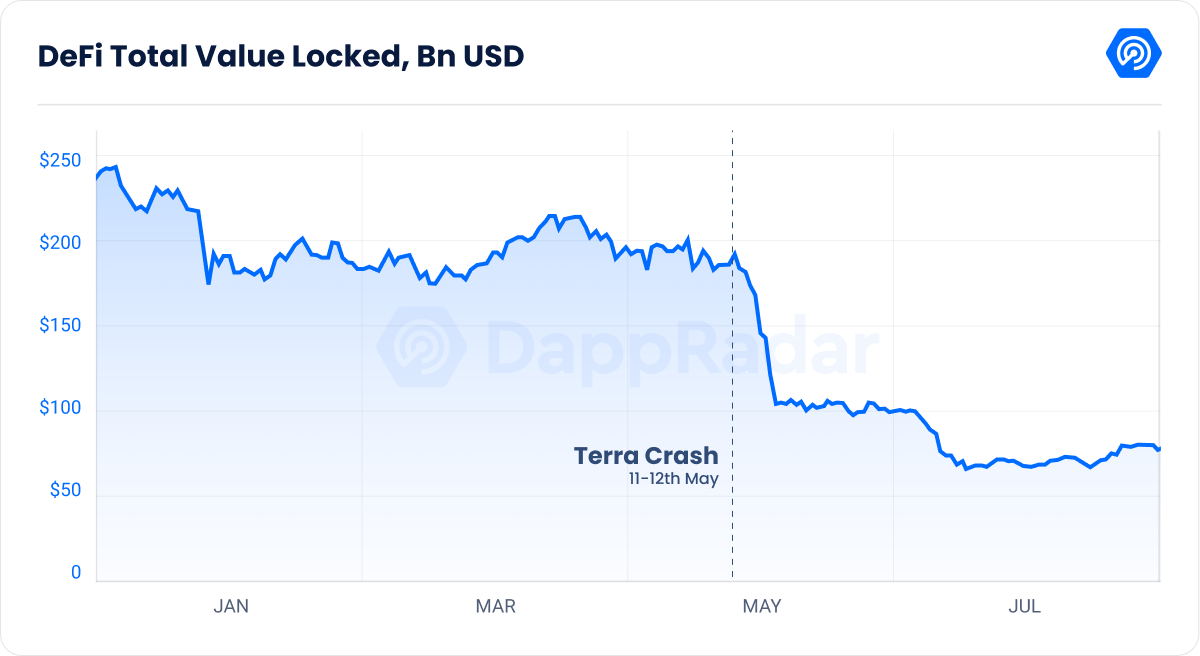

DeFi Recovers From Terra Crash – 22% TVL Increase

The DeFi business has experienced an increase in its overall net worth as a result of the crypto market’s gradual but steady rebound. Total value locked, or TVL has been used as the standard for assessing how effective dApps are. On December 2, 2021, TVL reached an all-time high of $253.91 billion. Throughout the entire month of July, TVL has grown. On July 31, TVL was worth $82.3 billion, up 22% from the $67.3 billion it had on July 1. Seven of the top ten smart contract chains saw an increase in TVL, which may be the cause of this development.

Ethereum continued to have the most value frozen in July. Ethereum TVL was about $46 billion on July 1 and rose to about $57.9 billion at the end of the month. BNB Chain has replaced Terra as the chain with the second-highest amount of value locked following Terra’s failure. On July 1, the TVL of BNB Chain was worth over $5.97 billion, and by the end of the month, it had risen to about $6.8 billion.

Similar increases were seen everywhere during the course of the month. TRON TVL had $3.95 billion at the beginning of July, but by July 31 it had grown to $5.9 billion. Additionally, Avalanche saw growth, going from $2.68 billion to $2.81 billion. Solana (SOL) saw a rise from $2.47 billion in TVL to $3.2 billion within the same period. The TVL for Polygon and Cronos climbed by $270 million and $110 million, respectively.

Polygon Continues To Build During The Market Volatility

This month, the Polygon network has received a number of significant enhancements in addition to its growing DeFi presence. A significant number of projects formerly housed in the Terra ecosystem can now be found on the Polygon network. The Terra Development Fund, a multi-million dollar program that helped these projects with their relocation, is mostly to blame for this. Additionally, as was already indicated, given that the sidechain’s TVL grew by 17%, this may potentially result in DeFi activity.

Additionally, Polygon was selected to take part in the Disney Accelerator Program, which is an initiative designed to encourage the growth of creative firms. This year’s Disney Accelerator class places a strong emphasis on augmented reality (AR), NFTs, and artificial intelligence (AI). In addition, Polygon intends to introduce a new web3 phone with London-based tech startup Nothing, which aims to “eliminate the barriers between individuals and technology.” They want to enable NFT drops directly to their Android-based phone with their new web3 smartphone.

Crypto Contagion Persists As Celsius Files For Bankruptcy

Due to monthly withdrawals from accounts and uplifting debt repayments, the Celsius saga has advanced to the next phase. The centralized lending network filed for Chapter 11 bankruptcy, which further raises questions about whether depositors’ money can be retrieved. The corporation filed for bankruptcy, revealing significant debt. The mining branch of Celsius accumulated $576 million in liabilities on its own after spending $750 million on mining rigs. Earnings from mining were significantly impacted by the downturn market. For instance, the cost of mining equipment decreased by 50%.

Loan liquidations also caused the business $135 million in damage. While the $75 million loan from Three Arrows Capital (3AC) was liquidated at a loss of $40.6 million, the $841 million Tether loan was liquidated at a loss of $94 million. But the fascination persists. It might not be as disastrous as it seems for Celsius to file for Chapter 11 bankruptcy. It does not imply that a company has necessarily perished. Examples of businesses that have undergone this process and come out stronger include General Motors and Marvel.

More Calls For Crypto Regulation

The Council’s presidency and the European Parliament came to a preliminary agreement on the markets in crypto assets (MiCA) at the end of June 2022. This agreement covers the companies that create digital currencies and stablecoins, as well as the exchanges and wallets where these assets are kept. This regulatory framework intends to safeguard investors, uphold financial stability, and promote innovation while enhancing the allure of the crypto asset market. Given that certain EU members already have disparate national laws governing crypto assets, MiCA aims to increase clarity within the EU. At the EU level, there was still no clear regulatory structure.

The rate at which cryptocurrencies and stablecoins are adopted by the public in the future will almost certainly have a correlation with the level and quality of regulation that exists in any particular country. Large economic regions, such as the United States and the European Union, are taking steps to offer initial direction as regulatory certainty influences the behavior of economic actors.

Has The NFT Bubble Now Officially Popped?

Despite the fact that the NFT market failed to surpass $1 billion in deals for the first time since June 2021, the answer may not be so straightforward. The current market environment is historically gloomy. The market’s liquidity has decreased, prices are largely influenced by the reduction in the value of cryptocurrencies, and the potential profit from reselling is modest. As a result, many users have chosen to liquidate their assets in the NFT market, awaiting better times or shifting to positions generally referred to as “holding,” the trade block until the “crypto winter” has passed.

The dollar-based trade volumes reveal that the market is experiencing a downward trend, with a month-over-month fall of 25%. In addition, the number of traders has declined by 8% month-over-month but climbed by 40% since July 2021.

The market is extremely and almost entirely dominated by the four projects that are owned by Yuga Labs. These projects include CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, and Otherdeed for OtherSide. In other words, Yuga Labs represents slightly more than 20% of the entire NFT market for July 2022’s total trading volume.

Recent developments, in particular market patterns, have facilitated the meteoric rise of utilities, primarily Ethereum Name Service domain names, with a total trading volume of 20 million dollars in the preceding 30 days. The majority of members of the Bored Ape Yacht Club have begun purchasing the four-digit domain name relating to the Ape they own. This number corresponds roughly with the domain name of the brand their ape carries. In these weak market conditions, where trade is concentrated on a single asset class, researchers find a hyper-centralization of activity as the majority of the value of blue-chip NFT collections persists.

The Way Forward

Due to price decreases, layoffs, and high-profile defaults such as Terra-Celsius-3AC, the “crypto winter” is approaching Bitcoin and other digital assets. The cryptocurrency market experienced three disastrous falls in less than a month, and enterprises that served as the foundation of the industry crumbled before our eyes.

It is crucial to evaluate the relationship between cryptocurrencies and the broader market, which has played a significant part in the present crisis. While Bitcoin should, in principle, trade independently from conventional finance, it has demonstrated a strong correlation with other risk-sensitive assets, such as stocks and notably tech-related ones, over the past year.

The price of Bitcoin is approximately $23,000, a decrease of more than two-thirds from its November 2021 record high of approximately $69,000. It has lost 50% of its value since the beginning of the year, compared to the S&P 500’s drop of slightly less than 20%. In fewer than eight months, the market capitalization of the entire cryptocurrency industry fell from $3 trillion to $945 billion, with Ether, Solana, and Dogecoin (DOGE) faring much worse.

However, cryptography, NFT, and web3 remain operational and will continue to do so. This crisis may be considered as a rapid market realignment that has eliminated “Ponzi” schemes that would not have stood the test of time. It is time to be resilient and construct. The successful projects will lay the foundation for an excellent bull run.